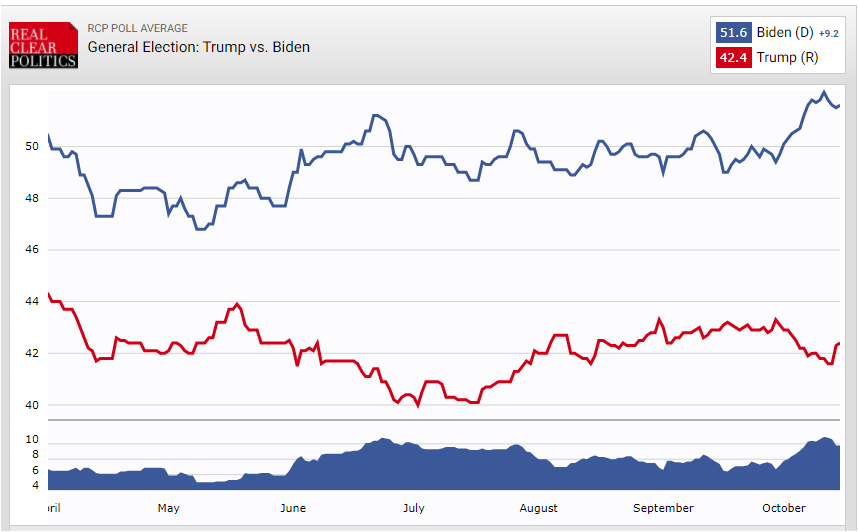

It looks pretty much like former VP Joe Biden has the election sewn up – not that anyone will be resting easy until 20 January 2021, when only one man gets the keys to the White House. But the market discounts events months in advance, and it’s looking increasingly like Biden will win.

Not only does he have a commanding (and increasing) lead in the national polls, but more importantly, he’s leading in many of the “swing states,” those that might vote one way or another. He has a 6-7 percentage-point (PPT) lead in Pennsylvania, one of the larger swing states. That’s probably enough to guarantee him victory there even if there is a polling error like that of 2016. He also leads by 2 ppt-4 ppt in Florida and North Carolina, two states that count mail-in votes before election day (as opposed to waiting until the election is over and then opening all the millions of envelopes at once, a logistical nightmare). If Biden wins Florida, and certainly if he wins Florida and North Carolina, it’s difficult to see Trump’s path to an Electoral College victory. That would reduce the odds of a contested election and reduce uncertainty.

Unless of course Trump pulls out the “nuclear option” and tries to get state legislatures to set aside the results of the polls and select electors themselves. As bizarre as that may seem, it’s perfectly legal, albeit unprecedented in modern times. The Republicans have discussed such a move, according to The Atlantic magazine. In Florida the Republicans control all the branches of the state government, so it’s conceivable. In Pennsylvania and North Carolina they control the state legislature but not the Governorship, which presents its own set of problems – what if the state legislature confirms its own set of electors but the Governor confirms a different set, and both rosters go to Congress? The law doesn’t say what to do in such a case. That would be Peak Uncertainty. It’s probably one reason why Trump is so eager to stuff the Supreme Court with another myrmidon before the election.

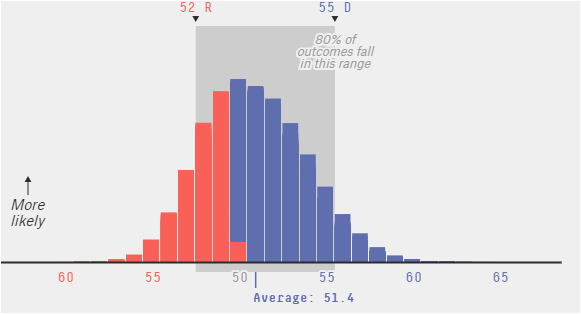

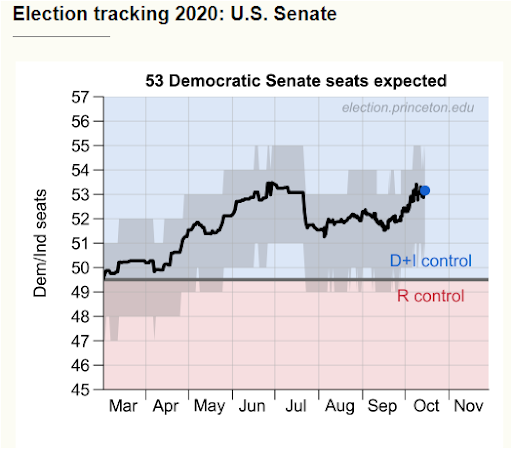

The election focus now is on the Senate, where the results are still uncertain. The well-respected polling website fivethirtyeight.com says the odds favor a Democratic majority in the Senate, but the Ds could win anywhere from 55 to just 48 out of the 100 seats. (The Vice President votes in case of a tie, so a party needs 50 seats to control it if they control the White House as well, 51 seats otherwise.)

The Princeton Election Consortium on the other hand sees the Ds getting a 53-seat majority

Democratic control of the Senate is critical for the US fiscal outlook and therefore the outlook for the dollar. If the Ds get a trifecta – the House of Representatives, the Senate and the White House – they will quickly enact a huge CARES Act 2.0 and then sooner or later a large-scale infrastructure bill. If however the Rs retain control of the Senate, Senate Majority Leader McConnell Y.S. will no doubt block any attempt to provide money for people who don’t have any. (The main legislative goal of the Republican party is to provide as much money as they can to people who already have a lot while taking as much as they can from people who don’t have anything.)

If then we assume a normal transfer of power in the White House – an assumption that we might not be able to make, but let’s assume it for the moment anyway – the fight for the Senate is therefore the key to the US financial markets for now.

What’s astonishing to me is that the market seems to want a “blue sweep.” For most of my career, the stock market has favored the Republicans. But now it seems that the party has gone too far in restraining government spending when what the economy needs most is fiscal support.

“A blue wave would likely prompt us to upgrade our forecasts,” said Goldman Sach’s chief economist, Jan Hatzius. “The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2tn shortly after the presidential inauguration on January 20, followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the likely longer-term tax increases on corporations and upper-income earners.”

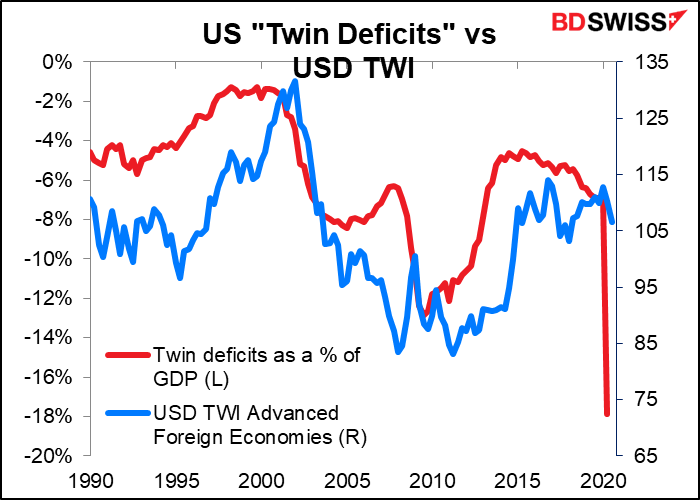

In this case, we could see a weaker dollar early on in the Biden presidency as the “risk-on” sentiment takes hold. Plus an even looser fiscal policy is likely to bring back memories of the dreaded “twin deficits” (current account deficit + government budget deficit), which could be negative for the dollar (although nowadays everyone is running a budget deficit.)

In the longer term though this kind of policy probably means an earlier economic recovery and acceleration in inflation, which will bring some measure of Fed normalization. That’s positive for the dollar once it starts to show up.

On the other hand, a continued split in Congress between a Democrat-controlled House and Republican Senate could mean the continuation of the stalemate we’re seeing on the CARES Act 2.0. That means millions more people reduced to penury. Fed officials have made it clear that they would try to compensate with an even looser monetary policy. In this case we also get a weak dollar at first too, but there’s no case to be made for a pick-up later on as the economy spirals down into depression and deflation, darkness and decay.

Some pundits are making the case that a split Congress would be best, because risk assets often perform well under “gridlock.” The reasoning is that the Republicans restrain the more left-wing impulses of the Democrats and produce more balanced growth. However, I think the historical record is no longer applicable owing to the scorched-earth politics that have become the norm on the Republican side. Ever since Mcconnell Y.S. made his famous comment in 2012 that his #1 priority was to ensure that President Obama was a “one-term president,” it’s clear that the Rs are willing to sabotage the economy in order to make the Ds look bad.

You can see how partisan conflict jumped after Obama was elected. It’s fallen recently as both sides have (until now) agreed on the need to support the economy, but I expect once the election is over, it’ll be back to the old way of doing business. Especially when the Republicans are out of office and therefore have no fear that their suicidally dogmatic policies might actually be enacted into law (e.g. the 70-some-odd times they voted to amend or repeal Obamacare, knowing full well that their bills would never pass. Even today they’ve never put forward a comprehensive health plan.)

Next week’s schedule: calm before the storm?

Three weeks from now, the week when the US election takes place, there will also be an FOMC meeting (the first time the two have coincided since 1984) plus the nonfarm payrolls. Outside of the US, the Reserve Bank of Australia (RBA) and Bank of England also meet. It’s going to be one hell of a week. I may be on vacation then. Just kidding — I wouldn’t miss it for the world. But if you do want to take vacation, I’d suggest you take it next week, because there’s not that much on the schedule.

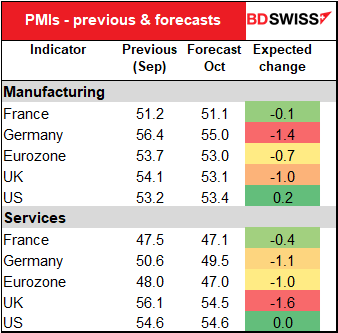

The main focus of interest will be Friday’s preliminary purchasing managers’ indices (PMIs) from the major industrial countries.

The key point to note is that they are all expected to be either (more or less) unchanged or lower. Not one is expected to be substantially higher. It’s particularly a shame for the EU service-sector PMI, which hasn’t even recovered to the 50 line yet. In other words, it’s expected to show that the service sector is contracting at an accelerating pace. It may therefore be negative for the EUR, especially as the US service-sector PMI is forecast to be unchanged at a relatively healthy level. The UK version too is expected to decline but remain solidly in expansionary territory.

From the US we get housing starts & building permits on Tuesday (expected to be higher as the housing sector continues barreling along).

The Fed releases the Beige Book on Wednesday. In the last one (2 September), they said that “While the overall outlook among contacts was modestly optimistic, a few Districts noted some pessimism. Continued uncertainty and volatility related to the pandemic, and its negative effect on consumer and business activity, was a theme echoed across the country.”

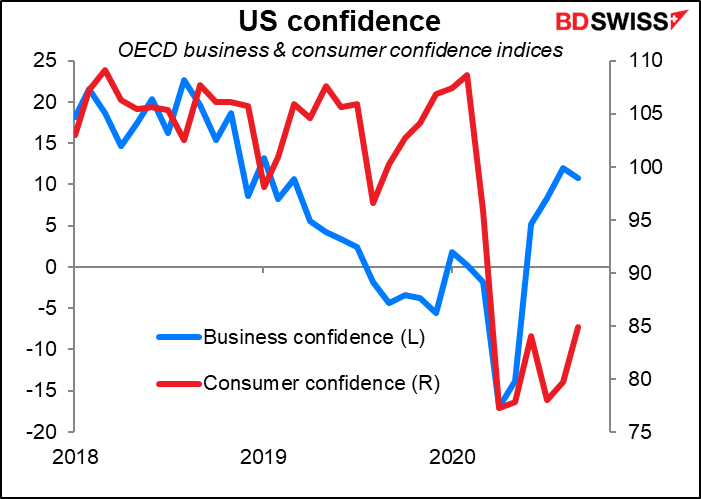

It will be interesting to see if “modestly optimistic” remains the key theme. The OECD confidence indices show that business confidence has rebounded a lot faster than consumer confidence has. I would guess though that the business confidence indicator suffers from “survivor bias” – that is, they can only interview companies that are still in business.

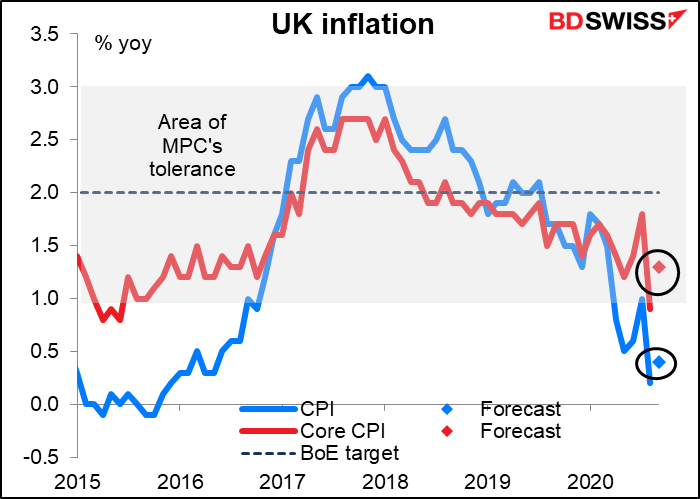

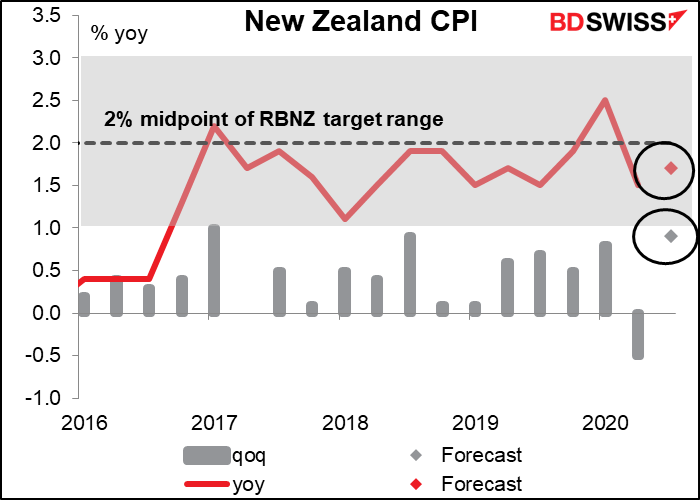

We’ll also get inflation data from Britain (Wed), New Zealand (Fri) and Japan (Fri). Overall they’re expected to show some acceleration of inflation – perhaps because of the change in consumption patterns during the pandemic?

Britain’s inflation data is expected to see a jump in the rate of inflation, both headline and core. I’m sorry but I don’t make the forecasts, so I don’t know why they are expecting this. Nonetheless with headline inflation still well outside of the Bank’s range of tolerance, the pressure for further stimulus is still there. GBP-negative

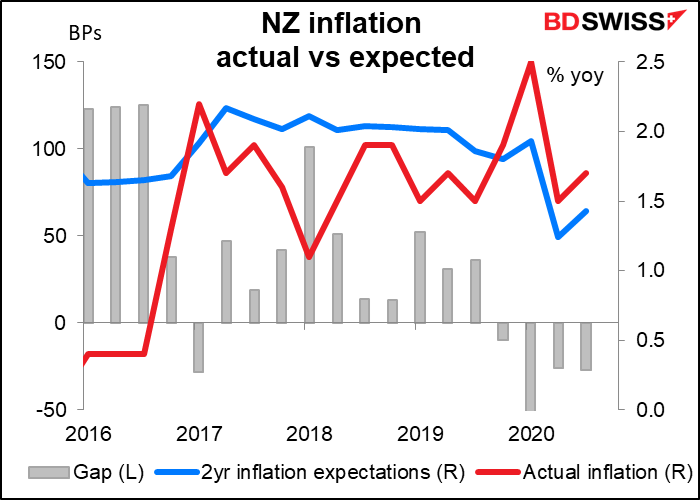

New Zealand is one of the few places on earth where the inflation rate is within the central bank’s target range and is expected to rise.

Furthermore, inflation expectations are well grounded – the two-year inflation forecast is 1.43%, also within the RBNZ’s target range.

In case you’re wondering then why the RBNZ is talking about negative interest rates, let me remind you that in February last year their remit was changed to a “dual mandate” – their goals are now “maintaining a stable general level of prices over the medium term and supporting maximum sustainable employment.”

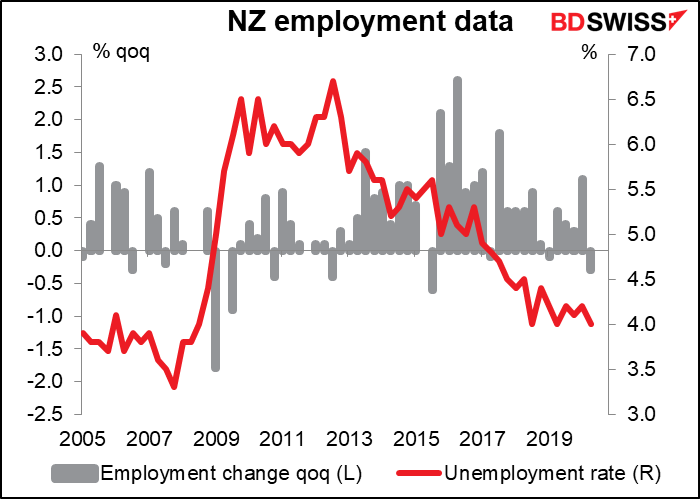

Having said that, the unemployment rate is still the lowest it’s been since 2008, so it’s hard to argue on the basis of current employment issues that such extraordinary policies are warranted, either.

But this is all assuming we are in a normal period. We obviously aren’t. According to the minutes of the last RBNZ meeting, “. The Committee agreed that a severe and prolonged economic downturn would make it difficult to achieve its inflation and employment objectives, and at the same time would pose a material risk to financial stability. Providing sufficient monetary stimulus would therefore both help achieve the Committee’s remit objectives, and promote financial stability.” So we can see that issues such as “financial stability” and avoiding an “economic downturn” are weighing as much on their mind as inflation and employment. And it’s true that their remit says that should “have regard to the efficiency and soundness of the financial system” and “seek to avoid unnecessary instability in output…”

That’s a very long way of saying that the inflation numbers don’t matter so much for New Zealand, because the RBNZ is more worried about other things nowadays.

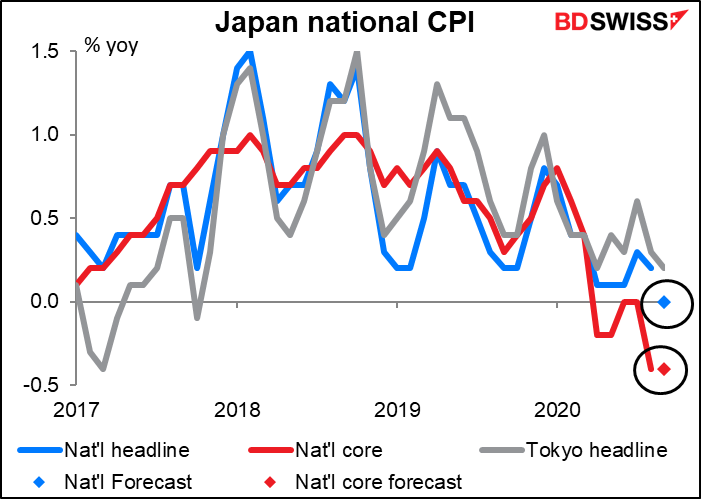

The Japan national CPI doesn’t attract as much attention as the Tokyo CPI, which comes out several weeks earlier. In any case, the annual rate of change of the core CPI is expected to remain unchanged – still modest deflation — while the headline figure drops down to no change yoy.

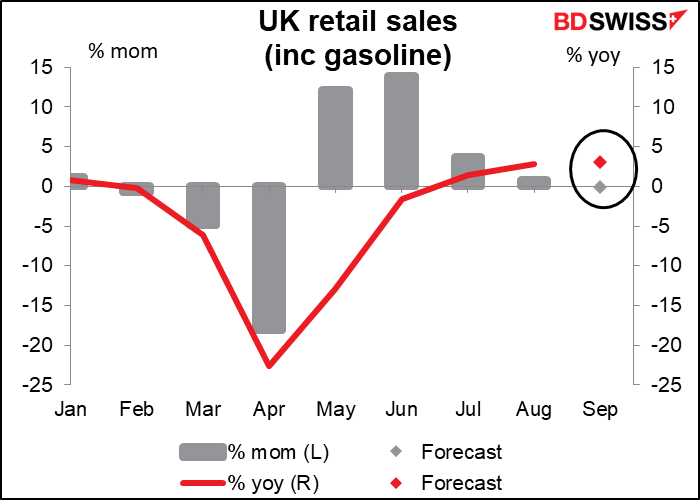

Britain announces its retail sales figures on Friday. Sales are expected to be down a negligible 0.1% mom (i.e., effectively unchanged). This signals the end of the rebound and will corroborate fading hopes for a strong recovery in demand, especially as the UK is going back into semi-lockdown. Along with the sub-target inflation I think this report is likely to add to the pressure on the Bank of England to lower rates and will therefore be taken as negative for the pound.

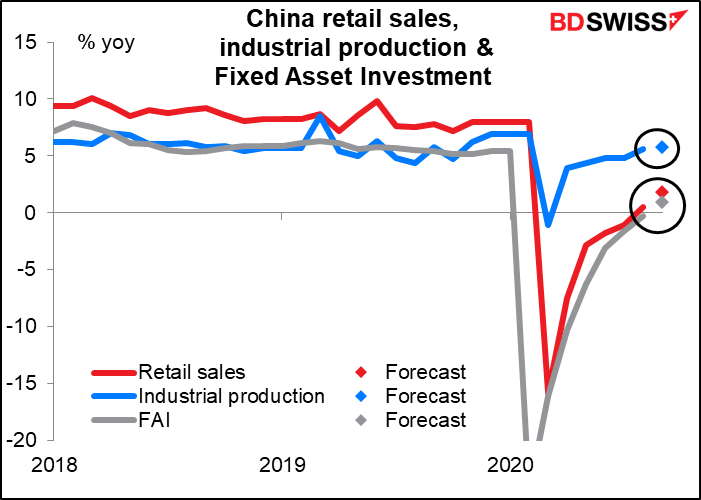

Finally, let’s discuss the first major indicators out during the week: China’s monthly release of retail sales, industrial production and fixed asset investment, plus the crucial GDP figure.

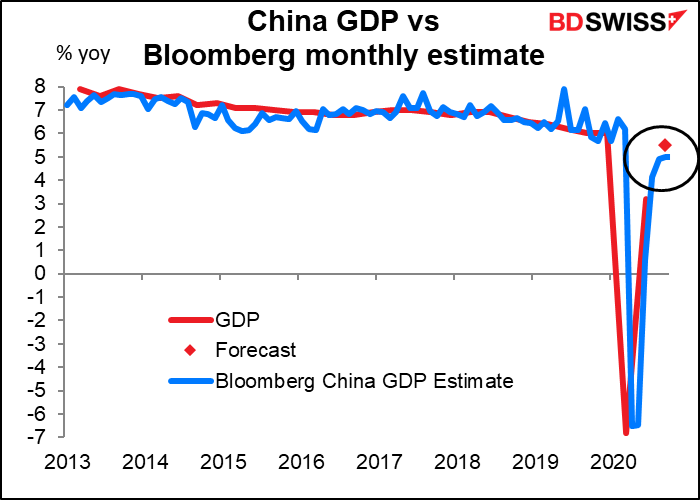

GDP is expected to rebound sharply. Growth isn’t expected to recover to the usual levels of last year, but it’s still forecast to be up 5.5% yoy, which is pretty good – and about in line with what the Bloomberg monthly estimate is predicting. Last year growth averaged 6.2% yoy and was slowing, so 5.5% would be almost back to within trend. Combined with this week’s record import figure, it would probably encourage risk sentiment and be bullish for AUD, except of course that the two countries are headed toward a trade war.

The other China indicators coming out at the same time are all expected to show continued improvement and year-on-year growth, indicating that China has indeed recovered from the severe lockdown earlier in the year. These should also help to boost the risk-on mood.