There were three notable points in the market over the last week that bear discussion, so this week I’m going to address several issues.

1) The Fed admitted it had started “thinking about thinking about” tapering down its $160bn–a-month asset purchases.

On June 10th of last year, Fed Chair Powell said “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates.” In his press conference after the April FOMC meeting he didn’t say that specifically about tapering, but he did say on the question of tapering, “when the time comes for us to talk about talking about it, we’ll do that, but that time is not now (4:16)”

But it looks like Powell wasn’t been 100% straight with the journalists. The market was surprised to see in the minutes of the April FOMC meeting the first reference to tapering. The key phrase was, “A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

This is of course consistent with the Fed’s “substantial further progress” test that they set out in December last year: that the economy would have to make “substantial further progress” from where it was then before they’d start thinking. The economy failed this test miserably just nine days later, when the appalling April US nonfarm payrolls hit with a huge dud — up only 266k vs market expectations of +1mn. With that in mind, you might think people would’ve concentrated on the part of that sentence that read “if the economy continued to make rapid progress…” Clearly it hasn’t, at least not insofar as employment is concerned, but that didn’t stop markets from moving.

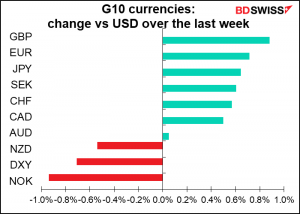

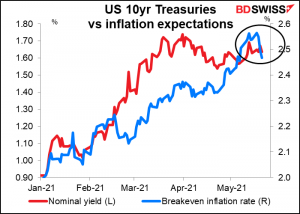

In response, bond yields rose and inflation expectations fell…

…leading to higher real interest rates and a stronger USD.

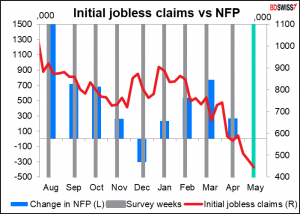

Is this going to start a trend of a higher dollar? I don’t think so. Ten-year Treasury yields fell back on Thursday and are now below where they were before the FOMC minutes came out. I expect that the market will continue to reconsider its haste and USD is likely to weaken until a week or two from now, when once again the market starts thinking about the May nonfarm payrolls (NFP), due out on June 4th. This week’s initial jobless claims, which covers the week that the survey for the NFP is carried out, was a good omen – down a larger-than-expected 29k, continuing the average over the previous month of -28k a week. A good May figure would suggest that the disappointing April NFP was just a blip, and the US economy is on its way to meeting the “substantial further progress” test that the Fed has set before it starts thinking in earnest. That could be the trigger for another round of dollar strength.

2) Cryptocurrencies fell sharply on Wednesday (but started to bounce back on Thursday). Bitcoin, the bellwether of the sector, was down more than 30% on the day at one point before recovering to finish US trading down around 12%. Other cryptos, such as Ethereum, Litecoin, and XRP suffered similar or even greater losses.

Bitcoin fell to just above $30,000 at one point, down more than half since its record time high of nearly $65,000 in mid-April.

The rout was mostly caused by two events. First, Tesla chairman and Bitcoin supporter Elon Musk last week shocked the crypto world by saying that Tesla would no longer accept Bitcoin in payment for its cars, citing Bitcoin’s horrendous environmental impact (each transaction requires as much energy as a US household uses in 40 days, with the carbon footprint of 1,235,398 VISA transactions). Musk had been a big supporter of Bitcoin. Back in February, when Tesla first announced it would accept Bitcoin as payment, it revealed that it had bought $1.4bn of the things, and Musk had tweeted approvingly about Bitcoin.

Secondly, the People’s Bank of China (PBoC) Tuesday banned financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading. China has banned crypto exchanges and initial coin offerings but has not barred individuals from holding cryptocurrencies.

This week’s action shows two of the headwinds facing cryptocurrencies. On the one hand, most people aren’t buying them to use as payment methods but rather as a “store of value.” I got an intensive lesson in this fact recently when I wrote an article about cryptocurrencies and tested some of my ideas out on Twitter. Crypto advocates ridiculed my observation that Bitcoin is not an efficient means of payment. That function isn’t at all important in their assessment of Bitcoin, rather, they are focusing on Bitcoin’s use as a store of value insulated from government interference. I got tweets like these:

(SoV = store of value MoE = means of exchange)

But the recent price movement might make people wonder: what kind of a “store of value” loses 40% of its value in one month? I’m sure this won’t dissuade retail speculators, but professional money managers can ill-afford such volatility in their P&Ls.

At the same time, more regulation is inevitably coming. The Bank for International Settlements (BIS), the G7, and the G20 all have their eyes on the field. The EU’s Markets in Crypto-Assets Regulation (MiCAR), will probably take effect by the end of this year or early next year. The US government has taken numerous regulatory actions, such as the Framework for ‘Investment Contract’ Analysis of Digital Assets”, and the Biden administration is expected to do more. For example, Thursday the administration proposed requiring businesses that “receive cryptoassets with a fair-market value of more than $10,000” to report the transaction to the Treasury, just like with cash transactions. The UK has just started the consultation process. Etc., etc. Governments are not going to surrender their monopoly on the monetary system without a fight.

In that respect, we should pay attention to next Monday’s speech by Fed Gov. Lael Brainard at the Consensus 2021 cryptocurrency conference. She seems to be the point person for digital currencies on the FOMC. (The conference runs from Monday to Thursday. Former Treasury Secretary Lawrence Summers, hedge fund manager Ray Dalio, and rock star investment manager Cathy Wood will also be speaking.) Gov. Brainard’s last speech on the topic was August 2020, so it’s high time for an update. Perhaps she’ll give us some clues on where the Fed stands with regards to central bank digital currencies.

3) Speaking of China, it’s worth keeping an eye on increasing tensions between the West and China.

For example, the US stock market sold off late Monday, mostly in the last 15 minutes of trading, on news that the Biden Administration was planning on tightening the Trump-era ban on investments in companies linked to the Chinese military. This news came out at around the same time as news that Speaker of the House Pelosi is calling for a boycott of next winter’s Olympics in Beijing because of China’s record on human rights. The European Parliament Thursday voted overwhelmingly to freeze the EU-China Comprehensive Agreement on Investment until Beijing removes sanctions placed back in March on 10 EU politicians who raised concerns about human rights violations against Uighurs. And I can’t even follow what’s going on between China and Australia.

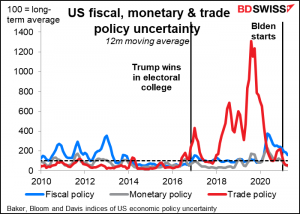

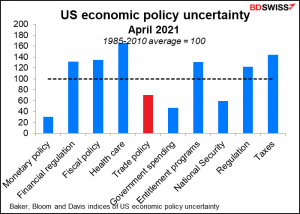

Trade policy was overwhelmingly the major economic uncertainty during the previous US administration.

It’s since calmed down a lot – trade policy is currently seen as a below-average uncertainty in the US – but it could start up again. Not necessarily US-vs-the-world, like it was under the Previous Individual, but China-vs-the-world, which might be just as bad as it could take on military tones.

Coming week: PCE deflators, RBNZ meeting, Japan vaccine rollout

Not a whole lot going on during the coming week.

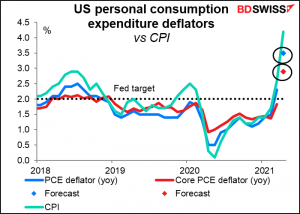

The main po9int of interest will be Friday’s US personal income & expenditure figures, which bring with them the personal consumption expenditure (PCE) deflators. They’re both expected to leap higher, although not as high as this week’s consumer price index (CPI) did.

The PCE deflator and its sub-index, the core PCE deflator, are the Fed’s preferred inflation gauges, not the CPI. The FOMC stated back in January 2012 that the PCE deflator was “most consistent over the longer run with the Federal Reserve’s statutory mandate.” They didn’t spell out that they focus on the core PCE deflator, but it’s widely assumed because of various hints they’ve dropped over the years. For example, in the February 2020 Monetary Policy Report to Congress, they said that the core PCE deflator “historically has been a better indicator of where inflation will be in the future than the overall figure.”

The PCE deflators aren’t expected to be as high as the CPI, but they’re both still expected to be well above the Fed’s 2% target (3.5% and 2.9%, respectively). I don’t think the difference between them and the 4.2% yoy CPI is significant, however. It’s a binary question: are they above or below 2% yoy? Above 2% means Fed can eventually taper.

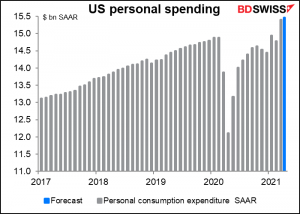

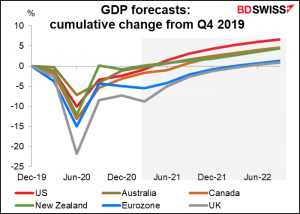

As for the personal income & spending, incomes are expected to fall back to a more normal among after the leap higher in March, when the $1,400-per-person stimulus payments went out. The mom drop isn’t really significant here; what’s more important is that incomes would still be 8% higher than the pre-pandemic level on this forecast.

Amazingly, personal spending is expected to be up a bit in April. I presume it’s because not everyone finished spending their helicopter money.

Other US indicators out during the week include durable goods orders, the Conference Board consumer sentiment index, the Richmond Fed activity index, and the final estimate of Q1 GDP.

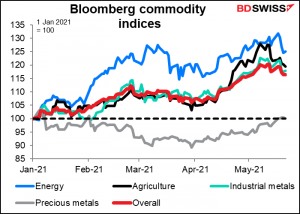

The only major central bank meeting during the week is the Reserve Bank of New Zealand (RBNZ), which holds its policy review and issues an updated quarterly Monetary Policy Statement (MPS) on Wednesday. I don’t think anyone expects a change in policy at this meeting. The economic outlook has improved, particularly with regards to commodity prices. Inflation is expected to rise above 2% yoy during the year, but that’s expected and shouldn’t cause any alarm. I would expect the MPS to upgrade the outlook slightly but to retain a cautious view and a dovish bias. I don’t expect much market impact.

Japan has two major indicators out during the week, although there is some question whether any indicator in Japan is a major indicator for the FX market nowadays, since neither Japanese government bond yields nor the FX market react very much to fundamental news.

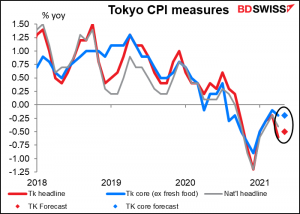

Tokyo CPI is expected to be little changed. Both the headline figure and core CPI remain in deflation. Japan bucks the world trend yet again, thanks to cuts in mobile phone charges.

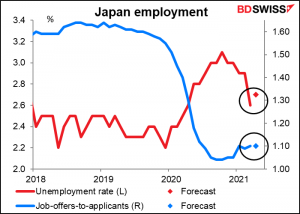

The unemployment rate is expected to rise one tick because of the latest state-of- emergency declarations, while the job-offers-to-applicants ratio is expected to rise a tiny bit. But it won’t make any difference to Japanese monetary policy.

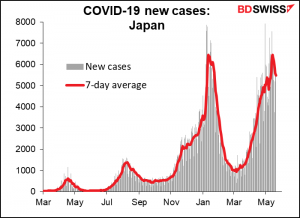

More important for Japan right now are the measures to deal with the virus. Tokyo and Osaka began accepting reservations for mass coronavirus vaccinations last Monday and vaccinations start this coming Monday. Market sentiment in Japan will be affected by how quickly the vaccinations rollout proceeds. (I hope my daughter in Kyoto will soon be eligible!) In addition, the current state of emergency is scheduled to end on May 31st, depending on how the pandemic develops over the next week.

Japan’s cases are still low relative to other countries…

…but the trend is worrisome. Whereas in other countries it’s come down a lot recently, in Japan it’s been rising a lot recently, especially outside of Tokyo. If the state of emergency is extended, that could be a “risk-off” event that would send Tokyo stocks down and the yen up.