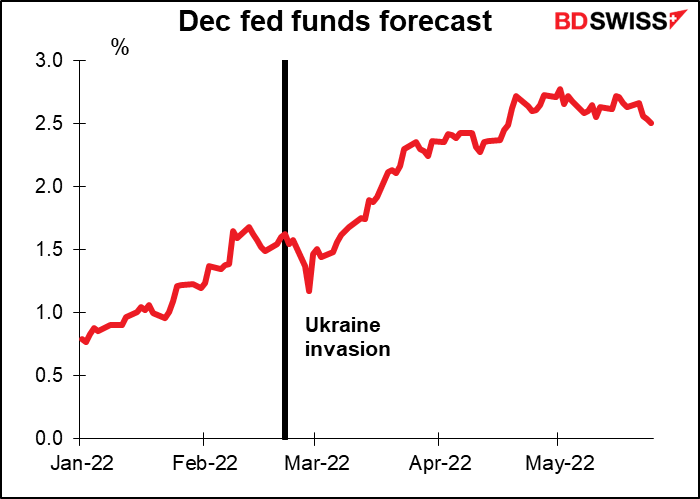

Something funny has been happening recently. Although inflation rates remain high and inflation expectations are still rising, interest rate expectations have been falling back.

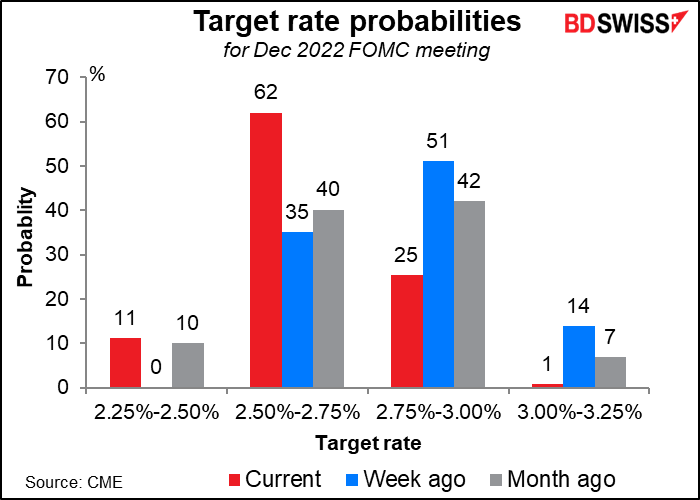

The leader of the pack as usual is the US. The December fed funds futures are now pricing in a rate of 2.51% at the meeting, down a full 25 bps rate hike from its peak of 2.78% on May 3.

The market now sees 2.50%-2.75% as the likely end-year target for fed funds. This is down 25 bps from just a week ago.

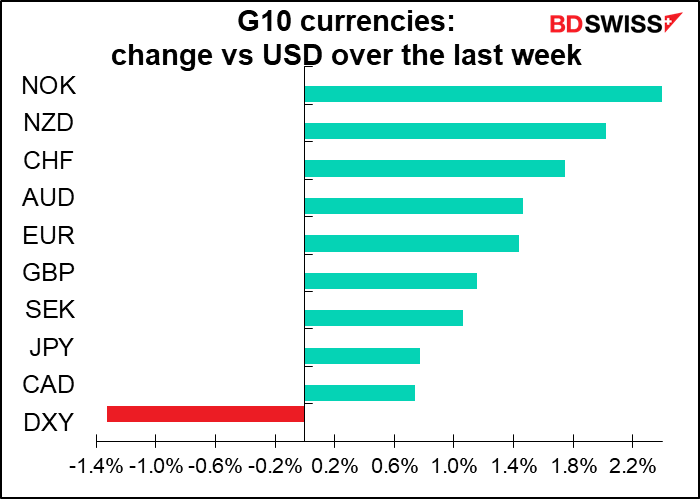

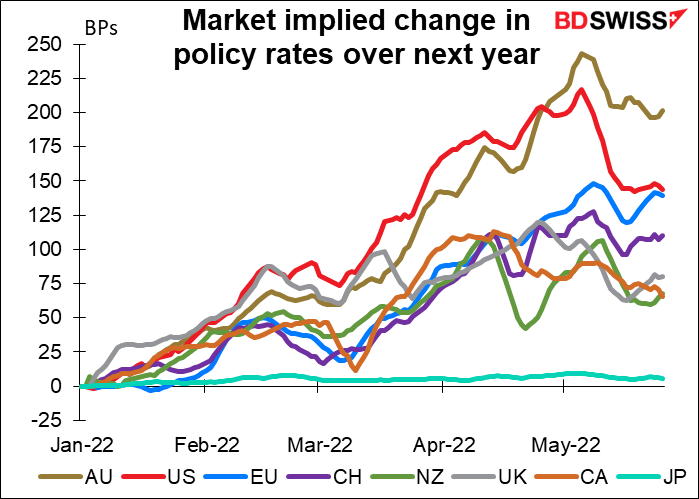

While the US has seen the greatest change, the market is repricing rate expectations for other countries too.

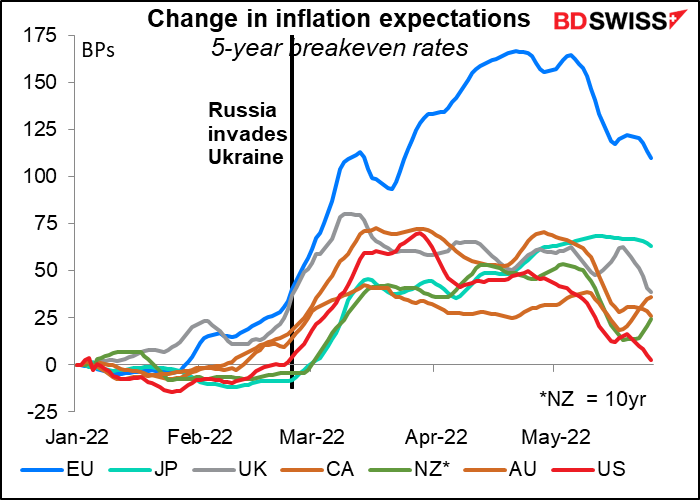

The reason is probably that investors are revising down their expectations for inflation. In the US for example the five-year breakeven inflation rate is back to where it was at the beginning of the year. Expectations for other countries too have been declining recently.

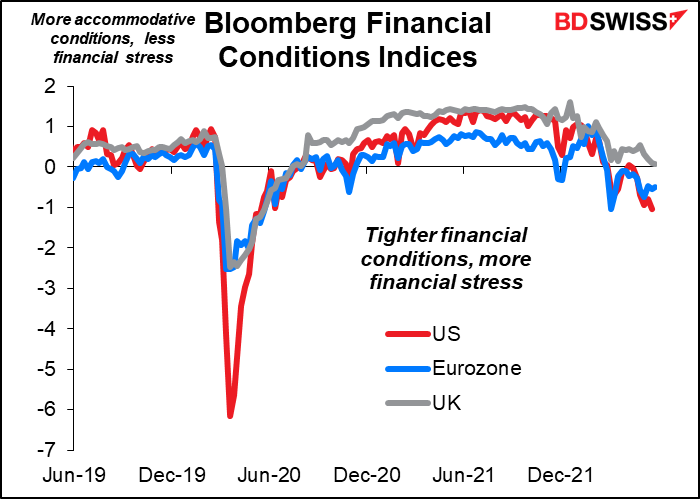

One possible reason: the market has done much of the work of the central banks. Financial conditions have been tightening as bond yields move higher, stock prices move lower, and credit spreads move wider.

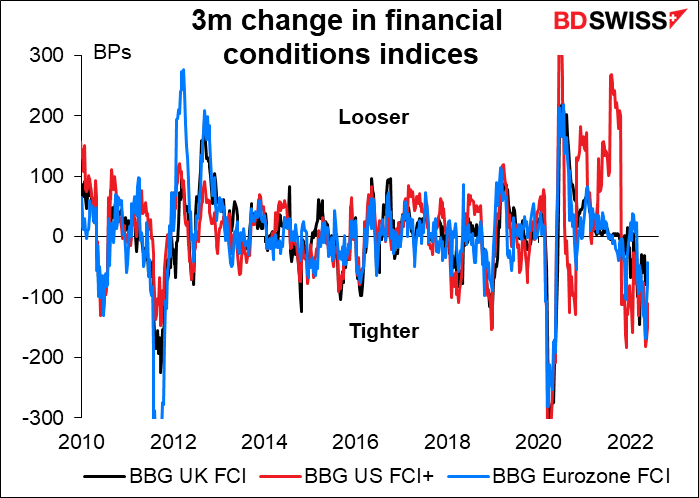

When we look at the change in the financial conditions indices (FCIs) over the last three months, it’s clear that there’s been a dramatic change in financial conditions recently. The Fed staff has noted this point. In the minutes of the May meeting of the Federal Open Market Committee (FOMC), the staff pointed out that “financial conditions, as measured by many financial conditions indexes, had tightened by historically large amounts since the beginning of the year.” This is true not only for the US but for the EU and UK, too.

The market is doing a considerable amount of the central banks’ work for them. EG in the US, look at the recent signs of a slow-down in the housing market as mortgage rates have risen by 200 bps this year alone! The more the markets react, the less the Fed and other central banks will have to tighten and the greater the chances of a “soft landing.” That would be a happy outcome all around.

The coming week: NFP, Bank of Canada, lots of other indicators

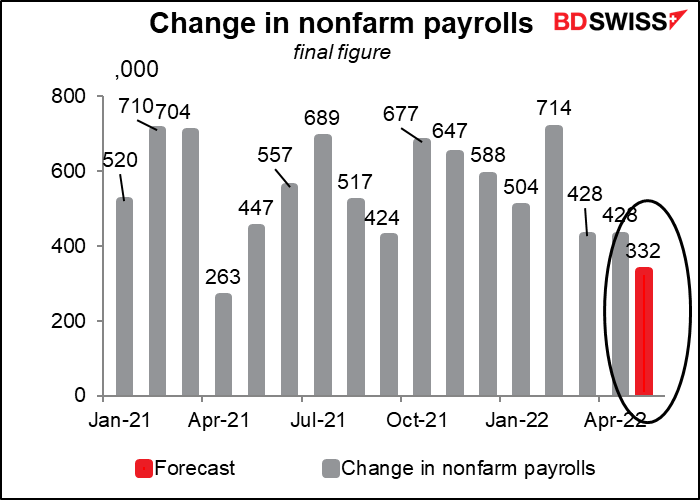

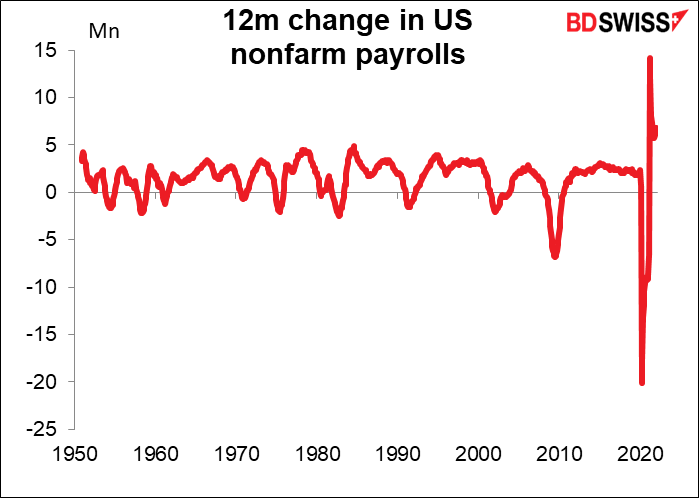

The main feature this week will be that old standard, the US nonfarm payrolls. They’re expected to show a somewhat lower but still healthy 332k increase, down from 428k the previous month. (Note: the consensus forecasts are subject to large changes as more economists send in their forecasts.)

Let me remind you that payrolls have risen by more than 400k for 12 consecutive months, the longest such streak in history. And if we exclude one month when it was “only” 261k the streak goes back another three months.

In fact under President Biden we’ve seen the largest increase in jobs ever in American history. But all the media can talk about is inflation, inflation, inflation. Furthermore, when the NFP figure fails to hit economists’ forecasts, journalists always frame it as “payrolls disappoint,” as if it’s the responsibility of the data to hit economists’ expectations instead of economists’ responsibility to accurately forecast the data (which we all know is impossible, but they go through the routine constantly anyway).

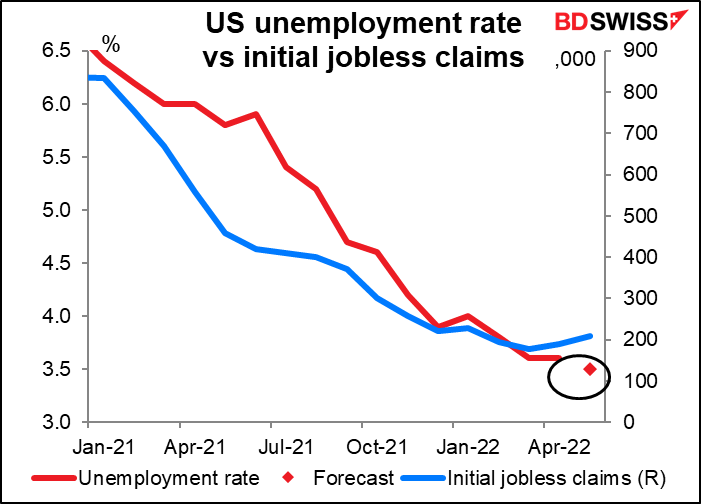

The unemployment rate is forecast to remain at 3.5%, which is the lowest for some 50 years. The risk is on the upside though, if not for May then for June, as initial jobless claims start to creep up again.

Of course as usual people will be looking to the ADP report for some guidance on the NFP, even though the two figures are virtually uncorrelated. This week the ADP report comes out on Thursday, not Friday, because of the Memorial Day holiday in the US on Monday.

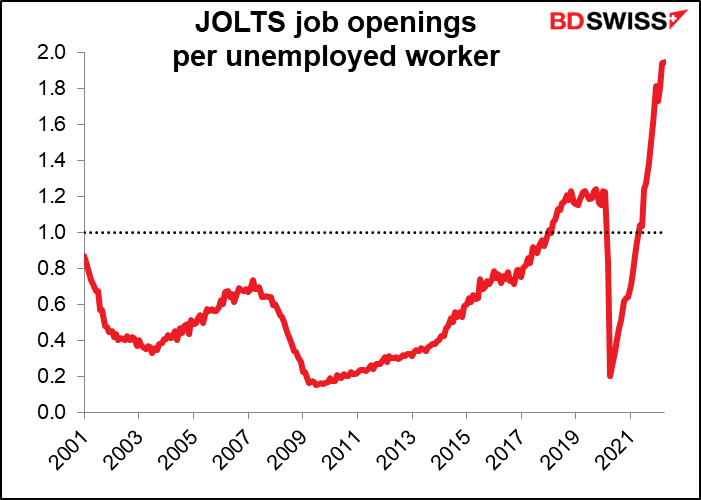

The Job Offers and Labor Turnover Survey (JOLTS) for April will come out two days before the NFP. There are no forecasts yet. The number of unemployed persons was pretty much the same in April as in March, so if the number of job openings stays around the record level that it reached in March, then the number of job openings per unemployed person would stay near the record 1.94 of that month. Imagine: there are nearly two job openings for every person who’s registered as unemployed! That’s what Fed Chair Powell meant when he said that the US labor market is “historically tight.” Usually there’s fewer than one job available (data available back to 2001).

The JOLTS report may not get that much attention from the markets, but it does get attention from the FOMC. For example, the minutes of the May meeting said that

(Participants) observed that various indicators pointed to a very tight labor market. Employment growth had continued at a strong pace, the unemployment rate had fallen to a near-50-year low, quits and job openings had remained extremely elevated, and nominal wages had continued to rise rapidly…Several participants raised the possibility that, in light of the exceptionally high ratio of vacancies to job searchers, a moderation in labor demand might serve to reduce vacancies and wage pressures without having significant effects on the unemployment rate. (emphasis added)

Other major US indicators out during the week include the Conference Board consumer sentiment index (Tue) ISM indices (manufacturing Wednesday, service-sector Friday), the Beige Book (Wed), and factory orders (Thu).

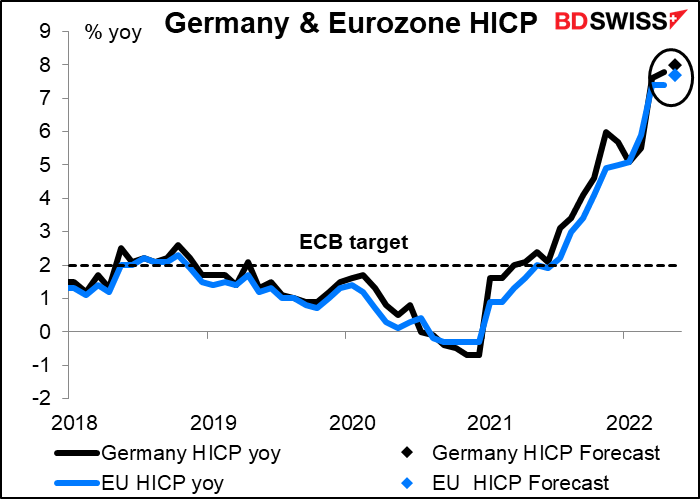

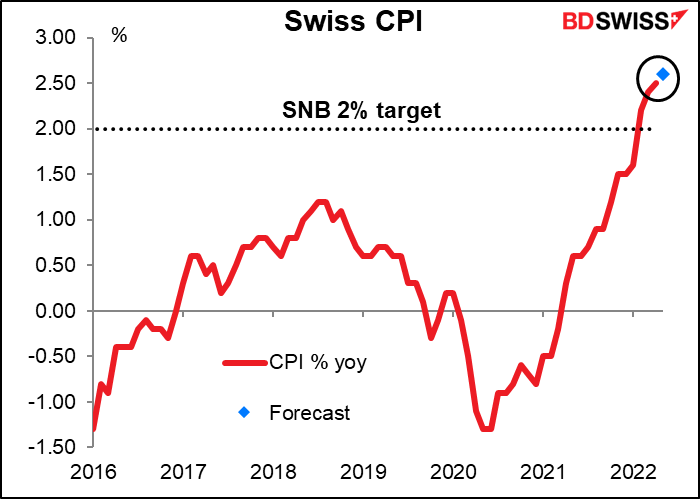

In the Eurozone, we have German consumer price index (CPI) (Mon) and unemployment (Tue), each followed a day later by the Eurozone-wide version of the same indicator. Also Swiss CPI (Thu) and EU-wide retail sales (Fri).

Within these, the CPIs are the most important. Both the German and Eurozone CPIs are expected to show a rise in inflation of 20 bps, to 8.0% and 7.7%, respectively. This will only cement the conviction among members of the European Central Bank (ECB) Governing Council that they have to start hiking rates ASAP. At the moment a 25 bps hike seems to be the consensus but a further rise in inflation could convince more members that a 50 bps hike is warranted. That could be positive for EUR.

Switzerland is also expected to see a further rise in inflation, which could add to speculation that the Swiss National Bank (SNB) will follow the ECB’s rate hike sooner rather than later. CHF+

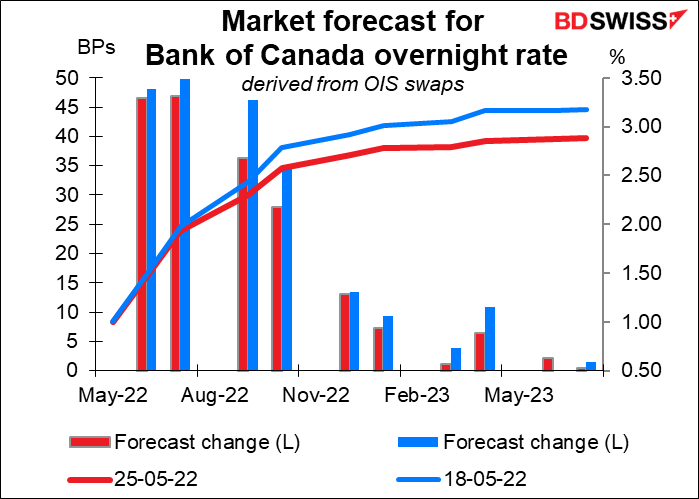

The only major central bank meeting during the week is the Bank of Canada. The market expects a 50 bps hike from the BoC, but with a little less conviction than a week ago.

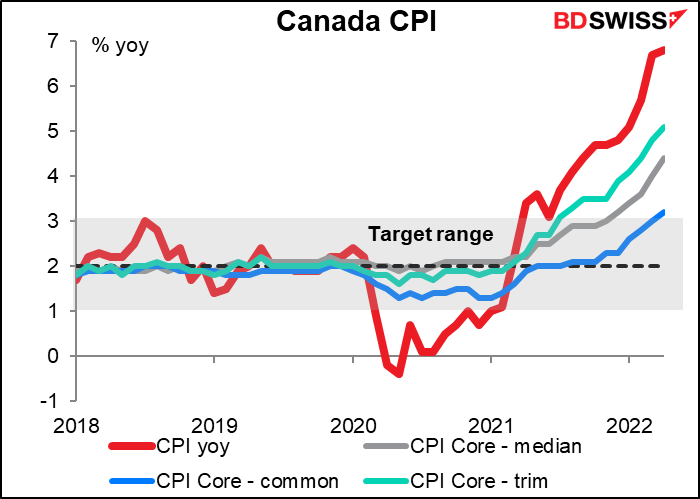

Inflation in Canada remains well above target and the labor market is historically tight. Since the last BoC meeting on April 13th, the BoC has gotten two more months of inflation data. Inflation has continued to rise to the point that not only the headline figure but even all three of their “core” measures are above their 1%-3% target range.

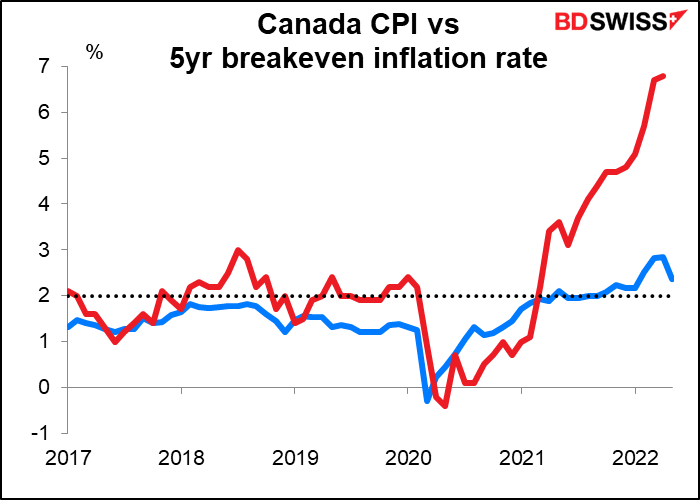

And inflation expectations have risen above their 2% target, although they’ve come down significantly in the last month – perhaps this is why rate expectations have come down somewhat, too. The Bank said back in April that “There is an increasing risk that expectations of elevated inflation could become entrenched. The Bank will use its monetary policy tools to return inflation to target and keep inflation expectations well-anchored.”

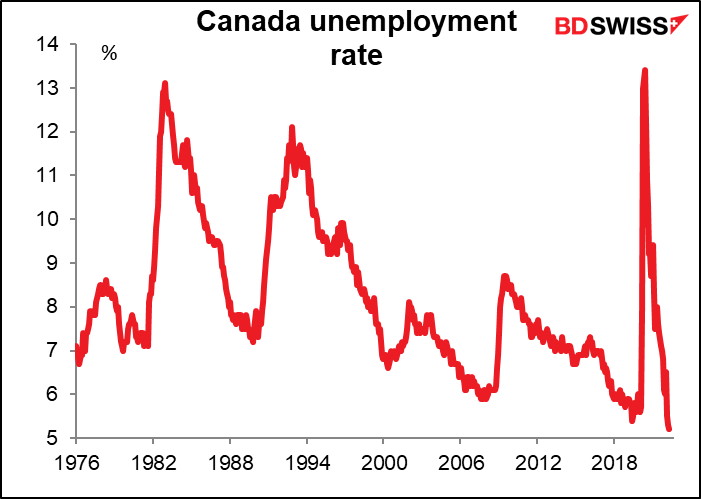

Meanwhile the unemployment rate is at a record low. Employment growth is slowing because there aren’t enough people who need jobs! No wonder the Bank said in April that “With the economy moving into excess demand and inflation persisting well above target, the Governing Council judges that interest rates will need to rise further.”

I think this meeting will be a lot like this past week’s Reserve Bank of New Zealand meeting, where the policy action wasn’t in doubt and the focus was instead on the outlook for future rate hikes. In that respect, I think there’s the possibility that the BoC surprises on the upside. Having said that, there won’t be a new Monetary Policy Report nor a press conference after the meeting. There will however be an Economic Progress Report by Deputy Gov. Paul Beaudry the next day – that could be an opportunity to goose the markets a bit.

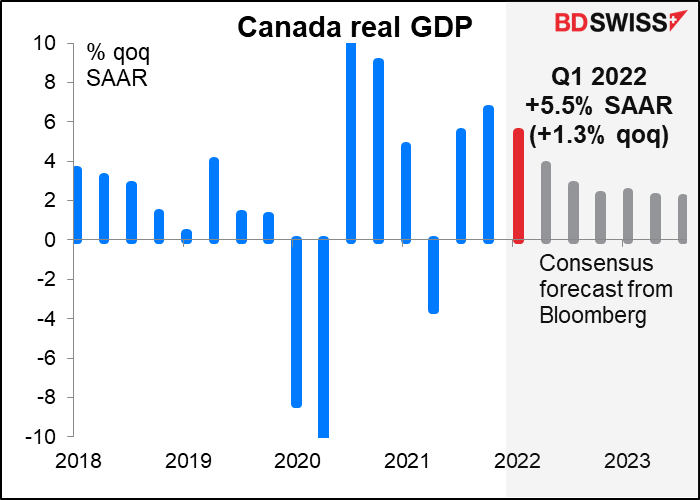

The day before the Bank of Canada meeting, Canada announces its March and Q1 GDP figures. Q1 GDP is forecast to be up 5.5% qoq SAAR, much higher than the 3.0% qoq SAAR rate that the Bank of Canada predicted in its April Monetary Policy Report. A result like this may cement the idea of a hawkish BoC meeting the next day and boost CAD.

As it’s the last week of the month, there are several Japanese indicators, mostly on Tuesday, when the government releases the unemployment rate, industrial production, and retail sales. (The monetary base comes out on Thursday, but you don’t really care about that, do you?)

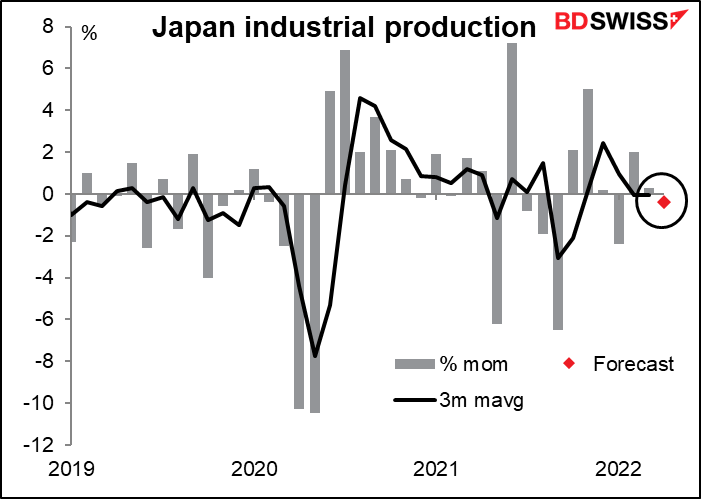

Within this, industrial production is probably the most important statistic. It’s expected to be down month-on-month. The trend – the six-month moving average – is for no increase at all. This is kind of pathetic.

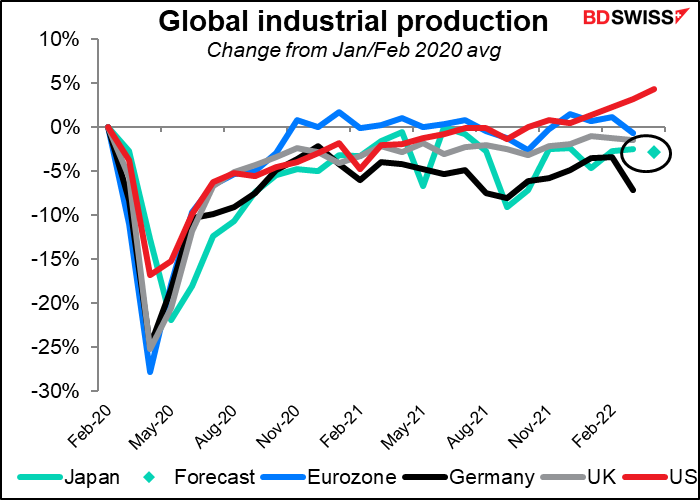

Japan’s industrial recovery has lagged behind that of the US and Eurozone but (so far) beaten that of Germany, another export-driven economy.

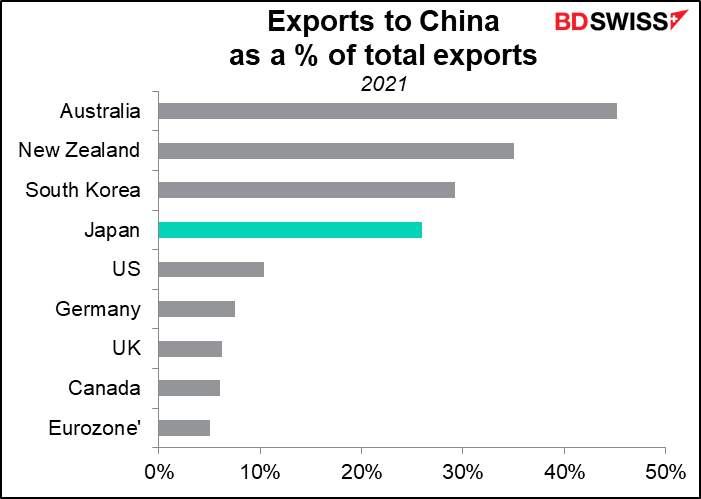

The recent sluggish growth in China, which takes 26% of the country’s exports, will do nothing to help Japan. China Premier Li Keqiang Wednesday gave a bleak assessment of the Chinese economy. He said the economy could struggle to post positive growth during the current quarter, in contrast to their goal of 5.5% GDP growth for the year. That’s a big negative for Japan.

For the FX market, the sluggish growth in Japanese industrial production suggests that the Bank of Japan is likely to remain focused on supporting the economy rather than dealing with inflation that’s just barely poked its nose over the 2% target. This seems to me to be a recipe for a weak yen.

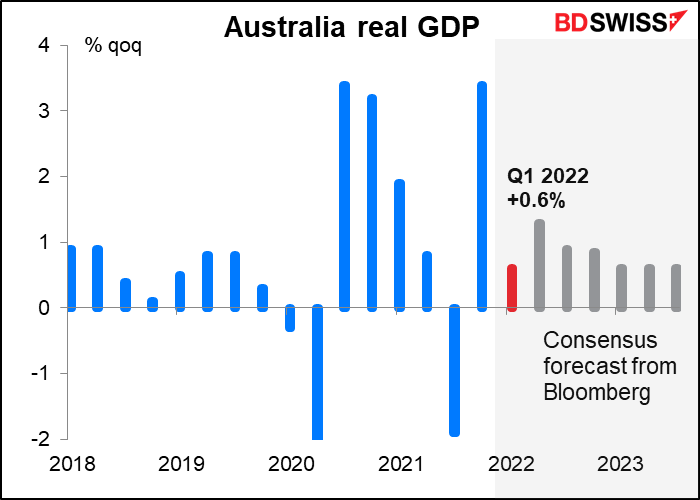

It’s big week for indicators from Australia too. These include the current account, private sector credit, and building approvals (Tue); GDP (Wed); and trade balance (Thu).

GDP is of course the most important of these. It’s expected to be somewhat sluggish, thanks to the omicron wave and severe flooding in parts of the country. It therefore probably won’t be seen as a precursor to weaker growth for 2022 as a whole.

The market’s focus will be on the various wage and price indicators in the report. Reserve Bank of Australia (RBA) Gov. Lowe specifically highlighted the national accounts measure of labor costs in his press conference following the May rate hike. (“So it’s a very clear message coming through all these channels that labour costs are on the move. I think in time, we’ll see that in both the Wage Price Index and in the measure of labour costs from the National Accounts.”) The wage price index rose only 0.7% qoq in Q1 (vs +0.8% expected). A stronger signal from the national accounts could boost the case for a 40 bps hike in the RBA’s cash rate at its June 7th meeting, as the market had been anticipating until recently (now pared down to 30 bps). That would probably be positive for AUD.

One important country is missing from this article: Britain. Mortgage approvals (Tue) are the only major economic indicator due out, and even that isn’t so major. Instead, politics are likely to remain the main focus in Britain as PM Boorish Johnson navigates the aftershocks of Sue Gray’s report on Partygate, as it’s become known. Also the brouhaha over the Northern Ireland Protocol remains unresolved and a possible flashpoint.

Finally, there will be a regular meeting of OPEC+ ministers on Thursday. As usual they’ll probably vote to increase production by some 430k barrels a day (b/d) but also as usual they probably won’t be able to deliver on that increase because so many of their members are pumping near capacity already anyway. It should be more or less a non-event for the markets.