I’ve been writing FX comments for…well, I don’t want to say how long. Let’s just say that when I first started in this business, I used a typewriter to write about currencies that no longer exist. (If you don’t know what a “typewriter” is, you can skip this part.) I can remember times when the market was becalmed, when currencies barely moved – like last November for example, when I wrote an article was explaining why volatility was going to be low permanently (hah!). But I can’t remember a time when the market was so volatile and yet so predictable.

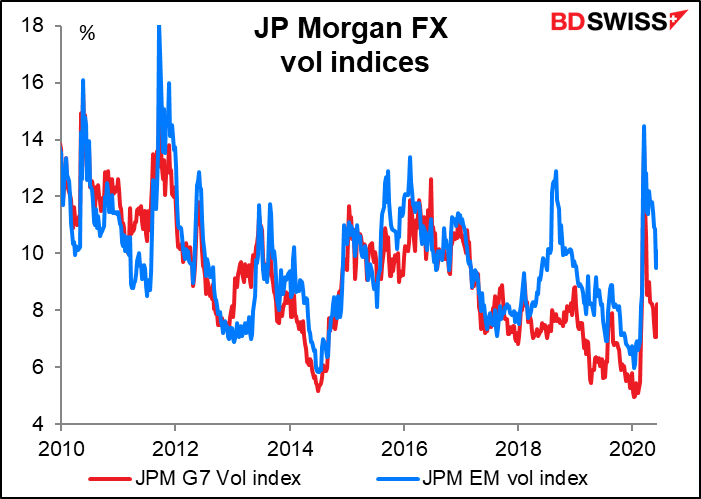

It’s definitely more volatile nowadays. We’re off the recent peak in March, but still more volatile than back when I was moaning about the lack of volatility.

You might think that a volatile market would by definition be an unpredictable one. Well it is to some degree. That is, I can’t necessarily predict today whether the market is going to be up or down tomorrow or the next day. What I can say though is by and large, when I get up in the morning and call up page WEI on my Bloomberg screen – World Equity Indices – I can pretty much predict what’s happened in the FX market by looking at what’s happened in the stock market.

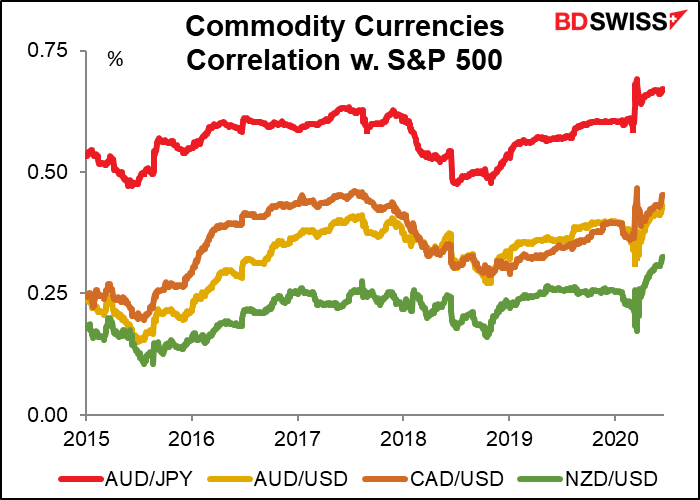

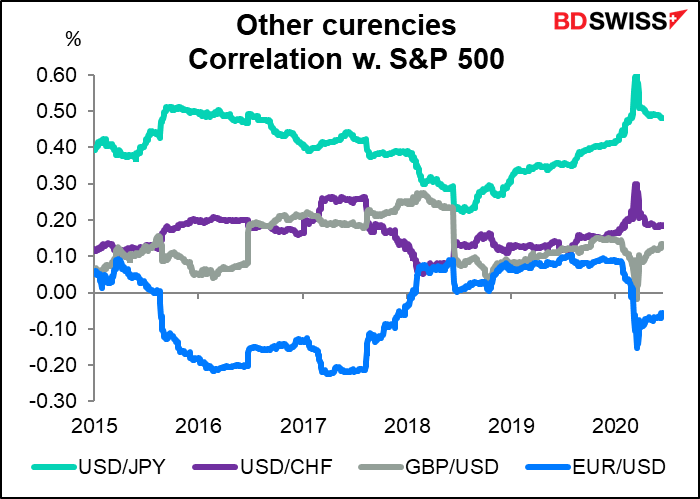

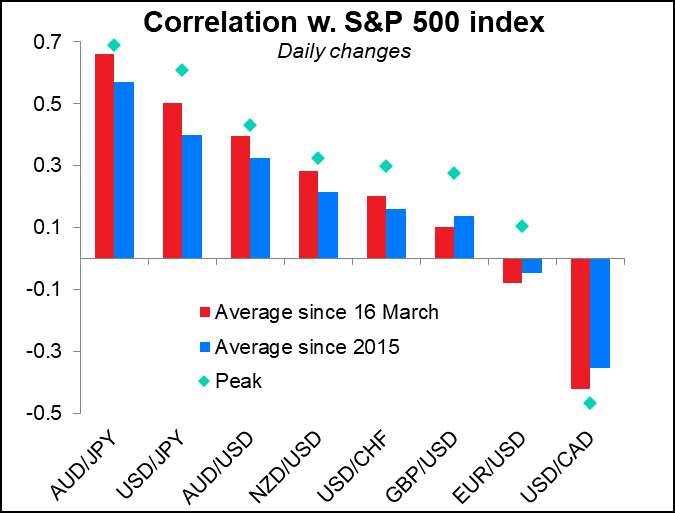

The correlation between the commodity currencies and the US stock market is unusually high. For AUD/USD and NZD/USD, it’s now the highest it’s been in at least five years (that’s all the data I have). For AUD/JPY, USD/JPY, USD/CHF, and USD/CAD (actually, CAD/USD), it hit the highest in the last five years around 16 March, which if you remember, was when the S&P 500 collapsed 12% in one day, only to rebound 6% the next day. (I used CAD/USD in the graph rather than the customary USD/CAD quote to make it comparable to AUD/USD and NZD/USD.)

It’s noticeable too that the correlation of AUD/JPY and CAD/USD with the S&P 500 spiked higher on 16 March, whereas it actually spiked lower on that day for AUD/NZD and NZD/USD. No clue why. Any ideas?

GBP/USD and EUR/USD are not particularly highly correlated with the S&P 500. EUR/USD has the distinction of sometimes being positively correlated, sometimes negatively.

It’s also noticeable that except for USD/CAD, all the correlations are positive even though not all the currencies are quoted the same way. That is, both AUD/USD and USD/JPY tend to move higher when stocks mover higher, even though in the former it means the dollar is weakening and in the latter the dollar is strengthening. (I’m ignoring EUR/USD as the correlation can be positive or negative at different times.)

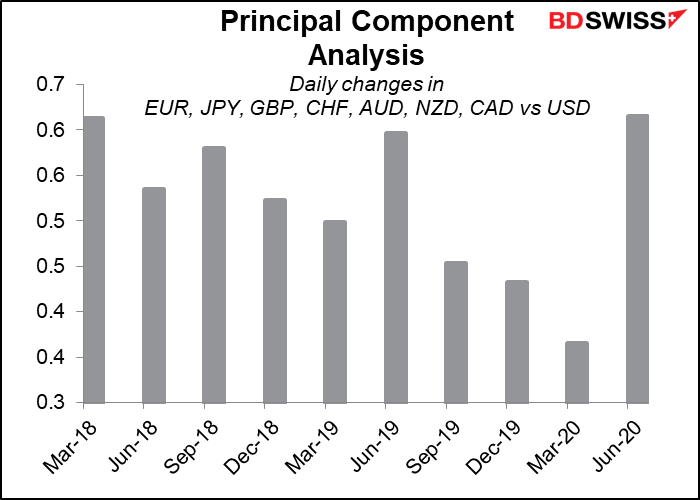

The correlation ranking accords with what we see most days – usually if it’s “risk-on” AUD is the best-performing currency, and JPY tends to be more volatile than CHF. I thought this question would be an excellent candidate for a study using Principal Component Analysis (PCA), a statistical technique that uses some fancy math to derive how much of the variance in data is due to some common but unseen factor. My hypothesis was that this unforeseen factor – in this case, risk sentiment – would be unusually high now. It turns out that it isn’t though. The amount of variance represented by the mysterious first factor – presumably risk sentiment or the stock market – was about the same in Q2 (actually, 1 March to now) as it was in Q2 2019 and Q1 2018. (I didn’t go back any further since I had already disproved my hypothesis. No need to go further when a flock of black swans go sailing by.)

(FYI I also tried this without EUR or GBP and got similar results.)

So I have to conclude that this is not a unique time when the market is moving in unison, it’s just unusually correlated to stocks. Perhaps back in 1Q 2018 the principal factor was US-China relations – although that would’ve affected stock markets too, I assume.

What can we conclude from this exercise?

1) Trading FX won’t necessarily diversify your equity portfolio right now. You have to choose the right currency pairs.

2) GBP and EUR are trading off more idiosyncratic factors than JPY and the commodity currencies. Investors looking to trade on a fundamental basis should concentrate on those two currencies.

3) Within the commodity currencies, AUD and CAD are more closely correlated with the S&P 500 than NZD is. This creates room for trading AUD/NZD on a fundamental basis. (I looked at AUD/NZD separately and found that it is positively correlated with the S&P 500, but not by much – less than CHF is.)

Upcoming week: PMIs, Personal Income & Spending, RBNZ

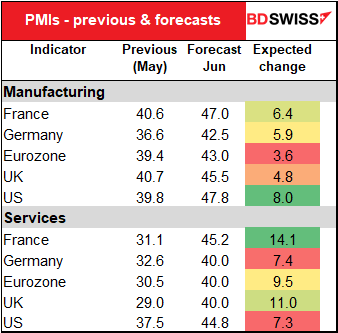

The main focus of the indicators next week will be the preliminary purchasing managers’ indices (PMIs) for the major industrial economies.

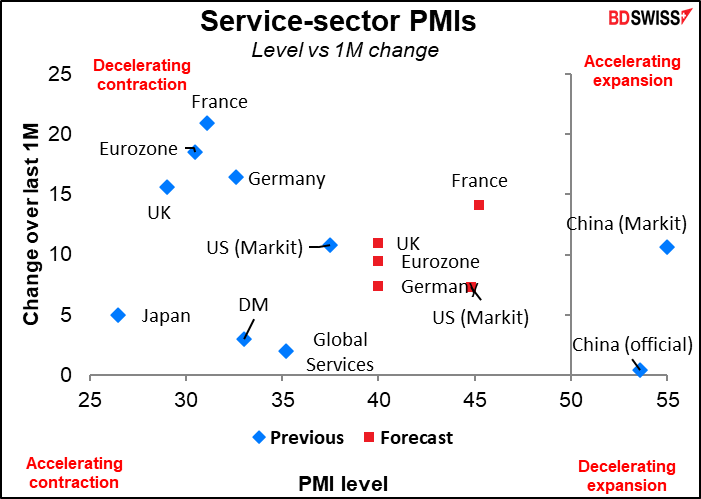

Although usually the manufacturing PMIs are the more important, nowadays it’s the service sector that’s under pressure and so everyone is waiting to see how the service sector recovers. My impression from looking at the so-called “forecasts” is that no one has a clue, really. The idea that Germany, the Eurozone as a whole and the UK should all have the same figure is fairly unrealistic.

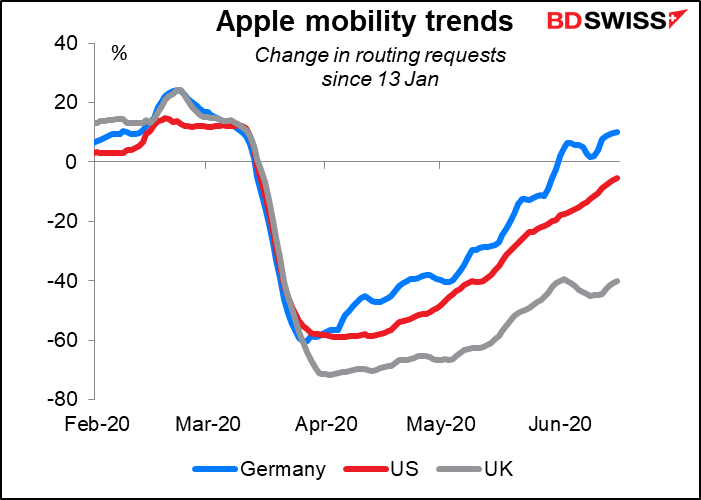

After all, it appears that Germany has emerged out of the lockdown much more than the UK, certainly, at least judging by the number of restaurant bookings and requests for directions.

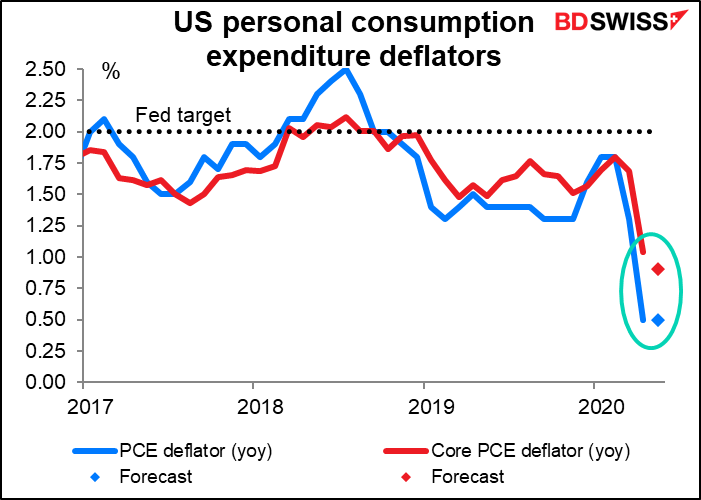

Ordinarily, the personal consumption expenditure (PCE) deflators would be major news, because they’re the Fed’s preferred inflation gauges. But inflation isn’t on anyone’s radar screen now. It’s pretty much accepted that the world may fall into deflation temporarily. Employment and overall activity are more important now, in my view. Accordingly, a further decline in the PCE deflators will be accepted as par for this unique course.

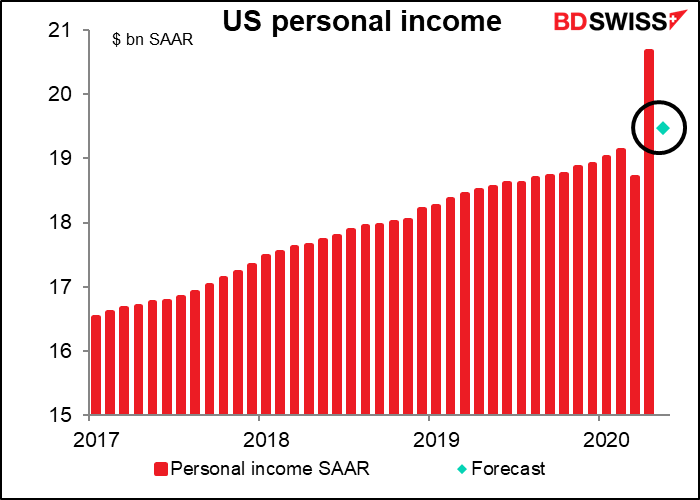

In contrast, the personal income and spending data will probably be more in focus this month, even for the FX market. That’s because it’s the basis of the economy.

I believe it’s more useful to look at levels rather than percentage changes, which are going to be all over the place for some time.

Personal income soared in April as a lot of people got supplementary income checks (not me unfortunately, even though I’m a US taxpayer! Maybe the check just hasn’t reached me yet.) It’s expected to fall back in May, but surprisingly, to remain above the pre-crisis level. Maybe that’s what’s sustaining the stock market rally. Or perhaps it’s just Jeff Bezos distorting the figures

Personal spending, which plunged in March and collapsed in April, is expected to recover somewhat (+8.7% mom) but that would still leave it 13% below pre-crisis levels.

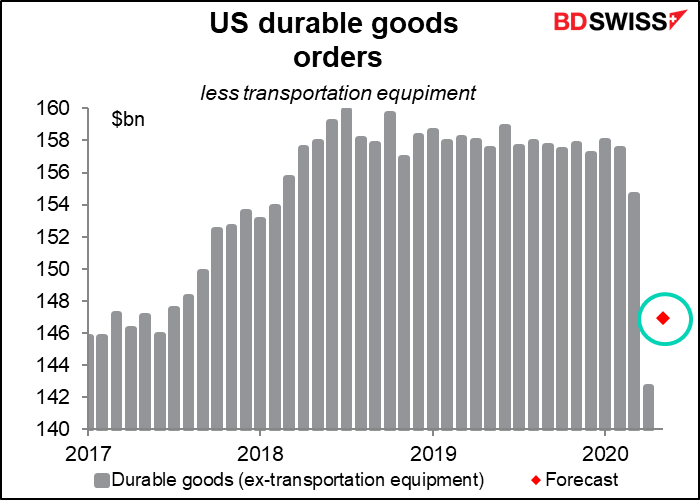

Similarly, durable goods orders are expected to bounce back +12% mom for the headline figure, a much smaller +3% for the ex-transportation-equipment figure. But both would still be well below pre-crisis levels.

Aside from the data, the only major central bank meeting during the week is the Reserve Bank of New Zealand. Like many central banks, they are on hold indefinitely. At their last meeting (13 May), “the Committee reaffirmed its forward guidance that the OCR (Official Cash Rate) will remain at 0.25 percent until early 2021.”

Nor is there likely to be any need to do so. New Zealand has been one of the global success stories in dealing with the virus, which has practically been eliminated. There have been only three new cases since June began.

The earlier-than-expected end to new cases has allowed them to lift the lockdown earlier than expected, too. As a result, the statement may well be more optimistic. Last time they said that “The balance of economic risks remains to the downside.” They could be a bit more optimistic now.

Nonetheless, I would expect them to reiterate that they are prepared to do a lot more if necessary, including going to negative rates. “The Monetary Policy Committee is prepared to use additional monetary policy tools if and when needed, including reducing the OCR further, adding other types of assets to the LSAP (Large Scale Asset Purchases) programme, and providing fixed term loans to banks.”

What might get them to move? “We expect to see retail interest rates decline further as lower wholesale borrowing costs are passed through to retail customers,” they said in a not-so-veiled threat to the banks. Watch for any comments about bank lending rates. Also perhaps some comments about the currency, which has appreciated since the last meeting: NZD/USD has risen from 0.5991 to 0.6417 now, while AUD/NZD has moved down from 1.0774 to 1.0672.

Other excitement: Tiff Macklem, the Bank of Canada’s new Governor, Monday will give his first speech as Governor. There will be a press conference after the event.