PREVIOUS WEEK’S EVENTS (Week 29.04 – 03.05.2024)

U.S. Economy

U.S. manufactured capital goods demand increased moderately in March. The report suggests that weakness in manufacturing does not appear to be intensifying. March’s increase was in line with economists’ expectations. Core capital goods orders gained 0.6% year-on-year in March.

Business spending on equipment has struggled in the aftermath of 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022 to tame inflation. Though the U.S. central bank is expected to start lowering rates this year, the timing of the first cut is uncertain.

U.S. economic growth (GDP change) slowed more than expected in the first quarter. GDP increased at a 1.6% annualised rate last quarter versus a forecast of GDP rising at a 2.4% rate. A slower pace should have a sticky inflation in the future some suggest.

______________________________________________________________________

Inflation

Australia

Consumer price inflation (CPI) slowed less than expected in the first quarter as service cost pressures stayed stubbornly high, a disappointing result for policymakers who were thinking of cuts this year. CPI rose 1% in the first quarter, above market forecasts of 0.8%. For March alone, the CPI rose 3.5% compared to the same month a year earlier, up from 3.4% in February.

The Reserve Bank of Australia (RBA) has left interest rates at 4.35% for three straight meetings as confidence had grown that inflation was on track to ease back to its target band of 2-3% in late 2025.

______________________________________________________________________

Interest Rates

ECB

European Central Bank officials plan to cut interest rates multiple times this year, even with higher U.S. inflation delays and tensions in the Middle East keeping oil prices high. ECB President Christine Lagarde has strongly hinted that the euro zone’s central bank is still likely to begin reducing its deposit rate from a record-high 4% in June.

BOJ

The Bank of Japan (BOJ) kept interest rates steady on Friday and highlighted that inflation was on track to durably hit its target of 2% in coming years, signalling its readiness to hike borrowing costs later this year. BOJ Governor Kazuo Ueda said the central bank would raise interest rates if upcoming data back up its latest price forecasts.

BOJ maintained its short-term interest rate target at a range of 0-0.1% as expected.

The projections for “core core” inflation, which is closely watched by the BOJ as an indicator of the broader price trend, for 2024 and 2025 were unchanged from January.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-core-capital-goods-orders-rise-moderately-march-2024-04-24/

_____________________________________________________________________________________________

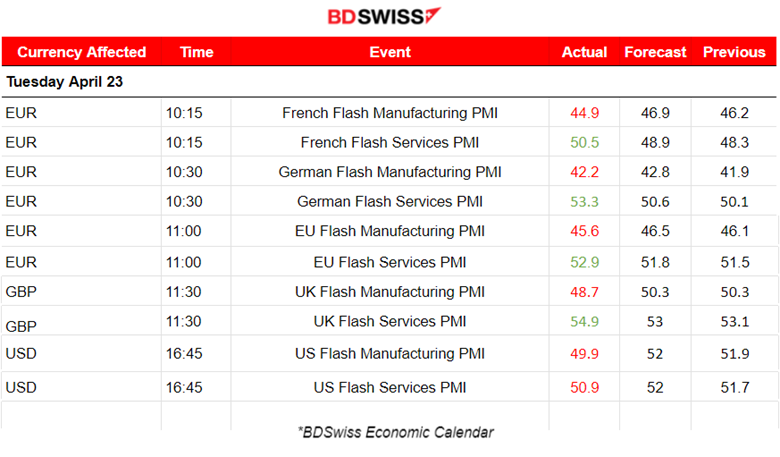

Currency Markets Impact – Past Releases (22 – 26.04.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

Currency Markets Impact:

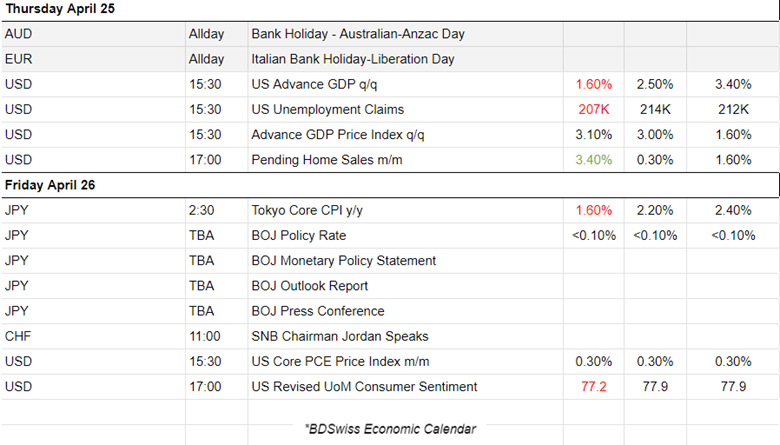

Eurozone PMIs:

Eurozone PMIs:

The French economy stabilised in April as renewed expansion in services activity offset the manufacturing sector contraction. The reported PMI in Manufacturing worsened to 44.9 but the services PMI turned to the expansion area with a reported PMI at 50.5 points. Private sector output levels remained unchanged from those seen in March. Services business activity increased for the first time since May 2023.

The German business sector returned to growth at the start of the second quarter driven by growth in services business activity. The manufacturing PMI remains in contraction while the services sector PMI reported a significant improvement to 53.3 points, turning in expansion. Although manufacturing remained in contraction, the rate of decline in factory production eased and confidence amongst goods producers towards the outlook reached the highest for a year.

The Eurozone PMI for services was reported improved. It shows that the economy is gearing up for an acceleration in activity after a year and a half of broad stagnation. It helps the EUR. However, that would be enough for a change in inflation expectations and a change in the ECB’s thinking about cuts? If we look at the U.S. the PMIs are not improving. This could be a signal of a downturn in U.S. growth and would suggest that the upcoming data will not be as great for the U.S. as before. Inflation obviously will be hard to bring down and the Fed will get even more puzzled on what to do in regards to future interest rate policy.

U.K. PMIs:

The U.K. experiences the fastest expansion of output since May 2023. The private sector activity expanded for the sixth consecutive month in April as a robust recovery in service sector output helped to offset a marginal decline in manufacturing production. Output growth from an upturn in new order volumes driven by the service economy. The services PMI reached, remarkably, to 54.9 points.

United States PMIs:

In the U.S. business activity expanded in April at the slowest pace this year on a pullback in demand that led to the first decline in employment since 2020. The services PMI was reported to worsen at 50.9 points. Orders showed contraction. The group’s measure of employment slid 3.2 points to 48.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The index is moving fairly sideways as the market eases activity due to the upcoming FOMC and Fed rate decision on Wednesday this week. The dollar is expected to be affected heavily, and probably to continue strengthening, if the Fed does not deny the fact that inflation is not going in the right direction. The Bank of Japan (BOJ) kept rates steady, keeping the interest rate differential between JPY and USD high and causing the pair to move to the upside aggressively. Today the pair dropped heavily, a sudden drop that hints at BOJ intervention, causing JPY to strengthen. The dollar was affected with depreciation against the other currencies during that time but the dollar index remains strong and over the support at near 105.5 points.

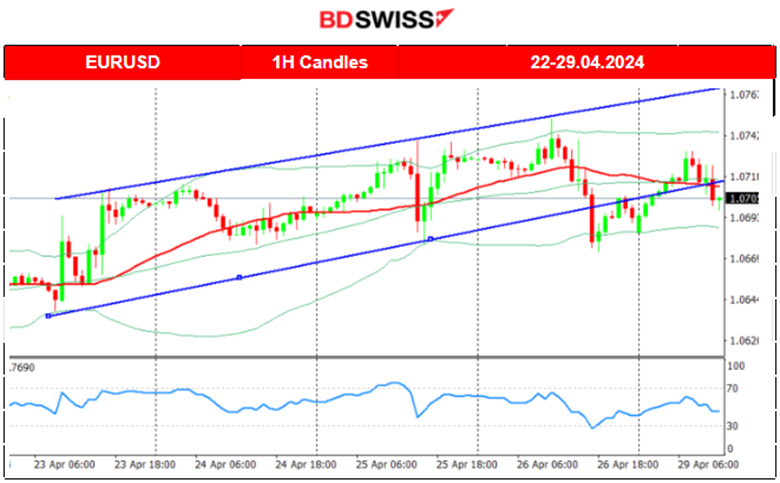

EURUSD

EURUSD

This pair was experiencing an upward 30-period MA and the price was moving in an apparent channel formation. However, on the 26th of April, the price dropped and broke that channel to the downside. The price reached the support level near 1.06730 as the dollar appreciated heavily before reversing to the upside again. Recent developments and economic data releases suggest a delay in interest rate cuts from the Fed while the probability of an ECB cut instead soon grows. EURUSD is expected to drop if the fundamentals remain fixed. Further comments on the 1st of May during the FOMC and Fed Rate decision this week would cause high volatility and the pair to move in one direction. Comments for the delay in cuts would potentially cause high dollar appreciation and eventually downward movement for the EURUSD.

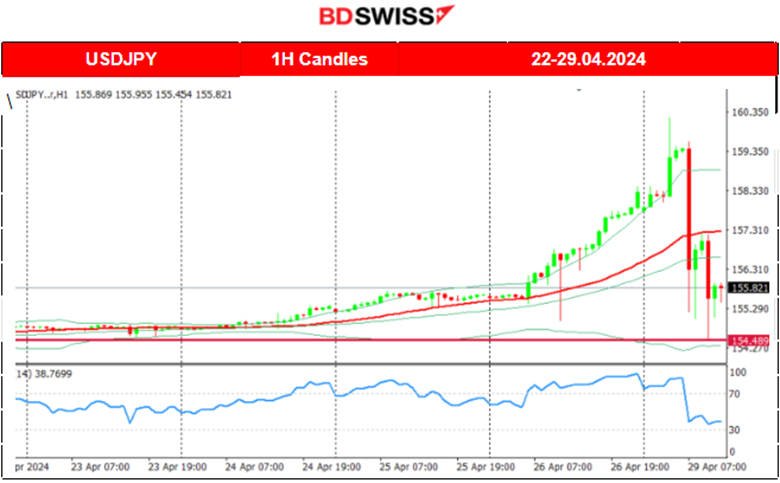

USDJPY

USDJPY

The dollar has been relatively stable this week as seen above. However, the JPY experienced a remarkable weakness against other currencies. USDJPY started to move upwards from the 24th of April and gained momentum causing its rapid increase to the upside since the 26th of April. The Bank of Japan kept interest rates around zero on Friday the 26th of April. The lack of clear guidance on the future rate hike path triggered a broad-based decline in the yen. Traders were on high alert for signs of intervention by Japanese monetary authorities and that probably happened today on the 29th of April as the USDJPY dropped more than 50 pips after JPY’s sudden and strong strengthening.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

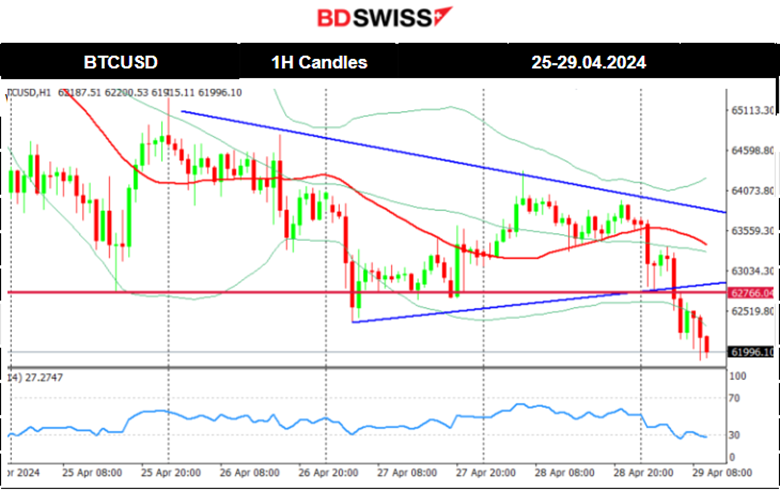

BTCUSD

Bitcoin halving took effect late on Friday 19th of April, cutting the issuance of new bitcoin in half. It happens roughly every four years, and in addition to helping to stave off inflation, it historically precedes a major run-up in the price of Bitcoin.

Currently, things are not looking good for the Crypto coin. A triangle formation has been breached today to the downside causing further Bitcoin price decline. 60K USD support so far away. However, considering its volatility, it is possible for the price to drop to that level, if other fundamental factors remain fixed.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

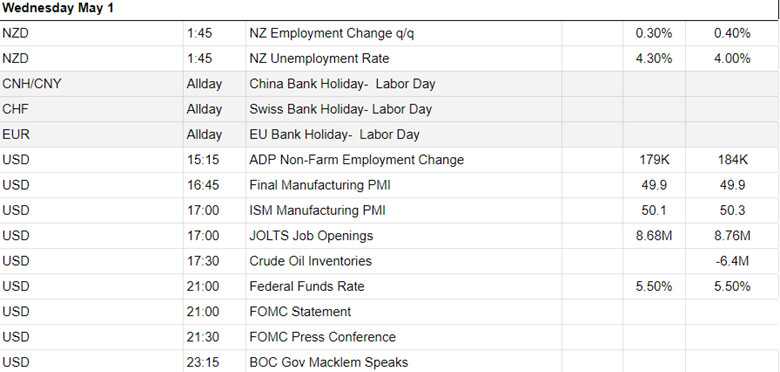

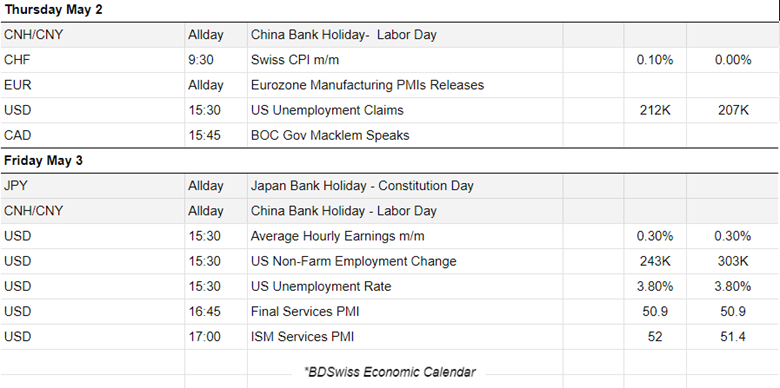

NEXT WEEK’S EVENTS (Week 29.04 – 03.05.2024)

Coming up:

The latest figures confirm the pick-up in US inflation over the past few months. We have the FOMC statement and Fed Rate decision on the 1st of May that probably is going to shake the USD pairs and the markets in general.

Other important releases include the employment data for the U.S. on the same day, the 1st of May and the NFP report on Friday.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 25th of April, the resistance of 83.5 USD was broken and the price reached higher. On the 26th of April, this breakout even helped the price reach near 84 USD/b. Now an upward channel is apparent indicating the highly volatile market conditions that Crude oil is facing at the moment. The price is moving around the 30-period MA with deviations from the MA up to near 1 dollar. Will the price continue to move to the upside thus following the channel? A breakout below the channel could cause a rapid drop back to 82 USD/b.

Gold (XAUUSD)

Gold (XAUUSD)

On the 24th of April, the price remained stable. An apparent upward channel was formed with 15-20 dollar deviations from the 30-period MA taking place. The proposed range is 2,300-2,340 USD/oz. It would be unlikely to see a jump to 2,400 USD/oz. For that to take place we should see an unusual increase in demand for metals. The fact that the price currently is below the MA indicates a rather sideways path for now. Breakout of the channel to the downside might spark a dive in Gold’s price to 2,300 USD/oz. Alternatively, the next important resistance is near 2,350 USD/oz which matches the upper band of the 50-period BB indicator.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

On the 25th of April, the market experienced a sudden plunge causing the index to drop to the support near 4,990 USD before eventually reversing heavily to the upside. It crossed the 30-period MA on its way up and reached remarkably back to the 5,100 USD level. On the 26th of April, stocks moved higher but the rapid movement to the upside seems to slow down. The RSI is actually pointing at a potential bearish divergence. The downside breakout of the upward wedge/triangle formation is however not clear.

______________________________________________________________