Rates as of 05:00 GMT

Market Recap

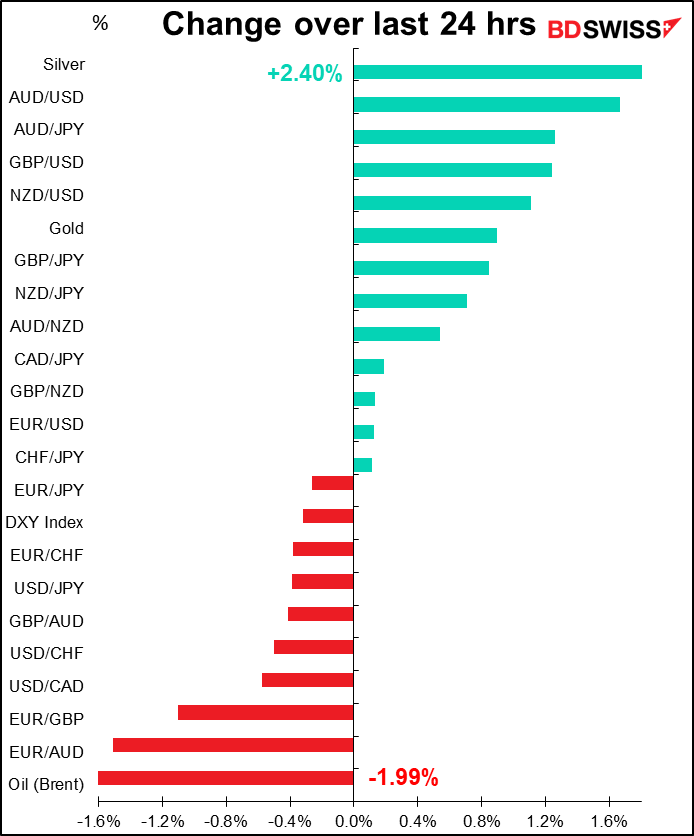

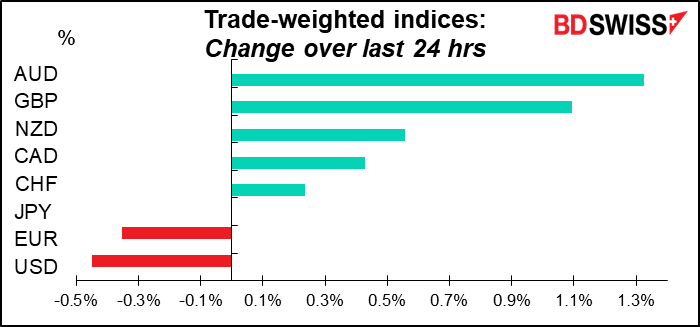

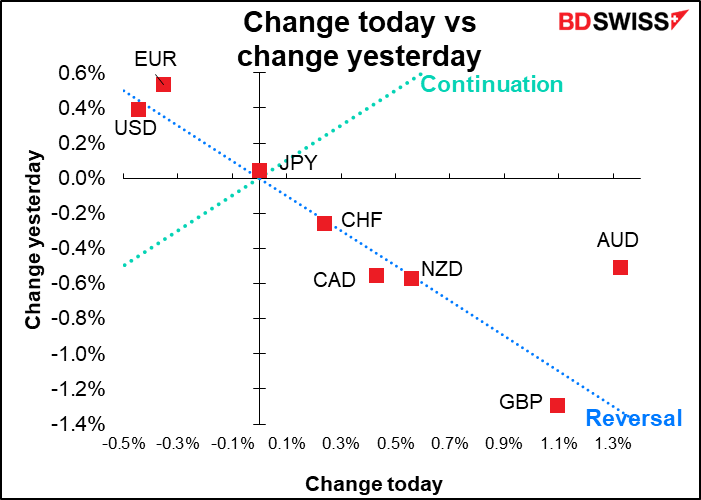

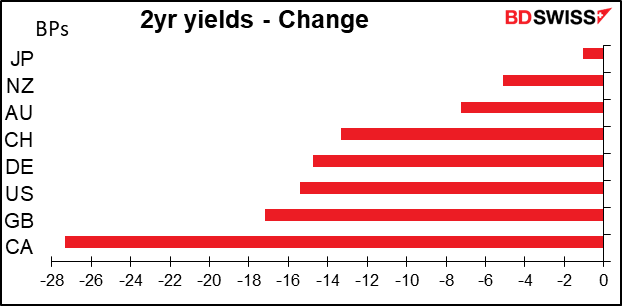

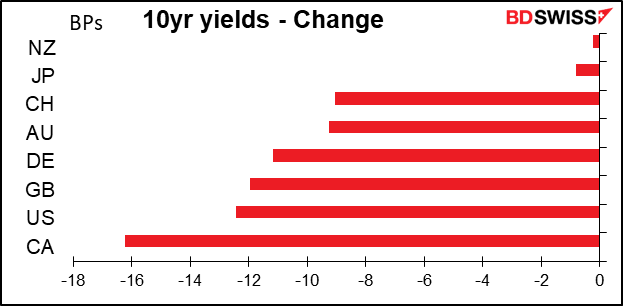

The Fed raised rates by 75 bps, as expected. The reaction though was not as expected, at least not as expected by me. The dollar was the worst-performing currency of the day, which is perhaps understandable given that the move was widely discounted. But the plunge in bond yields globally and the rally in stocks was a bit surprising, no?

The most important point from Chair Powell’s press conference was that the Committee would likely decide between a 50 bps and 75 bps rate increase at the July FOMC meeting. The possibility of a 50 bps hike in July was well received by the market, which as I mentioned yesterday had already priced in a 75 bps hike for the month, with a small possibility of 100 bps.

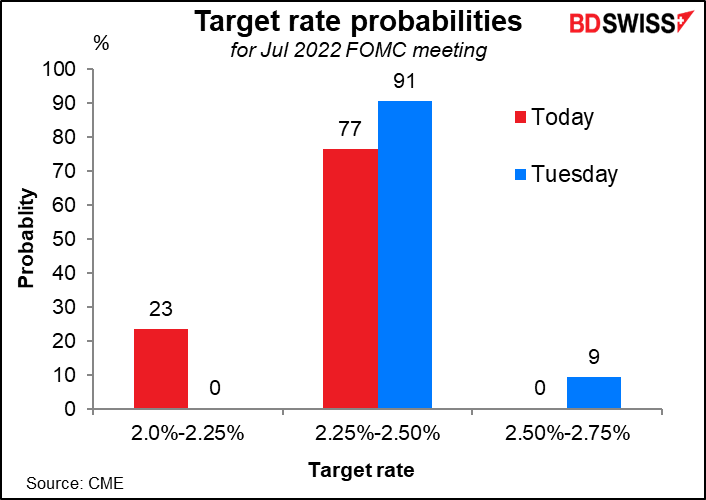

Speaking of the 75 bps hike, he noted that “I don’t expect these moves to be common,” which would appear to rule out even larger hikes – another positive for the markets (although later in the press conference he didn’t rule out larger hikes). And once the fed funds rate reached the Committee’s estimate of “neutral,” i.e. around 2.5%, rate hikes would probably revert back to 25 bps at a time: a “cautious” approach to hiking above neutral. The result from that would be a slower path of tightening than was previously expected.

So while the new rate path (red line) is substantially faster and higher than what people expected a week ago (grey line), before the release of the disastrous May US CPI figure, it’s actually shallower than what people expected on Monday (blue line), after the CPI release but before the Wall Street Journal report that a 75 bps hike was likely.

Note that the market is now pretty much in line with the Committee members’ expectations.

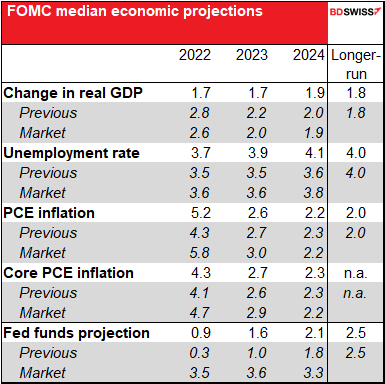

The expectations, set out in the “dot plot,” were substantially higher and with a stronger consensus — more dots are at the median rate. Note too that every member of the Committee now expects to be lowering rates in 2024 whereas before they were forecasting steady rates then. There wasn’t much change in their expectations of the long-term, i.e. neutral rate.

The market sees the fed funds rate hitting “neutral” around September, implying that the pace of tightening is likely to slow after that.

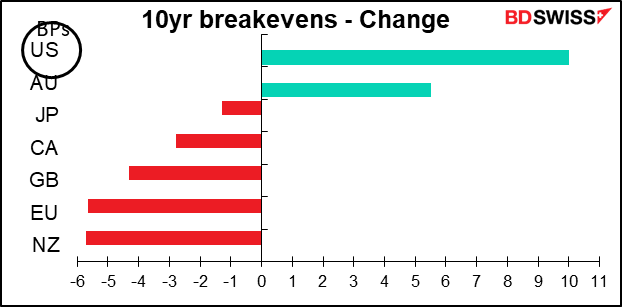

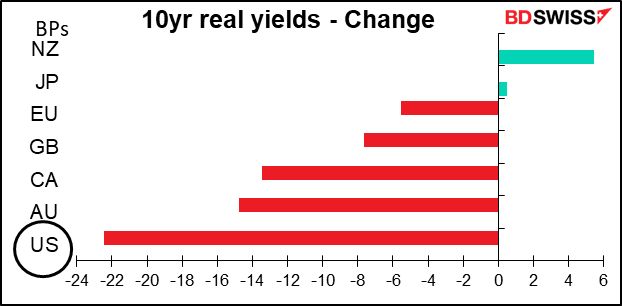

One fly in the ointment though: the slower pace of tightening implies that inflation will take longer to get under control. So breakeven inflation rates for the US rose.

The result was a big fall in US real interest rates, which would explain why stocks rose.

The Fed’s new projections are still for the fabled “soft landing,” but less soft than they predicted in March. They see substantially weaker GDP growth but not a recession – they would never forecast “yes, we’re going to kill the economy.” The expected rise in the unemployment rate is quite mild in my view – I’m not sure they can dampen demand sufficiently to get inflation down with such a small rise in unemployment.

But there’s one problem: they don’t see inflation coming back to their 2% target any time within the forecast range. Having said that, they are more optimistic on that front than the market is, which makes sense – they’ll naturally forecast that their policy will be successful. In the Fed’s defense, Chair Powell noted a number of factors outside the Fed’s control that are pushing up inflation, such as high energy and commodity prices due to the invasion of Ukraine and continued global supply chain disruptions that have been exacerbated by lockdowns in China.

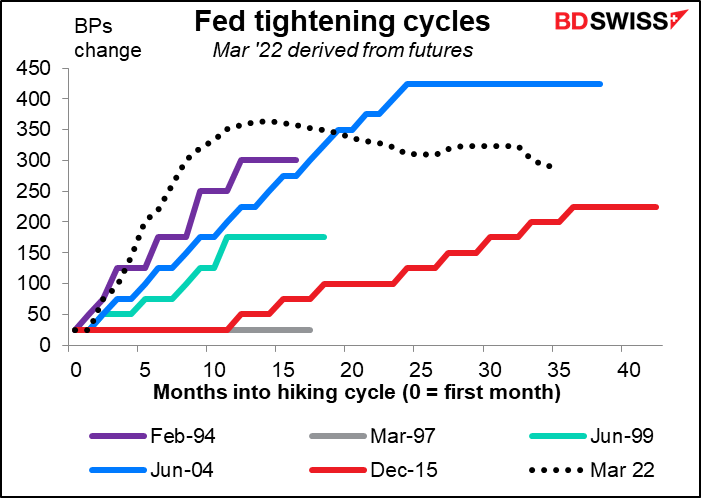

Compared to previous tightening cycles, this one is expected to be faster and steeper but end relatively quickly, with rates coming back down again sooner rather than later.

All told, I still think the Fed’s stance will keep the dollar well underpinned. It remains focused on fighting inflation and has shown that it’s willing to “do what’s necessary” to get it down. The Committee’s members are hopeful and cautious but if inflation doesn’t turn down as they expect they are likely to ratchet up the pressure as necessary. I think they have demonstrated that resolve, which will support the dollar going forward.

There was also some drama from the European Central Bank (ECB) yesterday. The ECB Governing Council held an ad hoc meeting to discuss “fragmentation,” which is what happens when the bond yields of some of the more fiscally challenged Eurozone countries (Italy, Greece) get way out of line with the others. They put out a statement that’s rather technical but in brief they said they’ll be flexible while they work on designing “a new anti-fragmentation instrument.” The statement helped to reassure investors who were concerned about the possibility of another Euro debt crisis. Assuming that they unveil the anti-fragmentation tool soon, the ECB can tighten rates faster than previously expected without worrying about the Eurozone blowing up.

The news caused peripheral European bond spreads, which had been widening sharply, to narrow substantially even as German Bund yields fell sharply, too. The Italian stock market benefited as well, up 2.9% vs +1.4% for the Euro STOXX 600.

EUR initially strengthened in reaction to the announcement of the ECB meeting but fell after the statement was released. It then recovered following the FOMC meeting. I think the euro is likely to benefit going forward from less tension and an accelerated pace of tightening.

Energy though remains the Achilles heel of Europe, Natural gas futures were up 24% yesterday, following a 16% rise on Tuesday, after Russia further squeezed gas supplies to Europe via the Nord Stream pipeline. This illustrates the problem that Fed Chair Powell highlighted: many of the major causes of inflation are beyond the reach of central banks’ policy tools.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Three central bank meetings in 24 hours! I’ve gone into a lot of detail about them in my world-famous Weekly Outlook so here I’m just going to repeat the conclusions now.

Swiss National Bank: nothing doing

The SNB has kept its policy rate on hold since 2015. I doubt if it’s going to change now. That’s also the unanimous view of 12 economists polled by Bloomberg. However, there is at least one dissenter. Goldman Sachs said, “We see a strong possibility that the SNB will deliver a rate hike this week, emboldened by the ECB’s clear forward guidance and low hurdle to move in 50bp increments later this year.”

My view is that they’ll wait until after the European Central Bank (ECB) starts to hike rates, which is widely expected in July. The market is currently discounting 80 bps of tightening by the ECB’s Sep 8th meeting. That would allow the SNB to raise rates on the coattails of the ECB at the SNB’s Sep. 22nd meeting. Instead, I just expect them to continue with their usual boilerplate statement about keeping rates steady and being “willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc..” At most I think they’re likely to make some more aggressive comments about the need to rein in inflation, which could be positive for CHF.

Bank of England: 25 bps this time, what next time?

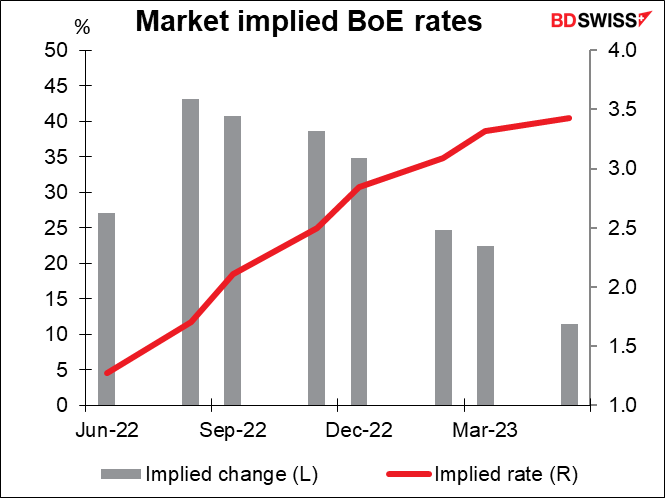

The Bank of England is widely expected to hike by 25 bps. By “widely” I mean 43 out of 45 economists polled by Bloomberg, with only two saying 50 bps.

The big question is what the vote will be. Last time three of the 9 members of the Monetary Policy Committee (MPC) voted for a 50 bps hike. Will they vote for it again? Will anyone else join them? On the other hand, with growth slowing, will anyone vote for no change? The MPC could be sharply divided.

I expect that there will be at least two votes for a 50 bps hike, perhaps even three again, and that the pound will rally as a result. The reason I think there will still be votes for 50 is because of four factors:

- Not only is inflation out of control in the UK but inflation expectations are starting to become un-anchored, too.

- The UK labor market is extraordinarily tight, with record-low unemployment and a record-high number of openings relative to unemployed persons.

- Although the economy is weak, as shown by the disappointing fall in GDP in April, the risk of outright recession has diminished thanks to the government’s fiscal policy.

- Other central banks are doing 50 and the Fed did 75.

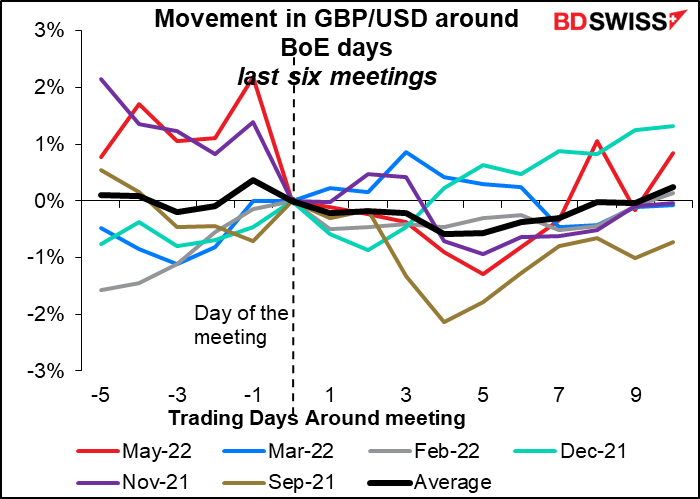

Market response: The pound has tended to weaken after the last several Bank of England meetings. That’s probably because of the caution some members have shown. I expect them to be more aggressive at this meeting and therefore the pound could shake this pattern. Past performance is no guarantee of future performance.

Bank of Japan: (probably) nothing doing, but we can’t be sure

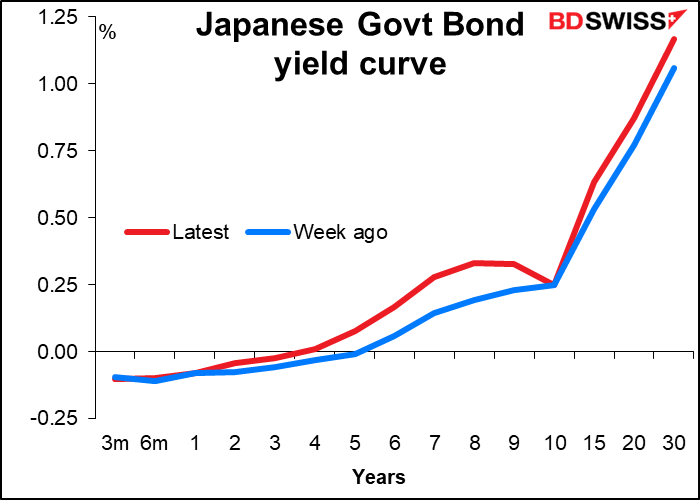

I had thought that the BoJ meeting was an open-and-shut case.. BoJ Gov. Kuroda made a speech on June 6th in which he laid out the case for a loose monetary policy and concluded by saying that “the Bank will take a strong stance on continuing with monetary easing.” It didn’t seem possible that 10 days later he would change course. And in fact the BoJ has intervened massively in the Japanese Government Bonds to defend their yield curve control (YCC) target, which is to keep the 10-year bond within ±25 bps of 0.0%. EG they bought a record JPY 2.2tn of bonds on Tuesday, etc etc.

Nonetheless the market is testing the BoJ’s resolve. Yields around the 10-year target have risen to well above 0.25%, implying that the market thinks the 10-year yield will have to move up at some point.

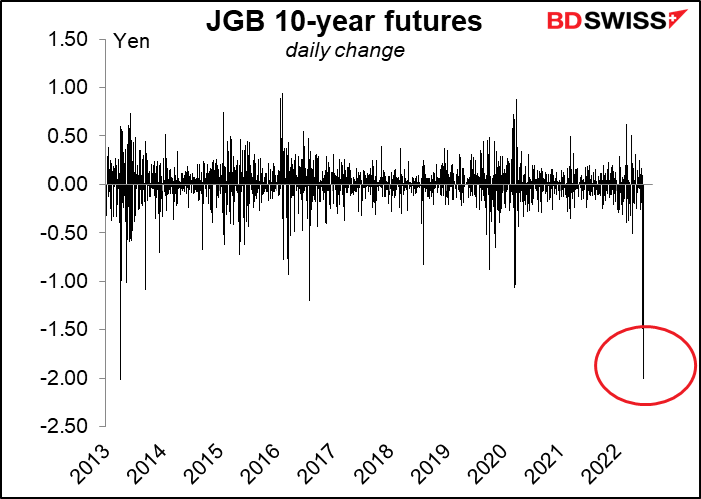

And the Japanese government bond (JGB) futures fell by the most in nine years on speculation of higher yields.

The problem here is that both the government and BoJ have characterized the plunge in the yen as a negative for the economy and have even hinted at intervention. However it’s the BoJ’s policy itself that is fueling the decline in the currency – not only is the yield gap between Japan and overseas countries widening due to the YCC policy but also the intervention necessary to maintain that policy is a form of quantitative easing, which is also negative for the currency.

Accordingly, we could see some changes to policy at tomorrow’s Bank of Japan meeting.

- They could widen the YCC’s ±25 bps band to allow the 10-year yield to come more in line with market pricing, but that would in effect amount to a retreat from its monetary easing, according to the policy review that they carried out in March of last year (Further Effective and Sustainable Monetary Easing )

- They could shorten the maturity that YCC is aimed at from 10 years to seven or five. I see that as the most likely change, as it would be in accord with the findings of the policy review (“the effects of the decline in interest rates on economic activity and prices are relatively large for short- and medium-term interest rates.”)

- They could end the YCC policy entirely. I don’t think this is likely as it would be too much of a surprise for the market, but you never know.

- Eliminate the easing bias in their forward guidance: Their forward guidance currently has a downward bias; that is, they hold out the possibility of lowering rates but not raising them. (“…the Bank will…not hesitate to take additional easing measures if necessary; it also expects short- and long-term policy interest rates to remain at their present or lower levels.”) They could eliminate this easing bias or even change it to a tightening bias, although that might engender expectations of a full-scale normalization of monetary policy, something Policy Board members have unanimously opposed so far.

- Announce another policy review: In the thinking of the Japanese authorities, “pleasant surprise” is considered an oxymoron. They almost never surprise investors as that could give rise to the dreaded “confusion in the marketplace.” More likely is that they announce a policy review ahead of next month’s Policy Board meeting. This would signal to the markets that something might change while also signaling to the government and the public that they’re aware of the problems with YCC and are dealing with it. They could then leak the results of that review ahead of time and by the time they announce the results the market would have gradually adjusted. This would also buy some time in case things change. If they do decide some change is necessary, I think this is the most likely option, with the possible exception of

- End the special pandemic loans: The BoJ scaled back its special pandemic funds-supplying operation in March, and the remaining measures will finish at end-September. Now that the number of virus cases has stabilized and the semi-emergency measures lifted, they could easily decide to end these emergency measures early.

Either way, Gov. Kuroda’s press conference following the meeting is shaping up to be a crucial market event. What does he think of the yen’s weakness? What does he think of the BoJ’s contribution to that weakness? How can he justify the current policy when public opposition to higher prices is rising so much? Etc etc.

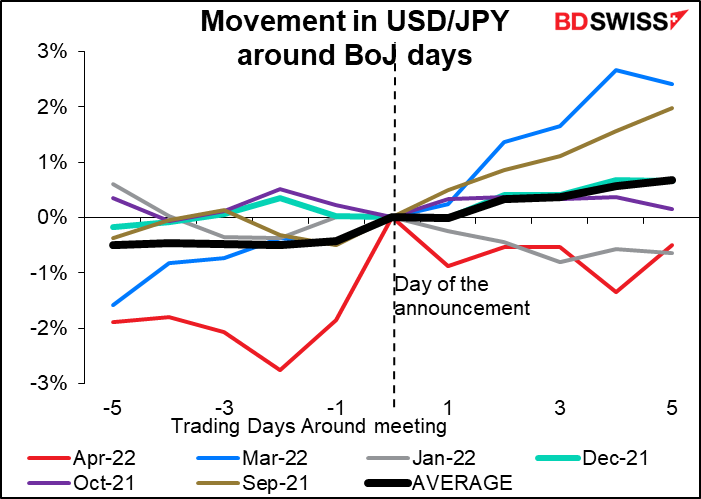

Market reaction: The yen has tended to weaken (USD/JPY move higher) after recent BoJ meetings. If they make no changes in their policy I would expect the same this time, too.

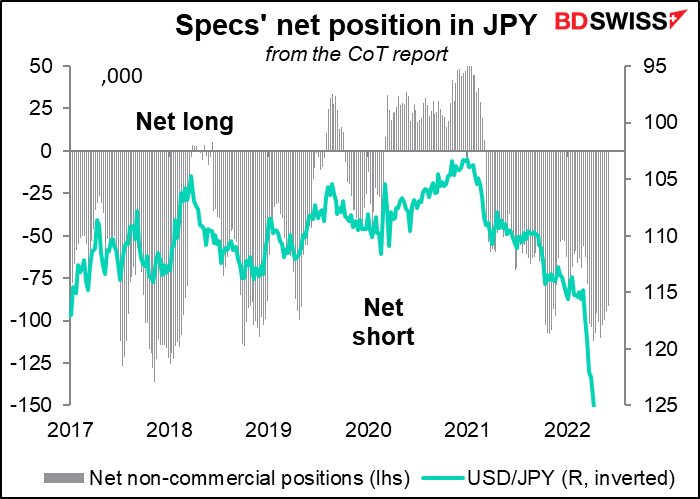

However if they do make any changes there could be a sudden reversal in USD/JPY, especially seeing as how short the market is. I think some profit-taking on short JPY positions and a rebound in the yen (fall in USD/JPY) are likely.

Today’s indicators

The European day will be focused on the SNB and Bank of England. The indicators don’t start until the US opens for business.

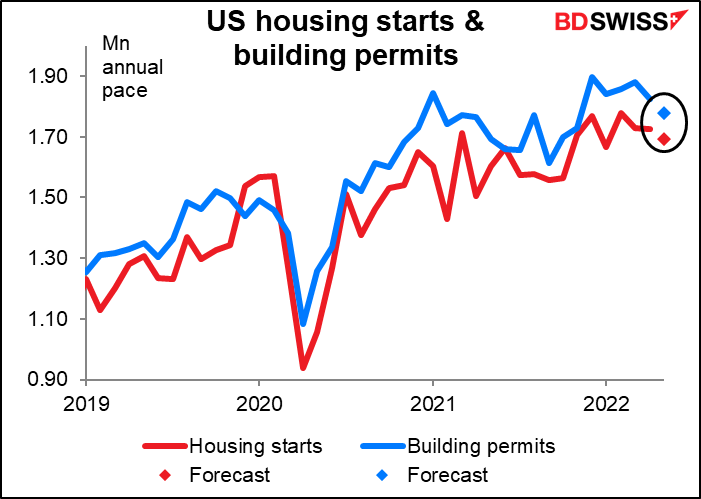

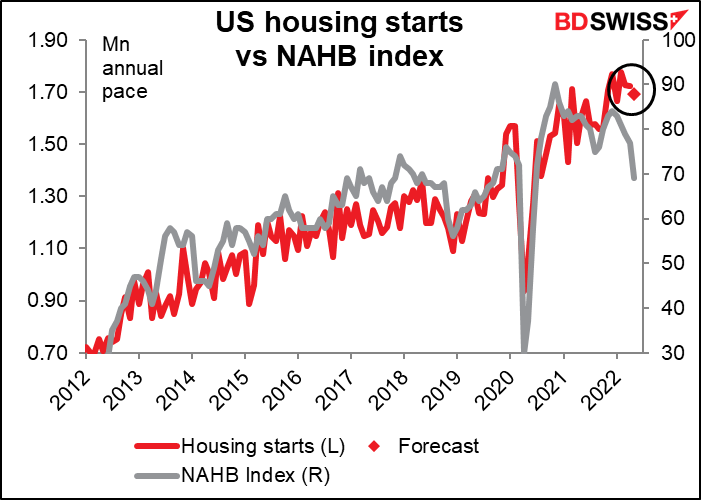

US housing starts and building permits are both expected to be lower, starts by 1.8% mom and permits by 2.5%. Permits are usually higher than starts because builders don’t necessarily get around to building all the buildings that they have permits for.

The decline doesn’t seem that worrisome, given that February’s level was the highest since the Global Financial Crisis in 2008, but of course it’s hard to see exactly when a dip becomes a trend. We have to watch this indicator because Fed tightening is aimed at slowing interest-sensitive sectors, of which housing is perhaps #1. The average 30-year mortgage rate in the US has jumped 250 bps so far this year – it would be a wonder if that had no impact on the housing market.

The recent downturn in the National Association of Home Builders (NAHB) index suggests that we may indeed be at the beginning of a downtrend in housing.

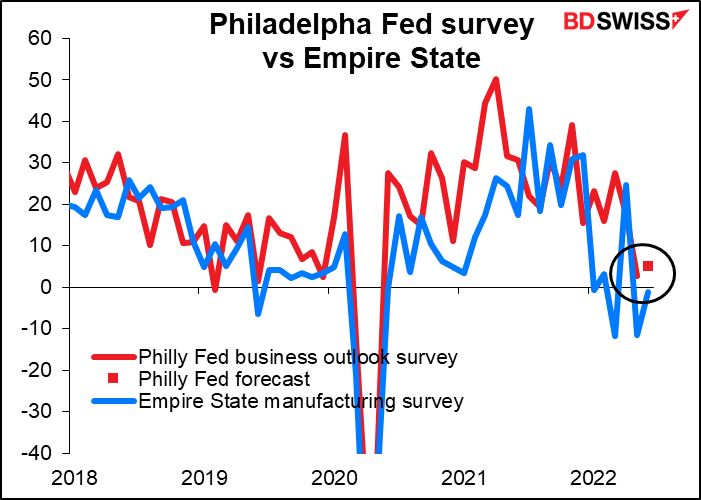

The Philadelphia Fed business sentiment index is forecast to be up slightly in what would likely be mean reversion after last month’s sharp (15-point) decline. Yesterday’s Empire State index was also expected to rebound, which it did, but less than expected – it remained negative (-1.2).

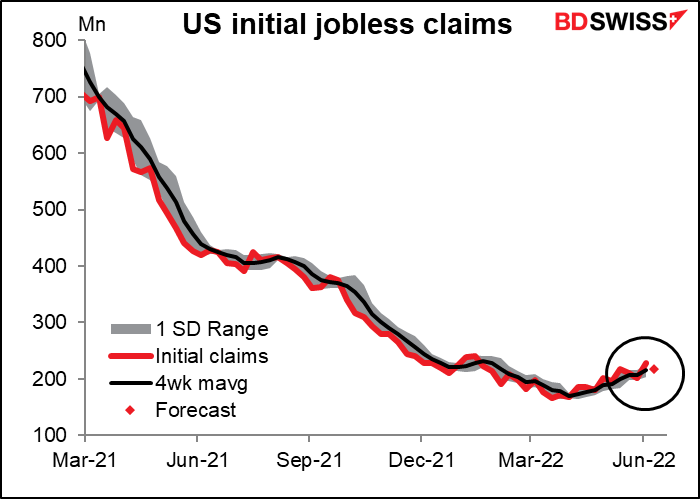

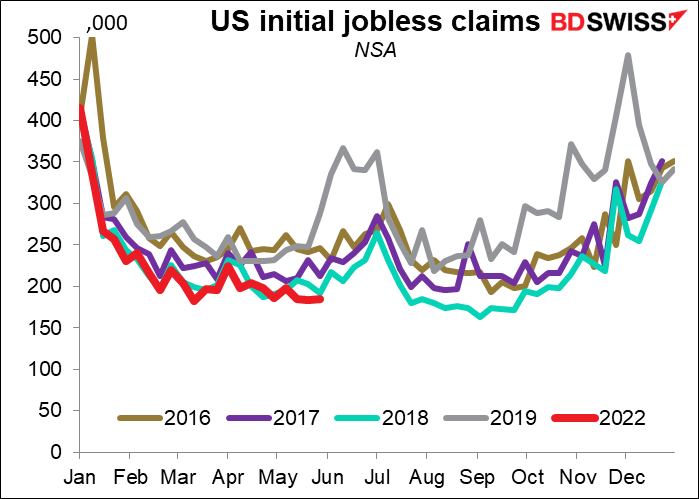

US initial jobless claims are expected to be down slightly – back to the level of early May. Here’s another indicator that we have to watch to see if we’re at the beginning of a trend. Of course the Fed’s tightening is meant to bring demand down more into line with supply and one way of doing that is by increasing the number of unemployed persons.

But as I’ve pointed out before, and will probably point out again, the upturn may be due more to changes in the seasonal pattern than to any increase in joblessness. If we look at the unadjusted figure, it’s near a 50-year low (and remember, the data aren’t adjusted for the increase in population). That hardly strikes me as indicating any major change for the worse in the job market. The next month should be interesting because as you can see there’s a big seasonal upturn in jobless claims in July (probably from teachers getting laid off at the end of the school year – once when I worked at a college, they planned on firing me at the end of the school year so I could collect unemployment over the summer, then hire me back in September.)

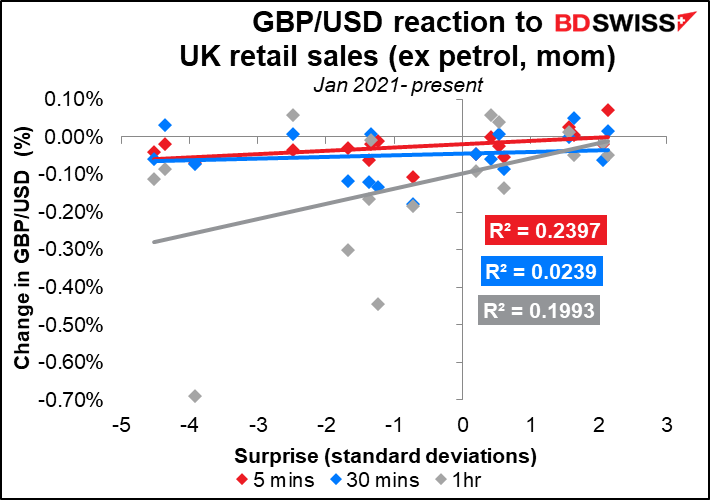

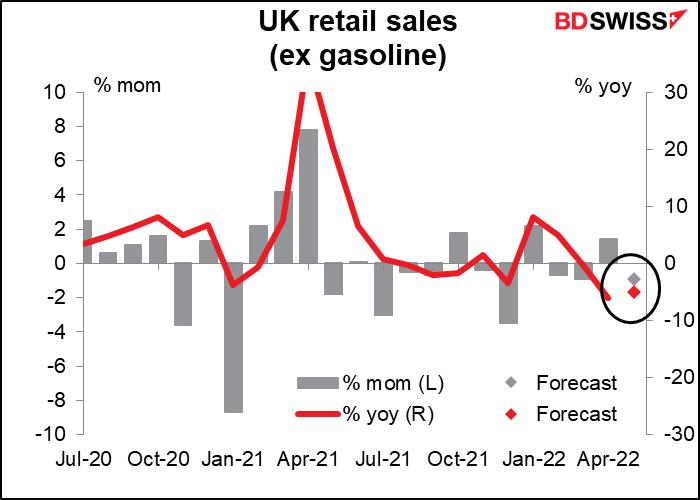

Then early tomorrow morning, before I can drag my weary body out of bed, sit down at my PC, and write my comment, the UK retail sales will be released. The market is looking for some payback after the spending spree in April. Retail footfall fell back after a bounce in April while consumer confidence plunged again. Moreover inflation is causing “sticker shock” that may reduce discretionary spending further.

Which of the four versions (with or excluding gasoline, month-on-month or year-on-year change) should you watch? The market response seems to be similar for all of them, but it’s slightly higher – at least at the five-minute level – for the month-on-month change in retail sales excluding auto fuel. One odd point of the data – the 30-minute response is consistently different than the five-minute and one-hour responses.