It looks like former VP Biden will indeed win the election, but the “blue sweep” that he was expected to bring with him failed to materialize. Once again the US is stuck with a divided government, with the Democrats controlling the White House and the House of Representatives while the Republicans keep their lock on the undemocratic Senate, where 53% of the senators represent only 46% of the people.

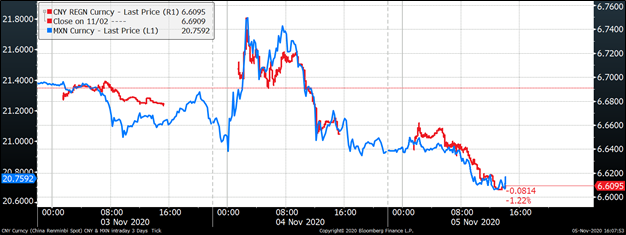

CNY (red) and MXN (blue) acted as gauges of the market’s view on who would win. When it looked likely that Trump would be re-elected, they both fell. But when VP Biden started to show an edge, they began to rally.

The delay in counting the vote is no surprise. We always knew the vote would take longer than usual to count because of the unprecedented number of mail-in votes.

The next step is to watch the Trump counterattack. This too was always expected. Michael Cohen, Trump’s former attorney, was quoted in The New Yorker as saying, “He will not concede. Never, ever, ever.” He went on, “I believe he’s going to challenge the validity of the vote in each and every state he loses—claiming ballot fraud, seeking to undermine the process and invalidate it.” And right on schedule, Trump came out Tuesday night with it, saying “We’re going to the Supreme Court.” Thursday night he made an even more – may I say it? – insane speech in which he started out by saying, “if you count the legal vote, I easily win. If you count the illegal votes, they can try to steal the election from us.”

So far the Republicans have filed suits in at least five states, seeking (with thanks to law professor Nancy Leong):

- A recount in Wisconsin

- Stop counting in North Carolina

- Count faster in Nevada

- Count backward in Pennsylvania

- Only count the ballots Trump likes in Georgia

The suits are of course preposterous. Votes postmarked by election day are normally counted even if received after election day. What about the troops stationed abroad? And as for voter fraud…some election officials are even live-streaming the vote count.

There is one small grain of truth in these accusations, though. According to the Washington Post, it looks like the US Postal Service is actively trying to prevent ballots from being delivered in the five states that have yet to announce their results. So yes, there is fraud and someone is trying to steal the election, but it’s the Republicans, not the Democrats.

I’m pleased to say though that what I’ve seen is general disgust at what Trump is trying to do. Even such Trump allies as Fox News and the Murdoch-owned NY Daily Post are pointing out that there is no evidence of fraud whatsoever. Most of the suits have been laughed out of court. The Michigan Attorney General’s office described Trump’s request as an “attempt to unring a bell.”

Twitter had this to say about Trump’s comments:

Nonetheless, there is still a risk. Conservative talk radio host Mark Levin, one of the most popular right-wing radio stars, urged Republican-controlled state legislatures to prepare to override the popular vote in their states and appoint their own slate of electors, a move that Trump has reportedly been planning for some time. It’s this “nuclear option” that really worries me, because it is legal and yet it is so radical that with the country evenly divided, it could cause a total rupture in civil society.

There’s also a big question of what he might get up to in his remaining time in office. He’s been suffering from dementia and paranoia for some time, but add this additional problem on top…

Assuming Biden wins, it’s a major victory. An incumbent president has been defeated only four times in the last hundred years: Hoover 1932, Ford 1976, Carter 1980, and Bush 1992.

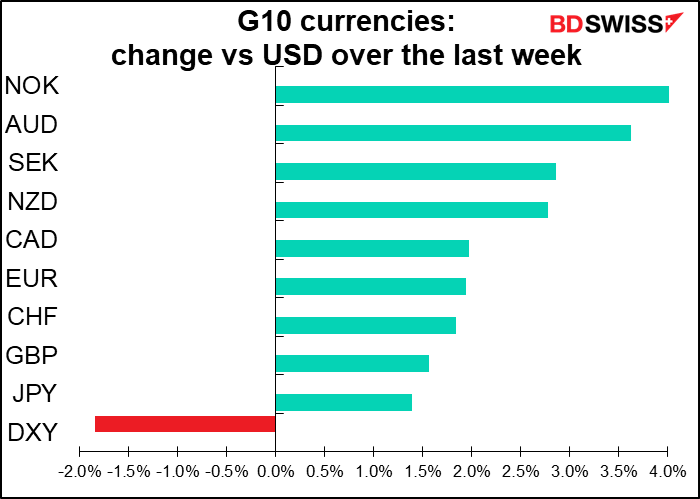

Likely impact on the dollar: bad

The markets have celebrated the results, but I think it’s dreadful for the US economy – perhaps the worst possible result from an economic point of view (not the worst for civil society, I hasten to add).

Investors are happy that the Republicans will probably block Biden’s ambitious plans for tax hikes and more regulation. The Democrats will also have to nominate more centrist people for the Cabinet than they might wish, otherwise they will never get Senate approval for the positions. That’s why shares in drug companies, health insurers, and tech companies were all doing well.

However, the flip side is that the Republicans will no doubt suddenly become worried once again about the budget deficit, something they forgot about entirely when a Republican president wanted to cut taxes on the rich.

Congress couldn’t agree to supply more money to the unemployed as the CARES Act funds run out even with Trump pushing for it. How much success do you think Biden is going to have? Just watch this video from 2010. It’s only seven seconds long. You can hear Senate Majority Leader Mitch McConnell Y.S. say “Our top political priority over the next two years should be to deny President Obama a second term.” This was December 2010, when the unemployment rate was 9.3%, even higher than it is today, and this was the “top political priority” for the Republicans. What do you think they’ll be aiming for now?

By contrast, we heard overnight from Fed Chair Powell, who said that CARES Act support was “absolutely essential” and that “more fiscal policy” will probably be needed.

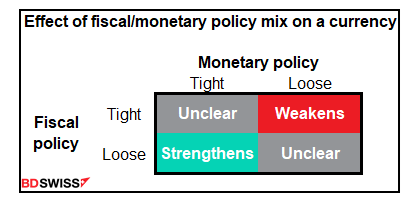

In short, to make up for the lack of action with fiscal policy, the Fed will have to be more aggressive with monetary policy. That’s a recipe for a weak currency.

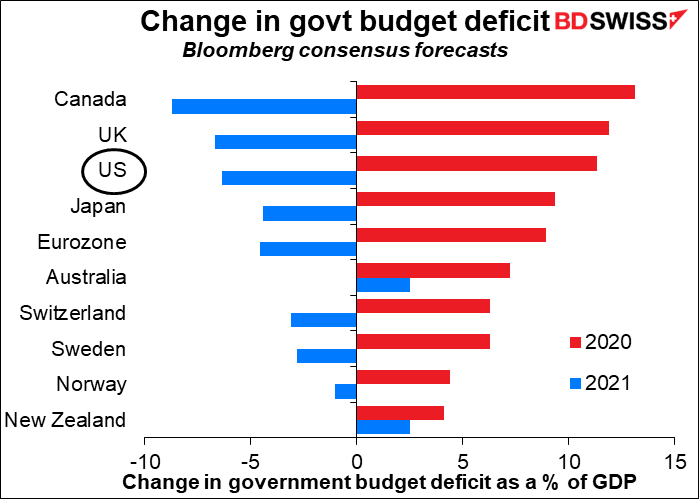

Especially when we contrast with the rest of the world. The US expanded its budget deficit significantly this year, but even on present forecasts it’s expected to have a fairly contractionary fiscal stance next year. If it contracts further, that will slow the economy even more.

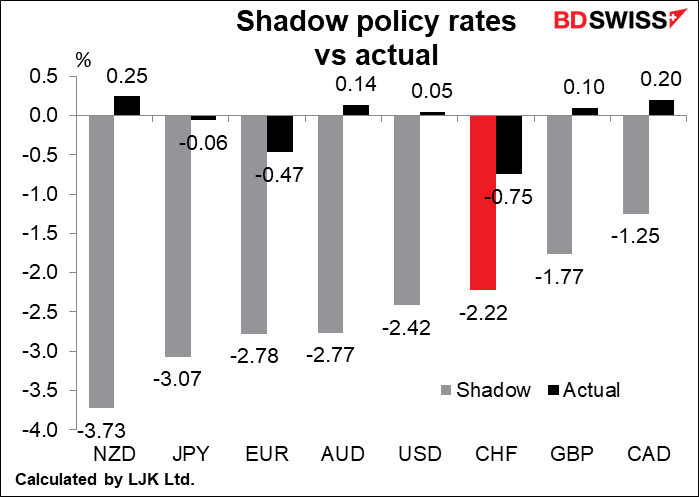

Meanwhile, the total impact of the Fed’s loosening, while significant, is not as significant as some other countries’, as expressed through their “shadow policy rates.” These are the policy rates of the various countries adjusted to take into account the impact of their various extraordinary policy measures, to provide a way to compare monetary policy across countries.

We can imagine what the impact on the exchange rate is likely to be if the US has an even tighter fiscal policy (thereby reducing growth further) and an even looser monetary policy.

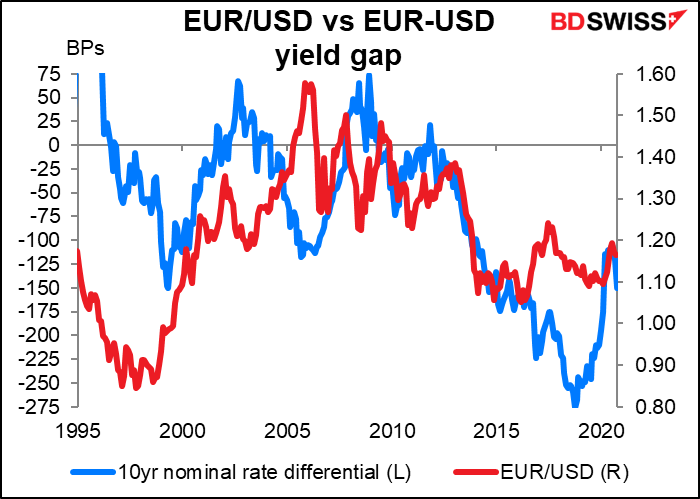

And of course with the Fed having to buy more bonds but the Treasury issuing fewer of them, the probability is that US bond yields will be lower than they would be otherwise, too. And that suggests a weaker dollar as well.

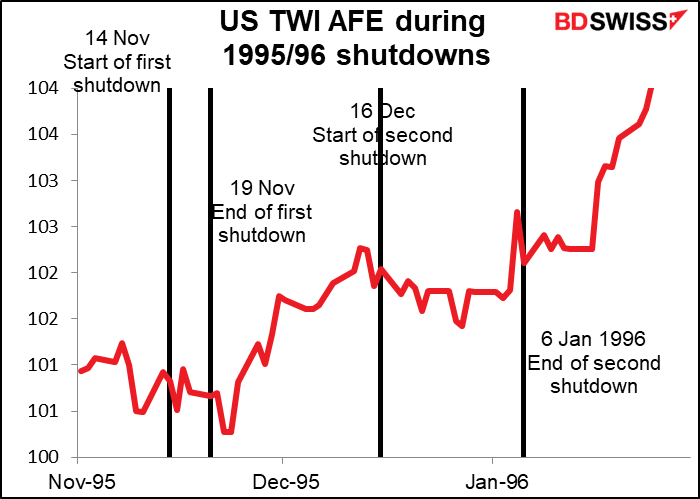

Not to mention what happens to the dollar when there’s disagreement in the government. For example, we can look at what happened during the longer US government shutdowns when Congress couldn’t agree to raise the debt ceiling. Generally the dollar fell either before or during the shutdown. I would expect to see more episodes like this, not necessarily with the debt ceiling but with stalemates surrounding other policies.

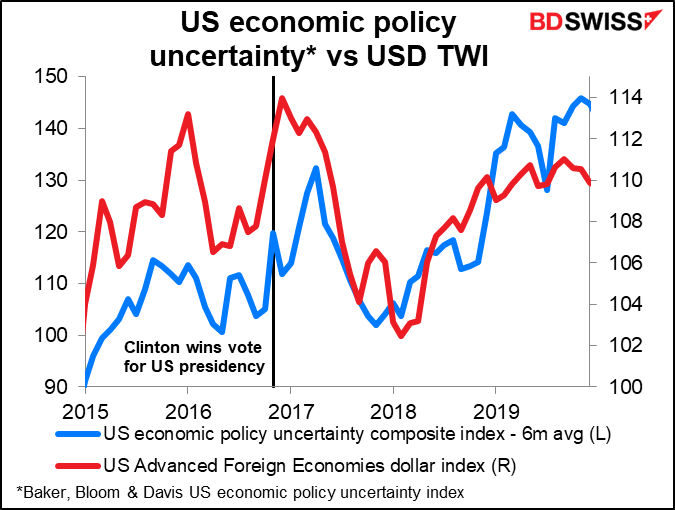

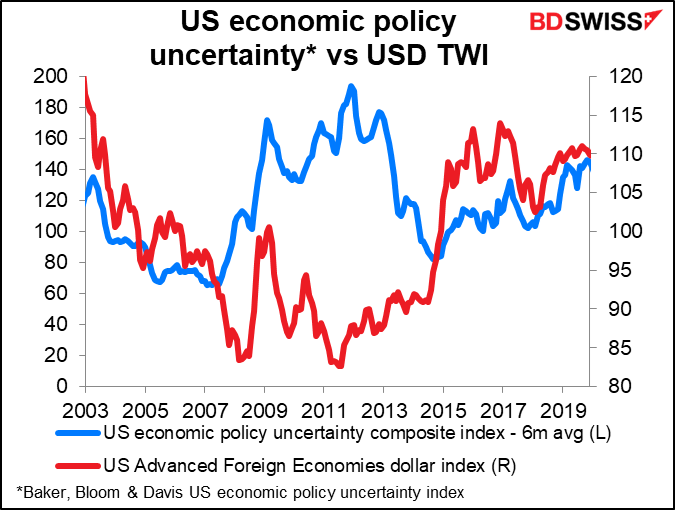

Of course, recently that’s been a reason for the dollar to strengthen. The US currency tends to act as a “safe haven currency” – one that goes up when global conditions are uncertain and weakens when investors are more confidence. We can see that over the last several years – odd as it may seem, the dollar has tended to strengthen during periods of US policy uncertainty. (The relationship is even stronger if we look at global policy uncertainty overall vs the broad dollar index).

But it wasn’t always like this – a few years earlier the dollar weakened during periods of US economic uncertainty. If people go back to associating US policy uncertainty with gridlock, we could perhaps return to this paradigm.

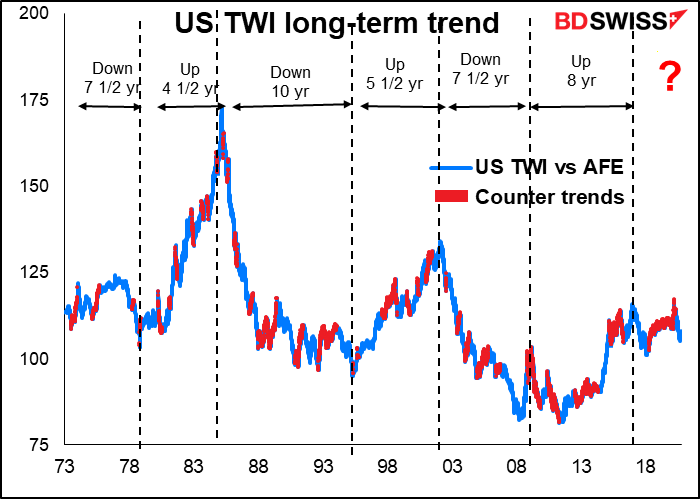

To sum up, assuming that Biden does win the Presidency and the Republicans do hold the Senate I expect a significantly weaker dollar over the next several years.

The fly in the ointment: competitive devaluations

The major flaw in this argument is: everyone wants a weaker currency. We’ve heard the European Central Bank (ECB) and the Reserve Bank of Australia (RBA) both state bluntly that one reason for their looser monetary policy is to weaken their currencies, while the Reserve Bank of New Zealand (RBNZ) has even discussed intervening in the FX market directly. What will all of these countries do if the US policy mix is offsetting the desired effects of their policy? We could be headed for a “currency war” of competing devaluations. But how they would accomplish that…I really don’t know.

Cautionary note: the Senate isn’t settled yet

Note that there is still a small chance that the Democrats take the Senate. Both of Georgia’s Senate seats have gone to run-off elections that will be held on 5 January. If the Democrats win both, the Senate will be split 50-50, with VP Kamala Harris (one assumes) breaking the ties.

There’s also a question about Alaska. The Republican candidate is far ahead of the Democrat, but it appears that few of the votes are counted yet. That contest could change too (I think).

Democratic control of the Senate would make a huge difference. If the Democrats take control, then they can move much further to the left (or to the center, if you want to look at US politics from a European point of view, where the default Democratic position would be considered right-wing). They can appoint who they want and enact more reforms. Growth would probably be much faster and interest rates higher, yet the Fed would probably refrain from hiking. Real rates would be higher as a result. Although this would be the most “risk-on” scenario, my view would change 180 degrees. I believe a “blue sweep” would strengthen the dollar.

Next week: much much quieter

The second week of the month is normally thin on major indicators. This month, coming after what must have been one of the busiest weeks on record insofar as scheduled events are concerned, next week is likely to seem preternaturally calm.

There’s only one major central bank meeting, the Reserve Bank of New Zealand (RBNZ) on Wednesday. They’re likely to keep both their Official Cash Rate (OCR) and quantitative easing program unchanged and add a “Funding for Lending Programme” (FLP) to the menu, as they hinted strongly back in September.

This sort of program, in which a central bank subsidizes loans that banks make to their clients, is a common policy tool among central banks as a way to ensure banks pass on the benefit of low interest rates to clients while also mitigating the cost of negative rates to the banks. The European Central Bank (ECB) for example has its Targeted Long-Term Refinancing Operations (TLTROs), which are quite successful in getting money out to borrowers.

We may also get an update on how banks are preparing for negative rates.

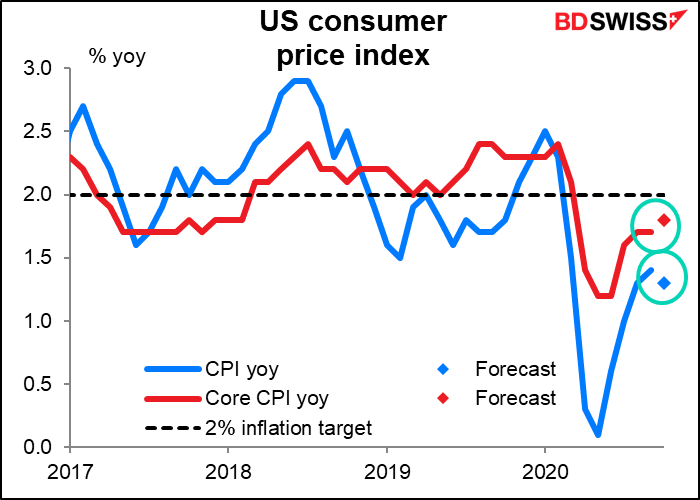

As for the indicators, for the US the second week of the month brings us only the consumer price index (CPI, and that’s not of such keen interest nowadays since the Fed is focused more on the labor market and supporting the economy than inflation.

Just for the record, headline CPI is expected to tic down while core CPI is expected to tic up. During olden days, core CPI at 1.8% yoy – i.e., closing in on the 2% target – might have started ringing some alarm bells about the Fed tightening pre-emptively, but that was a different era. Now the Fed has not only abandoned the very idea of tightening pre-emptively, it said it will allow inflation to rise above 2% for some time. So higher inflation only reduces real interest rates and is therefore negative for the dollar – if indeed anyone is watching it next week.

I suspect though that inflation will be the least of our worries next week. Having just recently completed our online classes on epidemiology, we now have to break out the law books and become experts on the Electoral Count Act of 1887 as we watch Trump’s legal machinations. The big question, as mentioned above, is can he drag it out until 14 December, when the state legislatures can decide by themselves which electors to confirm? We’ll see.

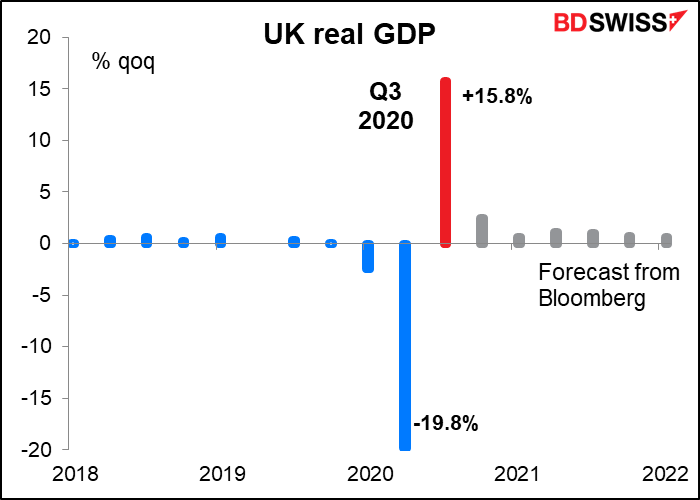

The second week of the month always brings a slew of UK indicators, including employment data on Tuesday and the short-term economic indicators on Thursday. This month it includes Q3 GDP as well as September, plus of course the usual industrial & manufacturing production and trade data.

The market is expecting a substantial rebound in GDP in Q3 but no one will be particularly encouraged by it after the Bank of England downgraded its forecast for Q4 yesterday. The Bank is now expecting GDP to plunge 11% qoq in Q4, about double the previous forecast made in August (-5.4%). That’s not as bad as the decline during the initial lockdown period, but it’s still terrible. Nor has the market yet internalized this forecast, as the Bloomberg consensus still shows a modestly positive number (+2.5%).

I suspect though that as usual, Brexit will call the tune for GBP, not economics. Hopes were raised a few weeks ago after both sides made some accommodating statements, but comments this week indicate the two sides remain as far apart as ever on the big issues. As usual, it all boils down to the two sides holding incompatible goals: the UK wants to be free from EU rules and regulations so that it can set its own course (“sovereignty”), and the EU says anyone wanting zero-tariff, zero-quota access to the market has to adhere to EU rules and regulations (“level playing field”). One side will have to give, and soon. The UK has made clear that it will prioritize sovereignty over market access, while the EU can’t negotiate away core principles of the single market. Does that mean no deal? Boris Johnson was elected on a promise to “Get Brexit Done.” The voting public won’t understand if he can’t do it. That’s why I think Boris “The Big Umbrella” Johnson will eventually fold. The days before the European Council video conference on 19 November will be critical in deciding whether they want to reach a deal and if so, what compromises they are prepared to make to do so.

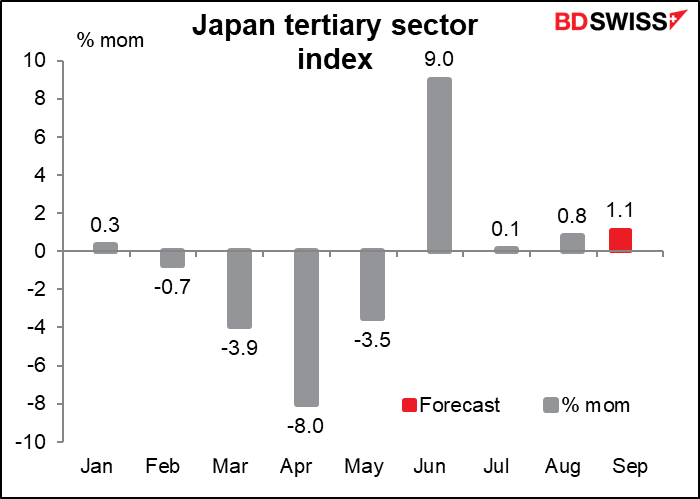

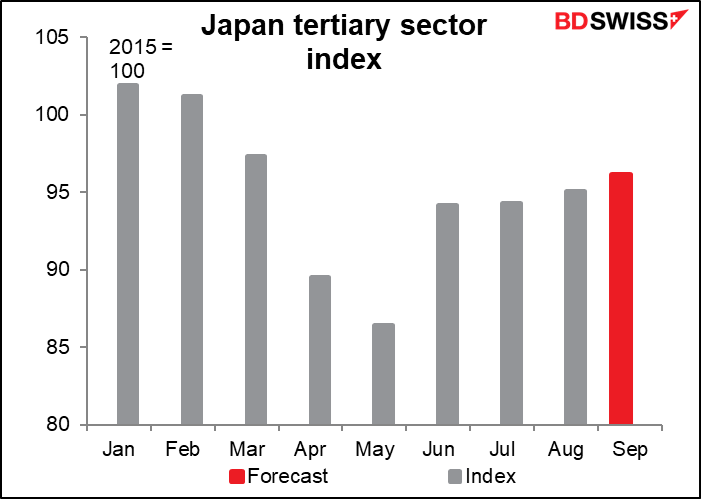

It is a big week for Japan indicators: current account on Tuesday and machinery orders and tertiary sector on Thursday. Unfortunately no one cares about Japan indicators, because the Bank of Japan is on hold indefinitely and the yen moves up and down in response to risk-on and risk-off more than the indicators. But I’m interested in them since I lived there for 18 years so I like to look at them and watch them. Humor me please.

The tertiary sector index is expected to rise for the fourth consecutive month, and at an accelerating pace.

Still, it doesn’t seem to be doing well. It remains far below pre-pandemic levels, which corroborates the message from Japan’s service-sector purchasing managers’ index (PMI) which still languishes below 50 (47.7).

But Japan’s current account surplus is expected to rise on a seasonally adjusted basis as overseas economies – notably China – recover from the virus. That should help to revive the economy and perhaps boost the service sector eventually.

Among other events, the European Central Bank (ECB) hosts an online seminar Wednesday and Thursday, “Central banks in a shifting world.” It looks pretty interesting if you like this sort of thing: discussions on de-globalization, macroeconomic implications of climate change, monetary policy challenges from falling natural interest rates, etc. Academics give the papers and the discussions are chaired by some of the heavy-hitters on the ECB Governing Council. The Big Event will be 16:45 GMT Thursday: a one-hour policy panel with ECB President Lagarde, Bank of England Gov. Bailey, and Fed Chair Powell.

Editorial comments (nothing to do with the markets, but I just want to say it)

- An Associated Press analysis reveals that in 376 counties with the highest number of new COVID-19 cases per capita, the overwhelming majority — 93% — went for Trump, a rate above other less severely hit areas. The causation though certainly runs the other way: the virus didn’t make them vote for Trump, but rather Trump supporters probably didn’t wear masks or social distance as much as Biden supporters did. This factoid supports my view of Trump as the Jim Jones of American politics. It also explains how he can convince his followers that there’s rampant fraud going on in the vote without putting forward a single shred of evidence.

- There are a lot of negative comments floating about concerning how long it takes to count the votes for the US election. There’s another point of view on the subject though. Russian opposition politician Alexei Navalny, who was poisoned with Novichok for challenging the Kremlin and trying to make Russia’s elections fair and democratic, tweeted Wednesday morning: “Woke up and went on Twitter to see who won. Still unclear. Now that’s what I call elections.”

- Finally, Google searches for ‘liquor store near me’ hit an all-time high Tuesday night as Americans watched the election results roll in. Other popular search terms were ‘liquor store open near me right now’ and ‘wine near me’. Personally, I had an unprecedented three large chocolate-chip cookies.