Rates as of 05:00 GMT

Market Recap

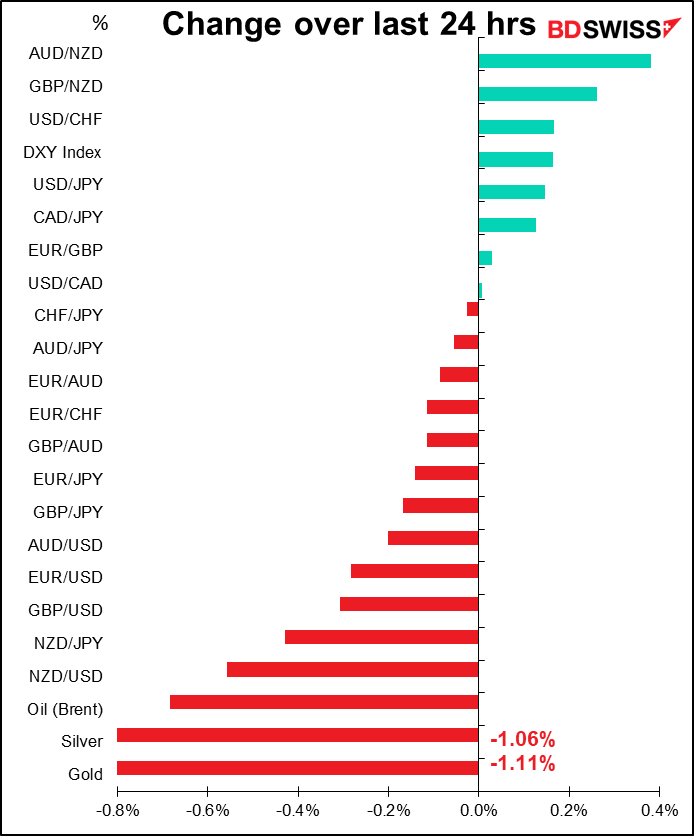

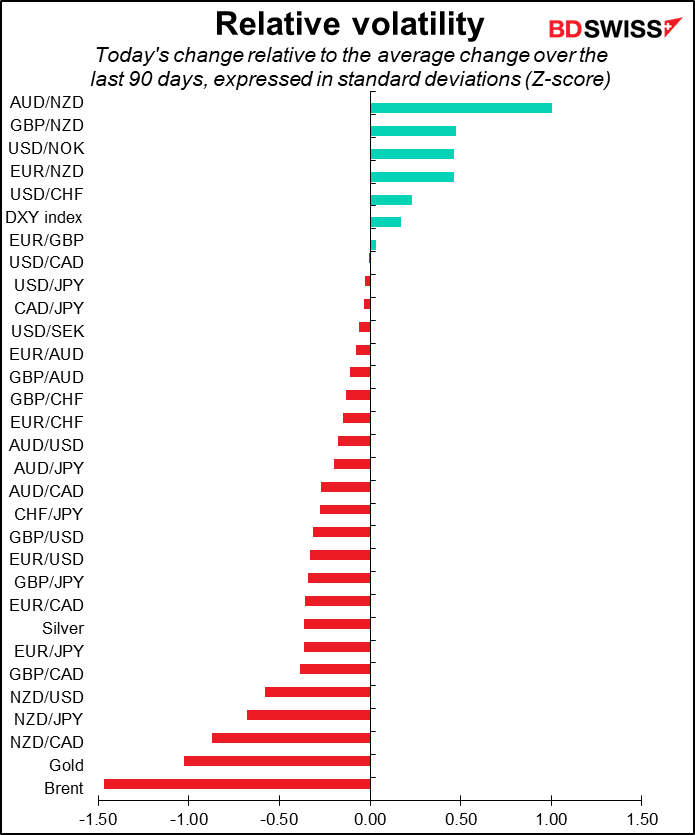

A relatively quiet day in the FX market. The seemingly big move in NZD is only big in comparison to the other moves, which weren’t big at all. Normally I wouldn’t even comment on a 0.2% move, which is what USD did overnight.

As for why NZD is lower…I have no idea and neither does anyone else that I could find, either. I would assume it’s just profit-taking on yesterday’s sharp move higher.

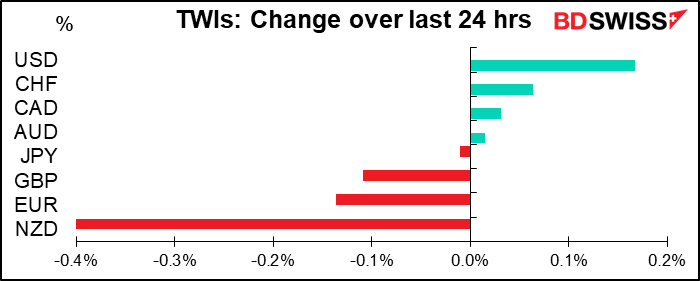

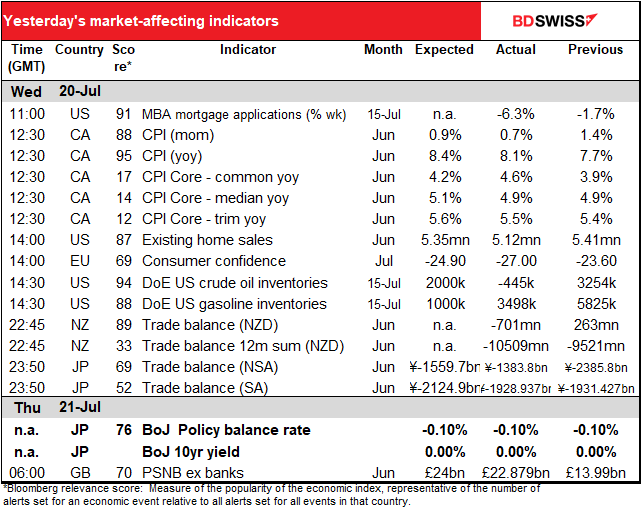

Looking at the massive -0.01% move in the JPY trade-weighted index today (that’s sarcastic) you can see what an impact the Bank of Japan meeting had on the market: virtually nothing. As expected, they didn’t change any of their policy settings.

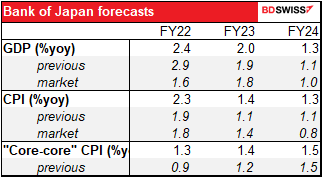

They did fiddle with their forecasts: lowered their growth forecast for this year and raised their inflation forecasts for this year and the next two. However they still don’t see inflation remaining above their 2% target level during the forecast horizon, so no chance of a change in rates at any time during the foreseeable future. This to me is a green light to sell JPY (buy USD/JPY).

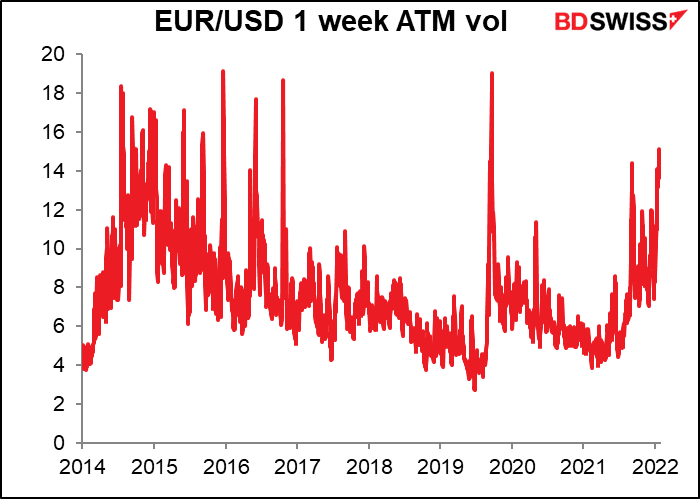

The yen might not be moving very much but that’s not the case with EUR/USD, which is extremely volatile (at least by historical standards).

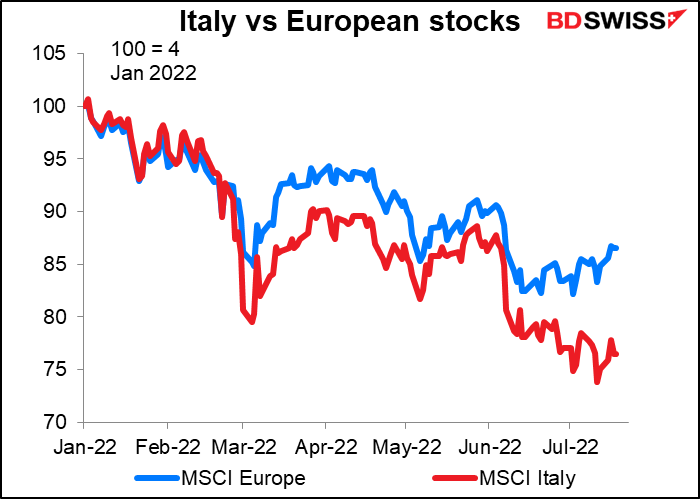

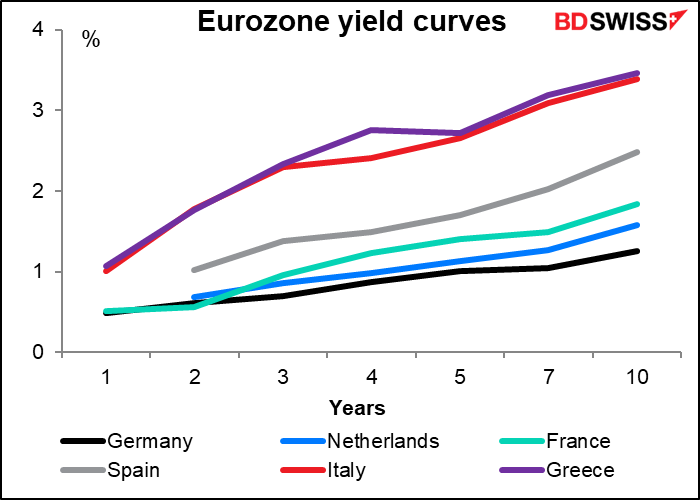

One of the things we hope to get out of today’s European Central Bank (ECB) meeting are some details about their proposed anti-fragmentation tool (see below). The importance of that was underlined yesterday as PM Draghi’s coalition collapsed after three parties (the League, Forza Italia and the Five Star Movement) failed to back him in a Senate confidence vote. He’ll make the same plea today to the Lower House but it’s unlikely to get a better reception. PM Draghi submitted his resignation last week but the President rejected it. However I don’t see how he can carry on under these circumstances. This raises the possibility of early elections in Italy.

As I pointed out yesterday, Italian President Mattarella will probably call snap elections, possibly in the second half of September. That would leave open the question of whether they have time to approve the 2023 budget before the end of the year and also meet the conditions necessary to get the third tranche of European Commission money. That’s the major risk: financial instability arising from political instability.

An early election in Italy could be negative for the euro in that it would increase instability in the bloc’s third-largest economy. Then again, if people think the election would result in a more stable government that would eventually back economic reforms, it could be good for the euro. Or given the chronic instability in Italy, which averages a new government every 15 months or so, perhaps no one will care.

On the plus side for Europe, Russia resumed gas supplies through the Nord Stream 1 pipeline yesterday after a 10-day maintenance period. There were fears that the shutdown would be extended after the maintenance period ended. This delays but does not eliminate the energy crisis in Europe.

Speaking of elections, the race for UK Prime Minister will now come down to former Chancellor of the Exchequer Rishi Sunak and Foreign Secretary Liz Truss. Conservative Party members will vote over the summer and the winner will be announced on Sep. 5th. Although Sunak was the favorite among Conservative Party Members of Parliament (MPs) (137 vs 113 for Truss), there’s no guarantee it will play out among the general membership. A YouGov poll of Conservative members found that Truss would beat Sunak by a wide margin, 54%-35%. In fact although Sunak was consistently the biggest vote-getter among Conservative MPs, YouGov found him to be the loser vs several of the potential candidates aside from Truss. So his ultimate victory is far from assured.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The big thrill today will of course be the meeting of the European Central Bank (ECB) Governing Council. I wrote more about this than any normal person would possibly want to read in my Weekly Outlook: ECB Behind the Curve, so I’ll just repeat the high points here.

The ECB’s decision at this meeting is hardly in doubt. At the June meeting, ECB President Lagarde said, “we intend to raise the key ECB interest rates by 25 basis points at our July monetary policy meeting.” She reaffirmed that decision at the ECB’s Sintra symposium. This would be the first hike in rates since the ill-fated and brief series of rate hikes in 2011.

It’s of course possible that the Governing Council might change its mind about July, but it’s unlikely that they would change a unanimous decision that’s been reaffirmed publicly. Nevertheless Reuters reported Tuesday that they might hike by 50 bps in conjunction with a robust “anti-fragmentation” tool (see below).

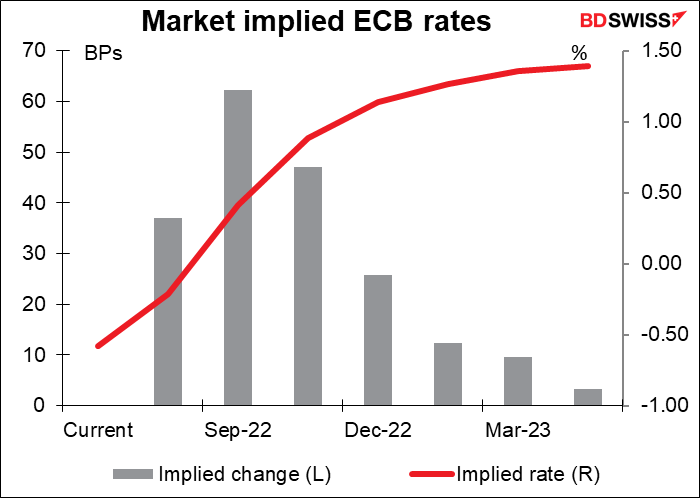

Following those reports, the market is now discounting a 37 bps hike — a 25 bps hike as promised and a good chance of a 50 bps hike.

The big question then concerns September. Lagarde said that they’ll raise rates again at that meeting and that the increase then could be bigger. “If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at our September meeting.”

The market is therefore looking for at least a 50 bps hike in September, maybe more. That’s not much in the context of what other central banks are doing: the Bank of Canada hiked by 100 bps last week and the US Fed is assumed to be debating between 75 bps and 100 bps for its July meeting. The big question that people will be looking to answer at this meeting is, what could get them to hike by 75 bps instead in September? Or convince them to hike by only 25 bps then?

And what about after September? The Governing Council has pledged a “gradual but sustained path” of tightening beyond September, “gradual” being a code word for 25 bps. The risk that Russia might cut off the supply of gas to Europe, thereby precipitating a recession, skews the risk to the pace of hiking to the downside for the later meetings. The ECB is in even more of a pickle than other central banks because it has to worry about a possible recession caused by exogenous factors – events outside of its purview. Other central banks simply have to worry that their tightening might crash their economies, not that Russia’s actions might crash them.

I expect that they’ll stick with their “gradual” terminology. I think this could disappoint those market participants looking for a more aggressive stance. EUR would be likely to weaken under this scenario.

We may also get some details about the ECB’s planned “anti-fragmentation” tool. This is a new program that they’re designing to allow them to buy bonds of a specific country if that country gets into trouble and the yields on their bonds start getting too far out of line with the other Eurozone countries. (Their current bond-buying operations have rules about how much of each country’s bonds they can buy so that the ECB isn’t seen to be supporting any one country more than the others.) The new program would probably involve some strict criteria about what conditions they would buy bonds in and what steps the country would have to take in return. The details of those conditions are important.

And of course everyone will be waiting to hear what if anything Mdme Lagarde has to say about EUR/USD breaking parity. I expect that she won’t be particularly fussed. Much of the reason is dollar strength, not euro weakness. While this may be a 20-year low for EUR/USD, it’s not even a 10-year low for the trade-weighted index. Of course a weaker currency pushes up inflation by increasing the price of dollar-denominated commodities, but it also helps exports. I remember the ECB about the euro being too strong but I can’t remember any complaints about it ever being too weak, but that may just be my faulty memory. (Former ECB President Trichet was fond of talking about the “brutal” rise in EUR/USD).

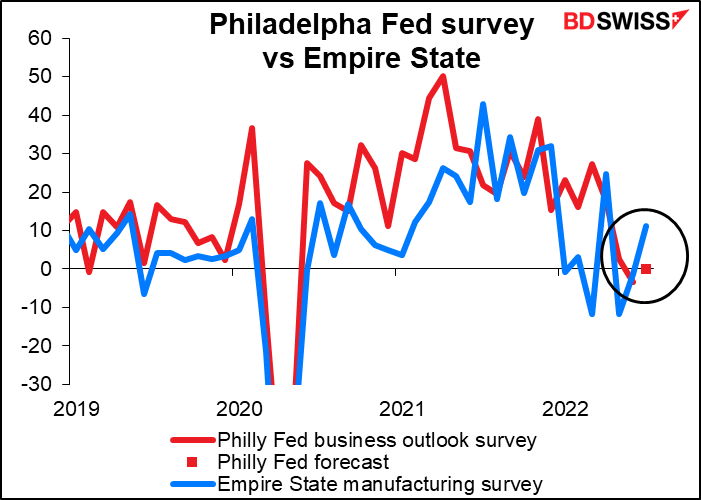

When the US day starts we get the Philadelphia Fed business outlook survey. It’s expected to be up 4.8 points. The forecasts aren’t particularly reliable however. Last week’s Empire State index for example was expected to be down 0.8 point to -2.0; instead it was up 9.9 points to 11.1. In any case, a rise back to above zero, as forecast, combined with the Empire State survey results would suggest that the long-awaited US recession hasn’t hit yet, that the economy continues to expand. That would be positive for the dollar.

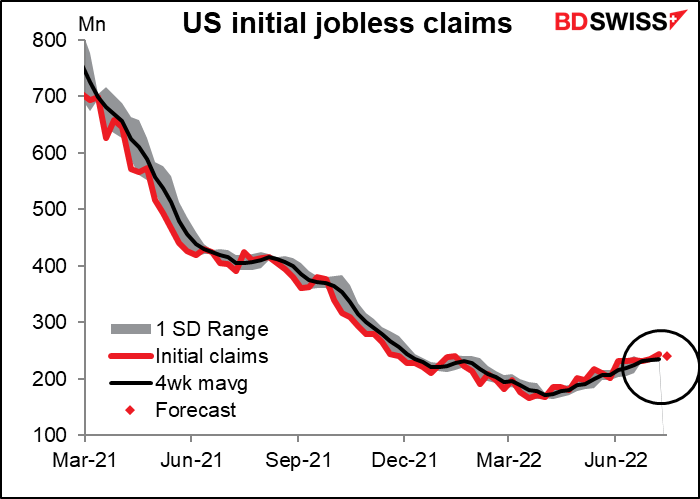

US initial jobless claims edged up again last week but still less than 10k (9k, to be precise). There’s no sign that higher rates are disrupting the labor market to any significant degree. And today’s figure is expected to show a decline in claims, which would only add to that impression.

Overnight Japan releases its national consumer price index (CPI). It’s expected to slow by 10 bps, in line with the performance of the Tokyo headline inflation rate. That would only confirm in the minds of the Policy Board members that the rise in inflation over their 2% target may be just temporary and would justify their keeping policy on hold. Admittedly the Japan-style core inflation rate (ex-fresh foods) and “core-core” (ex food and energy, same as most other countries’ core inflation rates) are expected to tick up by 10 bps, but that’s still nothing compared to what’s going on elsewhere in the world. JPY-

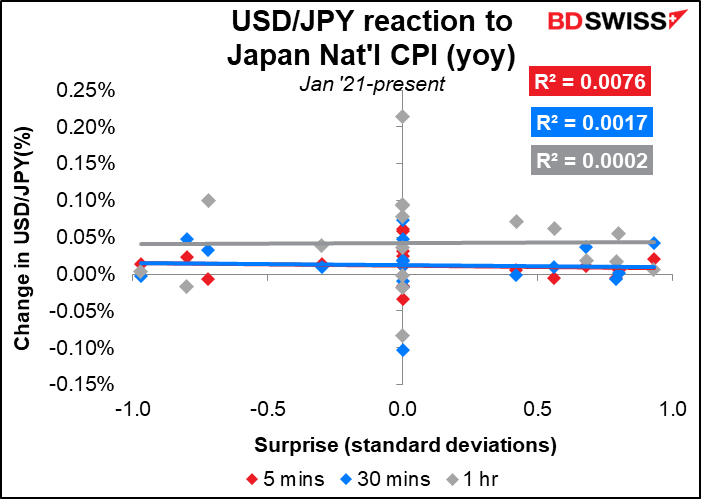

The CPI release has a bizarrely low impact on the currency. Japan is unique in this respect; nowadays the national CPI is usually the biggest indicator for most countries. That’s probably for three reasons: one, the Tokyo CPI comes out two weeks earlier and is a pretty good estimate of the national CPI; two, the forecasts usually get it right and so there normally isn’t much of a surprise to react to; and third, no one expects the Bank of Japan to change its policy in response to the data anyway.

Even the Bank of Japan meetings themselves don’t attract that much attention, or at least the policy rate decision doesn’t. The Bloomberg relevance score for the BoJ policy balance rate is only 79, whereas for most other countries it’s usually the highest-rated indicator for that country (for the Fed for example it’s 98 and for the Reserve Bank of Australia it’s 99.85, meaning that virtually everyone who has an alert set for any Australian indicators has one set for the RBA’s cash rate target.)

Later in the Japanese day we start to get the preliminary purchasing managers’ indices (PMIs) for the major industrial economies. There’s never a forecast for the Japan PMIs, which is kind of strange given that the Japan manufacturing PMI has a Bloomberg relevance score of 90, which is quite high, meaning a lot of people watch out for it. So I’ll talk about the PMIs tomorrow.

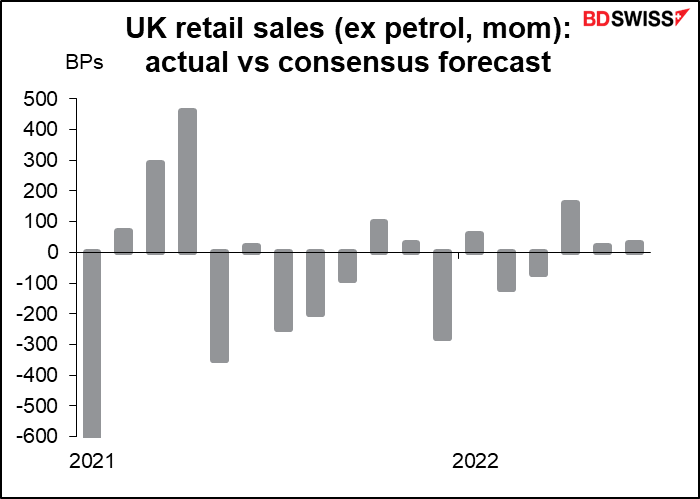

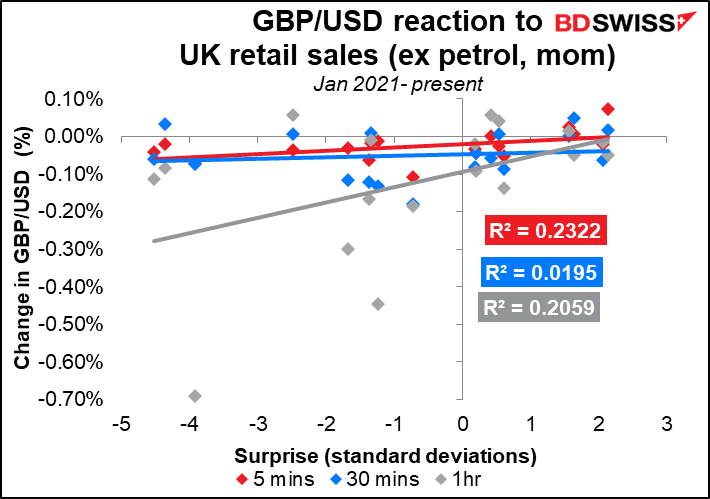

Then, bright and early Friday morning in Europe, Britain announces its retail sales. They’ve fallen on a month-on-month basis for six out of the last seven months and are expected to fall yet again this month. (I’m using the ex-petrol figures, as I discuss below.) The risks are probably to the downside because the May bank holiday migrated into June this year for the Jubilee celebration, which means there were two unusual holiday days. Shopping tends to fall off during such celebrations.

Under normal conditions I’d say that a continued decline in sales should be negative for the currency, but sluggish demand isn’t translating into reduced pressure on prices. I therefore expect the market to largely ignore this figure if it comes in as expected. The big risk is if there’s a surprise rise in sales. That would reaffirm to the Monetary Policy Committee that domestic demand is holding up despite the pinch on incomes and would increase the likelihood of a 50 bps hike at their August meeting.

Which one of the four series to watch? There isn’t that much difference in the response of GBP/USD to the various permutations (month-on-month or year-on-year, with or without fuel). The month-on-month ex-fuel figure is slightly better correlated with the subsequent market reaction so that’s the one I focus on. It also has some theoretical justification as sales of petrol are influenced as much by the price as by the volume, so best to exclude that.

How good are the forecasts? Not very. Since the beginning of 2021 the actual figure has beaten estimates 10 times and missed 8 times, so pretty much random. Note that the beats and misses have gotten smaller recently. Retail sales were distorted by the pandemic and the variable lockdowns in response, so I have some sympathy with the problems that economists faced forecasting the numbers.