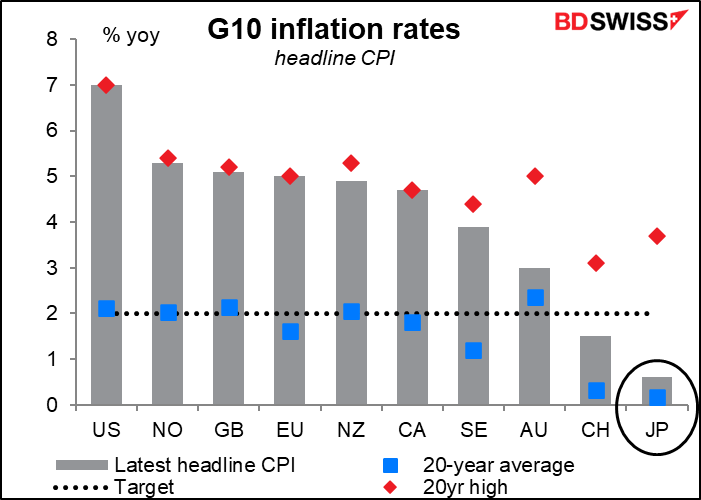

Japan has long been an outlier internationally when it comes to inflation, and therefore with regards to interest rates as well.

That anomalous situation may well be coming to an end. Reuters ran a story Friday: Exclusive: BOJ debates messaging on eventual rate hike as inflation perks up.

TOKYO, Jan 14 (Reuters) – Bank of Japan policymakers are debating how soon they can start telegraphing an eventual interest rate hike, which could come even before inflation hits the bank’s 2% target, sources say, emboldened by broadening price rises and a more hawkish Federal Reserve.

The story goes on to say that they’re talking about “well into 2023,” so nothing immediate. But it also quotes a BoJ source as saying “The BOJ needs to pay close attention to what other central banks are doing,” which is normalizing policy all around.

This is in contrast to what Deputy Gov. Amamiya said in a speech in early December: “Central banks conduct monetary policies in line with developments in economic activities and prices of their respective economies. It is therefore natural that the specifics of and directions for their monetary policies are not the same…”

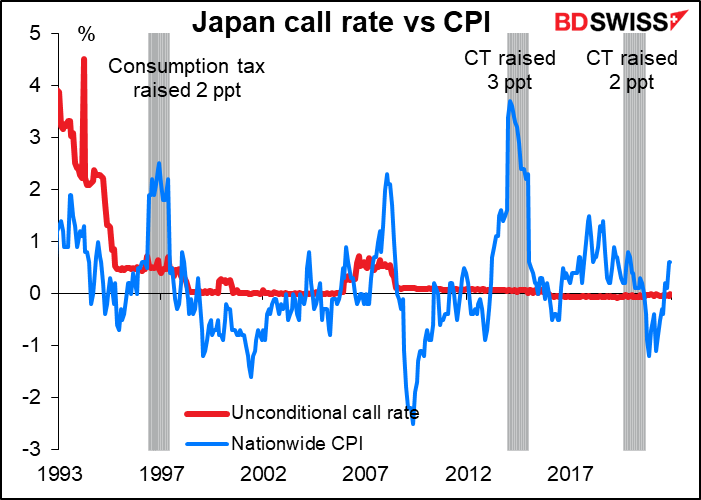

Since the BoJ first lowered the unconditional call rate, the price for overnight money, down to 0.5% in Sep. 1995, it’s only gone as high as 0.7% and even that was quite brief. So for 26 years money has been essentially free in Japan, making JPY the natural funding currency of choice for the rest of the world. Meanwhile, inflation has remained below 2% except a) when the government raised the consumption tax, which of course would raise consumer prices, and b) right before the Lehman Bros. collapse and the Global Financial Crisis in 2008.

The Reuters story said the BoJ is thinking that it could start raising rates even if hasn’t yet hit its 2% inflation target, which would be a huge turnaround. Most other central banks are already over their 2% targets, which is why they are considering hiking rates.

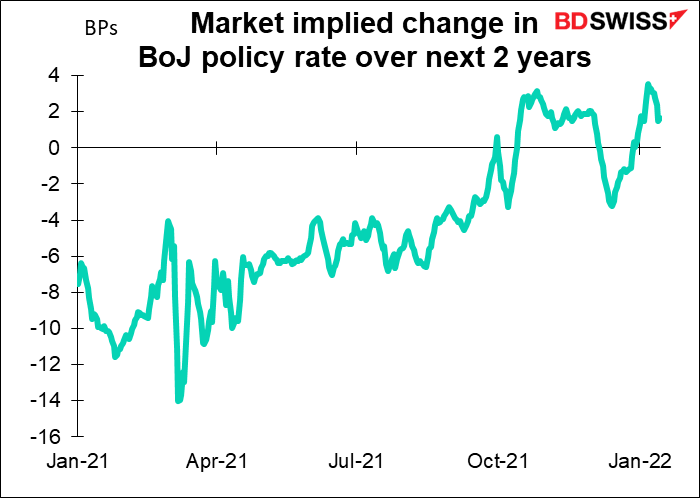

It doesn’t appear that the market believes the Reuters story fully. The overnight index swap (OIS) market, which trades interest rates in the future, has been trending up slightly in recent months but didn’t rise at all in response to the news. But that may be just because it came out on a Friday; perhaps the market hasn’t had any time to react.

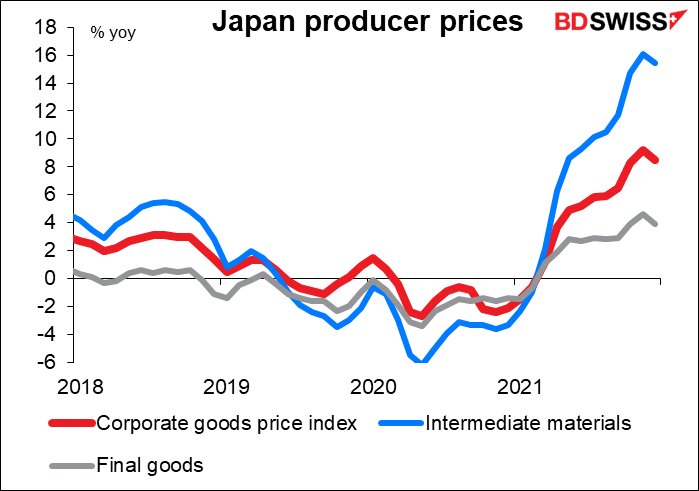

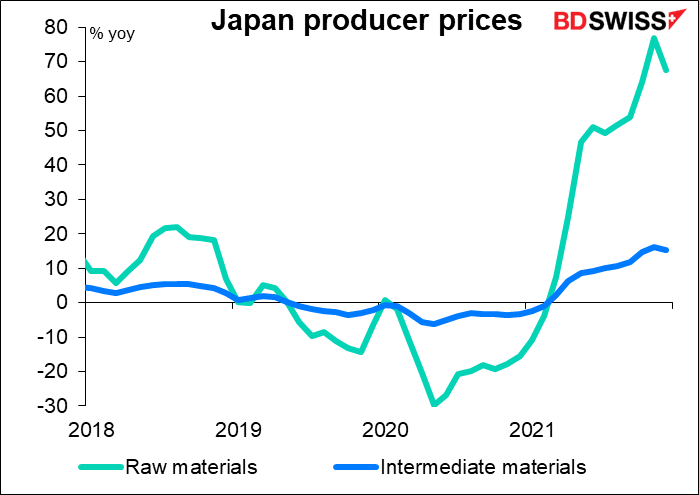

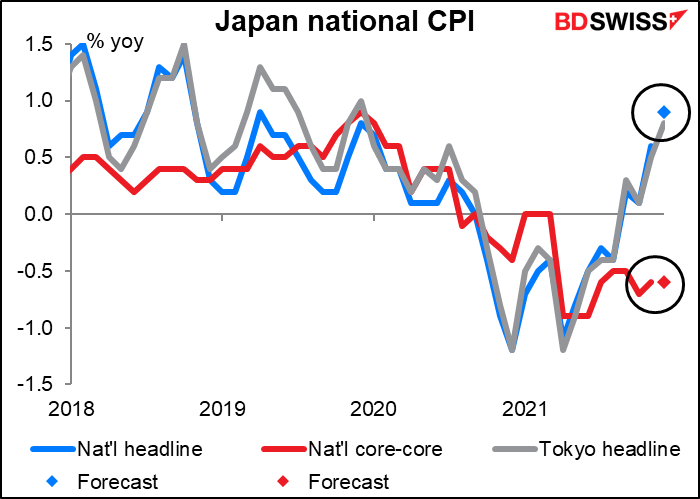

The change in BoJ thinking comes as producer prices in Japan heat up, something I’ve been talking about for some time. The December figure was released Friday morning. The rate of growth in the producer price index (PPI), or corporate goods price index as it’s known in Japan, slowed to +8.5% yoy from an upward revised +9.2% yoy in November. Still, that’s quite high given that the national consumer price index is up only +0.6% yoy and excluding food & energy it’s down 1.2% yoy (November), i.e. the country is still in deflation! The question is how long companies will be willing to take the hit to their margins from their input prices being so much higher than their output prices.

The upward pressure on corporate goods stems from rising raw material prices, which were up an astonishing 68% yoy in December. While this was a bit below November’s 77% yoy rise, it’s still bound to put pressure on companies’ margins.

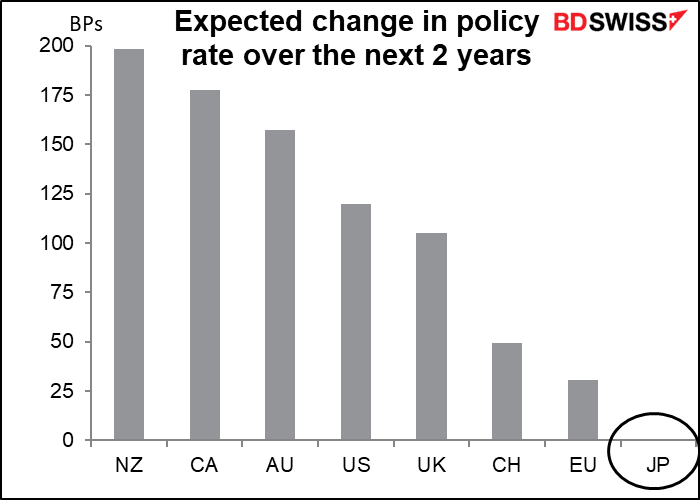

A change in Bank of Japan policy would be a huge event for the global financial markets. As it stands right now, JPY is the only one of the widely traded currencies that isn’t expected to raise rates in the next two years. That makes it the favorite funding currency, that is, a currency investors can borrow to invest in other, higher-yielding assets. A typical trade that a hedge fund might put on for example would involve borrowing in JPY and investing the money in 10-year US Treasuries. Investors like to borrow short-term funds for trades like this so that if and when they have to close out their position they can repay the loan easily & quickly. They therefore have to have confidence that the central bank won’t raise rates on them while the loan is outstanding.

If it starts to look like the BoJ might raise rates, then investors would probably switch some of those borrowings out of JPY and into EUR or CHF, the currencies that are expected to have the smallest rise in rates. That would cause JPY to strengthen and EUR & CHF to weaken.

The possibility of such a change means that investors will be paying more attention than usual to Tuesday’s Bank of Japan Monetary Policy Meeting (MPM) and Friday’s national consumer price index (CPI) (see below). While no change in policy is likely, they might show more confidence in the inflation outlook, e.g. by revising up the inflation outlook in their quarterly Outlook for Economic Activity and Prices and perhaps removing the part that says “risks to prices are skewed to the downside.”

They may also remove the downward bias in the forward guidance for policy rates that was introduced at the Oct. 2019 meeting. That would mean replacing the current statement that the Bank “expects short- and long-term policy interest rates to remain at their present or lower levels” with something like what they had before the change, namely “the Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time.” (That change was suggested in the Reuters article quoted above.)

The next steps to watch for would be to shorten the target yield in the yield curve control (YCC) policy from the 10-year to perhaps the 7-year, followed by the elimination of the negative interest rate – but those are steps for a future MPM.

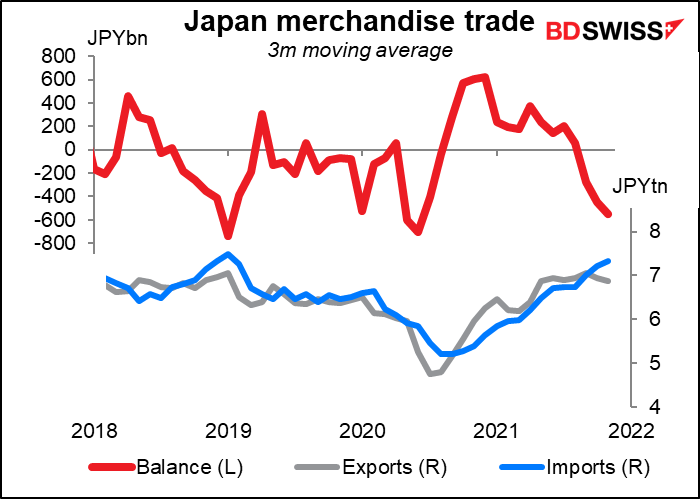

Investors will also be watching Gov. Kuroda’s press conference following the MPM for his views regarding the possibility of higher inflation and also on the implications of the weak yen for the economy and monetary policy. Historically the Japanese establishment has favored a weak yen as a way to promote exports, but recently officials have expressed more concern about the impact of a weak yen on consumers’ purchasing power now that Japan often runs a deficit on its merchandise trade account.

The BoJ also releases the minutes of its December MPM on Friday. The focus will be on what discussion if any they had regarding the possible decrease in the monetary base as they ended part of their pandemic financial support measures.

Nonetheless, let’s not get ahead of ourselves. Friday’s national CPI is forecast to rise 30 bps to 0.90% yoy, slightly above the Tokyo CPI (+0.8% yoy). But the BoJ’s “core-core” measure, which excludes both food and energy (in line with most countries’ “core” measures of inflation) is expected to remain at -0.6% yoy. It’s hard to see them normalizing policy any time soon when the country is still in deflation on that measure.

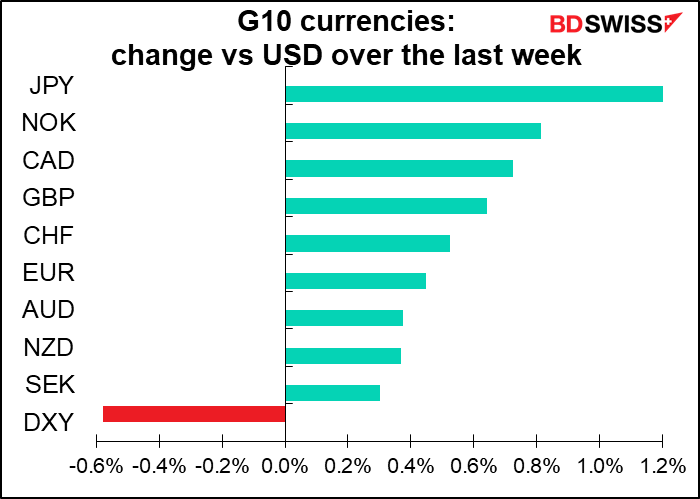

Why isn’t USD appreciating as US rate expectations rise?

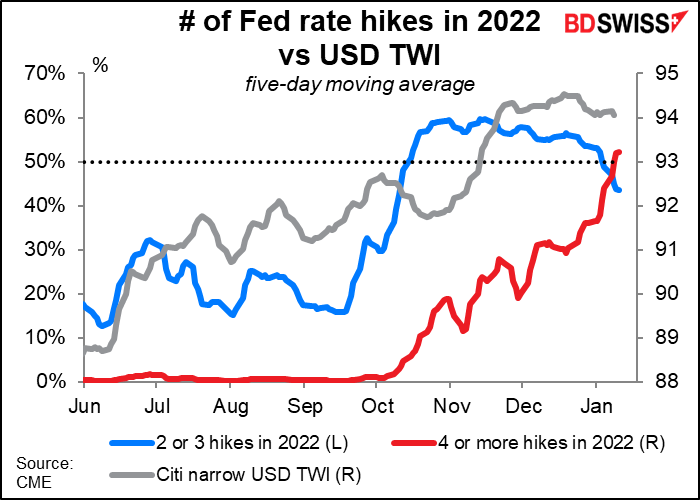

The other notable point about the market recently is how expectations of higher US interest rates are no longer causing the dollar to appreciate. The graph shows how earlier last year, the dollar did tend to move up and down somewhat as the odds of two or three rate hikes during the year ebbed and flowed. One might imagine therefore that as the odds of four or more hikes increased and even surpassed the odds of two or three hikes, the dollar would gain even more. But that hasn’t happened. The dollar peaked around Dec. 20th even as the odds of four or more rate hikes this year moved from “possible” to “probable.” (The graph uses the dollar’s trade-weighted average, but the story is almost identical if we use EUR/USD.)

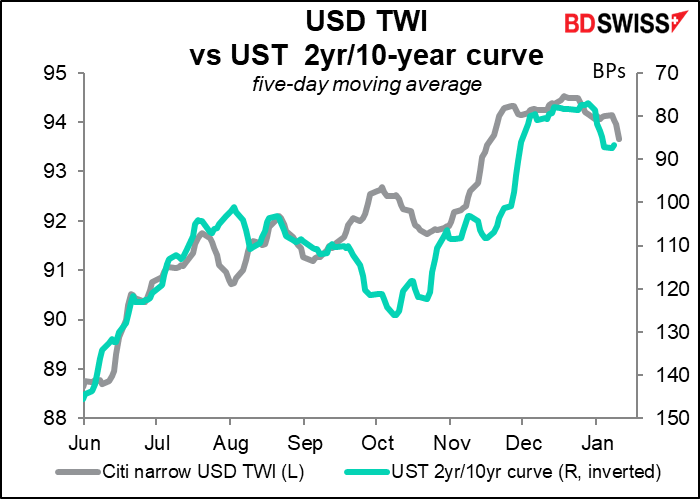

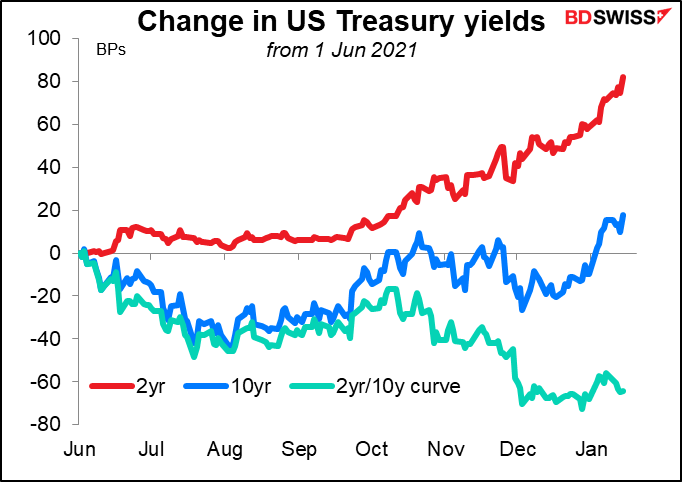

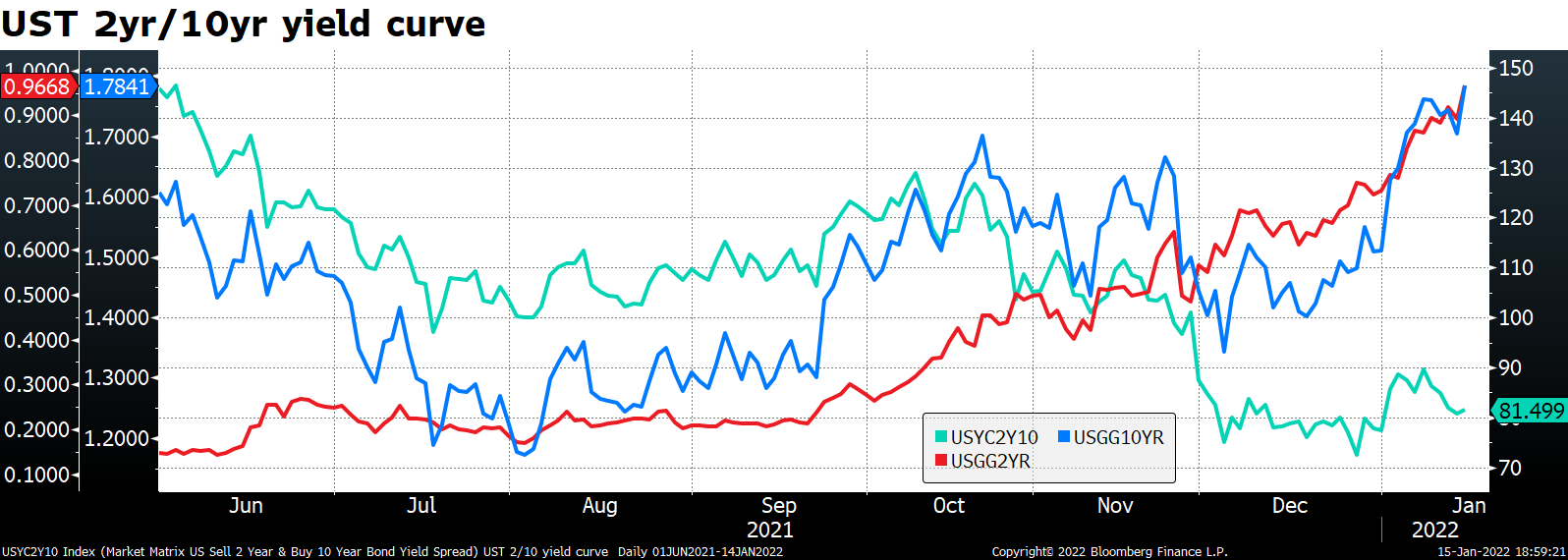

It seems to be due to the movement of the yield curve. As the graph shows, the US TWI has mostly followed the (inverted) yield curve.

What’s been going on with the yield curve? We can see that best if we look at a graph showing the change in the yield of the 2- and 10-year notes vs the change in the yield curve, rather than the actual numbers. What we see is that the yield on the 2-year note has risen much more than the 10-year. This is normal when the central bank is tightening. The two-year note represents to some degree the expected interest rate from borrowing overnight and rolling over the loan daily for 365 x 2 days. If the overnight rate is expected to rise during this period, then the 2-year yield should rise too. The 10-year yield on the other hand is heavily influenced by the risk of inflation. When the central bank is tightening policy, the risk of inflation over the next 10 years diminishes and so the 10-year yield can sometimes fall.

Since early December though the yield on the 10-year note has started to rise, too, causing the yield curve to stabilize and even flatten somewhat. That suggests the market thinks the Fed is behind the curve in controlling inflation. This is probably why higher inflation doesn’t help the dollar.

The market probably believes that either a) the Fed is going to allow rates to lag behind inflation – meaning that real interest rates will fall, which is negative for the dollar – or that b) it will have to raise rates precipitously at some point, sending the economy into recession, which is also not good for the dollar.

All in all, until we see or hear more aggressive talk from the Fed, I expect that the market’s reaction to higher inflation may be counter-intuitive. Everyone will be eager to hear then what Fed Chair Powell has to say after the next meeting of the Federal Open Market Committee (FOMC) on Jan. 26th, just a week-and-a-half away.

This week: Mostly UK & Canada data, Australia employment

Outside of Japan, this will be a quiet week for the major central banks. The Fed and the European Central Bank (ECB) are in their “purdah” periods ahead of their meetings next week and so there won’t be any speakers.

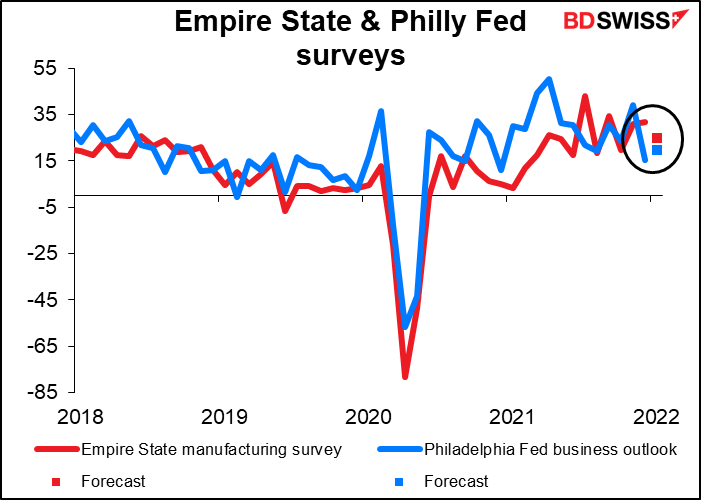

US: There are a few important US indicators out during the week. Monday is a national holiday in the US (Martin Luther King Day). The only major indicators are the Empire State manufacturing survey on Tuesday and the Philadelphia Fed business sentiment survey on Thursday, along with Existing Home sales the same day. The Empire State index is expected to fall while the Philly Fed index is expected to rise; I presume it’s because economists expect the two to converge over time. In any case, they’re both expected to continue to indicate relatively strong growth, which may be a relief after last week’s unexpected fall in consumer confidence. USD+

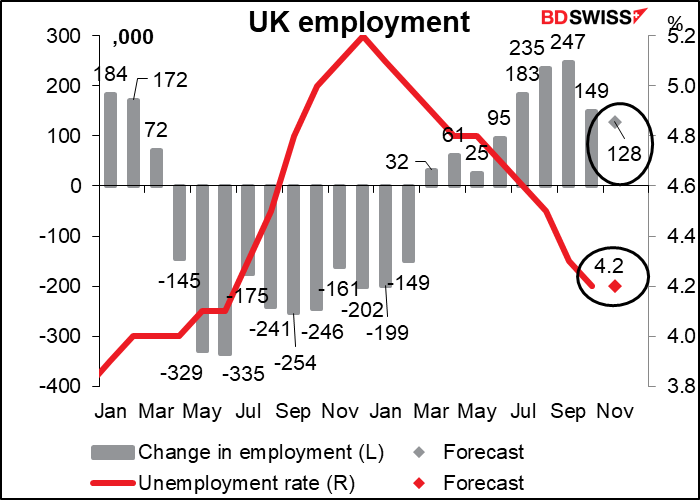

UK: Britain has several important indicators out during the week, namely unemployment on Tuesday, CPI on Wednesday, and retail sales on Friday.

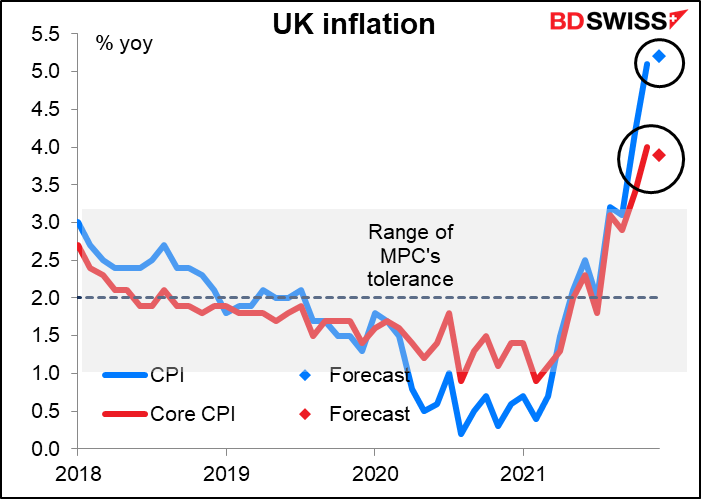

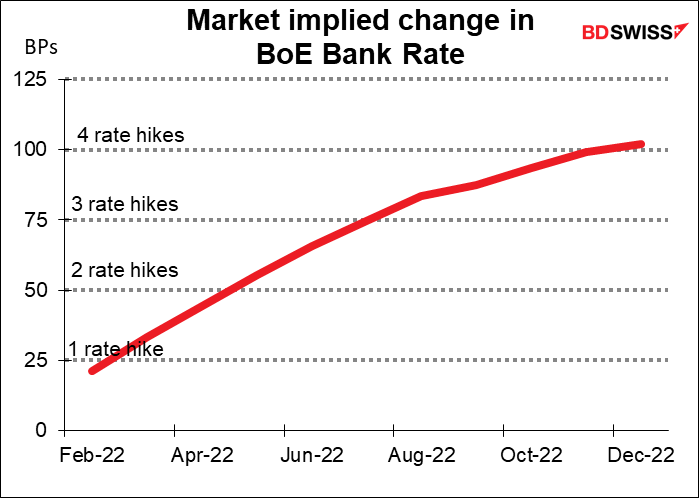

Core CPI is expected to be down one tic, but headline CPI is forecast to be up one tic, moving higher into 5%+ territory. That’s probably the more important figure insofar as public relations matter. It won’t faze the Bank of England, which said last month that it expects inflation “to peak at around 6% in April 2022.”

It’s likely to confirm the market’s assumption of four rate hikes this year and therefore could prove positive for the pound.

Especially if the employment data does show another increase in employment, as expected (although the unemployment rate is forecast to remain unchanged).

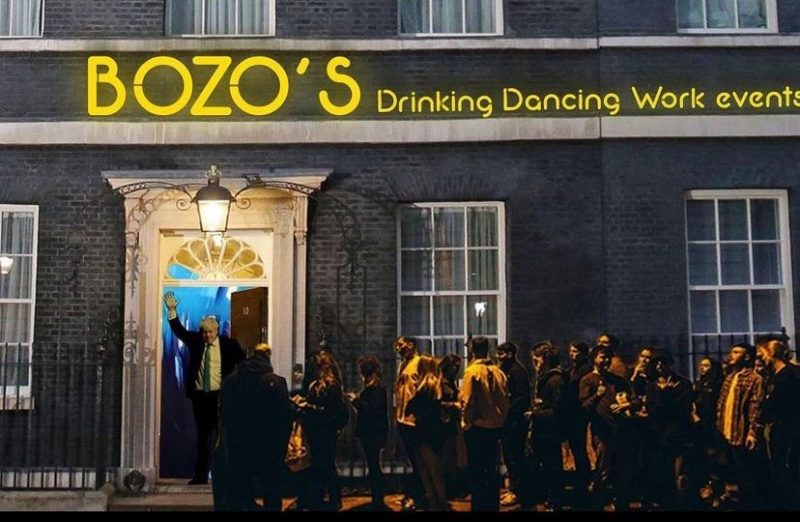

But the main event for Britain during the week is going to be Sue Gray’s investigation into the partying sorry work events at 10 Downing Street, the Prime Minister’s residence & offices. Not only did these alleged “work events” take place when the country was in strict lockdown and forbidden to gather even for funerals, but also one even took place on the eve of Prince Philip’s funeral (with one participant allegedly sent shopping with a suitcase to fill with wine). The country was saddened to see the Queen sitting alone during the funeral service because of social distancing requirements, and then to contrast that with the image of the PM and his buddies drinking & laughing it up together the night before against all the rules that they themselves had imposed on everyone else…

These kinds of official investigations usually wind up exonerating the alleged miscreants and so I wouldn’t expect Scotland Yard to drag the PM away in handcuffs (which is in theory possible). What may be the last straw for Boorish though was the revelation of a plan for others to take the blame so that he could keep his job. That may be a bridge too far for the British public, which I gather still has some vestigial expectation of “fair play.” A recent poll of Conservative Party members showed that over half think Johnson should resign.

I think his eventual resignation is inevitable but not for some time, for three reasons. 1) There’s no clear front-runner to take his place. As is often said in politics, “you can’t beat someone with no one.” Foreign Secretary Liz Truss and Chancellor Rishi Sunak seem to be the most popular alternatives but there’s no consensus yet. 2) There are a lot of problems still to be resolved with Brexit. In particular, the UK and EU are going to have to thrash out the Northern Ireland issue this year. No one else wants to deal with this intractable problem since there is no good solution. 3) The NI issue is complicated by the fact that there will be local elections on or before May 5th, including in Northern Ireland. If these elections nationally go badly for the Conservatives, and especially if they result in increased pressure for NI to break away and join the Republic of Ireland, then Johnson would probably have to take responsibility and resign. The Conservatives are OK with Johnson as long as he’s a vote-getter, but if he turns out to be a liability, then he’ll be out in a flash.

Would a Johnson resignation be good or bad for the pound? My guess is that he’s considered to be so incompetent, his departure could well be seen as positive for the currency, depending on who was to take his place.

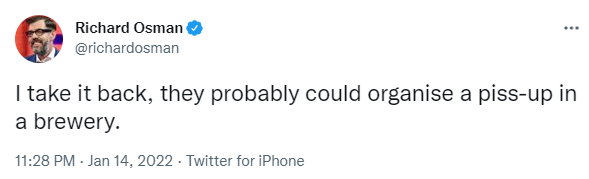

Meanwhile, the internet was naturally merciless about his problems.

(For those of you not familiar with British slang: it’s a common insult to say that someone is so bad at managing things, they couldn’t organize a drinking party (a “piss-up”) in a brewery.)

(Wetherspoons is a popular British pub chain.)

My view is that this whole affair reminds me too much of Poe’s story The Masque of the Red Death:

The “Red Death” had long devastated the country…But the Prince Prospero was happy and dauntless, and sagacious. When his dominions were half depopulated, he summoned to his presence a thousand hale and light-hearted friends from among the knights and dames of his court, and with these retired to the deep seclusion of one of his castellated abbeys… The external world could take care of itself. In the meantime it was folly to grieve, or to think…

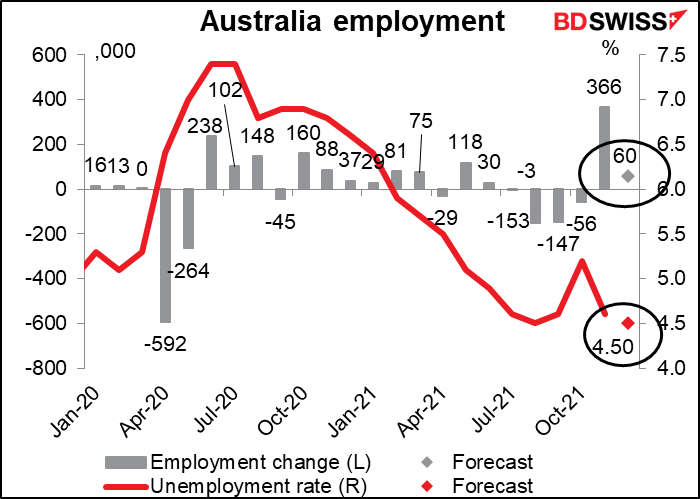

Elsewhere, Australia will release its employment data on Thursday. This is important since the Reserve Bank of Australia is one of those central banks that has a “dual mandate” requiring it to take employment into account as well as inflation.

With employment expected to rise slightly and the unemployment rate forecast to fall further below the pre-pandemic level of 5.1%, the labor market looks supportive of AUD.

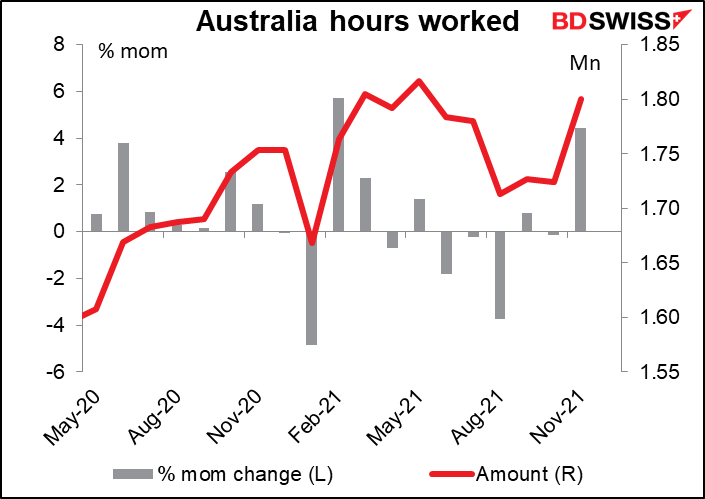

The RBA though is focusing on growth in wages, Its forward guidance reads, “The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.” (emphasis added) The wage data is only released quarterly; the next release is on Feb. 23rd. Until then, the market is also paying attention to hours worked, which also comes out with the employment data (no forecast available).

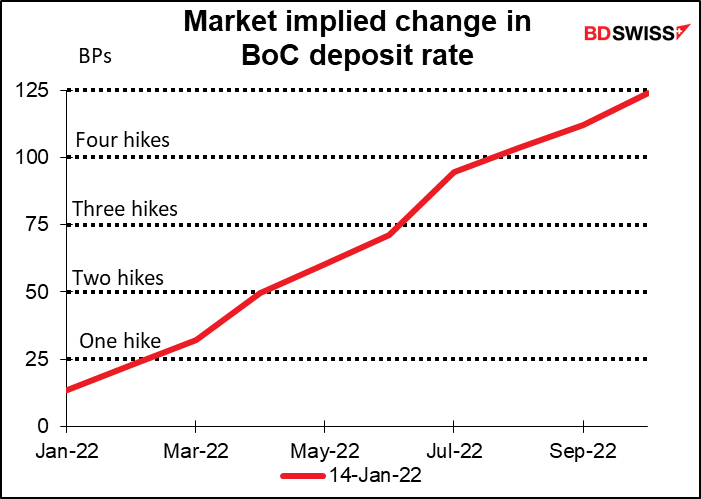

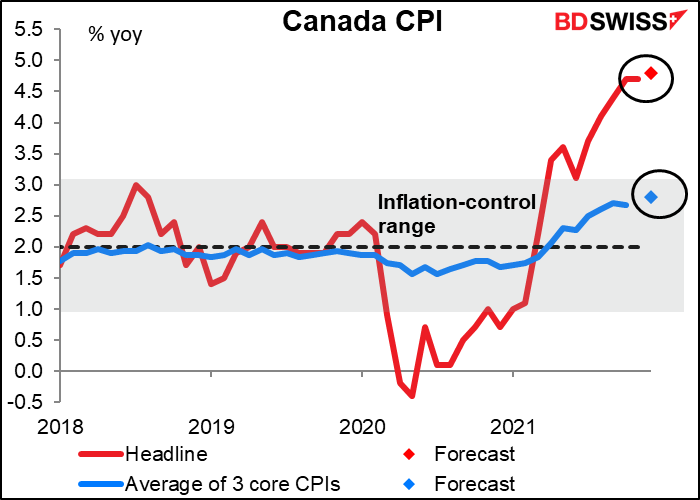

Finally, Canada will also release its CPI (Wednesday) and retail sales (Friday). Consumer prices are expected to rise further, including the core measures.

The Bank of Canada said it’s committed to holding its policy rate at the zero bound “until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.” It estimated that that would happen “sometime in the middle quarters of 2022.” At the moment the market is assuming a rate hike at the March 2nd Bank of Canada meeting, but a higher CPI in December could encourage some speculation about a change in policy at their Jan. 26th meeting. That could be positive for CAD.