With apologies to Tom Cruise, who starred in the famous anti-Vietnam War movie of almost the same name.

There’s little excitement next week. Monday is a national holiday in the US (the 4th of July, or Independence Day, is Sunday so everyone gets Monday off). The main indicator of the second week of the month, the US consumer price index (CPI), is delayed until the following week. There’s only one G10 central bank meeting, the Reserve Bank of Australia (RBA) – that might afford some temporary excitement, as will the minutes to the June FOMC meeting. Otherwise, you can probably put your bathing suit on and hit the beach (but don’t forget to bring your phone so you can keep trading on our award-winning phone app.)

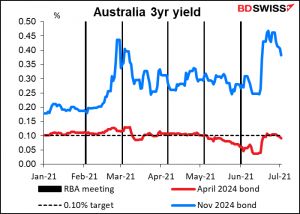

This is an important meeting for the RBA. At its May meeting it said:

At its July meeting, the Board will consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond. The Board is not considering a change to the target of 10 basis points. At the July meeting, the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September. The Board is prepared to undertake further bond purchases to assist with progress towards the goals of full employment and inflation. The Board places a high priority on a return to full employment.

So what will they do?

It looks like the market thinks they will not shift into the November bond. Otherwise the yield on the two would be converging.

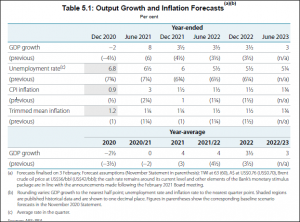

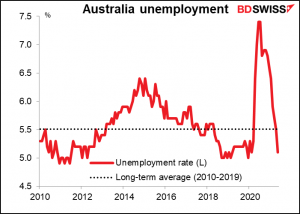

Back in February, when the unemployment rate was 6.4%, their Statement on Monetary Policy (SOMP) forecast that it would be 6 ½% now, falling to 5 ½% by June 2022 and 5 ¼% by June 20i23 (see table). (Note: they lowered these forecasts substantially in the May SOMP.)

In the event, the unemployment rate is already 5.1% — below where just three months ago they thought it would be two years from now. That’s well below the long-term average and not too far off the post-Global Financial Crisis low of 4.9% set in December 2010.

Accordingly, I agree with the market – I doubt whether they’ll feel the need to loosen policy further. By switching their purchases into the November bond, they would be buying a bond with seven months longer to maturity – that would tend to flatten the yield curve more and, significantly, would affect more mortgages and bank loans, which in Australia are usually tied to the three-year rate. By not doing that, they are allowing the impact of their intervention to fade gradually, which might be called “Lao Tsu Tightening” (Lao Tsu being the Taoist master who said “by doing nothing, everything is done.”)

The impact of such a decision could be positive for AUD, except that looking at the price of the two bonds I’d say it’s pretty well in the market already.

As for the bond purchase program, in the latest Reuters survey, 16 of the 20 forecasters polled thought that the RBA would extend its bond purchase program but with a flexible approach. Currently it’s buying AUD 5bn a week. It’s likely to maintain that pace for now but review it periodically in light of the economic data.

Indicators & releases: FOMC minutes, service-sector PMIs

The focus in the US is likely to be on Wednesday’s release of the minutes to the June meeting of the rate-setting Federal Open Market Committee (FOMC). That’s the meeting where they changed their forecast to show not one but two rate hikes by the end of 2023. Investors will scrutinize the minutes for details of the discussion that led up to that decision and any insights that they can glean about the Committee’s views on the economy. We’ve heard from so many FOMC members since then that I’m not sure we’ll learn much, but there always seems to be one or two nuggets of information or nuance that affect the market.

The major indicators will be the service-sector purchasing managers’ indices (PMIs). Most come out on Monday, including the final ones for those countries that have preliminary versions. Since the US will be on holiday on Monday, the US one, including the Institute of Supply Management (ISM) version, will be released on Tuesday.

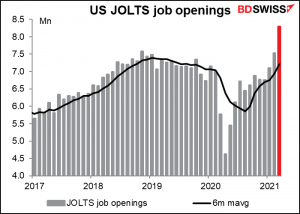

The Job Offers and Labor Turnover Survey (JOLTS) report is starting to get more traction as attention focuses on the labor market. Job openings hit a record in April and are expected to rise further in May.

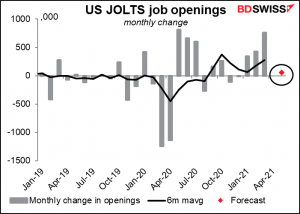

The pace of increase however is expected to slow.

When I say “is expected,” I don’t want to exaggerate how reliable these expectations are. At the moment there are only four forecasts in Bloomberg, and they range from 9.2mn to 9.55mn, so anywhere from -86k to +264k. In fact, no one has a clue, these are just numbers pulled out of a hat effectively, but they do provide the market with a benchmark against which they can decide to buy or sell.

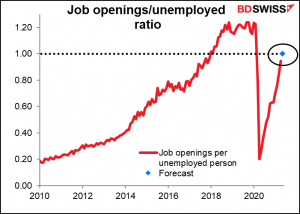

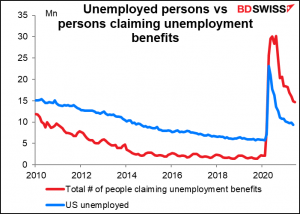

Despite the slowdown, the figure as forecast would be significant. It would mean there’s one job opening for every unemployed person in the country.

(Note: this exercise is actually a little disingenuous, because nowadays the number of unemployed persons is far below the number collecting unemployment benefits. This highly unusual condition is due to special conditions for collecting such benefits during the pandemic. For example, self-employed persons usually can’t collect unemployment benefits, but currently there are special programs for them. That makes the unemployment rolls a more accurate view of the real unemployment problem, in my view.)

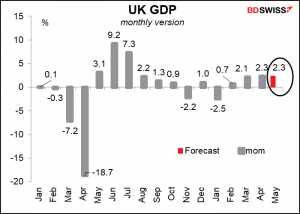

Friday brings the UK short-term indicator day, when they announce monthly GDP, industrial and manufacturing production, and trade data. GDP is expected to grow at the same robust pace as in April. That may help to reassure people that the UK is bouncing back despite the rise in virus cases, which would be positive for the pound.