Die Auswirkungen Der EZB Leitzinsentscheidung Auf Den EUR

Die Deutsche Bank Will 4000 Jobs Aus Großbritannien Abziehen

Trump Legt Brandneuen Steuerplan Offen

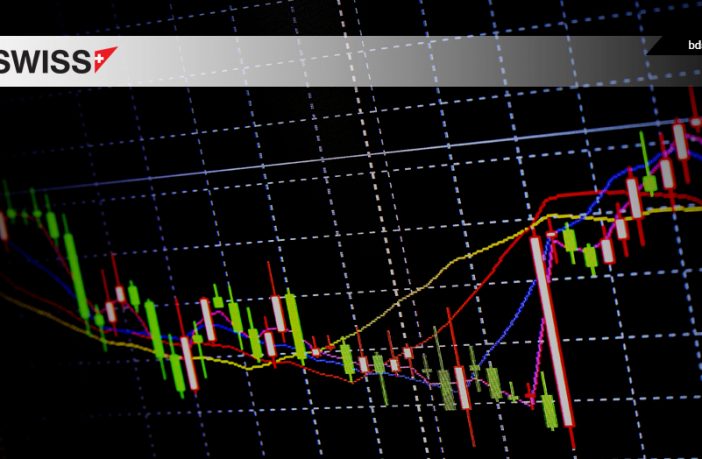

Marktzusammenfassung – Diese Woche in knappen Worten:

Nachdem der Gemäßigte Emmanuel Macron die erste Runde der Französischen Wahlen am Sonntag gewann , nahmen die Europäischen Märkte und der EUR am Montag erheblich an Fahrt auf. Auch am Dienstag profitierten die Märkte noch vom Sieg Macrons, da sich Investoren zuversichtlicher zeigten, dass er auch die finale Wahlrunde gewinnen wird. Der weltweite Anzug klang am Mittwoch jedoch ab. Die Gewinne der meisten Europäischen Indizes fielen ab, als der Finanzminister Steve Mnuchin US Präsident Donald Trumps neuen Steuersenkungsplan offenbarte!*

DO 27.4.: 3 Dinge, die Sie über die aktuellen Märkte wissen müssen…

1. Die Europäischen Märkte öffnen im Vorfeld des EZB Meetings schwächer

Während Investoren auf die Ansage des Präsidenten der Europäischen Zentralbank Mario Draghi warteten, öffneten die Europäischen Märkte diesen Donnerstag schwächer. Draghi verkündet erwartungsgemäß um 11.45 GMT die jüngsten geldpolitischen Entscheidungen der EZB. Auch wenn EU-Banken im Bezug auf die Anreizmaßnahmen vorsichtiger werden, herrscht Konsens, dass die Kurzfristzinsen unverändert bleiben werden. Die Europäische Zentralbank hielt die Leitzinsraten in neun aufeinanderfolgenden Monaten auf 0%. Wenn nun die EZB ihre Raten wiederum unverändert lässt und keine härtere Haltung einnimmt, könnte sich dies, gemäß investing.com, negativ auf den Wert der EUR-Paare auswirken.

Lesen Sie mehr seriöse Nachrichten und profitieren Sie von BDSwiss Erfahrung!

2. Die Deutsche Bank wird nach dem Brexit 4000 Jobs aus Großbritannien abziehen

Die Deutsche Bank hat angekündigt, dass 2000 Leute aus den Front Offices abgezogen werden könnten. 2000 weitere Posten würden, abhängig von neuen Bestimmungen, überprüft, wenn Großbritannien die Europäische Union verlässt. Insgesamt könnten auf Grund des Brexit bis zu 4000 Britische Jobs nach Frankfurt oder an andere Orte in der Europäischen Union verlegt werden. Es ist darauf hinzuweisen, dass Deutschlands größte Bank insgesamt etwa 9000 Angestellte in ganz Großbritannien beschäftigt. Die Ankündigungen der Deutschen Bank reagieren auf die Mahnungen der Bank of England, die sie an alle im Vereinten Königreich tätigen Finanzfirmen ausgesprochen hat. Die BOE hat den Finanzfirmen eine Deadline (14. Juli) gegeben, zu der sie darlegen müssen, wie sie sich auf die Trennung Großbritanniens von der EU vorbereiten. Dabei hat sie auch dazu aufgefordert, sich auf alle möglichen Ausgänge vorzubereiten – inklusive eines harten Brexit.**

3. Trump legt brandneuen Steuerplan offen

Das Weiße Haus hat am späten Mittwoch seinen Steuerplan zusammengefasst. Ein Vorschlag, der, wie sie sagen, die größte Steuersenkung in der Amerikanischen Geschichte darstellen wird. Finanzminister Steven Mnuchin fasste den Plan in einem Briefing gegenüber Journalisten am Weißen Haus zusammen und offenbarte Trumps Vorhaben, die Zahl der Lohnsteuerklassen von sieben auf drei zu kürzen. Der Höchstsatz beläuft sich dabei auf 35 Prozent und niedrigere Sätze auf 25 und 10 Prozent. Für die ersten 24.000$ Einkommen wird der Steuersatz bei Null liegen. Das Vorhaben wird auch die Körperschaftsteuer auf 15 Prozent von vorherigen 35 Prozent kürzen. Der Plan zielt weiterhin darauf ab, steuerlich absetzbare Beträge mit nur wenigen Ausnahmen, einschließlich des Hypothekenzinses und gemeinnütziger Spenden, zu streichen.*

*Quelle: Bloomberg

**Quelle: Seeking Alpha