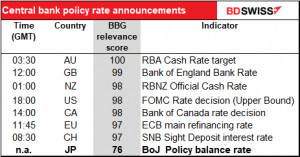

There are three major central bank meetings next week: the Bank of Canada on Wednesday and the Bank of Japan (BoJ) and European Central Bank (ECB) on Thursday. The BoJ is on hold indefinitely and the ECB has already said that it’s going to make its big decision on its asset purchase program at the December meeting. So that means the focus is going to be on the Bank of Canada (BoC) next week.

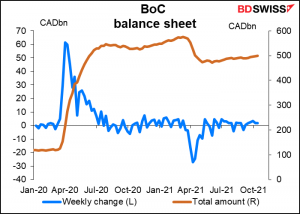

The BoC has been far and away the most aggressive central bank when it comes to expanding its balance sheet. At its peak the Bank of Canada had expanded its balance sheet to 4.8x as big as it was before the pandemic began. That dwarfed all the other expansions. (Of course in dollar terms it was not that significant, but that’s another matter.)

Through its policy easing, the Bank of Canada has engineered the second-largest reduction in its “shadow policy rate” – the policy rate that would be necessary to achieve the same effect on the yield curve – among the G10 countries.

The BoC has already tapered down its bond purchases considerably. It started out buying CAD 5bn a week, then in October last year cut that to CAD 4bn, then CAD 3bn in April this year, then CAD 2bn in July. Still, its balance sheet is growing ever so slightly.

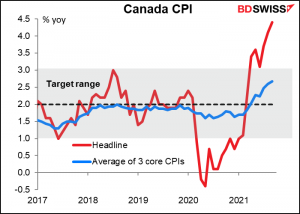

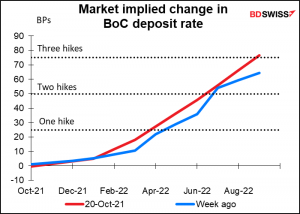

The market (and I) think it’s likely that they will taper down or even end the QE program at next week’s meeting. Consumer prices rose more than expected in October. The headline figure is way outside the Bank’s target range. Even the core measures, while still within the target range, are clearly headed upward.

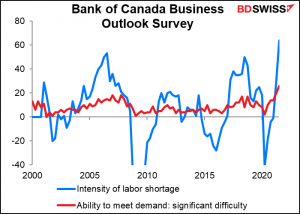

Moreover, this week’s Bank of Canada Business Outlook Survey exposed the upward pressure on prices in the country. “Intensity of labor shortage” and “ability to meet demand: significant difficulty” were both at record highs, suggesting a wage/price spiral and companies taking advantage of higher demand to raise prices.

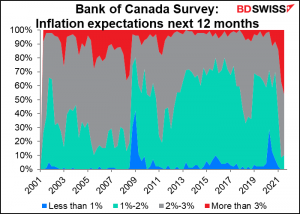

At the same time, inflation expectations are coming unanchored, something that terrifies central bankers. A record high 45% of the respondents thought that inflation would be more than 3% over the next 12 months, while a record low 10% thought it would be 1%-2% (the bottom half of the Bank’s target range). Apparently no one thought it would be less than 1%.

CAD has been appreciating (USD/CAD declining) for about a month now, but the CAD rally seems to be running out of steam. This could be a “buy the rumor, sell the fact” response before the fact is even known –

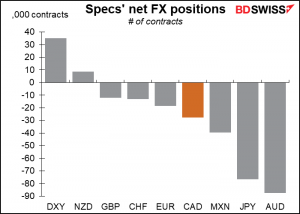

Speculators have a moderate short position in CAD.

By historical standards it’s not that big. It can still go much larger. But looking at it the other way, CAD could get a boost if these speculators decide to reverse their positions.

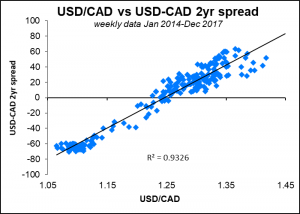

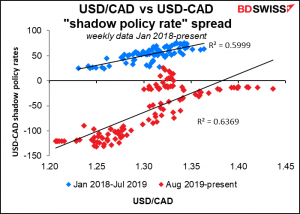

Would some tightening in Canadian monetary conditions support CAD? I looked at how USD/CAD reacted to the spread in US vs Canadian 2-year yields, a measure of near-term rate expectations. From Ja. 2014 to Dec 2017 this was an excellent predictor of the level of USD/CAD, with an R2 of 0.93.

(R2, or R-squared, is what’s called the coefficient of determination. Technically, it measures the proportion of the variation in the dependent variable (the one that you’re trying to predict) that is predictable from the independent variable (the one you know). Put simply, it measures how closely the dots on the graph fit the displayed line. A value of 1 means they’re all lined up perfectly; a value of 0 would mean they don’t line up at all. 0.93 is about as close as you get in real life.)

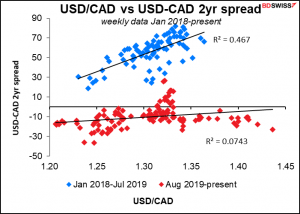

However, after 2018 this relationship breaks down. It holds fairly well until July 2019, then breaks down almost completely.

The “shadow policy rate” relationship seems to take over then, which implies that the market is taking the BoC’s quantitative easing program into account.

During this time, the connection between USD/CAD and oil has also strengthened. In fact that has a somewhat higher correlation than interest rates, which is understandable with rates stuck at the lower bound. There’s no upper bound to oil prices.

(By the way, for those of you who are curious, I did take a look to see if the change in any of these variables was related to the change in USD/CAD. In theory that’s a more logical relationship. However, it didn’t work – the correlation was much better with the levels.)

As the Bank of Canada tapers down its bond purchases, the shadow policy rate will come down. That should tend to boost CAD relative to USD and cause CAD to appreciate.

But of course the determining factor is not just what the BoC does relative to what the Fed does. Once the Fed starts tapering down its bond purchases – from sometime next month, by the look of things – then the spread between the US’ shadow policy rate and Canada’s is likely to move higher, to the advantage of USD. The point is that the Fed is just starting to taper down its bond purchases, while the BoC is nearly finished.

After it’s done tapering, there won’t be much to work to CAD’s advantage until March or April, when the market expects the BoC to begin hiking rates.

Bottom line: USD/CAD can fall further as the Bank of Canada withdraws its monetary stimulus, but that may soon be outweighed by what the Fed begins doing. The fate of USD/CAD then will probably be determined as much if not more so by oil prices than by monetary policy divergence.

ECB meeting: the calm before the storm

The ECB meets on Thursday. At their meeting last month, they “recalibrated” their purchases under the Pandemic Emergency Purchase Programme (PEPP), the EUR 1.85tn bond-buying scheme that it launched in response to the Covid-19 crisis, but put off until the December meeting the decision on whether to let this program expire as scheduled at the end of March. So I don’t expect any concrete changes in policy at this meeting.

Since the September meeting, energy prices have soared and headline inflation has gone well over the ECB’s 2% target (3.5% yoy, to be exact). The 5yr/5yr inflation swap, the ECB’s favorite measure of inflation expectations, is approaching their 2% target. (We’ll get Germany’s CPI for October on Thursday and EU-wide CPI on Friday.)

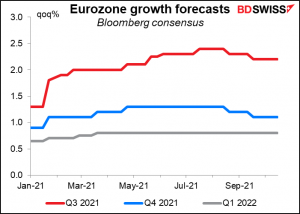

At the same time, economic activity has been disappointing and economists have started downgrading their forecasts for growth in Q3 and Q4 of this year against the background of supply bottlenecks and trade disruptions.

This combination of higher inflation and slower growth is likely to be the major topic of discussion at next week’s meeting. However, it’s unlikely that they’ll change policy in any way to deal with it. Most members of the General Council, even the hawks, still believe the higher inflation rate to be “transitory” and expect it to come back down below target over the coming months as supply chain problems get worked out and energy markets calm down. Given the large time lag that monetary policy operates with – a change in policy takes some three quarters or so to work through the economy – it would be pointless to change policy now to deal with a problem that may have disappeared naturally by the time the change in policy starts to affect activity.

Moreover, ECB President Lagarde still has to build a consensus on what to do with the PEPP. She’s scheduled two special meetings of the Council next month to lay the groundwork for the decisive December meeting. According to press reports, the Council is likely to decide at that meeting to end the PEPP on schedule in March, but to find some ways to retain at least some of the extra flexibility that came with the PEPP, which is exempt from rules that bar the ECB from owning more than a third of any individual country’s government debt or buying bonds with credit ratings below investment grade (such as Greece).

Much depends on the new staff forecasts that will be presented at the December meeting, which will include forecasts for 2024 for the first time. If the forecasts still see inflation falling back below 2% next year and staying there, then the ECB will have little choice but to keep its foot on the accelerator. That “monetary policy divergence” as other central banks tighten policy could lead to a weaker euro. But that’s December.

Bank of Japan: Is anyone listening?

Usually for the Bank of Japan meetings I just dig out what I said before the last meeting and repeat it. This time I’d like to show you why.

This table shows the Bloomberg relevance scores for various central bank meetings. The Bloomberg relevance score shows you what percent of the people who have an alert set for any economic indicator for a country have an alert set for that particular indicator. EG a score of 50 for US industrial production would mean that out of all the people who have alerts sets to tell them the results of US economic indicators, 50% have alerts set for the US industrial production.

Notice an outlier? Even the Swiss National Bank, which hasn’t changed policy since 2015, garners more attention from the market than the BoJ.

The meeting will include the BoJ’s quarterly Outlook Report. They may lower their growth forecasts for the current and next fiscal years. They could also lower their inflation forecast for the current FY while raising it for next year, thanks to higher energy prices. But this almost certainly won’t have any impact on policy. (I say “almost certainly” because Compliance rules in the financial industry forbid me from presenting anything as a certainty. I’m required to say things like “I believe that the sun is likely to rise in the east tomorrow, although past performance is no guarantee of future performance.”)

Investors will wait to hear what BoJ Gov. Kuroda has to say in his press conference about the rise oil prices and the fall in the yen since the last meeting and the possibility of the Bank extending its special pandemic funds-supplying operations beyond its March expiration date. I doubt if any of this will make waves in the financial markets, however.

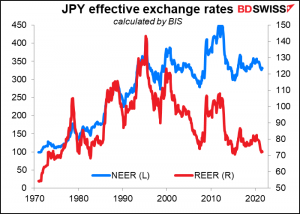

On a real basis (that is, adjusting for inflation), the yen is flirting with its lows of earlier in the decade. Before that, you have to go back to before the 1985 Plaza Accord to find a time when the yen was this weak. (The BIS rates are only calculated at the end of the month, meaning the October figures aren’t available yet.) There has been some concern in the Japanese media that the authorities might try some verbal intervention to slow the yen’s decline, as they did back in 2015 (when it was even weaker than today on a nominal basis). I doubt it, though. They would probably welcome the inflationary impact of a weaker yen. Plus no one can accuse them of “beggar-thy-neighbor” policy if they keep their policy unchanged and everyone else changes theirs, so why not go for it? This is why I expect the yen to weaken further, especially if stock markets continue to rally.

While I’ve said before that the BoJ is likely to remain on hold until either the end of the Anthropocene Epoch or the Rapture occurs, whichever comes first, the fact is that the hit to inflation from lower mobile phone fees will fall out of the yoy calculation in April next year. With a weaker yen and higher energy prices then, we could start to see inflation in Japan approach the unparalleled rate of 1% or so. Given that the rest of the world will be normalizing rates by then, that might be enough for the BoJ to start shifting policy too. But we’ll cross that bridge when we come to it.

Inflation figures from Australia, Germany, Eurozone, Japan, and US

There’s so much inflation data coming out next week that I’m just going to deal with it in a table.

Note that all the yoy rates of increase are expected to accelerate except for Australia. We may have to get used to rising inflation as higher energy prices and shipping charges feed through the economy.

Friday’s US personal consumption expenditure (PCE) deflators are the Fed’s preferred inflation gauges, but the market puts more emphasis on the consumer price index, for some bizarre and perverse reason. In any case they’re bound to be well above the Fed’s 2% target, so I’m not sure how much difference plus or minus a few basis points will make if they beat or miss expectations.

Inflation has been surprising on the upside fairly consistently. More upside surprises this week could start to spook bond markets, which in turn might trigger a “risk-off” mood in the stock markets, which have been remarkably resilient so far in the face of mounting inflationary expectations and rising rates.

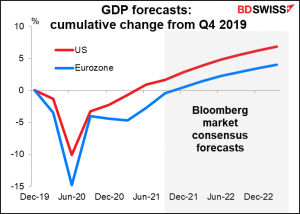

We also get US Q3 GDP on Thursday and Eurozone Q3 GDP on Friday. Output is expected to slow in the US but recover in Q4.

For Europe however this is expected to be the peak quarter and growth is expected to slow from here on. That’s likely to be a topic of discussion at the ECB meeting and the conundrum that set up against the background of rising inflation.

Europe is still expected to be slightly below its pre-pandemic level of output. The US on the other hand recovered to that level in Q2.