Which major events are expected to shape the markets in 2019 and what are the most probable scenarios? Thought Leaders Alex Douedari and Frank Walbaum share their views.

As markets move into 2019, investors are on the lookout for key forecasts and market predictions by senior analysts in order to strategize for the year ahead. For much of 2018 however, predicting each day’s events has felt impossible, as major geopolitical developments such as Brexit talks, the US-China trade war, Federal Reserve press conferences, NAFTA talks, OPEC meetings, midterm elections and even mere tweets by U.S. President Donald Trump caused the markets to wobble. In retrospect, 2018 was quite an eventful year; it started with a complete shutdown of the US government back in January and ended with an utter Brexit debacle which caused havoc in the U.K. markets. Overall however, markets remained largely bullish in 2018.

Another Eventful Year

According to BDSwiss’ market analysts Alex Douedari and Frank Walbaum, we should not expect 2019 to be any different. In their extensive 2019 Global Market Outlook, the two veteran analysts elaborate on the views of Wall Street strategists to create a detailed report with the key fundamental scenarios that traders and investors may be faced with in 2019. Alex and Frank’s report includes the biggest disruptions, innovations, and opportunities that are likely to present themselves next year.

Markets Remain Largely Bullish

Markets Remain Largely Bullish

In 2019, markets will remain largely bullish but will be dictated predominantly by politics according to Alex and Frank, “We see a choppier year ahead for global markets, oil will remain a wild card and investors will maintain a largely defensive stance when it comes to stocks as they continue to worry about a possible recession in 2020. The median forecast indicates the US economy will grow 2.6 percent in 2019 which is good news for major US retail shares. In Europe however, the macroeconomic picture will be very different, shares are expected to move in a tight range throughout 2019, as slowing growth, political risks and worries over Washington’s protectionist policies keep investors on the sidelines.” comments Alex. To help investors navigate next year’s markets the two analysts have broken down the most probable and improbable macroeconomic scenarios.

The China/US Scenario

The China/US Scenario

For much of this year the raging trade war between China and the US has caused the dollar to rally against its rivals as the US continued to impose hefty tariffs on Chinese imported goods. As Frank explains, the Sino-US trade war is currently undergoing a 90-day cease fire, ending sometime in March 2019. “ The current trade truce has done nothing to alleviate China’s deteriorating A-shares market. Looking at China’s current declining numbers on fixed asset investments, a retreating industrial production and a slowing growth in the property market growth, China will be paying the heaviest toll in an extreme 2019 trade war scenario. Halfhearted stimulus attempts simply won’t work. China will simply need to take time to deleverage and rebalance.” comments Frank, adding that on a longer term basis we could see China recover if the Communist Party of China General Secretary, Xi Jinping makes good on his promises to move the nation away from fixed asset investing and into the high-tech engineering fields. If successful, this would likely propel China’s growth after 2025.

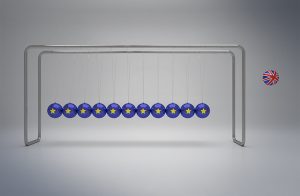

The Brexit Headache

The Brexit Headache

If there’s one thing everyone agrees on when it comes to 2019, is that navigating Brexit uncertainty will remain the U.K.’s biggest challenge. As Alex explains, the recent failed no-confidence vote in Theresa May seems to have reduced the risk of a no-deal, but the most likely final scenario still remains something close to the current deal, especially after a threatened or actual second referendum. “How the UK fares beyond March 29 is the big question. A less favourable deal will limit U.K.’s access to EU financial services markets and cause a short-term depreciation of the sterling. We will also likely see more bear trends for U.K. high street stocks. Retail shares like Debenhams are already at all time lows so we could even witness sell-offs, merges, takeovers and even bankruptcies when it comes to retail shares. A digital services tax could save the ailing U.K. high street but that won’t happen until 2020” says Alex.

Alex adds that when it comes to the overall U.K. economy, it all boils down to how fast and effectively the Bank of England will be able to react to any Brexit outcome after March 29. The worst case Brexit scenario is that Britain crashes out of the EU with no deal and with insufficient preparation. In such a case, the BoE will have little choice but to hike rates sharply to shore up the pound and hold inflation down. As Alex explains, “Under the Bank’s model for a no-deal Brexit, the base rate jumps to 5.5%. If no-deal is mitigated by a transition arrangement, the base rate is anticipated to hit 1.75%. For the sterling this could mean two extremely different outcomes, if the BoE choses to hike rates sharply to hold inflation down, the sterling will soar. On the flipside, if the BoE slices rates as it did after the brexit vote in 2016, this would in turn cause the GBP to tumble against its rivals.”

More Scenarios

Among other major 2019 scenarios, Alex and Frank explore the possibility of an emerging market crisis, the yearly outlook of major cryptocurrencies, possible instabilities in the global political scene, a tighter than expected Federal Reserve monetary policy and some major trends in the forex, commodity and stock markets. Overall, 2019 will be quite the year according to Alex and Frank, with a lot of opportunities for investors and many decisive developments in the broader geopolitical sphere.

Read Alex and Frank’s Full 2019 Global Market Outlook Report