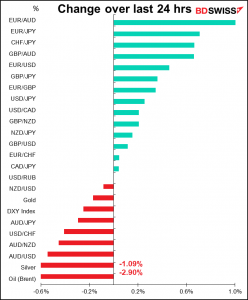

Rates as of 06:30 GMT

Market Recap

The focus as usual is on the war in Ukraine, where things aren’t looking as good as they were a few days ago. The negotiations in Turkey aren’t going as well as many people had hoped. Kremlin spokesman Dmitry Peskov said that they hadn’t seen a breakthrough in the talks, while Ukrainian President Zelensky said that “Russia is deploying new forces on our terrain to try to continue destroying us.

Meanwhile Reuters reported that the European Commission is readying new sanctions against Russia, with the magnitude of the new measures depending on Moscow’s stance on gas payments in roubles. US President Biden pledged a further $500mn in aid to Ukraine while UK PM Boorish Johnson said the UK was “looking at going up a gear” in its military support to the country.

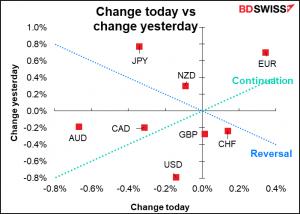

Net net the belligerents aren’t showing any sign of coming to an agreement yet and those on the sidelines are pouring in further aid, which suggests that the conflict is less likely than ever to end in Ukraine’s defeat or surrender. Since Russia is unlikely to admit to defeat any time soon either, that suggests the conflict will be dragged out longer. This has caused a risk-off reaction that has dragged down stock markets and hit the risk-sensitive commodity currencies.

Oil prices rose on the disappointing negotiations but then turned around and fell sharply on news that the US is considering releasing up to 180mn barrels of oil from its Strategic Petroleum Reserve. The SPR has 583mn barrels of oil so this would be almost 1/3rd of the total amount. US President Biden will speak about efforts to lower energy prices at 1730 GMT today.

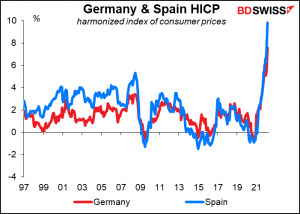

EUR rallied as Germany and Spain’s inflation figures surged even more than expected, which was surprising as they were expected to rise quite a bit anyway. Spain’s 9.8% yoy inflation was particularly shocking.

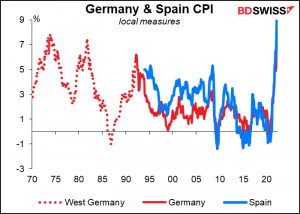

They’re not only far and away the highest readings since the start of the Eurozone, they’re also the highest readings in decades using the national definitions of inflation, which go back a few more years than the EU-wide harmonized index of consumer prices. For Germany, it’s the highest inflation since Nov. 1981.

Speaking in Cyprus after the data releases, ECB President Lagarde warned that Russia’s Ukraine invasion poses “significant risks to growth” and has introduced “considerable uncertainty” into the economic outlook. She said three main factors are likely to take inflation higher for longer: energy prices, food inflation, and global manufacturing bottlenecks. As for the ECB response, she repeated recent comments in which she said the ECB would “emphasise the principles of optionality, gradualism and flexibility.” She also advocated a fiscal approach to dealing with higher energy prices, which seems to be the way countries are navigating the risk of stagflation: fiscal policy to fight the “stag,” monetary policy to fight the “flation.”

Today’s market

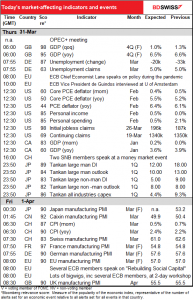

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

OPEC+ meeting: business as usual?

There will be a virtual OPEC+ meeting today. Recently these meetings have been brief and short on drama as the group generally just agrees to continue with their previously determined plan to increase output by 400k barrels a day (b/d). Now however they face a crossroads. Russia is the largest producer in the group, although perhaps the #2 exporter (after Saudi Arabia).

Now what do they do? With Russia being shut out of world markets, how do they treat it? How do they treat its production quota? And most of all, what should they do in response to the request from the G7 meeting last week: “We call on oil and gas producing countries to act in a responsible manner and to increase deliveries to international markets, noting that OPEC has a key role to play.”

The market is assuming that the answer is a firm “no” and that they’ll just proceed to increase output by the usual 400k b/d that they’ve already agreed on. This is for three reasons:

Likely market reaction: Some people may be expecting them to hike output anyway. I therefore think oil prices may rise somewhat if they decide just to boost output by the usual amount. On the other hand, the majority of market participants probably don’t expect any change in the group’s plans and so an increase in output would probably cause a serious fall in oil prices.

Today’s indicators:

We’ve already covered the early European indicators, which anyway come out long before I get this written nowadays.

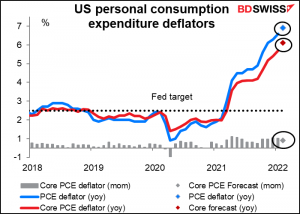

That means the first indicator of the day is the US personal consumption expenditure (PCE) deflator and its sub-index, the core PCE deflator. This, and not the consumer price index (CPI), is the Fed’s preferred inflation gauge, although the fact is that Fed officials seem to refer just as often to the CPI and the market too puts more emphasis on the CPI. Oh well. Nerds like me still pay attention to the PCE deflators.

The market expects a further rise in inflation, which I don’t think would surprise anyone. It might however convince people that the Fed was indeed liable to hike nine times this year and so could support the dollar.

US personal income & spending are both expected to be up 0.5% mom (which is why you see only one dot on the chart).

This would still leave incomes 11.7% above pre-pandemic levels and spending 13.0% above, an amazing response to what many of us thought might be the end of civilization as we know it.

This huge support to incomes is one reason why the US economy rebounded so quickly from the pandemic. It’s also one of the reasons why inflation is higher in the US than in other countries. The San Francisco Fed’s research department recently published a study (Why Is U.S. Inflation Higher than in Other Countries?) that concluded,

The United States is experiencing higher rates of inflation than other advanced economies… Among other reasons explored by the literature, the sizable fiscal support measures aimed at counteracting the economic collapse due to the COVID-19 pandemic could explain about 3 percentage points of the recent rise in inflation. However, without these spending measures, the economy might have tipped into outright deflation and slower economic growth, the consequences of which would have been harder to manage.

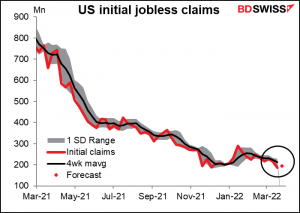

US initial jobless claims are expected to be a bit lower.They’re already extremely low so I’m not sure being even lower matters that much, except to confirm that the labor market is really really tight, which we already knew.

Canada’s monthly GDP is expected to be up only slightly. The retail, wholesale, construction, and finance industries apparently did OK during the month but manufacturing and mining/quarrying/oil & gas extraction suffered – although Canada’s overall purchasing managers’ index (PMI) was up 0.4 point to 56.2 during the month.In any case, although the increase is fairly small, I think the market will take a “half full” approach and reason that as long as the economy is expanding, the Bank of Canada can continue to normalize monetary policy. That should make this indicator positive for CAD.

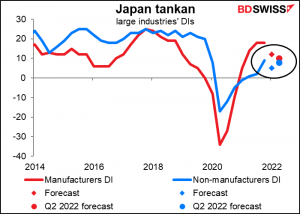

Then overnight we get what’s probably the most important Japanese economic indicator: the Bank of Japan’s quarterly Short-Term Survey of Economic Conditions, universally known by its Japanese acronym, the tankan.

It’s expected to be pretty bad. Not only are the diffusion indices for this quarter expected to be lower, but the forecast DI for large manufacturers for Q3 is expected to be even lower. The March survey is typically conducted from Feb. 25th to March 31st, but most companies respond in the first half of that period. That means it’s likely to reflect the impact of Russia’s invasion of Ukraine but not fully reflect the lifting of the semi-emergency measures in several major cities.

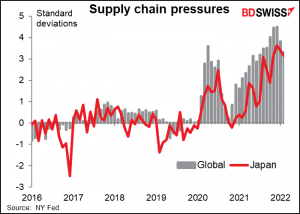

Manufacturers are being hit by supply constraints, as shown by the New York Fed’s Global Supply Chain Pressure barometer. The index for Japan peaked just in December and hasn’t come down that much since, indicating that supply chains are nearly as stressed as they’ve ever been before.

The implications of the tankan for the yen are ambiguous. On the one hand, a disappointing tankan makes it more likely that the Bank of Japan will keep up its support to the economy. It’s therefore likely to be negative for the yen. On the other hand, a disappointing tankan would be bad for the stock market, which might cause some risk aversion that would be positive for the yen. (The reverse would be true for a better-than-expected figure.) Those interested in trading the figure should be nimble to see how the market is reacting.

Then overnight and into the European & US day we get the final manufacturing PMIs. The preliminary ones for the major industrial economies weren’t particularly wonderful. Only the US and Japan rose, and Japan was already at the lowest level of any of these economies. Still, they’re all in expansionary territory, meaning the global economy hasn’t fallen into recession yet. It will be interesting to see how the fighting in Ukraine and the surge in energy prices are affecting other countries.

Finally, Switzerland announces its consumer price index (CPI). I haven’t bothered much with Swiss indicators because I assume the currency is being moved more by risk-on/risk-off sentiment. However with inflation continuing to rise above the Swiss National Bank’s target, the SNB may be tempted to relax its efforts to restrain the franc and let the currency appreciate to reduce inflation. The data may well be positive for CHF as a result.