This week I really should be writing about stock markets, which is where the drama has been recently. Where are stocks headed? Are we nearing a collapse? Are we going to see the S&P 500 (3,916 at the time of writing) meet the 30-year Treasury yield (3.0%)? Alas I have no answers. Furthermore I don’t even want to think about it, since most of my savings are in the stock market. O, that way madness lies; let me shun that; / No more of that, as King Lear said. So I’m going to ignore the question entirely and not look at the report from my brokerage account for the next, say, five or six years.

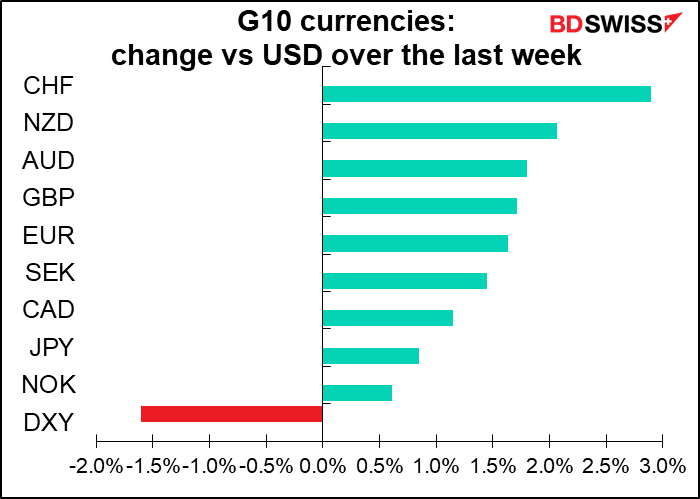

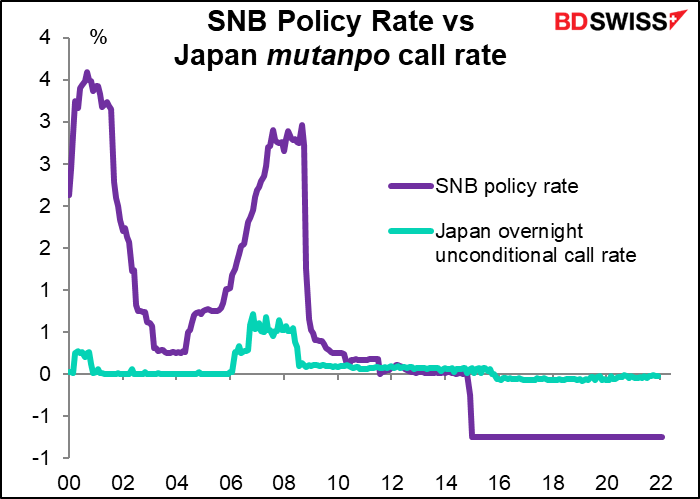

Instead I’m going to focus on currencies, which is what I spend most of my time nowadays looking at, and discuss the relative merits of the two so-called “safe haven” currencies, the Swiss Franc (CHF) and the Japanese Yen (JPY). The two have been largely moved by global risk sentiment for the last several years, as their central banks have been effectively on hold for years (the Swiss National Bank from January 2015, the Bank of Japan from 1995, more or less).

Now though I think we are going to start to see “monetary policy divergence” between the two as the Swiss National Bank (SNB) follows the European Central Bank (ECB) and begins to normalize its interest rates, which are the lowest in recorded history. The Bank of Japan (BoJ) however has as yet shown no interest or intention at all in making any changes in policy. This divergence could send CHF/JPY sharply higher in coming months, in my view.

SNB: following the ECB

ECB officials have made no secret of their desire to start normalizing policy. No one is discussing whether, the only questions are when and how quickly. The consensus seems to be to start hiking in July. The market is discounting some 100 bps of hikes this year, bringing the deposit rate up to +0.50%.

From the beginning of the Eurozone, the SNB followed the ECB’s rate moves. That became problematic in 2011 when EUR/CHF began to move down (CHF became overvalued relative to EUR, the currency of Switzerland’s main trading partner). That ended with the end of the EUR/CHF floor in 2015, when Switzerland set its policy rate at -0.75%, the lowest interest rate in recorded history.

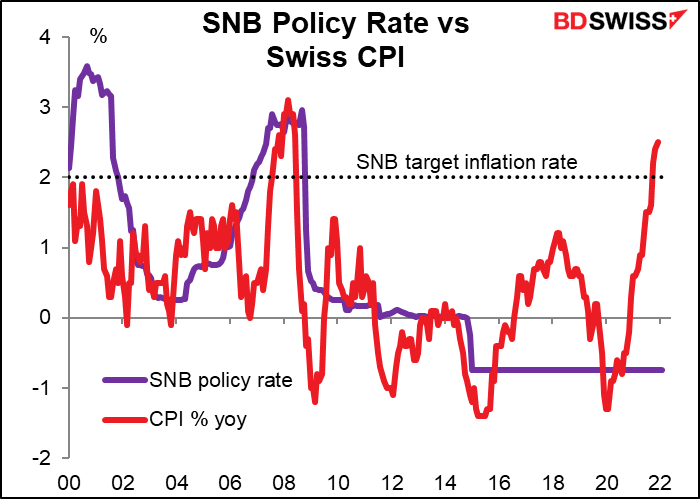

Now, inflation is running above the SNB’s 2% target. The SNB has a choice: allow EUR/CHF to fall further, thereby reducing imported inflation (especially important when imported energy is causing much of the rise in inflation) or tightening monetary policy. The last time inflation was at this level in Switzerland, the SNB’s policy rate was around 2.75%, not -0.75%.

SNB President Jordan has expressed concern about the matter. This week he said that he sees stable Swiss prices despite shocks, but that “the SNB will take care to maintain price stability.” “We see the risk of second-round effects,” he noted. He didn’t say what action the SNB might take, but if the ECB starts to hike rates in July, as is widely expected, it’s not beyond the range of the imagination that the SNB starts at the following meeting, in September.

BoJ: on hold during the remainder of the Anthropocene Epoch

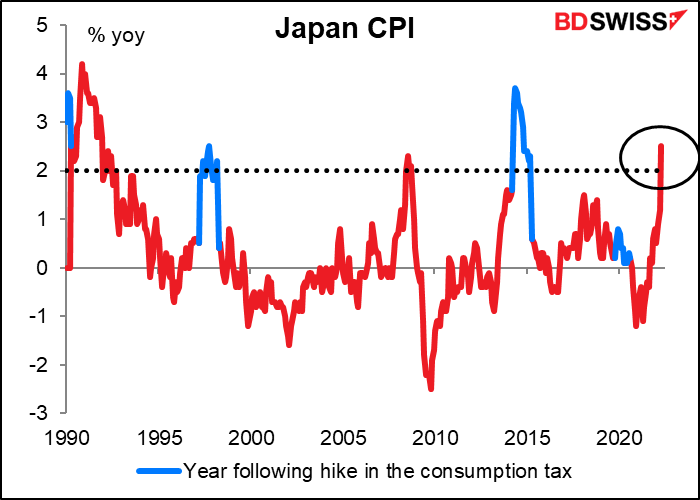

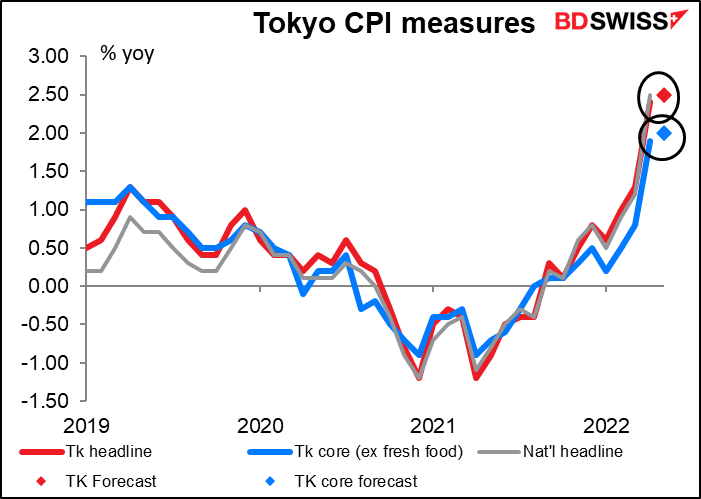

Something similar is going on in Japan, where headline inflation in April was 2.5% yoy, the first time since 1993 it’s been above the BoJ’s 2% inflation target without a hike in the consumption tax (except for three months in 2008).

But the reaction of the BoJ’s Monetary Policy Board couldn’t be more different. The Summary of Opinions from their April meeting didn’t have a single comment about the dangers of rising inflation. On the contrary, members are still concerned that as long as the output gap persists, above-target inflation is likely to prove only temporary.

ECB President Lagarde recently said, with regards to European and US policy, “Comparing our respective monetary policies is comparing apples and oranges. We are not applying policies to the same economic situations at all.” The same could well be said about Japan and Switzerland – or for that matter, Japan and virtually every other country.

As a result…well, spot the odd man out in this graph.

If you were a hedge fund manager thinking of borrowing money short-term and investing it somewhere, which currency would you use? Which currency offers the least chance of getting caught out by an unexpected rate hike? You only get one guess. I expect that as global interest rates rise, we’ll hear more and more about the revival of the “yen carry trade,” which funded the world’s speculation in the late 1990s. At the moment both EUR and CHF have lower funding costs and may therefore be better options, but I expect that to change over the next several months.

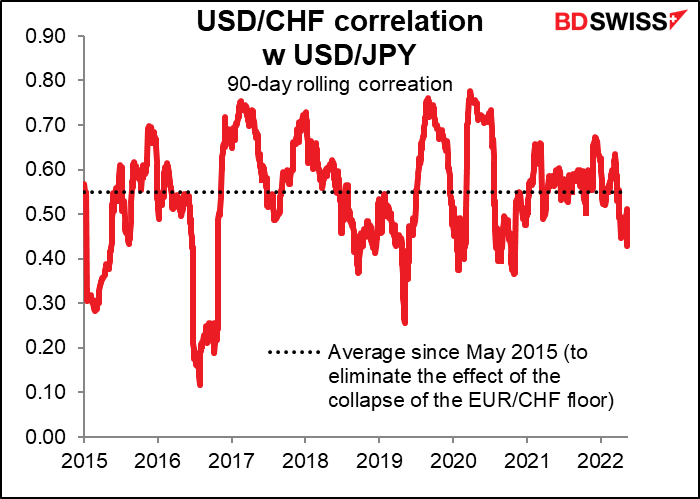

The daily changes in USD/CHF and USD/JPY are still fairly closely correlated. I believe this could change as the SNB moves closer to changing its monetary policy – or at least as speculation increases about a change in SNB policy. Meanwhile, the BoJ has yet to even start “thinking about thinking about” changing policy, to use Fed Chair Powell’s famous line.

I believe that CHF/JPY could well move higher on the “monetary policy divergence” theme while offering some insulation against a change in risk sentiment, since both currencies are affected by global risk appetite.

This coming week: RBNZ, FOMC minutes, preliminary PMIs

There’s not too much on the schedule for the coming week. Not much to distract us while we stare at the screens in horror, watching our life savings disappear into the maw of the the S&P 500. Oh well. I didn’t really want to retire anyway.

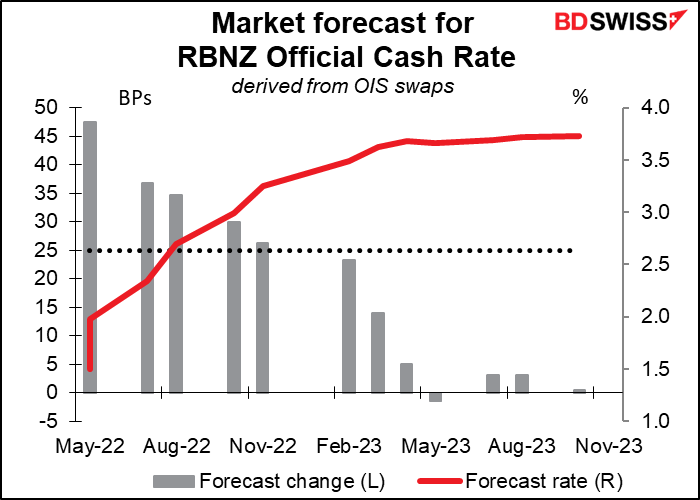

The only G10 central bank scheduled to meet this coming week is the Reserve Bank of New Zealand (RBNZ). At their last meeting on April 14th they hiked by 50 bps and the market is discounting another such hike this time too.

The minutes of the April meeting explain why better than I could:

Members noted that annual consumer price inflation is expected to peak around 7 percent in the first half of 2022. The risk of more persistent high inflation expectations has increased. The Committee agreed that their policy ‘path of least regret’ is to increase the OCR by more now, rather than later, to head off rising inflation expectations and minimise any unnecessary volatility in output, interest rates, and the exchange rate in the future… Members agreed that a larger rise in the OCR now is consistent with the forward path for interest rates outlined in their February Statement.

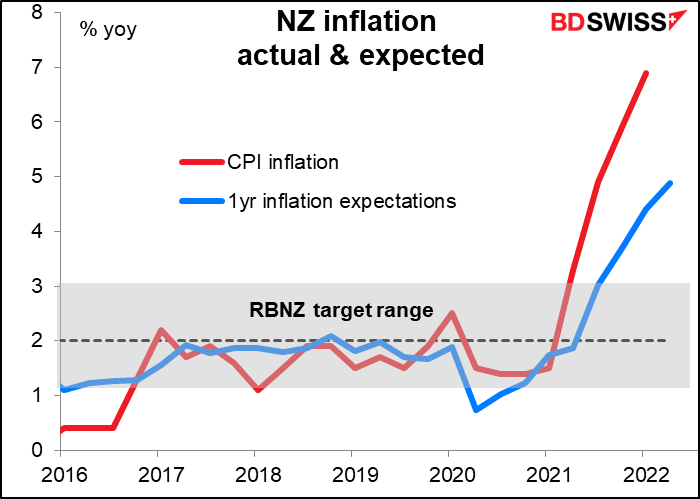

Since then, the Q1 CPI figure came out at 6.9%, suggesting that it is indeed on track to “peak around 7%” in 1H, if not higher. Furthermore, 1-year ahead inflation expectations rose in Q2 to 4.88%, the highest in 32 years, indicating that the rate hikes so far haven’t had the hoped-for effect of dampening inflation expectations.

Accordingly, we can expect the RBNZ to continue to follow “the forward path for interest rates outlined in their February Statement,” which pegs the OCR at 1.5% in June. I don’t see much room for debate.

The main points of interest then will be any change in their sentiment and how high they think the rate might have to go. There will be a new Monetary Policy Statement issued with new forecasts. The February one had rates peaking at around 3.4%; is that still the case? Do they still see 2% as the “neutral” rate for the OCR? I think these will be the major questions people will be asking.

FOMC minutes: how high is high?

On Wednesday the US Fed will release the minutes of the May 4th meeting of the Federal Open Market Committee (FOMC). This meeting decided to hike the fed funds rate by 50 bps and to start running down the Fed’s ginormous balance sheet.

Since then we’ve heard any number of Committee members speak. They tend to range from hawkish to more hawkish. We’ve also had several speeches by Fed Chair Powell in addition to his usual press conference. There isn’t that much left to learn, but I’m sure we’ll glean some insights from lucubrating the document.

For example, the statement following the meeting said that “The Committee is highly attentive to inflation risks.” What specifically are they worried about? They said they anticipate “that ongoing increases in the target range will be appropriate.” How far? How high? What might get them to hike by 75 bps? We probably won’t get any specifics, but we will get a better sense of where the consensus on the Committee lies and just how far they might be willing to go. Spoiler alert: it will probably be higher than we think. That might be good for the dollar but negative for stocks.

Preliminary PMIs

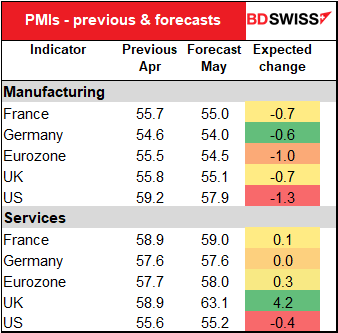

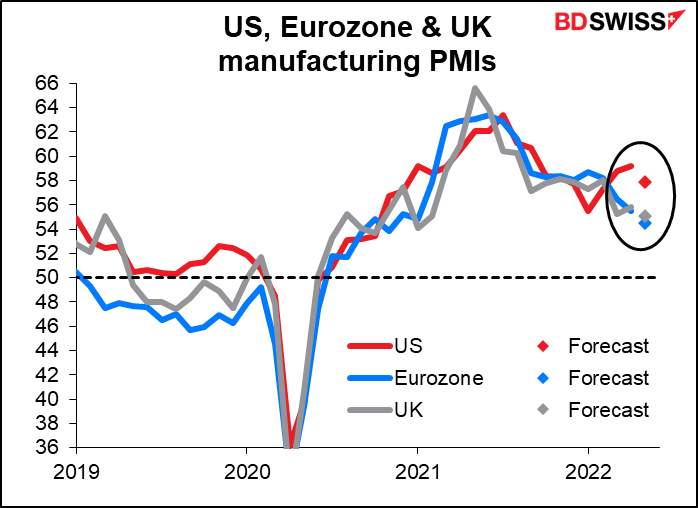

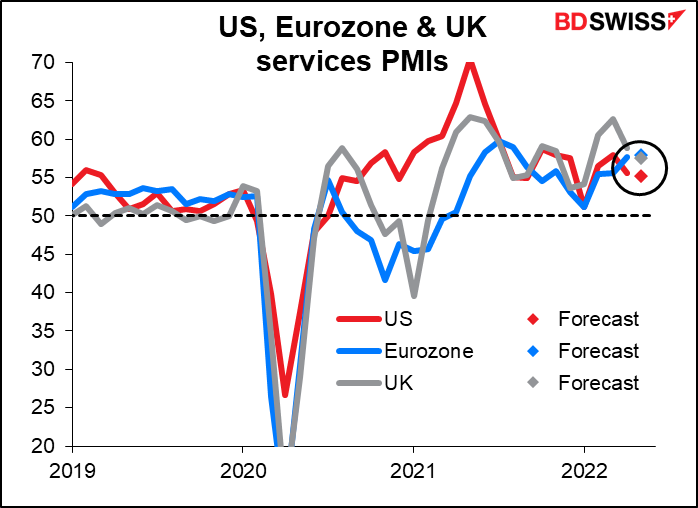

The preliminary purchasing managers’ indices (PMIs) for the major industrial economies are released on Tuesday. They’re expected to be split: the manufacturing PMIs are uniformly expected to be lower, while the service-sector PMIs are mostly expected to be stable to higher (except in the US, which is seen fractionally lower). This accords with the shift in spending that we’ve been seeing wherein people who bought a lot of goods while they were locked up in their homes are now enjoying going out and buying a lot of services that they couldn’t enjoy before (e.g. spending in bars & restaurants hit a record high in the April US retail sales figures). Nonetheless in that respect the fact that only small increases, if any, in the service-sector PMIs are expected is somewhat worrisome, although it could simply be a function of how high the indices are already.

Other indicators

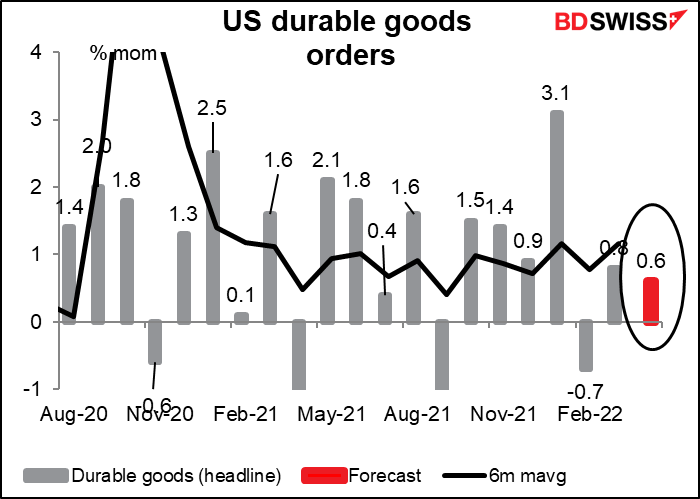

The main indicators for the US will be the durable goods orders on Wednesday and personal income & spending on Friday, with their constant companion, the personal consumption expenditure (PCE) deflators.

Durable goods orders are expected to be up once again but at a bit slower pace than in the previous month and below the six-month moving average, which is boosted by the tremendous leap in January. That was due to a 16% increase in aircraft orders.

If we look at orders excluding volatile aircraft, orders are expected to be pretty much in line with the recent trend. This may reassure people that higher interest rates haven’t dissuaded businesses from investing, which is good for the long-term outlook. USD+

I think though that Friday’s personal income & spending figures will be of more interest than the durable goods figure. This past week we had a surprisingly strong US retail sales figure. People will want to know where is everyone getting the money to spend and will they keep spending?

Both incomes & spending are expected to be up 0.6% mom (which is why you only see one dot in the chart instead of two – they’re both the same number). This is a bit above trend for incomes and a bit below trend for spending, but nothing serious. The main point is that incomes are holding up and that should support spending going forward. That’s good for the US economy and may be considered good for the dollar, too.

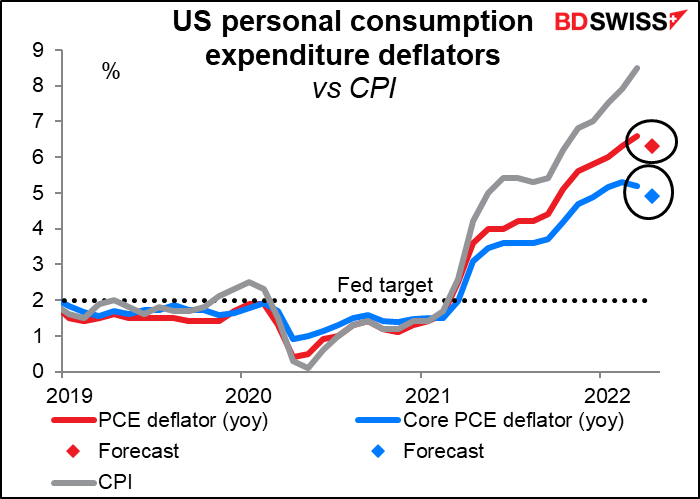

I used to get all excited about the personal consumption expenditure (PCE) deflators. Since they are the Fed’s preferred inflation gauge, I thought they should be more significant for monetary policy than the more widely known CPI. However I’ve noticed recently that although the Fed may frame its forecasts in terms of the PCE deflators and I’m sure their 800 or so PhDs pay a lot of attention to them, when Committee members talk about “inflation” they almost always refer to the CPI, not the PCE deflators. I’m not going to be more of a stickler than they are.

Nonetheless, we could get some excitement around this month’s PCE deflators as they’re expected to show a slowdown in inflation at both the headline and core level. This is in contrast to the CPI, which has just kept going higher and higher.

It’s not all base effects, either. If we look at the expected three-month change annualized, the headline rate is forecast to remain steady but the more important core PCE deflator – which the Fed said “historically has been a better indicator of where inflation will be in the future than the overall figure” – is forecast to show a substantial slowdown. This could trigger some unwinding of fed funds expectations that would be negative for the dollar.

The question then is, which would the market consider more significant: a strong income and spending figure, or a slowing PCE deflator? Looking at the Bloomberg relevance scores, market participants put a lot more weight on the income & spending data (both have a score of 85) than the PCE deflators (mom change of the core deflator is 60, mom change of the headline is a mere 20). That makes me think that the income & spending figures are likely to take precedence, especially if the stock market takes heart from them.

Elsewhere, we’ll also get some information on the US housing market from new home sales (Tue) and pending home sales (Thu).

For Japan, the Tokyo CPI (Fri) will be an exciting event. The Tokyo CPI hit 2.4% yoy in April while the national CPI was up 2.5% yoy. People expect it to move a bit higher in May, with the Japan-style core inflation (excluding fresh foods) finally hitting the BoJ’s target of 2.0%. As described above this is not likely to trigger any change in policy from the BoJ but it could trigger a knee-jerk reaction from the market. I think it’s likely to be JPY-positive although I would sell into a stronger JPY.

There aren’t many important EU indicators out during the week. The German Ifo indices on Monday and the Eurozone money supply data on Friday, including bank lending, are about it.

There are no important UK indicators out, so we’ll be able to spend our time instead shaking our heads about the fight over the Irish border and the Northern Ireland protocol. It defies belief. “We are indeed trying to push the case that the protocol is at the end of the line,” said Sir David Frost. “The best way forward would’ve been to renegotiate it as we suggested last year but we keep hearing from the EU, the government keeps hearing they’re not interested in doing that.” He said the EU was being “unreasonable.” The irony of the situation: he’s the one who negotiated it in the first place! And he got a knighthood for doing so! Now he’s complaining that the EU won’t renegotiate it. This is typical of the “have your cake and eat it too” syndrome that the UK was blinded by, or “magical thinking” as the EU put it. There is no good solution to the Northern Irish border problem, there never has been, and there never will be except for Britain to go back into the EU. I expect the tussle over this issue to continue to weigh on GBP.

As for other indicators, Canada and Australia release their retail sales (Thu & Fri, respectively).