Rates as of 05:00 GMT

Market Recap

Currencies were a bit calmer than usual yesterday ahead of today’s meeting of the Federal Open Market Committee (FOMC), the rate-setting body of the US central bank (see below).

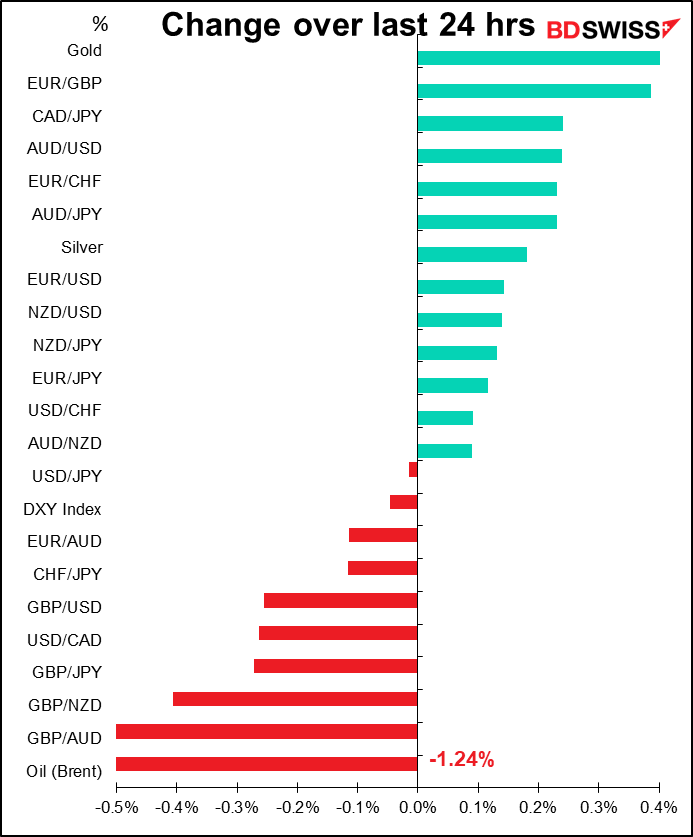

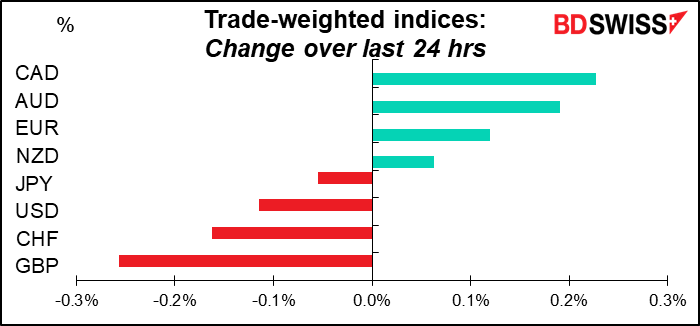

It’s a bit surprising that CAD tops the list of currencies this morning even though oil prices are down. CAD seems pretty well divorced from oil at this point.

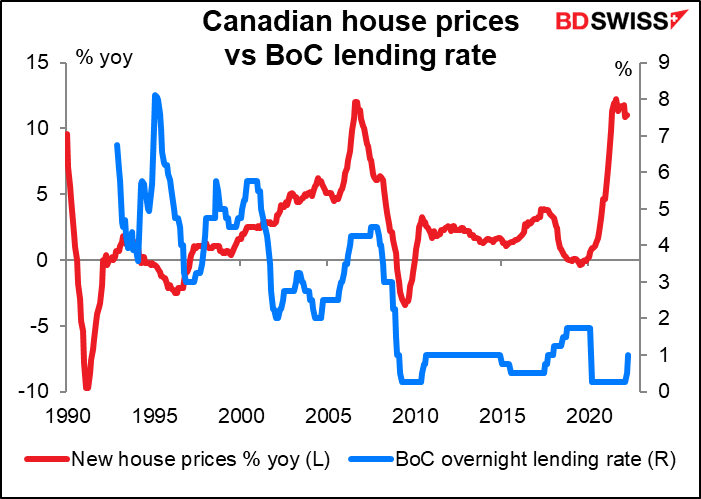

The currency was already gaining when Senior Deputy Governor Carolyn Rogers made some comments that helped it to appreciate further. Following her first speech since joining the Governing Council, Rogers said in answer to a question that “housing price growth is unsustainably strong in Canada” and “”We need higher rates to moderate demand, including demand in the housing market.”

It’s true that the last time Canadian house prices were rising this much, the Bank of Canada’s overnight lending rate was over 4%, not 1.0%.

I think CAD strength might have more to do with USD weakness than CAD strength. USD is 60% of the CAD trade-weighted index and EUR is 22%.

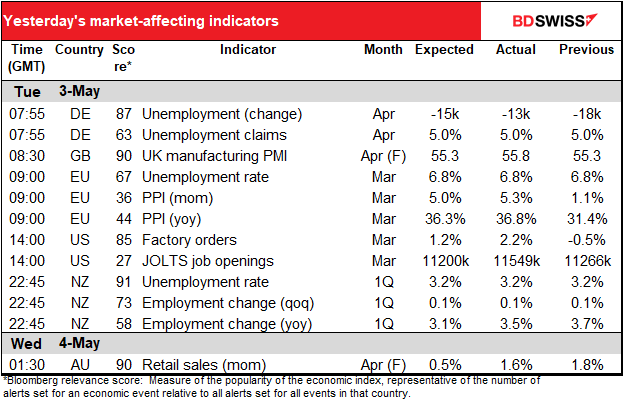

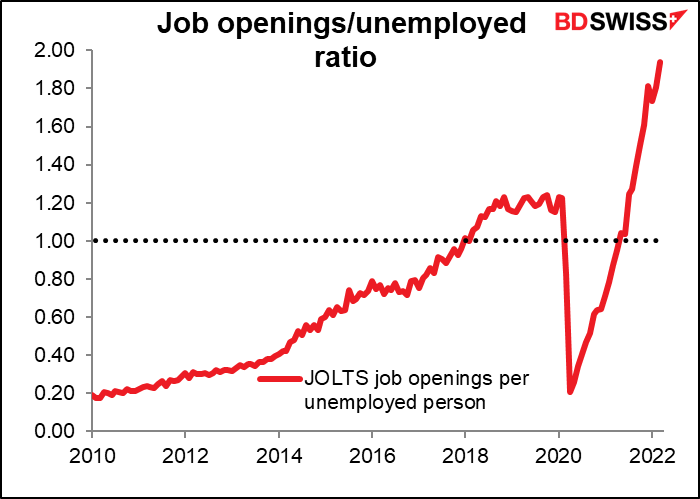

It’s a little surprising to me that the dollar weakened after the Job Offers and Labor Turnover Survey (JOLTS) report showed an increase in job openings to a record high (see table above) while the quits rate returned to its record high of 3.0%. There are now a record 1.94 jobs for every unemployed person. This evidence of a “hot” labor market should help to convince the Fed that they can hike rates much much further without causing the labor market to collapse. That’s why it should in theory be good for the dollar.

Maybe the dollar’s weakness came about because former Fed vice chair for supervision, Randal Quarles, said the unmentionable yesterday. “Given the intensity of inflation, the degree to which unemployment has been driven down — to bring that back into an equilibrium, it’s unlikely the Fed is going to be able to manage that to a soft landing,” he said on the IntraFi Network’s Banking with Interest podcast. “The effect is likely to be a recession.”

Everyone in officialdom knows that but everyone also goes along with the fiction that the Fed can manage to ease the economy into a low-inflation expansionary path. For example, Fed Chair Powell in March told US lawmakers that “it’s more likely than not that we can achieve what we call a soft landing, and they’re far more common in our history than is generally understood.” Other people, notably former Treasury Secretary Larry Summers, argue that those examples are not relevant today because inflation is much higher and unemployment much lower. Plus the Fed no longer has a “pre-emptive” framework but rather “flexible average inflation targeting” that allows for temporary overshoots in inflation before the Fed starts tightening policy.

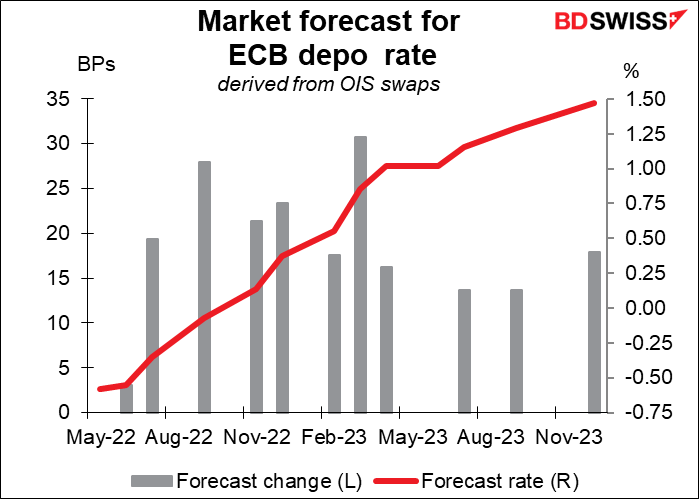

Meanwhile, EUR was boosted a bit by comments from European Central Bank (ECB) Executive Board member Schnabel, who said “it’s not enough to talk now – we have to act.” “From today’s perspective, I think a rate hike in July is possible.” Others have said it’s possible but not likely, so this was a bit more aggressive. Nonetheless significant tightening is already priced into the euro, including a 25 bps hike in July, and so it will take more than that to turn the trend around, in my view.

AUD gained from better-than-expected retail sales figures (see table above), which added to the currency’s momentum after yesterday’s larger-than-expected Reserve Bank of Australia (RBA) rate hike.

As for why GBP was at the bottom of the table…I couldn’t find anything specific, but with the Bank of England meeting and especially the UK local elections tomorrow, it’s no surprise that perhaps some people are taking risk off the table. As I said in my Weekly Outlook, the local elections are likely to result in a victory for the Republican party Sinn Fein in Northern Ireland with a resulting increase in centripetal forces in the UK.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

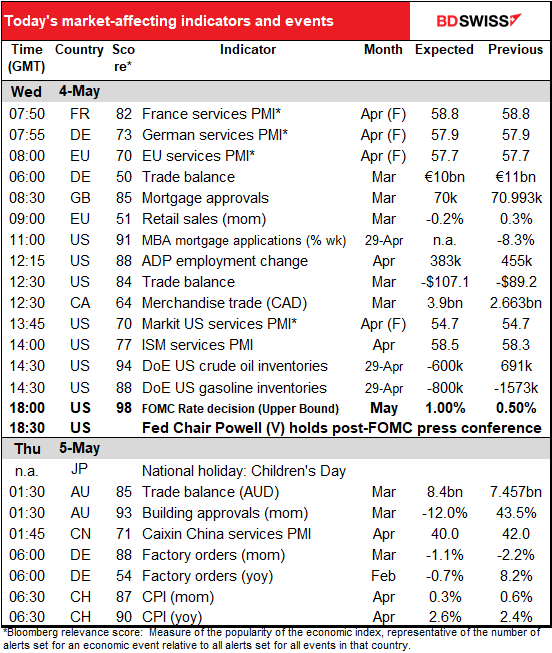

There’s a lot on the schedule today, but the markets aren’t interested in most of it. The focus is naturally on this evening’s meeting of the rate-setting Federal Open Market Committee (FOMC), the decision-making body of the US central bank.

As usual, I covered this in depth and detail in my world-famous Weekly Outlook, which I’m sure you’ve read, so I won’t repeat all the details here, just the main points.

First off, a 50 bps hike is a near-certainty, as several Committee members have suggested. It’s also likely that they will announce that they will begin to shrink their balance sheet – “quantitative tightening,” or QT – in June.

With the changes in policy well foreshadowed, the focus is likely to be on the tone of Fed Chair Powell’s press conference. He’ll probably repeat what he’s said before about the need to “expeditiously” move to a more neutral policy stance and make it clear that this is the consensus of the Committee. In particular, he’s likely to reaffirm that given the inflation outlook, some “front-loading” of policy moves is appropriate. Of course to get to what the Committee considers the “neutral” rate of interest – 2.4% — by the December meeting would require at least one if not two more 50 bps hikes, which the market has already priced in. I therefore expect him to confirm the current market pricing for 50 bps hikes at the June and July meetings as well, or at least not to protest against this pricing.

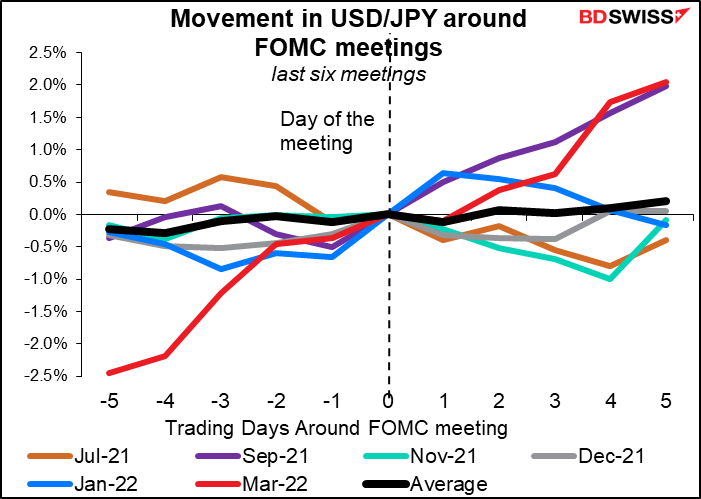

Market impact: The dollar has tended to appreciate vs EUR following the last six meetings. Of course as always, “past performance is no guarantee of future performance,” but if Fed Chair Powell’s performance is anything like what it’s been in the past, I would expect this meeting to have the same impact as before.

The movement vs JPY has been more mixed, but the last three meetings have shown a marked rise in USD/JPY (appreciation of USD vs JPY) following the meeting. That’s probably because the Bank of Japan is on hold indefinitely so the gap between rate expectations in the US and Japan widens. I would expect this to happen yet again and for USD/JPY to move higher after the meeting.

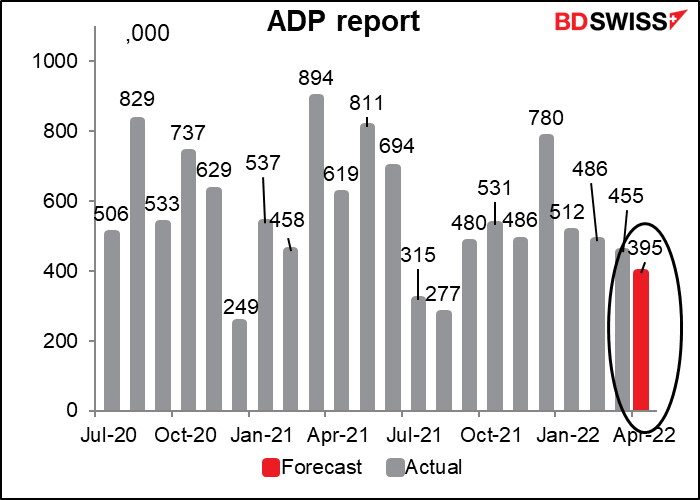

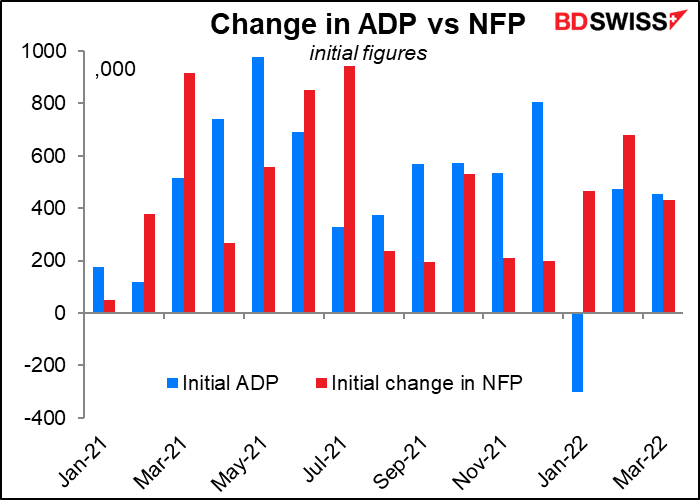

The other big point of interest today is the ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls (NFP) figure might be.

Note though that the ADP adjusts its figures to match the final estimate of the NFP’s reading on private payrolls. It is therefore two steps removed from the headline figure that everyone focuses on, which is the initial figure for total payrolls, including government workers. So while it’s one of the few guides to the NFP that we have, it’s not perfect by any means – in fact, neither is the NFP figure itself, since it’s always revised.

The market is looking for an increase of 395k jobs, similar to last month’s 455k jobs and also similar to the 390k forecast for Friday’s NFP figure.

Every month I go through this though – the two really aren’t that closely correlated. Just look at the January figure, when the initial ADP report was -301k and the initial NFP was +444k! (The ADP report was later revised up to +512k – oops!) But everyone treats the ADP report as if it is a guide to the NFP and the market reacts accordingly.

Other indicators

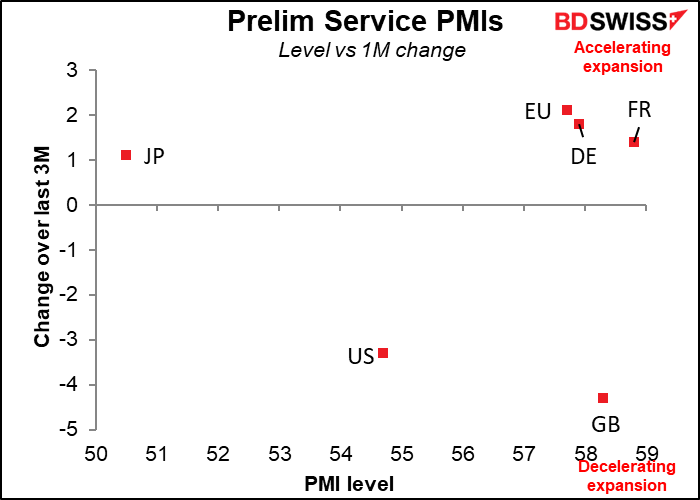

We start off the day with the service sector purchasing managers’ indices (PMIs), once again the final ones for the major economies and the first and only versions for all the other countries. These used to play second fiddle to the manufacturing PMIs, which are much more cyclical, but ever since the pandemic hit the service sector harder than manufacturing these have been the stars of the show.

The preliminary versions didn’t show any consistent pattern. The US and UK fell while Japan and the Eurozone rose somewhat. The absolute levels aren’t converging, either.

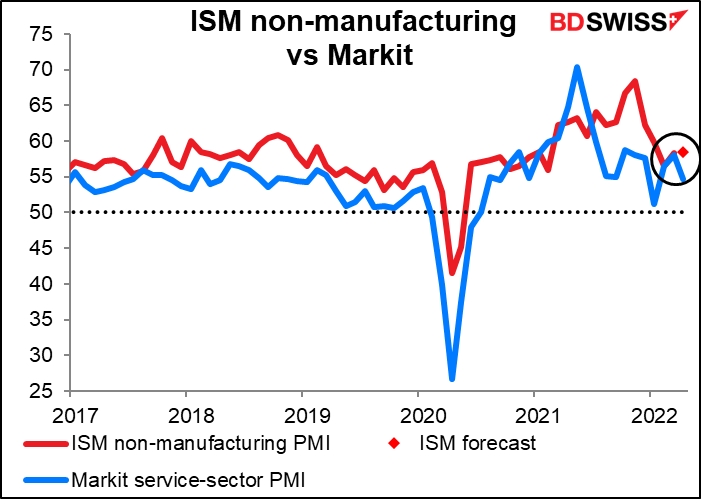

A few minutes before Markit releases the final version of its US service-sector PMI, the Institute for Supply Management (ISM) releases its storied version of that indicator. It’s expected to rise a tiny 0.2 point. This is in contrast to the Markit version, which was down 3.3 points during the month. Nonetheless the absolute level of the two is pretty close at this point.

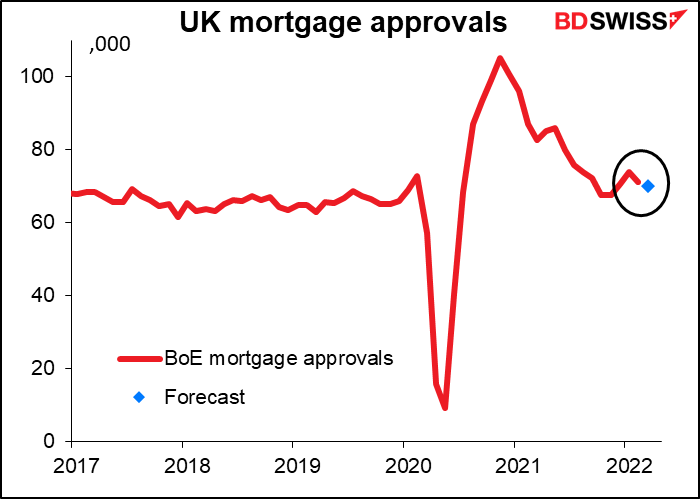

UK mortgage approvals are expected to continue their slow decline as the country works off the frenzy of house-buying that went along with the stamp tax holiday during the pandemic. (The stamp tax took a few months off and went to Ibiza during lockdown so people didn’t have to pay it while it was away.) I don’t think this will have any impact on GBP today.

There are several sets of trade data coming out today.

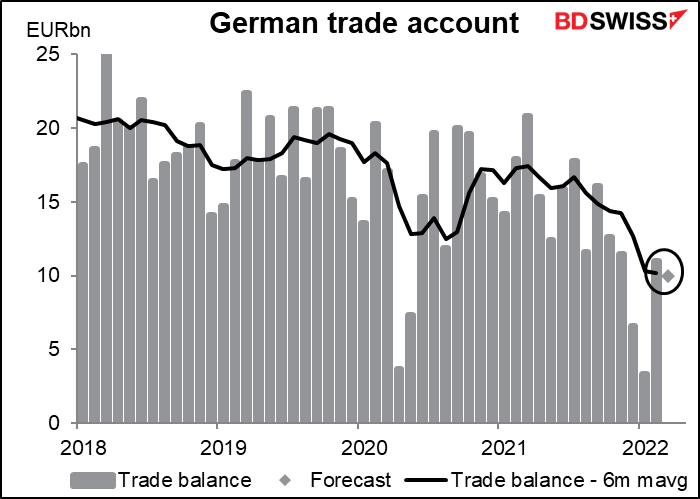

Germany’s trade surplus is expected to fall. It crashed in December and January as imports rose sharply – oil & gas prices? — but returned to a more normal level in February. March is expected to be more in line with February but a bit lower.

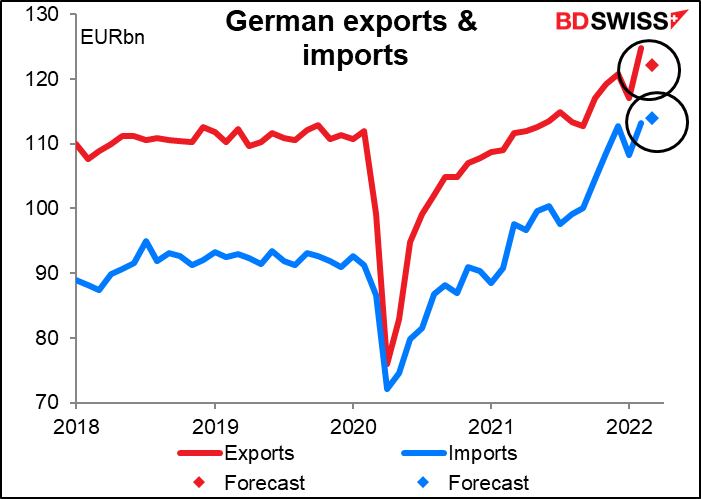

Exports are expected to fall while imports rise. This dynamic may be one of the things weighing on EUR: the additional cost of energy imports when growth elsewhere in the world is slowing.

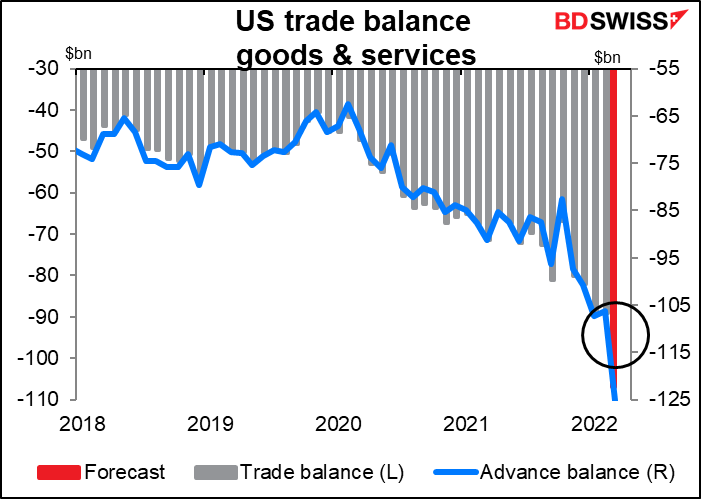

Germany isn’t alone in this. The US trade deficit is expected to hit a record, which would surprise absolutely no one after last week’s merchandise trade figure (aka advance trade balance) hit a record deficit.

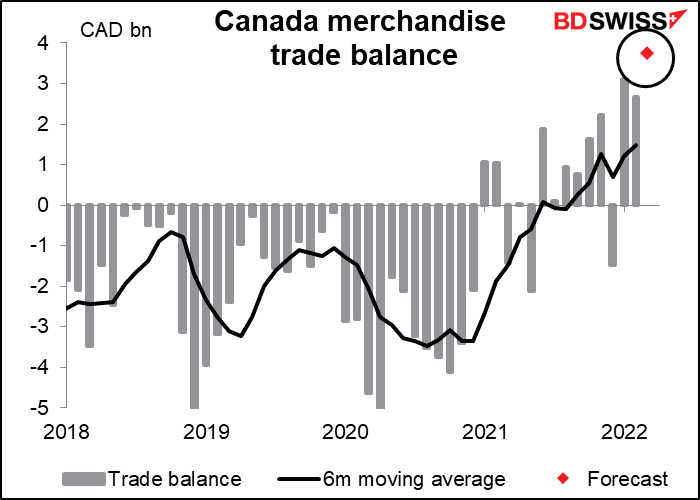

Canada’s merchandise trade surplus on the other hand is expected to hit the highest level it’s been since the collapse of Lehman Bros. in 2008. Hmm, must be nice to be an oil exporter at this time.

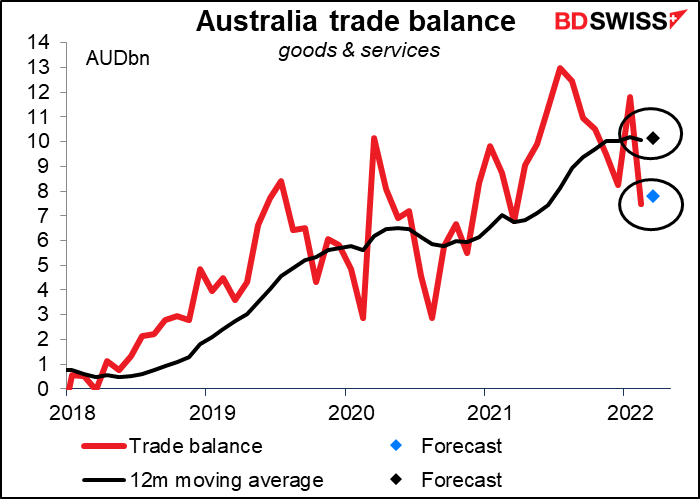

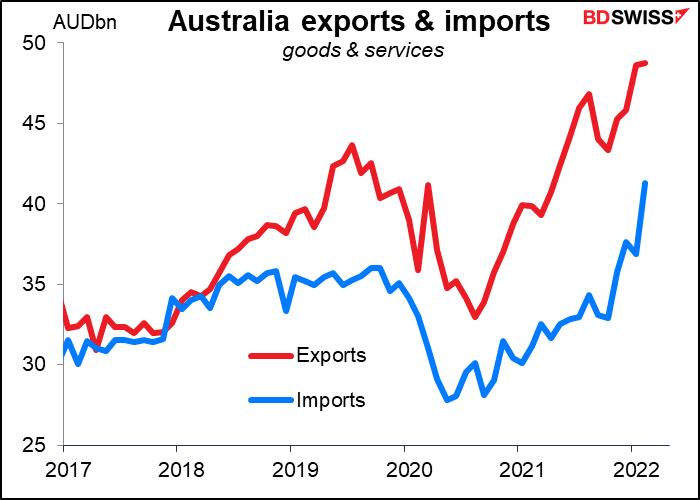

Then continuing the run, overnight we get Australia’s trade balance. The country’s trade surplus is expected to be up a bit, but the data aren’t seasonally adjusted so what’s more important is the forecast 12-month moving average. Based on the forecast for the month, the 12m moving average would be effectively unchanged – pretty steady for the third month in a row. So it’s not bonanza time for every commodity exporter.

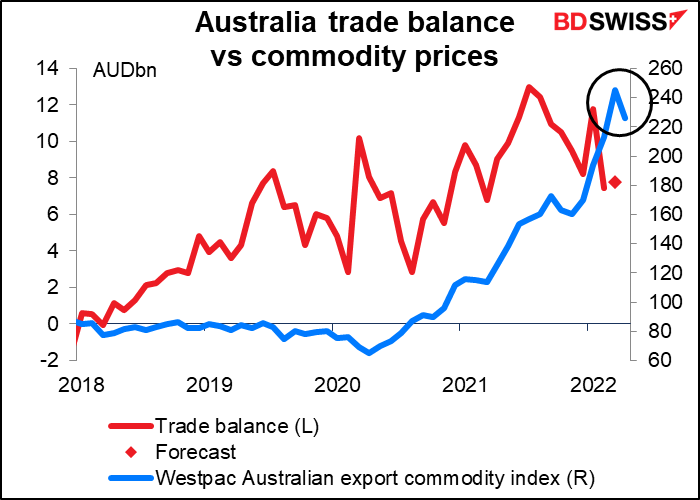

The Westpac index of Australian export commodity prices was up 15% during the month, although it fell back somewhat in April.

The problem doesn’t seem to be on the export side. We don’t have forecasts for imports and exports yet but if we look at the past few months it’s clear that imports have been shooting up as lockdowns end and people can get out and spend, spend, spend again. Meanwhile the lockdowns in China and the subsequent slowdown there, particularly in the construction industry, are likely to weigh on Australian exports and AUD for the next few months at least.

As for Australia’s building approvals, they’ve been doing up and down in quite a volatile fashion. After last month’s enormous increase, this month they’re expected to be down a lot. Thie six-month moving average however would be down only a little bit (from +1.8% mom to -0.3%)

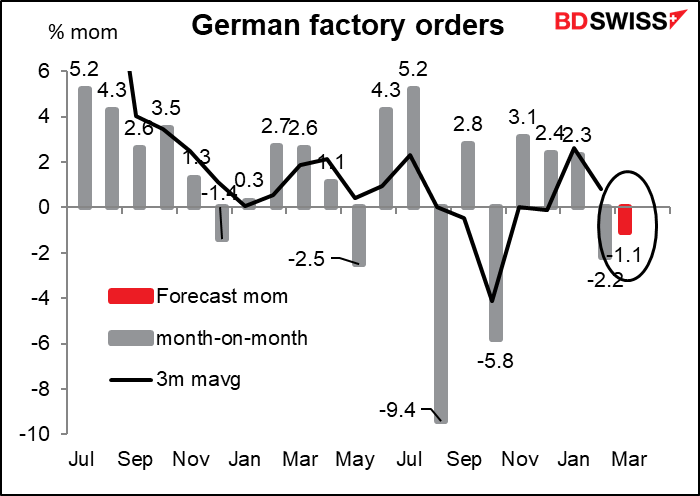

Then early in the European day, Germany announces its factory orders. This is a major leading indicator for industrial production and is therefore a key indicator for Germany. It’s expected to be down for the second month in a row, which isn’t surprising. A lot of companies have had to either cut back production or even stop entirely because of high energy costs or difficulties in getting hold of raw materials or parts.

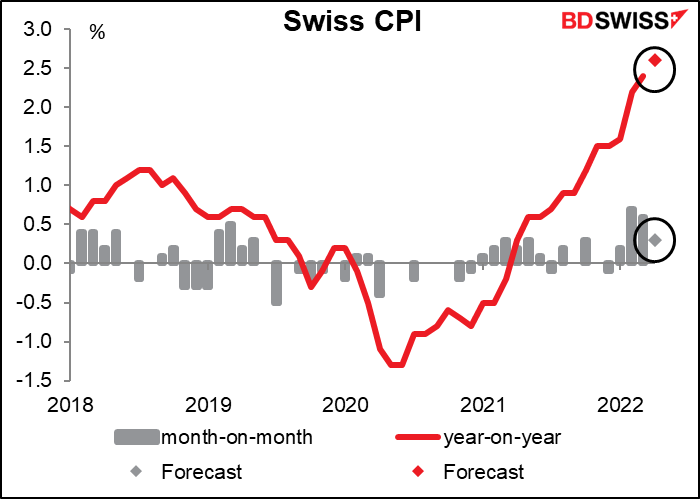

Finally, the Swiss consumer price index (CPI). I’m amazed to see such high inflation in Switzerland. Prices there are already preternaturally high! Rising inflation could encourage the Swiss National Bank (SNB) to let the CHF appreciate more to hold down imported inflation. The news therefore is likely to be positive for CHF even though it’s already the most bizarrely overvalued currency in the world (second only to the NOK according to the OECD’s calculations, but #1 by a long shot using the Big Mac index – fortunately I’m a vegetarian.)

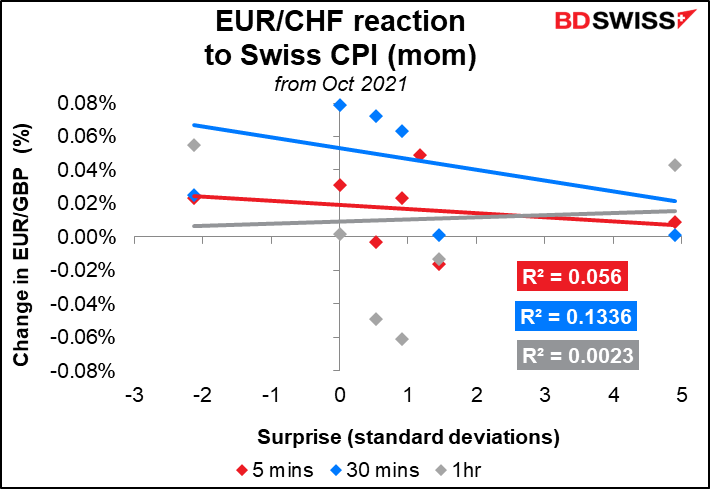

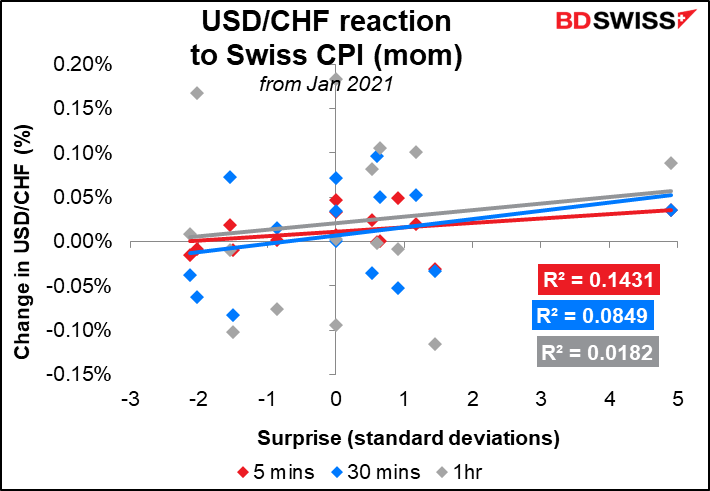

However please note that CHF is not particularly responsive to the CPI. And when USD/CHF does respond, the response tends to be backward! That is, CHF seems to weaken when the CPI is higher than expected and strengthen when it’s lower. That used to be the response of currencies before inflation targeting became the norm. It certainly shouldn’t be that way for CHF as the SNB is using CHF appreciation to fight imported inflation. (I tried this using data just from October last year, reasoning that perhaps before then people assumed the SNB would never move but after October it would be responding to inflationary pressures. However there was no statistically significant difference.)

EUR/CHF seems to be little better, although at least with EUR/CHF the 5-minute and 30-minute lines (barely) tilt in the proper direction.