Inflation and inflation expectations are likely to be in the spotlight in the coming week. We saw a decline in US inflation expectations this week and with that, a decline in bond yields that pressured the dollar.

Fed officials voiced their lack of concern about inflation, saying not only do they not think it’s going to accelerate but even that they wish it would. And Fed Gov. Brainard reminded us that the Fed’s forward guidance “is premised on outcomes, not on the outlook.” “We are actually going to have to see that in the data.”

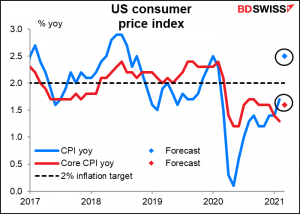

St. Louis Fed President Bullard, a noted dove, said he expected to see inflation at 2.5% by year-end. But we may get it much earlier than that. The market consensus forecast for Tuesday’s March headline CPI is 2.4% yoy.

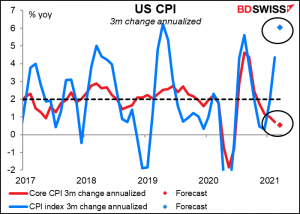

Of course this is a year-on-year comparison and so is affected by what was happening in March a year ago, when prices were falling. If we take just the last three months of price changes and extrapolate them forward, we see that prices are rising at a much faster rate – +4.4% yoy – and on the market’s forecast for March would leap to a stunning 6.1% yoy.

But in both these graphs, you’ll notice the big divergence between the blue line, headline CPI, and the red line, core CPI (= excluding energy and food prices). Core inflation is still quite low, even dormant – the 3-month annualized rate of change is only 0.7% yoy, and if we plug in the market’s forecast for March, it would fall to +0.5% yoy.

Will this surge in headline inflation nonetheless worry the Fed? Gov. Brainard explained that “there are some unique factors this year that could be expected to push inflation above 2%,” but she said those are just “transitory pressures associated with reopening.” “It’s more likely that the entrenched inflation dynamics that we’ve seen for well over a decade will take over than that there will be a sustained surge in inflation for a persistent period,” she said.

We will get lots more indications of officials’ views this coming week, as Gov. Clarida (V) (2x), NY Fed President Williams (V), San Francisco Fed President Daly (V) and Philadelphia Fed President Harker (NV) speak on the economic outlook and policy, not to mention several others speaking on racism & economic inclusion. Of particular note will be Fed Chair Powell’s moderated Q&A with the Economic Club of Washington on Wednesday. Although he’s not going to say anything different than what he said this week, nonetheless the market tends to react all over again to him as if it were totally new.

Then can I grieve at grievance foregone,

And heavily from woe to woe tell o’er

The sad account of fore-bemoaned moan,

Which I new pay as if not paid before.

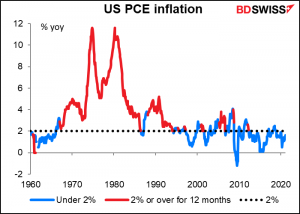

Although the market watches the CPI carefully, that’s not the gauge that the Fed uses to measure inflation. The Fed’s main gauge is the personal consumption expenditure (PCE) deflator. And that hasn’t been over 2% for a sustained period (= 12 consecutive months) since 2012 – or really since 2006, if you want more than a couple of months over the line. In fact, since 1997 it’s been below 2% more than it’s been above 2% (177 months out of 290, or 61% of the time), rising to 79% of the months over the last 10 years (95 out 121 months). There certainly do seem to be some “entrenched inflation dynamics” keeping price increases low.

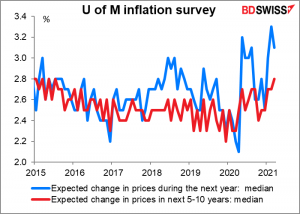

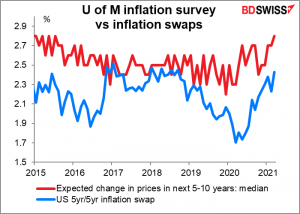

Friday’s University of Michigan consumer sentiment survey, with its survey of inflation expectations, will provide further information for the Fed. Inflation expectations according to this survey have been rising in recent months, certainly for near-term inflation (blue line) and for longer-term inflation as well (red line).

Although this survey is consistently above market-based estimates of inflation expectations, the direction is the same nowadays.

The debate over the AstraZeneca vaccine is also likely to be a major issue for the market. Britain’s decision to recommend people under the age of 30 be offered a different vaccine has called into question the country’s promise to give everyone a first jab by the end of July. That’s fueled selling of sterling by speculators who went “long and wrong” GBP in mid-March only to see it top out. EUR/GBP took a particularly big hit from this change of view, moving up sharply.

I sincerely hope the authorities continue with the AstraZeneca vaccine if for no other reason than that I’ve had the first shot and dearly want the second one. But if for some reason they decide not to, I think it would be worse for the EU than for Britain. Britain is well on its way to immunizing a good portion of its populace. The EU on the other hand has not only made less progress than the UK but is also dependent on the AstraZeneca vaccine, so they will be back to Square One.

The coming week: US retail sales, digital Euro, China GDP, RBNZ

A big week for US indicators coming up, or to be even more specific, a big day: Thursday. That’s when we get the Empire State and Philadelphia Fed indices (usually on different days, but not this week), US retail sales, US industrial production, and as usual, the weekly jobless claims, which were such a big surprise this week. And on Wednesday, Fed Chair Powell speaks yet again and the Fed releases the Beige Book.

Among these, retail sales are probably the most important. The market is looking for a fairly large increase from the previous month, which stands to reason – note the jump in January, when additional pandemic payments were made. There were even larger payments made in March, which means, in the immortal words of Viv Nicholson, “spend, spend, spend!”

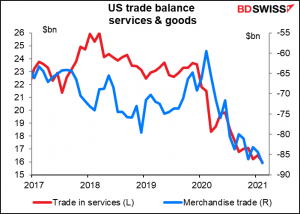

The result of this spending spree by the way has been a record trade deficit for the US, as we saw on Wednesday, as much of the money goes on imported goods.

The deficit is widening from both sides. The surplus in services is falling (red line) while the deficit in merchandise trade is widening (blue line). This widening deficit is how the US and its unprecedented fiscal stimulus program will act as an engine of growth for the global economy this year.

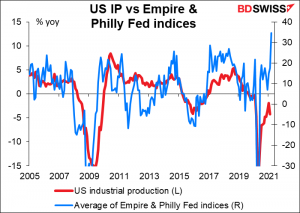

Industrial production is expected to be up sharply (+3.0%5 mom), which seems believable – the Empire State and Philadelphia Fed indices for March are pointing to a big upswing in production.

US industrial production is lagging behind EU industrial production. The EU February figure comes out on Wednesday. It’s expected to be up a modest +0.3% mom. Still that would carry it almost back to pre-pandemic levels (-0.1% compared to the January/February 2020 average) in February vs still down 1.3% for the US in March.

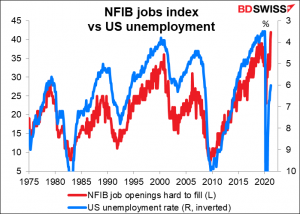

Wednesday’s Beige Book is likely to come under intense scrutiny for one strange issue that’s plaguing the US economy: a lack of job seekers. Some companies are having problems finding employees despite the millions of unemployed persons. For example, the National Federation of Independent Businesses (NFIB), the small-business organization, has a “job openings hard to fill” index. It’s at a record high despite the high unemployment rate. As you can see from the graph, this is an unusual divergence between the two indices; the NFIB’s members report that jobs are now harder to fill than they were when the unemployment rate was 3.5%.

Many people believe this is because of the generous level of unemployment benefits. It’s possible. The anecdotal evidence of the Beige Book may shed some light on this phenomenon.

For the Eurozone, the big event may be – we don’t know – on Wednesday, when European Central Bank (ECB) Executive Board member Panetta presents the results of the public consultation on the digital euro in the European Parliament. He had a blog post recently (March 25th) on the digital euro, “Digital central bank money for Europeans – getting ready for the future.” In that he said:

My guess is that he will say that the conclusion of the public consultation is favourable and that the ECB will take it under consideration when deciding whether to proceed with the project, which I think they will eventually do. “…our responsibility to Europeans means that we must ensure our single currency is future-proof and fit for the digital age,” Panetta said. That sounds like a pretty good indication of which direction they’re headed in.

Although China has passed the baton of global growth engine to the US this year (pardon my mixed metaphor), it’s still important for the outlook for the world economy. We’ll get a lot more information about China this coming week when the country announces its trade data on Tuesday and the Big Four indicators on Friday: retail sales, industrial production, fixed-asset investment, and the all-important GDP.

As I mentioned above, the yoy comparison involves what was happening a year ago, and of course Q1 2020 activity in China was uniquely abnormal – that was when COVID-19 was discovered in Wuhan and people’s doors were being welded shut so that they couldn’t go out. It’s not surprising then that the yoy rate of change in the economy is expected to be abnormally high. The market consensus is currently +18.6% yoy. That’s well below the Bloomberg monthly China GDP estimate, which puts it at +22.2% yoy.

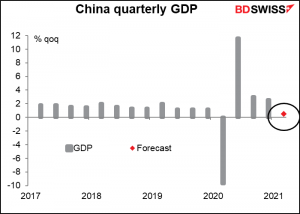

On a quarter-on-quarter basis, the figure is decidedly less impressive: it’s expected to be up just 0.5% from the previous quarter. That’s far less than the average 1.7% qoq growth seen before 2020 (data from 2011).

The other figures will be similarly distorted. Worse, only yoy figures are available, not mom, so we won’t be able to see the recent performance of the economy just by looking at the headline numbers.

Britain will have its short-term indicator day on Monday, when it releases monthly GDP, industrial & manufacturing production, and trade data. GDP is the most important one to my way of thinking. Showing an increase in GDP from the previous month – even a modest one – could help to restore confidence in the beleaguered pound and spur some buying, in my view.

There’s one central bank meeting: the Reserve Bank of New Zealand (RBNZ) meets on Wednesday. I’m not going to discuss this at any length because I don’t think anyone expects them to change policy. The main question will be just the tone of the statement following it: will they be optimistic, which could spur thoughts that the next move will be up, or will they be dovish, meaning that perhaps the market starts discounting lower rates again? I think they could tilt dovish, which might push NZD lower. Q4 2020 GDP fell 1.0% qoq, vs the RBNZ’s expectation in the February Monetary Policy Statement that it was likely to be unchanged. Coupled with weak forecasts for GDP in 2021, the RBNZ may think the economy needs some support. Recent moves by the government to rein in investor activity in the housing market has removed one obstacle to lower rates. They may at least start hinting again.

Finally, OPEC releases its monthly oil report on Tuesday. If they turn optimistic on the oil market – which they could, as the group’s recent agreement reflected a bullish point of view – then oil prices and CAD could get a boost.