Rates as of 05:00 GMT

Market Recap

Following on from the Fed’s 75 bps hike, we’ve had three more central bank meetings. I’ll just briefly review what they decided:

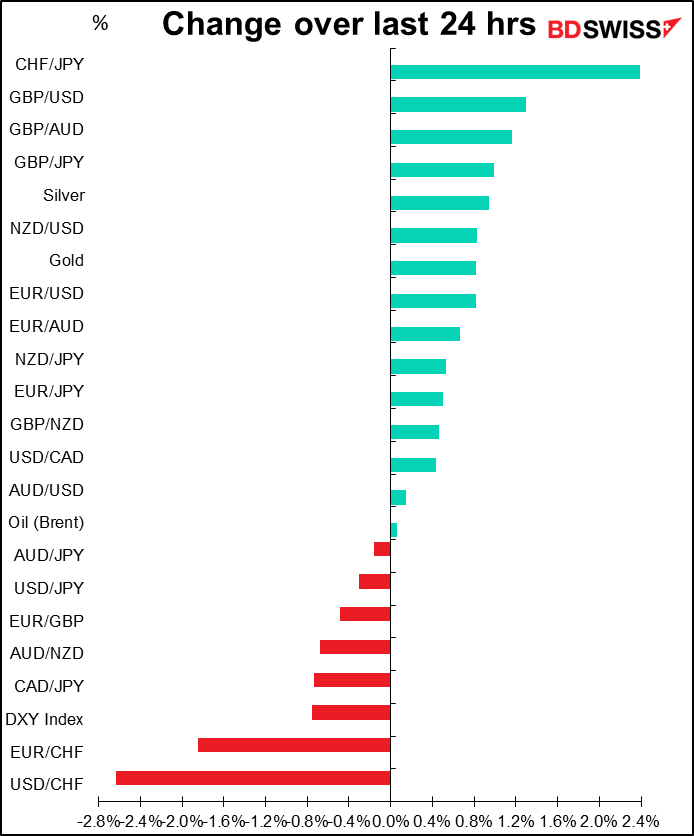

- The Swiss National Bank (SNB) was the big shocker: it raised rates for the first time since 2015 and did so by a no-nonsense 50 bps! It also predicted that “further increases in the SNB policy rate will be necessary in the foreseeable future to stabilize inflation….” Moreover it changed its foreign exchange policy from guarding against CHF appreciation to a more double-sided policy. Whereas before the SNB said it “is willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss fran,.” now their official statement reads, “To ensure appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary.” SNB President Jordan clarified that that means the SNB would be willing to intervene to prop up the currency if it weakens. These changes are clearly supportive of CHF, as the sharp movement yesterday demonstrates.

- The Bank of England went pretty much as expected, voting 6-3 to hike rates by 25 bps (the dissenters wanted to hike by 50 bps, as usual). It turned distinctly hawkish though. Whereas last month their conclusion was the rather wishy-washy “most members of the Committee judge that some degree of further tightening in monetary policy may still be appropriate in the coming months,” this time around they confidently asserted that “The Committee will be particularly alert to indications of more persistent inflationary pressures, and will if necessary act forcefully in response.” (Act forcefully = hike by 50 bps or more, presumably.) This despite raising their forecast for the peak in inflation to 11% from 9%. This change in tone is positive for GBP.

- The Bank of Japan…I’ve often said that the BoJ is likely to keep policy on hold for the remainder of the Anthropocene epoch, but even I thought there was a chance they could at least adjust their yield curve control (YCC) program, in which the BoJ pledges to keep the 10-year bond yield within ±25 bps of 0.0%. After all, it’s the widening gap between Japanese and foreign bond yields that’s causing the yen to plunge. But no! They didn’t even do that. Nothing! They did insert a small comment about watching the exchange rate into their statement following the meeting (“…it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices.”) but that’s about it. They even retained their easing bias in their forward guidance (The BoJ “will not hesitate to take additional easing measures if necessary; it also expects short- and long-term policy interest rates to remain at their present or lower levels.”) And as usual there was only one dissent, from Mr. Kataoka, who as always wanted to loosen policy further. Nonetheless the yen didn’t weaken much if at all, which implies that the result was pretty much as expected.

The conclusion we can draw from these actions are:

- Inflation is more intractable than central banks had thought.

- Officials are having to take stronger and stronger action to hold the line.

- Japan will probably be the last country on earth to tighten monetary policy, which suggests either further downside for the yen or an eventual change in BoJ policy.

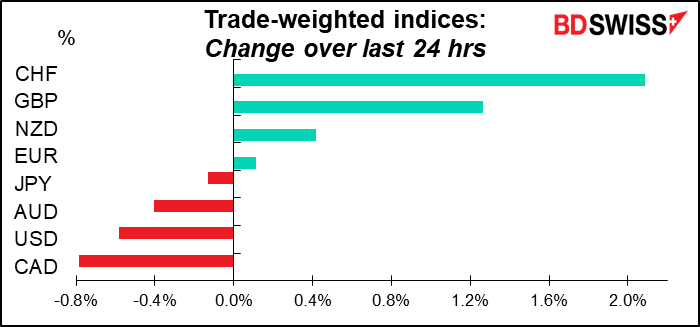

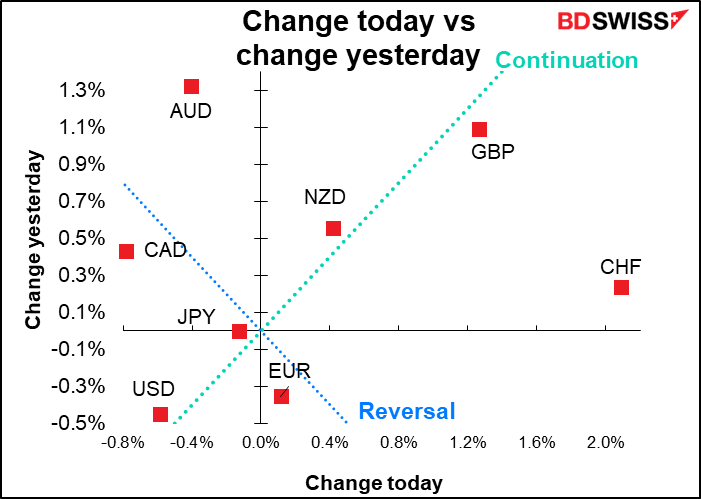

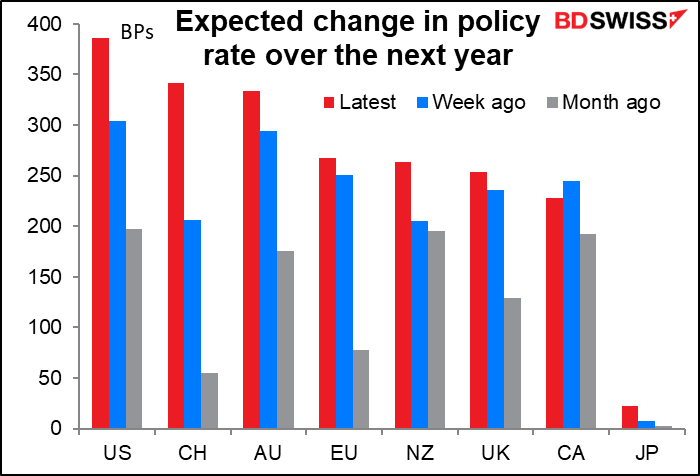

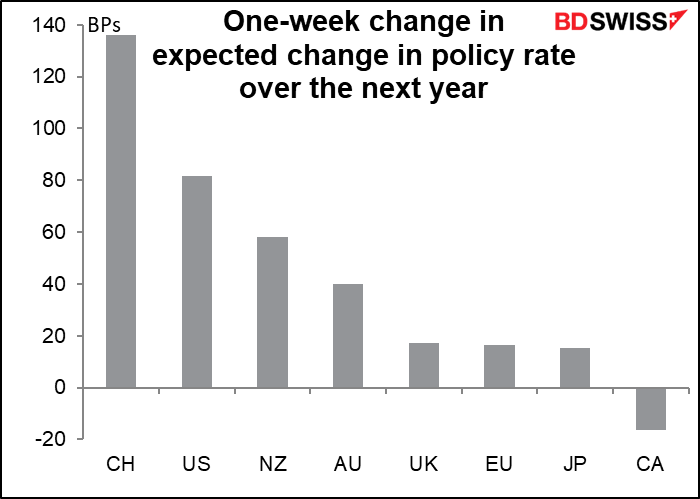

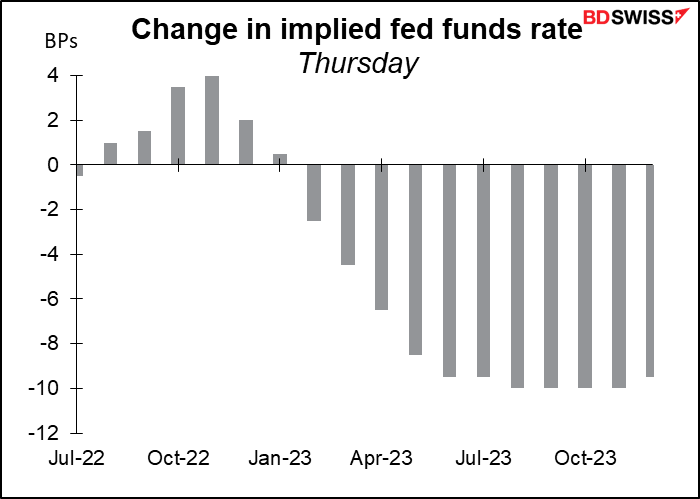

The amount of tightening discounted in the market has increased substantially just over the past week, except in Japan.

The biggest change over the last week was for Switzerland. Only Canada saw its expected rate hikes decrease.

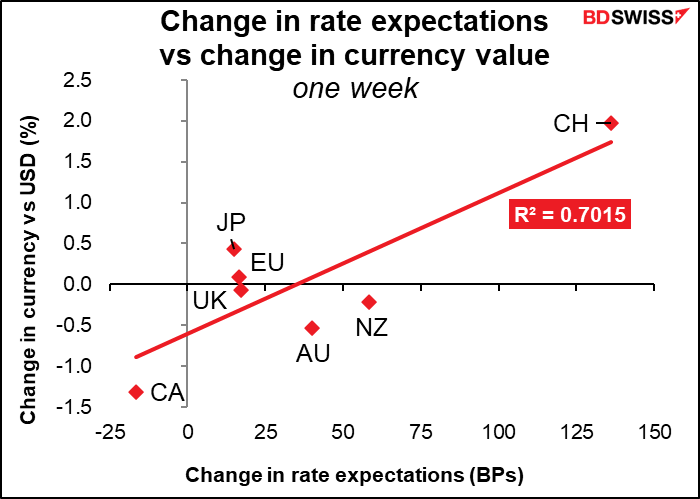

This change in expectations had a lot to do with how currencies behaved this past week.

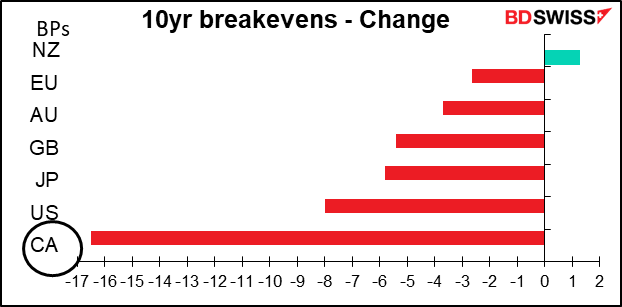

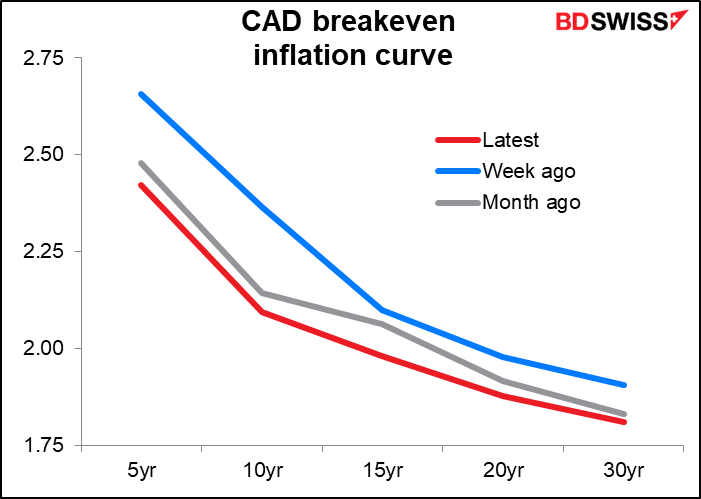

Why the decline in rate expectations for CAD? And why the fall in the currency today? Probably because of declining inflation expectations. Several Canadian banks Wednesday upped their forecast for the Bank of Canada’s July 13th meeting to a 75 bps hike from a 50 bps. Usually this might be expected to boost the currency but now it looks like the market is worried the tightening is going to tip the Canadian economy into recession. Longer-term inflation expectations have receded accordingly.

Canadian inflation expectations have come down across the forecast horizon.

Some of the same fears are active in the US, too. On Wednesday markets were encouraged by Fed Chair Powell’s comment that 75 bps hikes would not be “common,” but on Thursday the market reevaluated the likely path of US rates. Investors speculated that perhaps they underestimated the amount of tightening that would be necessary this year. On the other hand the expected result of that tightening would be more of a slowdown in the US economy next year and therefore less need for tightening then. This possibility weighed on USD yesterday, with the huge miss in housing starts and building permits (see table above) as a sign that the Fed’s tightening is already causing the economy to slow.

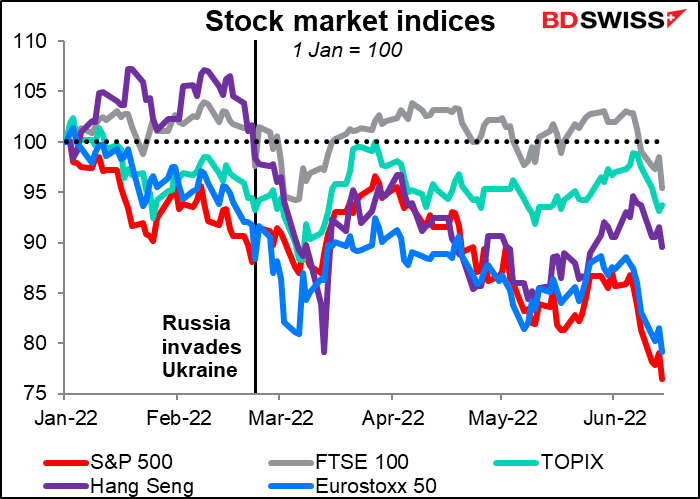

I think this was the theme in the markets yesterday: that central banks are going to have to tighten more than perhaps investors had assumed and that spells trouble for economies further down the line. That likelihood is depressing stock markets around the world.

But even more important…

Forget about the markets. There’s more important stuff. Read this:

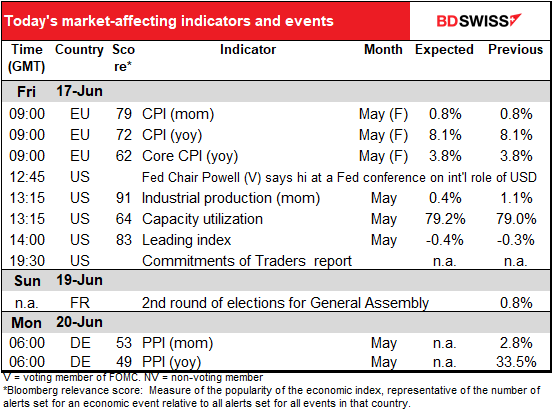

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Wow…after a real busy week, finally a quiet day (at least in terms of the schedule).

The UK Office of National Statistics yesterday announced that the UK retail sales that were supposed to be released this morning have been postponed until next Friday.

The major point in the European morning will be the final EU-wide CPI. Germany’s on Monday wasn’t revised, France Wednesday the mom was revised up 10 bps but the yoy figure wasn’t revised, nor was Italy’s.

In the US morning, Fed Chair Powell will make some welcoming remarks at a New York Fed event, “Inaugural Conference on the International Roles of the U.S. Dollar.” There are a lot of Fed (and a few ECB) employees meeting with a large number of academics to discuss things like “Central Bank Swap Lines: Micro-Level Evidence” and “Global Inflation and Exchange Rate Stabilization under a Dominant Currency.” You can see the whole schedule, all the topics, in the link. I don’t think Chair Powell’s 15 minute speech will have any great insights but I’m looking forward to reading the paper for the last session, which is “Digital assets and the U.S. dollar.”

The only major US indicator today is industrial production and its child, capacity utilization. I don’t normally bother with capacity utilization but with inflation and bottlenecks on everyone’s mind it might be an important topic.

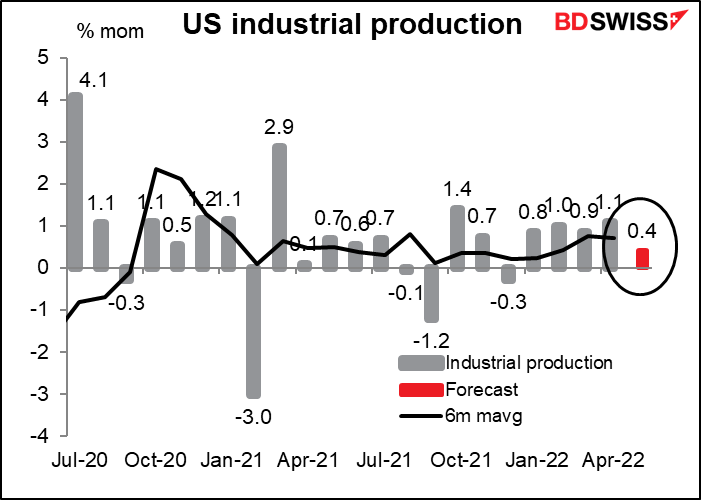

Industrial production is expected to slow somewhat, which would actually be a pretty good outcome in light of the 2.2-point fall in the Markit manufacturing PMI for the month (and the 36.2-point collapse in the Empire State manufacturing index in May and the 15-point plunge in the Philly Fed index).

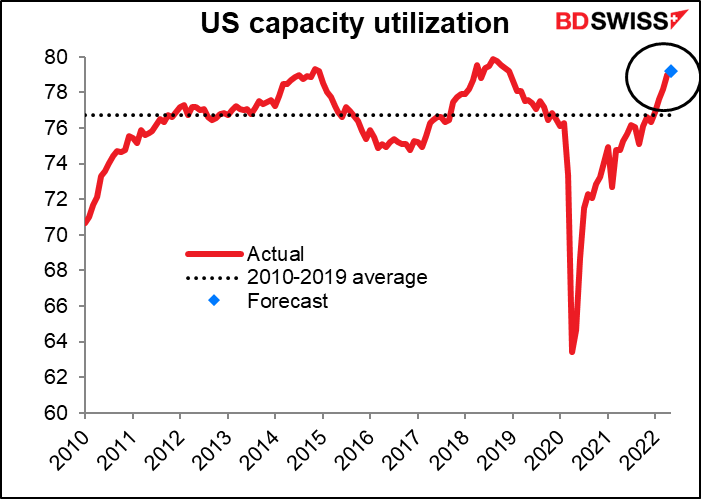

Capacity utilization is expected to rise a little but not yet up to recent highs.

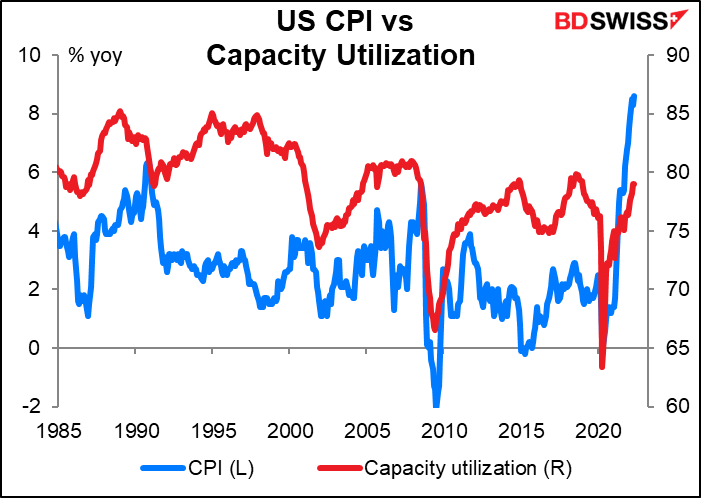

Still, there isn’t that good a correlation between capacity utilization and inflation from 1990 to 2000 capacity utilization was very high but inflation trended lower.

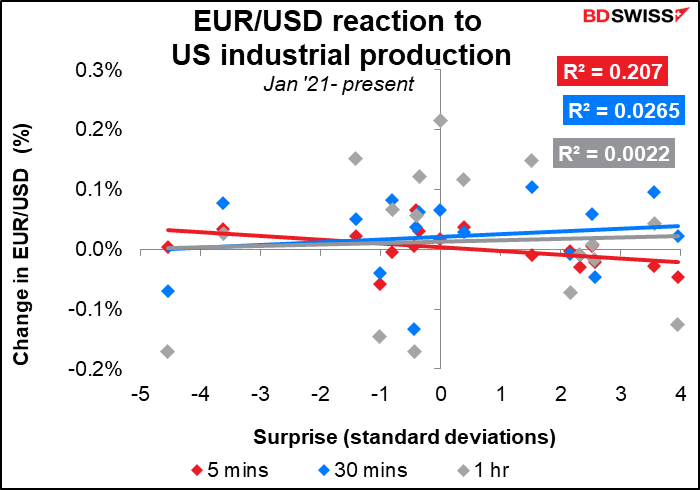

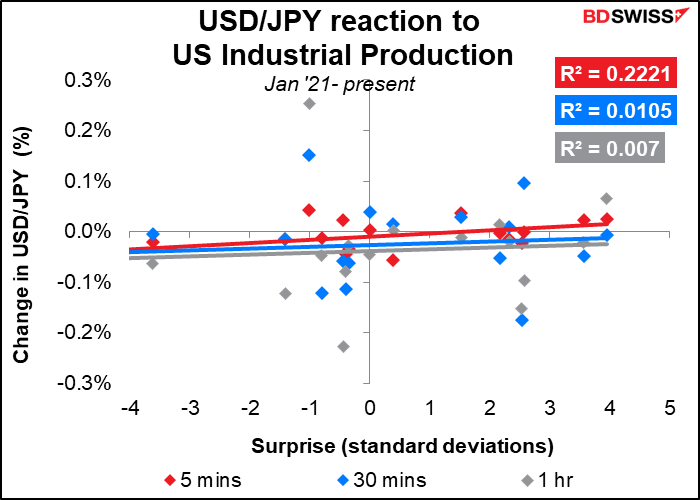

The IP data does have an immediate effect on the FX market, although it doesn’t seem to last long.

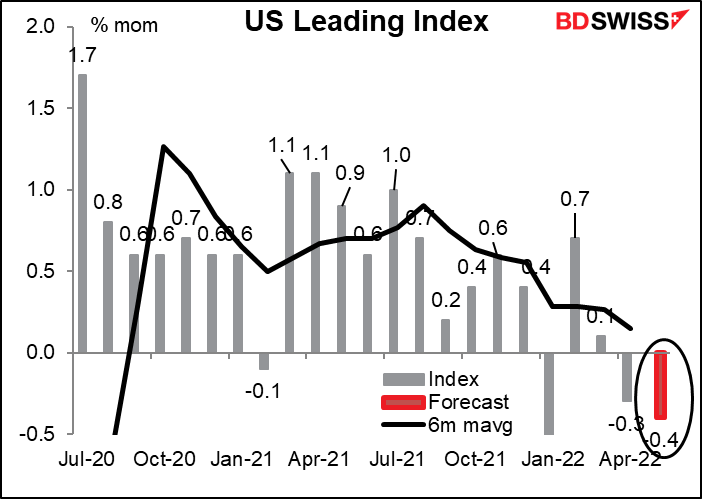

The US leading index is headed down for the second month in a row. This is not a good sign, particularly given some of the recent numbers we’ve seen from the Fed surveys, such as the -1.2 in the Empire State manufacturing survey. Also the Atlanta Fed’s GDPNow estimate for Q2 GDP is +0.0% (qoq SAAR). This would follow the Q1 actual figure of -1.5% and leave the US economy bordering on a technical recession (defined as two consecutive quarters of shrinking GDP).

Over the weekend there’s the second round of voting for France’s General Assembly. According to Politico, President Macron’s LREM/ENS coalition is expected to win anywhere from 257 to 296 seats. That doesn’t leave much margin for error for them to get the 289 seats necessary to win a majority

There are three likely scenarios:

- President Macron’s party wins a majority of the seats. That would of course make it easier for him to pass his proposed reform measures, such as raising the retirement age and overhauling a low-income aid program.

- Macron’s party wins a minority with the left-wing NUPES coalition the largest opposition party. NUPES (short for Nouvelle Union Populaire Écologique et Sociale) is a coalition of left-wing parties under the direction of Jean-Luc Mélenchon. That would result in a fragile government that would have to compromise with some other party or parties to get anything done. It would be a dramatically different political landscape than today’s, where President Macron can rely on his party’s majority to pass legislation without much resistance. In a sense, NUPES would bring the public opposition to much of the president’s agenda into Parliament, making it much trickier to realize.

- NUPES wins a majority, leaving the government in “cohabitation” – the President (Macron) being from a different party than the Prime Minister (presumably Mélenchon, the head of NUPES). This is unlikely because it would require NUPES’s base voters to turn out in much greater numbers than they did in the first round, especially young people and low-income voters. But if it did happen, it would be a seismic change to European politics. It could encourage other ideologically similar parties in Europe, which have struggled since the heydays of Syriza in Greece and Podemos in Spain. Moreover, a French government willing to push back forcefully against the European Union’s restrictions on public spending and state intervention in the economy could force changes in EU policy – or cause policy gridlock, perhaps.

The notable point here is that while the Presidential elections were focused on the threat to President Macron from the right, i.e. Marine Le Pen, the actual threat to his agenda will be from the left.