A while ago, it looked like central banks were irrelevant as far as the forex market was concerned. With monetary policy on hold for the foreseeable future, the market would concentrate on newly available high-frequency indicators of growth plus the daily virus updates to see which economy was going to bounce back soonest. Plus of course fiscal policy: which government was doing the most and the most successfully for their economy?

We spoke too soon! The week just ending was dominated by expectations for – and surprise about – the minutes of the Fed’s latest policy-setting meeting, and the coming week will be dominated by the Kansas City Fed’s annual symposium. The symposium usually takes place at the resort town of Jackson Hole, Wyoming but this year will be held virtually (so you can attend, too!) Many of the Great and Good of central banking will be assembled in cyberspace to discuss “Navigating the Decade Ahead: Implications for Monetary Policy.” Information about the symposium will probably be posted on the Kansas City Fed’s website.

(While you’re looking, you might want to listen to Wilbert Harrison singing about Kansas City. Just FYI, I went to Kansas City on a business trip many years ago and found that there no longer is an intersection of 12th St and Vine, much to my disappointment. I also doubt whether the no-nonsense KC Fed President Esther George is one of the “crazy little women” mentioned in the song.)

The venue has been used several times before to signal major policy changes. Then-Fed Chair Ben Bernanke’s 2010 to 2012 speeches prefigured new rounds of Fed stimulus: QE2 in November 2010, Operation Twist in September 2011, and QE3 in September 2012. Then-European Central Bank (ECB) Chair Mario Draghi stole the show in 2014 when he suggested a series of radical changes in policy that would have been unthinkable in earlier ECB orthodoxy.

Of course, much depends on the timing: if no major changes are coming up, then no major changes will be announced. But with the Fed’s policy-setting Federal Open Market Committee (FOMC) thinking that they should wrap up their review of their monetary policy framework “in the near future,” as Wednesday’s minutes showed, everyone will be waiting to see what bombshells Fed Chair Powell will drop.

We don’t have the full schedule yet, but the weekly schedule of Fed events said Chair Powell will kick off with a speech on the Monetary Policy Framework Review at 09:10 EST, which is 13:10 GMT. We are all looking for some big reveal from Powell, which would then lead up to a formal change at the 16 September FOMC meeting, perhaps embodied in some changes to its quarterly Summary of Economic Projections, which will accompany that meeting.

You can watch the presentation on the Kansas City Fed’s YouTube channel.

As per Wednesday’s minutes, yield curve control seems to be off the table for now, but there remains some debate about switching to average inflation targeting and making clear the Committee’s intentions not only with regards to rates but also with regards to asset purchases. That makes me wonder what he can say; there doesn’t seem to be a consensus yet. Perhaps he will just summarize the discussion and say what alternatives are being considered without offering a conclusion about what will eventually be decided in September.

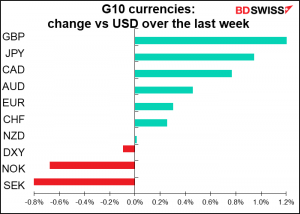

Powell’s remarks are likely to engender the same market reaction that Wednesday’s minutes did, or would have. That is, if he also refrains from setting out a timetable or confirming that the Fed is headed toward average inflation targeting, then the dollar is likely to rise (as it did after the minutes were released). On the other hand, if he does give some hints of policy changes to come…well, the dollar will no doubt react depending on what those changes are.

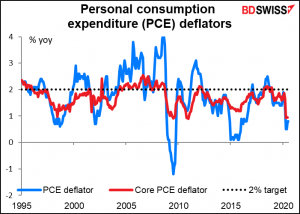

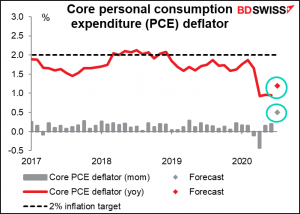

Average inflation targeting would mean lower real yields eventually because the Fed would not raise nominal rates even as inflation rose. And since the core personal consumption expenditure (PCE) deflator, their main inflation gauge, has been below the 2% target for 75% of the time since 1995, it means that they would probably have to do a lot more to get inflation up and would have to keep it high for a long time to make up for lost ground. It would therefore mean a weaker dollar.

So far, we also know that Bank of Canada Gov. Macklem will speak on Thursday. That’s the day after the Bank of Canada holds a workshop on “Towards the 2021 renewal of the Bank of Canada’s Monetary Policy Framework.” Perhaps we’ll get some hints from him on what they’re thinking about, although of course it’s still early days (or months). And Bank of England Gov. Bailey will speak on Friday; his Bank has also been reviewing its policy tools and he could have something exciting to say. Maybe not, though.

The ECB is also undergoing a similar review of its monetary policy framework. It isn’t known yet who if anyone from the ECB will be attending, but assuming someone does, they might use the meeting to clarify their intentions too. Thursday’s ECB meeting minutes implied that some changes might be coming in September. The minutes mentioned this possibility several times, with oblique comments like “It was generally underlined that, by the time of the September ECB staff projections, more information would be available for a reassessment of this profile and any implications for the medium-term outlook for the activity” and “At its September meeting the Governing Council would be in a better position to reassess the monetary policy stance and its policy tools.” I doubt if they would take any action in September, but they might at least start to indicate what actions they’d be likely to take if they find it necessary. Today’s preliminary Eurozone purchasing managers’ indices (PMIs), which showed the Eurozone recovery stalling, only add to the pressure on them to take preventive action.

The week’s data: mostly US: personal income & spending, PCE, durable goods

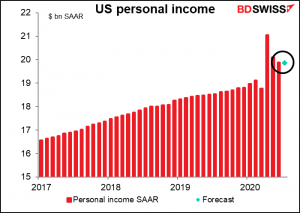

There’s not that much on the schedule for the week, and what data there is is mostly from the US. Personal income and spending on Friday will be the highlight, together with durable goods orders on Wednesday.

Personal income is expected to be down slightly (-0.1% mom), but that would still leave it well above pre-pandemic levels as government support flows to the unemployed. This is likely to change by next month though as the taps dry up.

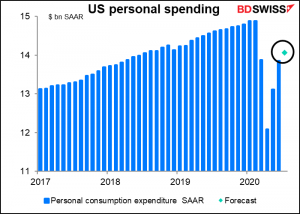

Personal spending however is expected to remain weak, although continuing its gradual recovery (+1.5% mom). So back above March’s level but still well below pre-pandemic levels (94.5% of Jan-Feb average). With the savings ratio estimated to be 29%, it will be hard for the recovery to gain traction.

The personal income and spending data come out with the personal consumption expenditure (PCE) deflators. In days gone by I would’ve said those were the major indicators of the week, since they are the Fed’s preferred inflation gauges, but the market isn’t as focused on inflation as it was pre-pandemic.

Still, there was a notable reaction last week when the producer price index and consumer price index (CPI) for July came out significantly higher than expected. It was fascinating to see the dollar drop after the news – in days gone by, currencies used to rise when inflation accelerated because the news made it more likely that the central bank would raise interest rates. Now that central banks (the Fed in this case) are on hold indefinitely, any acceleration in inflation just means a decline in real interest rates, which is negative for the currency.

In that case, we could see the dollar weaken again when the core personal consumption expenditure deflator, the Fed’s favorite inflation measure, accelerates. Especially with the Fed now discussing allowing inflation overshoots, there’s no possibility that anything short of Weimar-era inflation would convince them to start tightening.

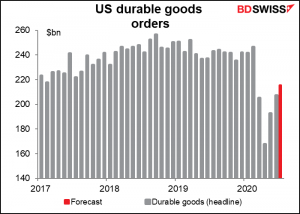

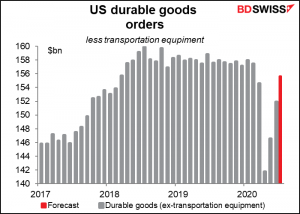

US durable goods orders are expected to continue recovering but remain well below pre-pandemic levels. This is a very slow process, apparently. But at least orders are expected to surpass March’s level.

The problem seems concentrated in the transportation sector. Excluding transportation equipment, orders are expected to be just 1.3% below the January/February average, compared with -11.6% for the headline figure.

The second estimate of US 2Q GDP comes out on Thursday. It’s likely to be revised one way or another, but I think after the initial shock of seeing a -32.9% figure, people aren’t going to get too bothered by a revision of a few percentage points one way or another.

We also get the Richmond Fed manufacturing index and the Conference Board consumer sentiment index on Tuesday. The Richmond Fed index is expected to be unchanged from the previous month, which would be good news; the Empire State index plunged and the Philadelphia Fed index fell more than expected. Both remained in positive territory though, signifying that although the expansion may be slowing, it’s still expanding. Although the Richmond index doesn’t get as much attention as the two that are released earlier, in fact it has a better correlation with the all-important Institute of Supply Management (ISM) purchasing managers index and so is probably the most important one of the five regional Fed indices.

The Conference Board index is expected to be up a bit but not to regain the level it hit in June. No surprise there as millions remain unemployed and the death toll from the virus keeps mounting. I’m an American and I will have zero confidence until, I hope, 4 November, the day after the Presidential election.

Also new home sales on Tuesday and pending home sales on Thursday.

And of course after this week’s surprise rise in initial jobless claims, we’ll be waiting to see if that was just a one-off or the start of a trend. Furthermore, the continuing claims are a week behind the initial claims. We’ll be eager to see this week how many of those newly jobless people were absorbed by the labor market.

Outside of the US, there’s not that much on the schedule during the week. No major UK indicators. There will be no formal Brexit talks, but the chief negotiators and their teams will meet in “specialized sessions” as necessary this coming week and the next. My guess is that these sessions will indeed be necessary, as the talks haven’t made much progress at all.

The latest dispute just shows how intractable the problems are: it’s about the British trucking industry’s ability to pick up loads while they’re on the Continent. Basically it makes a lot of sense, because a) it’s wasteful and harmful to the environment for them to be driving around empty, b) they aren’t much competition for the EU truckers, since they’re more expensive, and c) the EU trucks can pick up loads in the UK, so why not make it reciprocale? But the EU is holding out simply because it doesn’t want Britain to have the same level of access to the EU that it did when it was a member. Meanwhile, UK talks with the US, Japan and even New Zealand have made little progress.

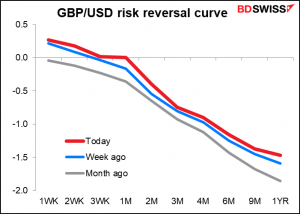

But Brexit seems to be no longer much of an issue for the FX market. The risk reversals have been moving up recently, and in any event they show no big lurch around the five- and six-month area, which would cover the end of the year, when Britain is likely to crash out of the EU without a trade agreement. Perhaps that’s already in the price? Or is assumed that PM Boris “The Big Umbrella” Johnson will fold, as he did before?

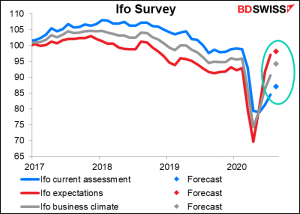

The only major EU indicator out is the Ifo survey on Tuesday. It’s expected to be relatively optimistic. That may help to revive the outlook for the Eurozone after Friday’s disappointing purchasing managers’ indices.

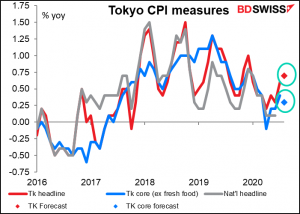

Japan announces the Tokyo CPI data on Friday. It’s expected to show a small acceleration in inflation, but at this point no one dreams that it will have any impact on Bank of Japan thinking. The only question is whether falling real yields in Japan would send more Japanese money abroad.

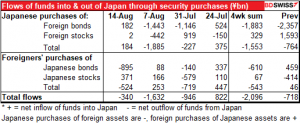

Japanese cut back their purchases of foreign bonds in the latest week, while foreigners stepped up their sales of Japanese bonds. The result was only a very small outflow of funds from Japan. This could keep JPY underpinned. However, I expect that there is some measure of “reflexivity” involved, to use George Soros’ famous term. That is, when the yen strengthens, Japanese investors take advantage of the currency to buy overseas assets. This causes the currency to weaken, at which point they either cut back on their purchases or take profits.