This week isn’t much for economic indicators, but there are a lot of market-moving events. Politics will be at the fore, with the Canadian federal elections on Monday, the countdown to Sunday’s German federal elections, and the race for the leadership of Japan’s ruling Liberal Democratic Party (LDP). Then there are four major central bank meetings: The Bank of Japan and the US Fed on Wednesday and the Swiss National Bank and Bank of England on Thursday. Finally, the preliminary purchasing managers’ indices (PMIs) for the major industrial economies are released on Thursday and Friday.

Let’s take the central bank meetings first. I don’t expect any change in policy at any of them, but they will nonetheless give important clues to the market on which way policy-makers are leaning.

FOMC: is progress substantial yet?

The eight meetings a year of the US Fed’s rate-setting Federal Open Market Committee (FOMC) are crucial events for the market, but this one is shaping up to be even more crucial than normal. The market will focus on two things:

- What will they say (or do) about tapering down their $120bn-a-month bond purchases? And

- What will the new “dot plot” show about their view on interest rates?

The key point is a line in the statement following the meeting that reads:

Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings. (emphasis added)

The question is, how will they assess the progress? Remember that in his speech at the Jackson Hole Symposium last month, Fed Chair Powell said, “At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.” I would expect to see this phrase incorporated into the statement following Wednesday’s meeting (e.g.., “if the economy evolves broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year” or something like that). That would still leave them the option of starting to taper in November or waiting until December. That would probably be positive for the dollar (except that it’s widely expected).

Or following the disappointing August nonfarm payrolls, they could just leave the statement as it is. That would imply they’re still not sure about tapering. It would probably be negative for the dollar. I think this is the greater risk because probably more people are expecting them to change their tune after what Powell said. If they don’t, then that would be the bigger surprise.

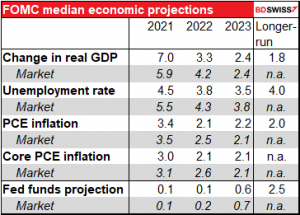

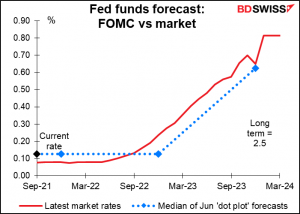

The second question is about the Summary of Economic Projections (SEP), the spreadsheets where each member of the Committee inputs his or her forecasts for various economic variables This is the median of forecasts from the June SEP compared to what the market is forecasting now (from the Bloomberg consensus forecasts).

As you can see, the Fed’s forecasts are not a million miles away from what the market is expecting, so I doubt if there will be any shocking changes. Just one point: the SEP will now include forecasts for 2024 (no market consensus forecasts available). People will certainly want to see what the Fed is thinking about that far-off time, although of course any forecasts that far in advance should be filed under “creative fiction” or maybe “wishes for Santa Claus.”

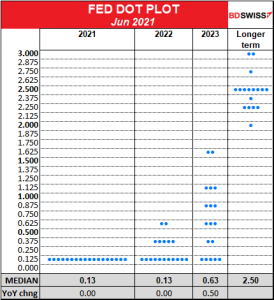

Finally, within the SEP the most important bit of information is the “dot plot” in which each Committee member gives his or her forecast for where they see the fed funds rate at the end of each year. Eleven members see rates unchanged next year while seven see them rising; will that change? It would only take two people to change their view from 0.125% (unchanged) to 0.375% for the median to rise to 0.25%. So it’s quite possible that they go from forecasting no rate rises next year to at least one. Similarly, they are now forecasting two hikes in 2023 – that could easily go to three as well. And then how many hikes do they expect for 2024?

In Fed Chair Powell’s press conference, I would expect him to once again emphasize that the decision to taper down the bond purchases is totally separate from the decision to start raising rates. Moreover he’ll probably try to downplay the significance of the dot plot as a signal of where policy is likely to lead, particularly for 2023 and 2024. But the market has generally been more extreme than the dots, so if the dots rise, then the market’s forecasts could rise even more. Expectations of higher short-term rates would probably be positive for the dollar.

Bank of England: steady as she goes

The Bank of England will probably remain on hold at this meeting. With no change in policy likely, the focus will be on any change in nuance in their forward guidance. At their August meeting, the Monetary Policy Committee (MPC) ratcheted up the guidance a bit in line with the improved forecasts in the Monetary Policy Report and said as follows:

The Committee judges that, should the economy evolve broadly in line with the central projections in the August Monetary Policy Report, some modest tightening of monetary policy over the forecast period is likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term.

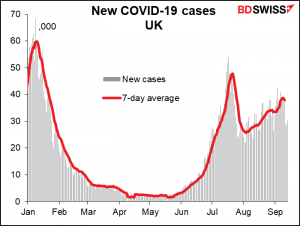

Much of the news since the August meeting has been disappointing. July GDP missed expectations at only +0.1% mom, although that may improve as the country comes out of lockdown. Friday’s retail sales were similarly below expectations. Brexit is starting to bite, with supply chain disruption causing widespread shortages. On the plus side, the unemployment rate fell one tick to 4.6% while the number of employees rose a substantial 183k. That could be encouraging except that some 1.6mn people remain on furlough (4.7% of the labor force) with only a few days left before the furlough scheme ends at the end of September, tossing these troubled souls onto the dustheap of unemployment. Slowing demand, an uncertain labor (sorry, labour) market outlook, and another surge in virus cases isn’t really the time to turn more hawkish.

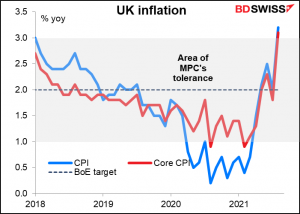

The only potential point of concern is that the headline rate of inflation leaped to 3.2% yoy from 2.0%, but the MPC has already said that they expect it to peak at around 4% this year so it would not force anyone to change their mind.

Given that the future is so uncertain and there’s no pressing need to change policy at this meeting, I’d expect another unanimous vote to keep the Bank rate unchanged and probably another 8-1 vote to maintain the QE program (8-1) (external member Michael Saunders being the dissenter there who wants to end it early). “Steady as it goes” is usually not a source of volatility for the FX market and I would expect little change in the pound.

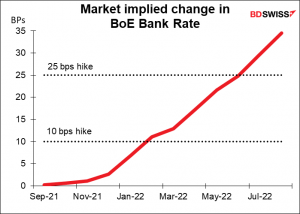

Currently the market expects the BoE to raise rates by a full 25 bps by next June.

Bank of Japan: no change, as usual

As for the Bank of Japan (BoJ), it’s committed to keeping policy steady during the remainder of the Anthropocene Epoch or until the Rapture occurs, whichever comes first. With the national CPI (due out this week as well) remaining in deflation thanks to cuts in mobile phone charges and Japan’s vaccination program lagging far behind the rest of the developed world, there’s little chance of the Bank even “thinking about thinking about” normalizing policy any time soon. Nobody in their right mind looks for any significant policy change at this meeting or indeed any other meeting in the foreseeable future.

(Note: that’s the same paragraph I used for the last BoJ meeting in July. I think I’ll probably be able to use it with just minor tweaks for the rest of my career.)

The BoJ could offer some details on the climate change lending scheme that it outlined at the July meeting, such as the amount of lending and the eligibility requirements. However, the sketchy, one-slide framework provided in July suggests that the program isn’t going to play a significant role in monetary policy.

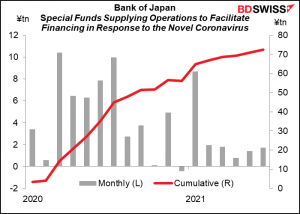

Note that the European Central Bank is already discussing what to do about its Pandemic Emergency Purchase Programme ahead of its proposed expiry at the end of March. The BoJ’s “Special Funds Supplying Operations to Facilitate Financing in Response to the Novel Coronavirus (COVID-19)” expires at the same time. The Policy Board may also begin thinking about what to do when that happens and the monetary base starts to fall as a result. The difference is probably that there are far more doves on the BoJ Policy Board than hawks (in fact there’s only one recognized hawk, Hitoshi Suzuki), meaning if anything the vote would probably be to continue the program, not taper it.

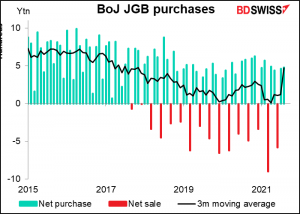

The big announcement for Japanese monetary policy will be on Sep. 30th, when the BoJ announces its schedule for purchasing Japanese Government Bonds (JGBs) during Q4. The bank announced in June that it would begin announcing its purchasing schedule every quarter, probably in an effort to reduce the focus on these operations and allow macroeconomic factors to have a bigger influence on the JGB market (within the limits of the BoJ’s “yield curve control” program). They stepped up their bond-buying in July and August, averaging JPY 47.4tn a month, vs 11.7tn a month in Q2. If they reduce that amount, it could be seen as a form of tapering. That might be positive for the yen.

Swiss National Bank: same old same old

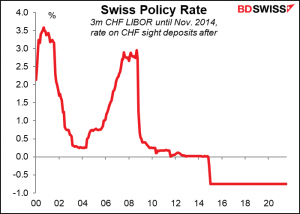

The Swiss National Bank (SNB) is likely to be even less exciting than the BoJ, and that’s saying quite a lot. They meet four times a year and basically just change the date on the press release they issue afterward. They’ve kept the interest rate on sight deposits –their effective policy rate – at -0.75% since January 2015. That must be a record for the post-Bretton Woods era among major central banks for the longest period without a change.

We can be pretty sure that the SNB will once again say something along the lines of “It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The Swiss franc remains highly valued.”

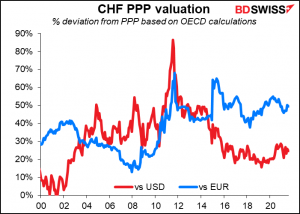

That’s because they’re right. The Swiss Franc is highly valued – according to the OECD’s way of calculating, it’s 25% overvalued vs USD and 49% overvalued vs EUR.

Politics: Canada on Monday, Germany on Sunday, campaigning in Japan

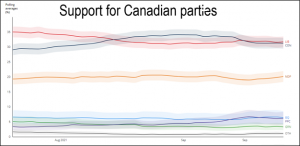

Monetary policy will share the spotlight with politics this week. First up is the Canadian federal election on Monday. PM Justin Trudeau called an early election so that he could regain a majority in the Canadian House of Commons (his party lost their majority in the 2019 election). Unfortunately for PM Trudeau, since calling the election the polls have narrowed substantially, as the graph below shows (it starts on Aug. 16th, the day he called the election).

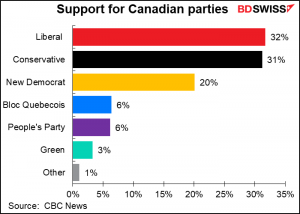

Having gone into the election with a 35%-29% lead, Trudeau’s Liberal Party is now running neck-and-neck with the Conservatives, according to CBC News’ polling average. CBC’s election model shows the Liberals remaining the largest party but falling short of a majority.

If the election does result in another minority government led by the Liberals, well then that’s no different from today and shouldn’t have much of an impact on CAD. And even a change in government might not be all that big a deal; fiscal policy is likely to remain expansive as none of the major parties has been pushing for a pullback in government spending, while monetary policy will of course be unchanged.

With the election looking this close, the big concern is that perhaps no party will be able to form a stable minority government. The uncertainty may last some time, because there’s likely to be more mail-in voting than usual, which could delay the counting of ballots. The results of Canadian elections are usually known within hours of the polls closing, even when no party has won a majority. Against the background of the pandemic, probably any government is better than no government. That’s the big risk for CAD.

German election: a key point of interest

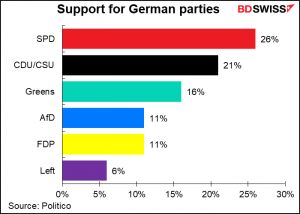

Germany goes to the polls to elect a new Bundestag, including a new Chancellor to replace the beloved Angela Merkel, who is bowing out after 18 years. I won’t go into much detail here, because I’ve written an extensive piece on the subject: Germany’s Election: What it means for Germany and Europe. This race too has tightened considerably since I wrote that piece, and it now looks as if Finance Minister Olaf Scholz of the Social Democratic Party (SPD) may become Chancellor and the ruling CDU/CSU party may be out of the government for the first time since WWII.

However, as I explain in this piece, German politics move slowly and with consensus, so none of the likely coalitions would be likely to cause any rapid, major shifts in policy. Germany’s gradual shift towards a more fiscally relaxed, center-left and greener policy stance is likely to continue under most plausible combinations. Perhaps it would occur a bit faster under Chancellor Scholz than under the CDU/CSU’s Laschet, but the trend is the same.

The candidates will have a final debate on TV on Thursday.

Japan election: ho-hum

My guess is that most of my gentle readers can’t name the outgoing Japanese Prime Minister, and frankly speaking, I can’t blame them. He was only there for a year. Japan has had 36 Prime Ministers since WWII, giving them an average tenure of 2.1 years.

Even though I lived there for many years myself, Japanese politics just don’t grip me, and I suspect it’s the same for other people even though they may immerse themselves in the policy differences between Germany’s CDU and SPD. That’s probably because the same party has been in power in Japan almost without interruption since 1955. The question is not which party will win, the question is which candidate from the ruling Liberal Democratic Party (LDP) will win. Technically this is not an election for the PM, it’s an election for LDP President. Since the LDP has a majority in the Diet, the LDP President automatically becomes the PM.

The differences among the candidates with regards to economic policy are usually differences of nuance and aren’t that significant. The bureaucrats will continue to run the show and the LDP will continue to do what the LDP generally does, which is borrow money and spend it building bridges to nowhere. Some PMs do manage to make their mark – even the outgoing Mr. Suga managed to cut mobile phone charges. But don’t expect the new captain to steer the ship of state in a radically different direction.

The election takes place on Sep. 29th. There will be 766 votes for the leader, half cast by the 383 LDP members in the Diet and the other half by the 1.13mn rank-and-file party members If one candidate receives a majority, he or she wins (and yes, two shes running this time!) If not, there will be a runoff election by the top two candidates on the same day. The voters in the runoff election are the 383 Diet party members and 47 votes prefectural votes, one from each prefecture.

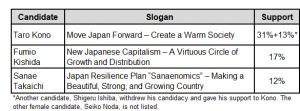

The main candidates, their slogans (just for your amusement), and their support among party members in a recent Nikkei poll are:

So it looks like Mr. Kono is the favorite. I’ll discuss him and his policies closer to the event.

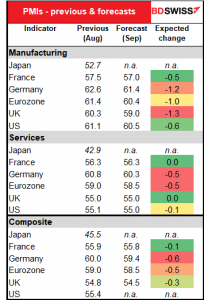

Indicators to watch: preliminary PMIs

Outside of the central bank meetings and the elections, the major indicators to watch during the week will be the preliminary purchasing managers’ indices (PMIs) from the major economies. These will be released on Thursday, except for Japan, which is on holiday that day so theirs will be released on Friday. Overall, the market expects both manufacturing and service-sector PMIs to decline but only slightly. This could add to the recent concerns about “stagflation” and hurt sentiment toward the commodity currencies, although the absolute level of the PMIs is expected to remain relatively high – well in expansionary territory (outside from Japan, that is).