The market’s attention is focused on the virus, as usual. Stocks plunged on Monday on fears that the new more virulent delta variant would force us all back into lockdown and kill off the global recovery, but by Thursday stock markets had recovered – the S&P 500 was up 0.93% for the week and the STOXX 600 was up 0.39%. Although the variant has punctured the “vaccine euphoria” that was prevalent in the market several months ago, investors seem convinced that economies will continue to open up gradually despite the new variant.

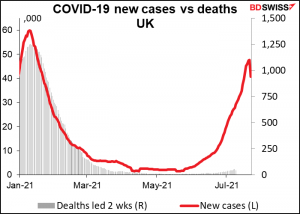

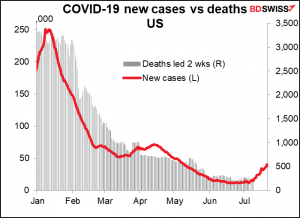

Presumably the hope is that with the most vulnerable population vaccinated – the elderly and those with pre-existing conditions – as well as a good portion of the rest of the population, the link between new cases on the one hand and hospitalizations & deaths on the other may have been broken. The virus may keep raging, but without flooding hospitals and killing thousands. That’s evident so far in the data from the UK, where a surge in new cases has not resulted in a surge in deaths – yet. That may be a risk that individuals and governments are willing to take.

What can we deduce from this new situation? There are several points that we can make:

1. Greater uncertainty

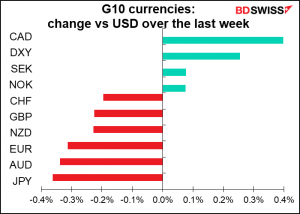

We don’t know how households and businesses will react to the new variant. Will people resume their normal behavior in the face of worsening numbers, or will they pull back? And how will governments and central banks react? If people do turn more cautious, will they boost spending and monetary aid, or will they continue to normalize policy? We don’t know what will happen and we don’t know what the reaction to it will be. That means greater risk in financial markets, which usually means a more cautious approach. Good safe-haven USD, JPY, and CHF.

2. A slower reopening of the global economy

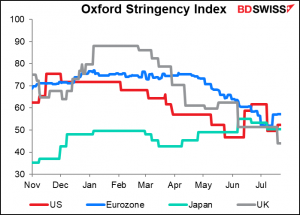

The UK example notwithstanding, governments are likely to be more cautious in reopening their economies (e.g. the US and French response). That’s good in that it will make for a longer, more gradual upcycle rather than a V-shaped recovery that runs the risk of a boom followed by a bust, not to mention less inflationary pressure. On the other hand, how long will it take to get back to business as usual? And how many businesses will go bust and how many people will lose their jobs in the interim?

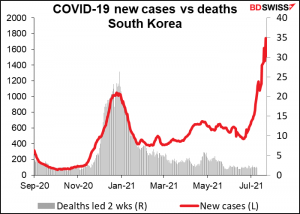

3. Supply chain disruptions

The delta variant is hitting some of the Asian countries particularly hard. This may weigh on global supply chains, prolonging the disruption there and keeping upward pressure on prices.

4. Back to school?

We will have to watch how people respond in September as the new school year starts in the West. If schools don’t reopen, many people (let’s be honest: many women) won’t be able to go back to work and labor participation rates won’t return to normal. That will prolong supply bottlenecks and keep upward pressure on wages & prices. It will also force the Fed to keep policy loose, as officials have said many times that they want to see a “broad and inclusive” rebound in the labor market.

A busy week ahead!

Next week’s focus is going to be on Wednesday’s meeting of the Federal Open Market Committee (FOMC), the rate-setting body of the US central bank. But there are plenty of other highlights. We have:

● Q2 GDP from the US (Thu), Germany, and the EU (Fri)

● CPI figures from Australia and Canada (Wed), Germany (Thu), and the EU (Fri). Plus the key US personal consumption expenditure (PCE) deflators (Fri).

● Employment data from Germany (Thu) and Japan (Fri)

Plus other bits & bobs to keep us occupied.

Let’s take them slowly.

FOMC meeting:

The FOMC is bound to discuss the appropriate timing for tapering down their $120bn-a-month bond purchases, but they’re not likely to be in any rush to make a decision, IMHO. Several FOMC members have said that they want to see more data. I expect them to win out. The fastest I can envision anything solid coming out is the September 22nd FOMC meeting, when they could “provide advance notice” of tapering, as Fed Chair Powell has promised many times that they would do. We’ll get a better idea during the Fed’s Aug. 26-28 Jackson Hole Symposium, which is often used to reveal policy changes. In any case, they’ve promised to warn us well ahead of time before they start making any changes.

At their last meeting on June 16th, the Committee determined that reaching the standard of “substantial further progress” was still a ways off, but that they expect progress to continue. How has it gone since then?

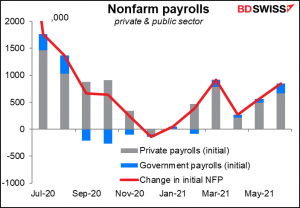

The June nonfarm payrolls figure was good, but not great. The headline figure of +850k was good, but it wasn’t up to the March figure of +916k, and more of it was government payrolls than back in March (+188k vs +136k). We’d have to see a string of +1mn or so gains in jobs to meet the “substantial” standard.

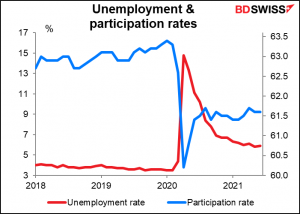

Meanwhile, the unemployment rate rose one tic and the participation rate has stopped rising. That’s not progress at all.

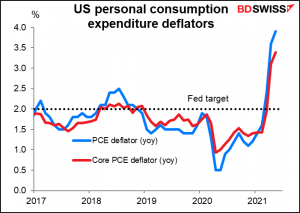

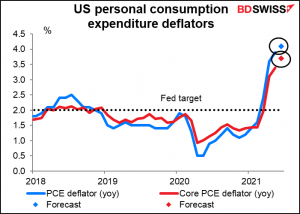

They’ve had more success meeting their inflation goal, though. Inflation is well over their target of 2% on the PCE deflator.

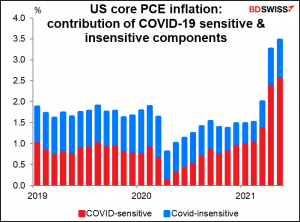

But they can still have confidence in their view that inflation is “transitory.” The San Francisco Fed has analyzed the PCE deflators and broken them down into components that are sensitive to the virus and areas that aren’t. As the graph shows, the decline in inflation during early 2020i was largely due to these COVID-19-sensitive components, and the rise in inflation now is due to them too (mostly health-care services and used cars and trucks). They therefore will probably feel no urgency to take their foot off the accelerator due to higher-than-expected inflation, at least not yet.

We can expect an optimistic outlook on the US economy from the Fed. The Beige Book, which usually sets the tone for the FOMC statement’s characterization of the economy, upgraded its view on the economy slightly. “The U.S. economy strengthened further from late May to early July, displaying moderate to robust growth,” it said. That’s better than in June, when it said “The national economy expanded at a moderate pace.”

They are however likely to remain cautious because of the alarming spread of the delta variant of the virus. One hopes though that with most of the vulnerable over-60s cohort vaccinated, hospitalizations and deaths won’t rise at anything near the increase in new cases and the US can continue to open up. This is one of the main reasons why I think the “let’s wait” crowd is likely to prevail.

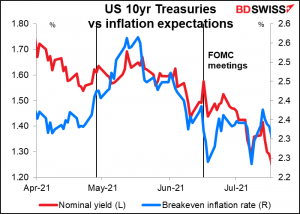

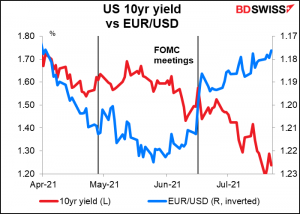

Market reaction: hard to say

Yogi Berra famously said, “it’s tough to make predictions, especially about the future.” I know this feeling well, since my career has been making predictions (leading me to frequently remember the saying that “he who lives by the crystal ball has to learn to eat glass.”) But rarely in my decades in the market have I seen things so unpredictable, so contrary to the standard playbook. Case in point: the June FOMC meeting marked a turning point in the Fed’s stance, with its upbeat outlook for the labor market and concern about higher inflation. The Fed acknowledged the strong economic outlook and the possibility that inflation might be higher than they expected, leading to the possibility that the economy might need less accommodation at some future date. Furthermore, most of the US economic data since then has corroborated that view. Hawkish, no? Interest rates up, no? Hahahah! Except for a blip up on the day of the meeting, yields are down. Ten-year Treasury yields were 1.49% the day before the June meeting, 1.58% the day of the meeting, and now…1.24%. Ten-year inflation breakevens have gone from 2.32% the day before the meeting to 2.26% now.

Furthermore, even if we get the bond market’s reaction right, that doesn’t mean we’ll get the currency right. Earlier this year the dollar weakened as US rates came down, more recently it’s strengthened.

In any case, I expect the FOMC to take a relatively optimistic view on the economy and the outlook. I think they are likely to talk about having made “further progress” toward meeting their goals, although not yet using the magic word “substantial.” Nonetheless I would expect this to push bond yields higher and to boost the dollar. I think that’s especially likely now that the European Central Bank has revised its forward guidance in a way that promises “lower for longer.” The famous “monetary policy divergence” should in theory kick in and send EUR/USD lower. But really, who knows in this market?

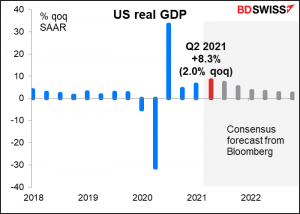

Q2 GDP: same story

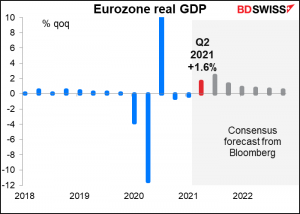

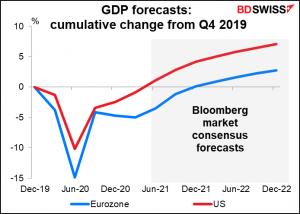

This coming week’s release of Q2 GDP figures from the US and Eurozone is likely to reinforce this divergence theme.

Thursday’s US GDP figure is expected to show the US growing at a substantially faster pace than the Eurozone figure due out the next day.

Based on these forecasts, the US should be back to pre-pandemic levels of output in Q2, whereas the Eurozone isn’t expected to achieve that until Q4. In that case, heaven knows when the EU will achieve its new criteria for normalizing monetary policy. These growth figures should only firm up the case for “monetary policy divergence” that will push EUR/USD lower.

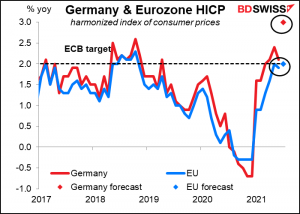

Germany’s CPI is expected to leap to 3.0% yoy, but it’s so filled with distortions I’m not sure what it means. A year ago Germany cut its VAT, sending retail prices sharply lower. It’ll be a year before that distortion falls out of the picture. Germany of course accounts for about one-quarter of the EU-wide figure, plus there were various distortions with summer sales last year, making the EU-wide figure unreliable too.

In any event it’s expected to hit the magic 2% yoy level, but that’s not enough to trigger a change in ECB policy by any means. Under its new forward guidance, released Thursday, the ECB wants to see inflation reaching 2% “durably for the rest of the projection horizon,” which at this stage is 2023. Since every central bank – including the ECB – believes the current high level of inflation is “transitory,” they’re not going to take much notice (not to mention that the new guidance also makes allowance for “a transitory period in which inflation is moderately above target.”) The June staff projections foresee headline inflation averaging 1.9% this year, peaking at 2.6% in Q4, and falling to 1.5% in 2022 and 1.4% in 2023. Until we see those forecasts “durably” above 2%, the ECB is going to be on hold.

Meanwhile the US is expected to see the personal consumption expenditure (PCE) deflator, the Fed’s preferred inflation gauge, and the core PCE deflator, its even more preferred inflation gauge, moving ever higher. Of course as the graph above showed, most of the rise is due to components that are affected by the pandemic, but does the market care? Does the average FX trader read the San Francisco Fed’s economic blog? No way Jose. So this rise could push USD even higher, especially coming after a hawkish FOMC meeting and strong US Q2 GDP.

Speaking of inflation, we’ll also get inflation data from Canada and Australia.

No forecast yet for Canada’s inflation.

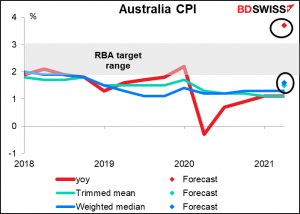

Australia’s headline inflation is expected to leapfrog over the Reserve Bank of Australia (RBA)’s 2%-3% target band. However with both of their core inflation measures still below the band, that probably won’t set off too many alarm bells with the RBA – although it may set off some with market participants. It’s likely to be positive for AUD.

Japan has its usual end-of-month data dump. Friday we get employment, industrial production, and retail sales. I’m not so sure they’ll affect the FX market that much; it looks to me like global risk sentiment is more important for JPY nowadays than Japanese economic indicators.

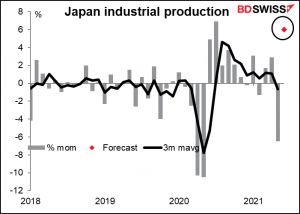

In any event, industrial production is expected to be up sharply. It looks like the global recovery is starting to feed through to Japan. This could help to boost the stock market. Would that be positive for JPY by encouraging inflows & discouraging Japanese from investing abroad, or would it be negative by raising risk tolerance? Under current circumstances I’d say the latter. JPY-negative

Finally, the debate in the US over the $1tn infrastructure bill continues. Bloomberg reported that there’s talk of a compromise, but still there are objections on both sides. Details won’t come out before Monday.

Other important data coming out during the week includes:

US: durable goods and Conference Board consumer confidence (Tue); personal income & spending (Fri)

Eurozone: Ifo indices (Mon); German unemployment (Thu)