I’m not a fan of former US Secretary of Defense Donald Rumsfeld, the architect of the US invasion of Iraq. However he did say one memorable thing that has become part of the American vocabulary. At a US Department of Defense news briefing on February 12, 2002, Rumsfeld was asked about the lack of evidence linking the government of Iraq with the supply of weapons of mass destruction to terrorist groups. He replied:

Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tends to be the difficult ones.

It’s the same for the financial markets. It’s often the unknown unknowns – the things we have no idea about – that are important for the markets. At the beginning of 2020, who had a global pandemic on their list of things to be worried about for the year?

For 2022, some of our “known unknowns” are the development of the virus and the pace of monetary policy normalization. The Chinese real estate market and that country’s economy, particularly how it will affect the global demand for commodities. OPEC and the oil market – can they keep pace with rising demand? These are the kinds of things that I covered in my 2022 outlook.

Today I’d like to discuss some of the “unknown unknowns” – some of the things that could happen that we’re not thinking about.

1) The implosion of North Korea

I subscribe to a Patreon channel, Voice of North Korea, by Yeonmi Park, a North Korean defector. She also has a free YouTube channel that’s well worth subscribing to. One of her recent videos was Imminent Threats Indicating the Collapse of the North Korean Regime. She says there are indications that North Korea might collapse, because of the stress of the pandemic. North Korea doesn’t have any vaccines or equipment to deal with it and the entire population is malnourished and immunocompromised, including the enormous military of almost 1mn people (3.7% of the population). Once the military gets infected the virus is likely to spread unchecked and cause the military to collapse, which would leave the regime defenceless. Park also argues that Respected Comrade Kim Jong-Un may have died already. She’s an optimist so I don’t believe everything she says but the pandemic argument sounds reasonable. She argues China would take over North Korea in case of a collapse, possibly causing a major international crisis. This is the extreme bull case for CHF, because JPY might not act as a safe-haven currency with such chaos in its nuclear neighbour.

2) President Biden dies

President Biden is the oldest person to occupy the White House. He could drop dead any minute. What would that do to the US? Vice President Harris would become President. She doesn’t have a very strong base even in the Democratic Party, much less in the US as a whole. This would throw the US government into chaos ahead of the 2022 midterm elections, probably resulting in a majority for the Republicans in Congress. That would set up the US for total gridlock.

3) Trump gets arrested…or dies

Why is this a market risk? Because I think a) it’s possible if not likely that he gets arrested sooner or later and b) I think it could set off civil war in the US. While many people would think “it’s about time!” never forget that some 74mn people voted for him, the second-most votes any Presidential candidate ever got. I don’t doubt that Trump’s arrest would spur some citizens to take up arms against the government – look at what happened in the Capital on Jan. 6th — and could threaten civil war in the US. As for his death…he’s 75 years old, obese, a drug addict, and he’s had COVID-19. He could go any time. What would that do to the Republican Party?

Connected to that, I’d say the US midterm elections in November are one of the “known unknowns.” They could result in the Democrats losing control of Congress, which would mean a split government unable to take any strong action. Or worse – the Democrats could win but be prevented from taking office thanks to cheating on the part of the Republicans, who will probably be the ones counting the votes. That could set the US up for a disruptive constitutional crisis. Of course there’s also the possibility that the Democrats emerge with an enlarged majority that can finally take decisive action and pass all sorts of wonderful progressive legislation that finally brings the US into the 21st century, but that’s too wild and fantastic a scenario to consider.

4) Rebellion against COVID-19 restrictions

The worsening of the pandemic isn’t an “unknown unknown.” On the contrary, it’s probably #1 on everyone’s risks for 2022. But if the world has to go back into lockdown…there are so many people everywhere now who are sick and tired of being locked down. The unknown risk is not the damage to the economy from lockdown as much as it is civil unrest caused by resistance to lockdowns. The “unknown unknown” isn’t the virus, it’s the civil and political response to the virus. What will the impact be on the French elections in April, the Northern Ireland election in May, and the Australian federal election in May?

On the other hand, we could also get lucky and see the opposite – COVID-19 burns out and disappears or dissipates into a harmless illness. We don’t worry about the Spanish Flu or bubonic plague anymore although at one time those diseases killed millions. Apparently diseases can burn out and die of natural causes. Perhaps the Omicron variant or one of its successors proves easier to spread and less harmful – it could become just another illness that people have to cope with.

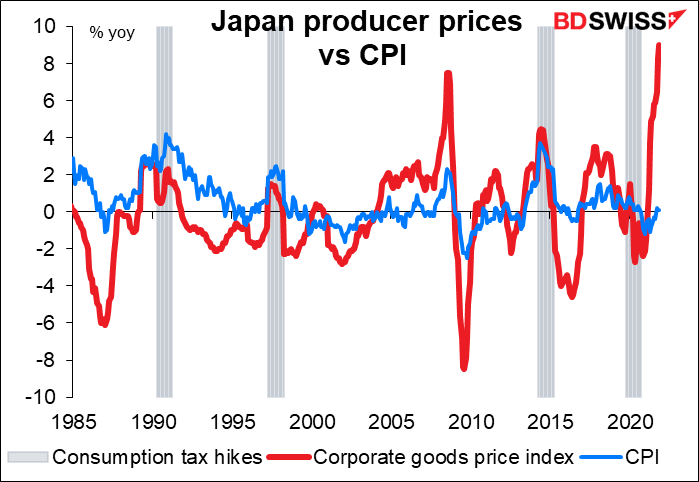

5) Inflation in Japan

Japan hasn’t had noticeable inflation in around 25 years. The only times the consumer price index has risen over 2% a year was when the government raised the consumption tax, which obviously pushes up retail prices. But with raw material prices rising some 75% yoy and producer prices up 9%, could that change? And how would the Bank of Japan react? More to the point, what would happen to Japan’s government finances if the government had to pay significant interest on its debt? Japan has been described for years now as “a bug in search of a windshield” because of its unsustainable finances, yet it chugs along nicely because it can raise money almost for nothing. With inflation the government’s tax revenues would rise but so too would the interest bill.

Higher inflation in Japan might also send the world’s carry trade investors elsewhere in search of a low-interest-rate currency. It could mean a weaker EUR or CHF.

Just FYI, Japan’s national CPI comes out on Friday. It’s expected to be up 0.5% yoy, same as the Tokyo CPI for the month, so I doubt if it will cause any big disturbance in the Force.

6) Deflation hits

Maybe I believed Chair Powell too much, but I still think many of the causes of our current level of high inflation are transitory. EG there’s been a change in patterns of demand and patterns of supply are having a hard time adjusting. What happens though once they do? What happens once the demand is met or once capacity has expanded to meet what could be only a temporary surge in demand? There’s the possibility that just as inflation exploded suddenly, it could end suddenly too as expanded supply meets diminished demand. Then we might find real interest rates significantly higher than they are now.

8 Northern Ireland breakaway

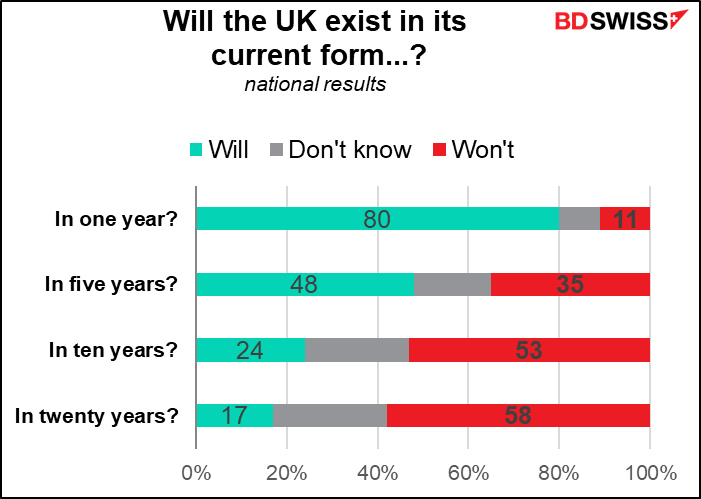

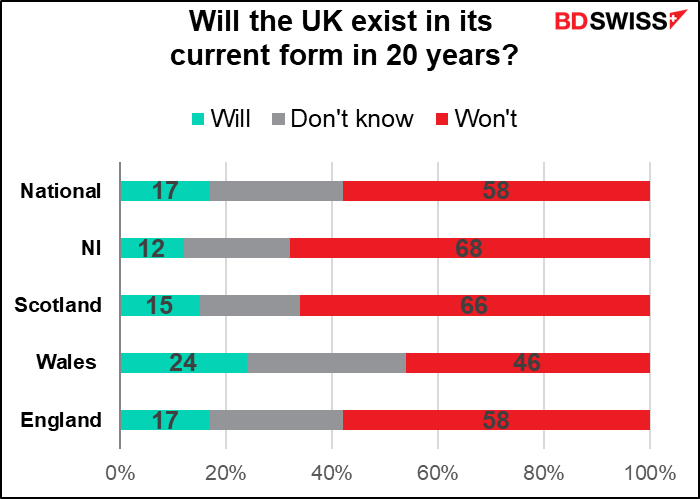

There’s a lot of focus on the possibility of Scotland voting for independence, but I think it’s more likely that Northern Ireland goes first. The economic ties between Northern Ireland and the Republic are much greater than those between Scotland and the EU, although heaven knows economics isn’t the major moving force in these matters – otherwise Brexit would’ve never occurred in the first place. The UK government is making a right balls-up of Brexit, which is no surprise since there really was no way to leave NI both in the UK and in the EU entirely at the same time – only quantum particles can be in two states simultaneously. The Northern Ireland Assembly elections in May could be a risk event for the markets – although it’s still early days the polls put Sinn Fein, a party that seeks union with the South, in the lead.

Similarly, I would include the possibility that UK PM Boorish Johnson gets booted out of office during the year in this list except that I don’t think it’s an “unknown unknown” at all – on the contrary I’d give that a better than 50-50 chance.

In a poll taken in April, 11% of the respondents said the country wouldn’t exist in its current form in a year. Thirty-five percent said it wouldn’t exist in its current form in five years.

The people in Northern Ireland, not Scotland, were the ones with the biggest doubts about the strength of the Union.

7) Crypto implosion

I think one or more major countries could announce that they were coming out with a central bank digital currency (CBDC). As I’ve argued before, this would eliminate the raison d’etre of cryptos or stablecoins from a currency point of view (although not from a “store of value” point of view). But if cryptos no longer have a niche as a method of payment, why should they be a mainstream store of value? Accordingly I think the widespread adoption of CBDCs could spell the end of the crypto boom.

Of course, I’ve been pessimistic about cryptos for a long time, maybe because I lived through so many booms that turned into bust (I remember silver at nearly $50 an ounce and I remember when Pets.com was a market darling.) Perhaps the real risk here is just the opposite: a “melt-up” in cryptos that sucks the vitality out of other markets and makes me look foolish (no editorial comments, please).

8) Amazing medical breakthrough

I don’t know if this would have a big market impact as much as a social impact, but…think of how quickly the pharmaceutical industry developed a vaccine for the COVID-19 virus. I’m not sure everyone realizes just how amazing that was. Perhaps this represents some new technological breakthrough in the pharmaceutical industry that could lead to amazing new drugs and treatments to prolong life and healthspan. If suddenly everyone is living 25 years longer, that could disrupt the medical and pharmaceutical industries, not to mention the life insurance and pension industries.

I’m still waiting for a host of other technological wonders, such as three-dimensional chips that will speed up computing dramatically while solving the heat problem, etc. I must say though that people don’t realize what a miracle a 2TB USB thumb drive is.

9) Something else

This is the real “unknown unknown” – something I have no idea about today, indeed have never imagined. I guarantee that this one will come about and that it will be big. Stay tuned!

Next week: a quiet week

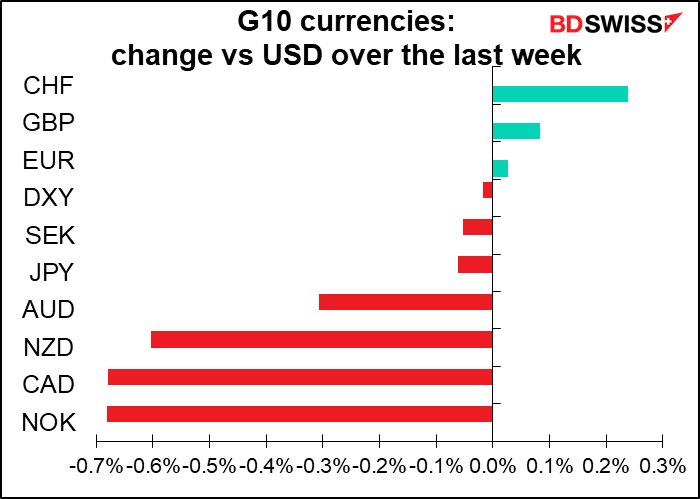

This past week was jam-packed with events and with data: five major central bank meetings, preliminary PMIs, US retail sales, UK CPI and labor market data, etc etc. Next week: not so much. In fact, almost nothing.

Thursday is perhaps the only day of interest next week. US personal income & spending will be announced, together with the crucial personal consumption expenditure (PCE) deflators, the Fed’s preferred inflation gauges.

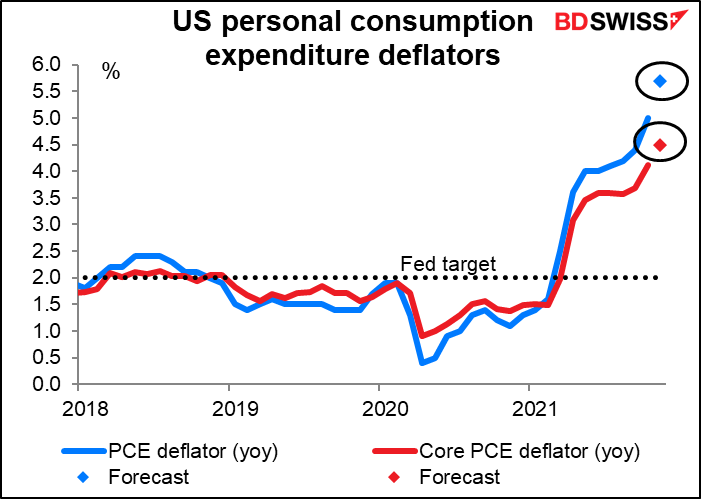

The headline PCE deflator is forecast to leap to 5.7% yoy, the highest since July 1982, while the core measure, the Fed’s favorite inflation gauge, is expected to rise to 4.5% yoy, the highest since March 1989. Both would be way above the Fed’s 2% target, confirming the idea that inflation is out of hand.

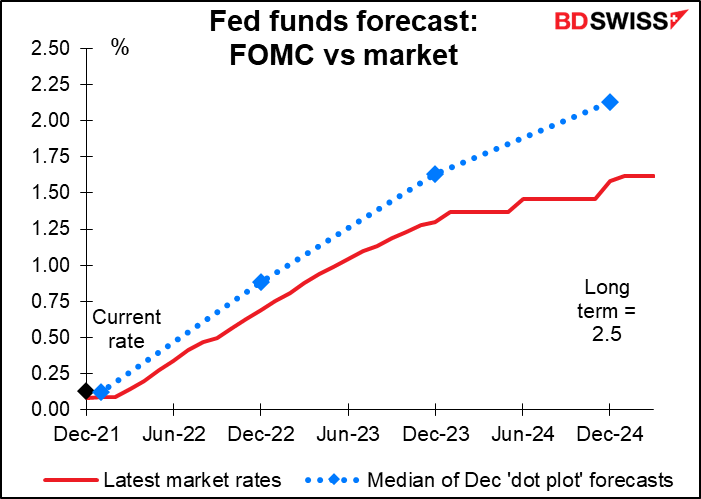

But with the Fed having doubled its tapering and come out with forecasts for fed funds more aggressive than even the market, can anything move the needle at this point? I’m not sure proof of higher inflation would change anyone’s thinking. At this point it would be hard for the market to discount more tightening than the Fed has already promised.

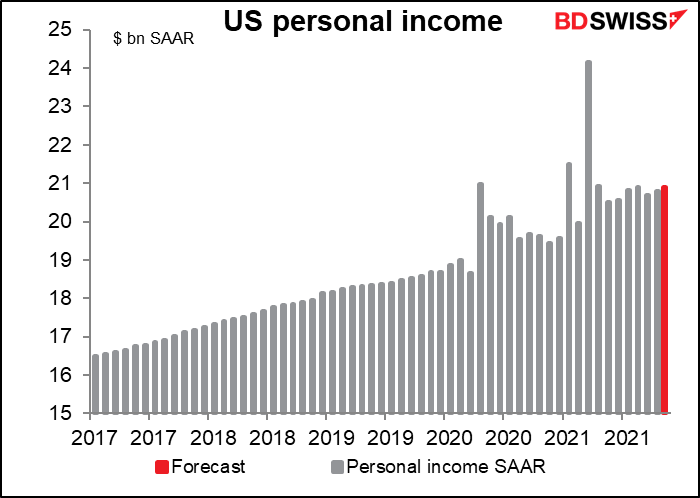

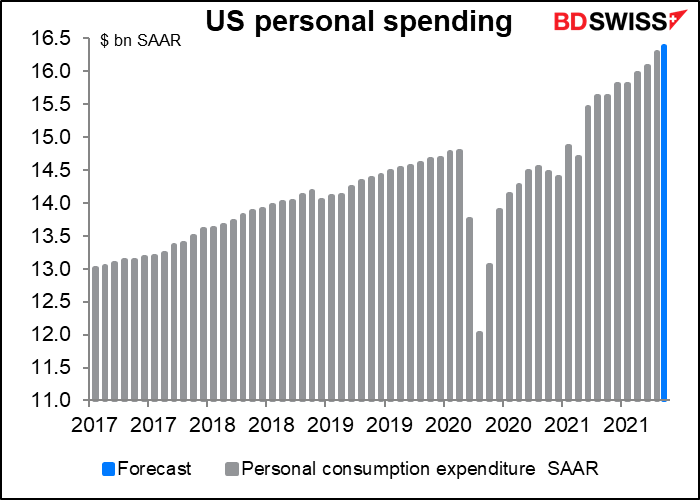

Meanwhile, both personal income and personal spending are expected to be up from the previous month, +0.5% mom and +0.6% mom respectively. That would put incomes a whopping 10.3% higher than their pre-pandemic level and spending 10.9%. In a consumption-led economy like the US, this kind of steady increase suggests a strong underpinning to the economy.

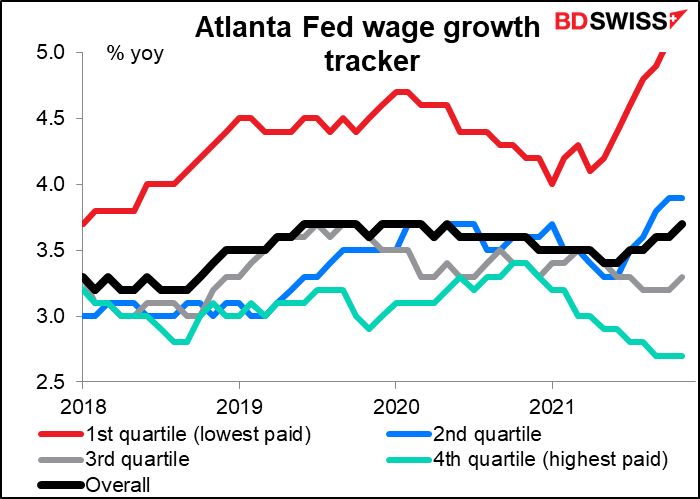

Higher incomes reflect two things: first off, more people working. Secondly, wages are going up, especially for lower-waged people. This is no doubt a result of the intense competition seen in the US recently (and elsewhere) for people at the bottom of the employment ladder, many of whom are being asked to do dangerous jobs where they come in contact with the (unmasked, unvaccinated, and rude) public without any protection.

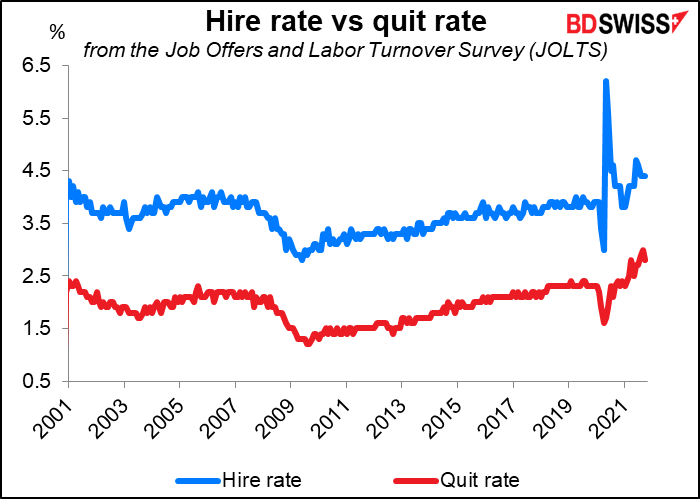

A lot of attention focuses on the quit rate, the percentage of people quitting their job willingly every month. It recently hit a record high. That’s taken as a measure of people’s confidence in their ability to get a new job. The counterpart of that would be the hire rate – which also recently hit a record high (excepting the surge immediately after the lockdown was lifted). People who quit their job are usually moving to one with better pay. This goes a good way to explain how personal incomes and spending can be rising so much in the US – people are upgrading their jobs.

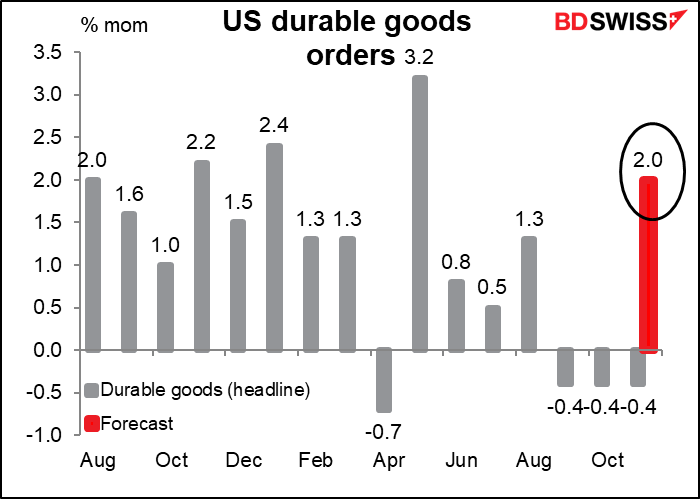

US durable goods are also out on Thursday. The market is expecting a sharp 2.0% mom rise after three consecutive declines. This would bring orders to an astonishing 15.5% above the pre-pandemic level. What we’re seeing globally is a rush to invest to overcome the bottlenecks and shortages that are occurring. As mentioned above, this could be sowing the seeds of deflation – or at least disinflation – some time down the line.

Canada will announce its monthly GDP figure on Thursday as well. No forecast available yet.

The US will start its Christmas holiday on Friday. Therefore the weekly Commitments of Traders report will come out on Thursday. Hmm…if they can put it out on Thursdays, why don’t they do that every week?