I debated whether the title of this week’s piece should be “from ‘transitory’ to ‘persistent’” but decided to go with the above. In any case, the idea is the same: central banks are beginning to think that maybe inflation won’t be so “transitory” after all, that it may be a bit more “persistent” than they had expected. That has implications for interest rates and therefore for currencies too.

We got this gem from the Bank of Canada this week:

The recent increase in CPI inflation was anticipated in July, but the main forces pushing up prices – higher energy prices and pandemic-related supply bottlenecks – now appear to be stronger and more persistent than expected… The Bank is closely watching inflation expectations and labour costs to ensure that the temporary forces pushing up prices do not become embedded in ongoing inflation.

Notice that the word “transitory” no longer appears, but “persistent” does.

Not everyone has changed their view. ECB President Lagarde still has one foot in the “transitory” camp, although she dropped the phrase “largely temporary” from the monetary policy statement following the meeting and admitted that “the current phase of higher inflation will last longer than originally expected.”

While inflation will take longer to decline than previously expected, we expect these factors to ease in the course of next year. We continue to foresee inflation in the medium term remaining below our two per cent target.

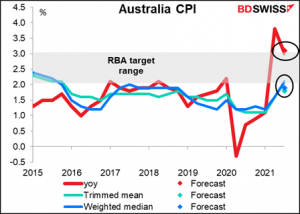

The inflation data out this week was indeed worrisome. Australian headline inflation slowed, but the core measures rose, beating estimates. They’re both back within the Reserve Bank of Australia’s 2%-3% target range for the first time since Dec. 2015.

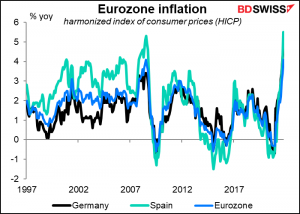

Spanish and German inflation for October hit the highest since at least 1997 (start of data series), while the Eurozone as a whole tied its previous high.

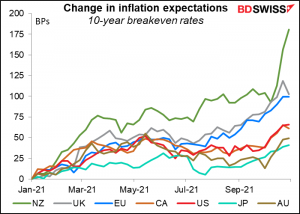

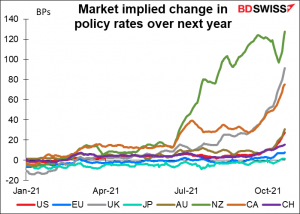

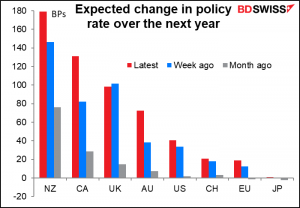

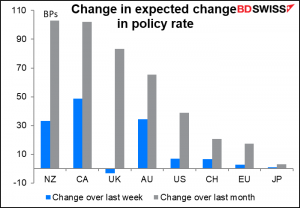

As inflation continued to rise, inflation expectations rose too.

With inflationary pressures proving less “transitory” than expected, there were some policy tweaks in response. The Bank of Canada Wednesday not only ended its quantitative easing (QE) program but also brought forward the time when it expects to start raising rates, from “the second half of 2022” to “the middle quarters of 2022.”

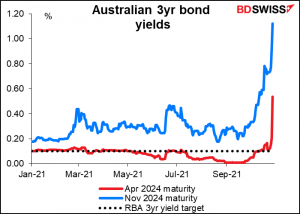

The next day, the Reserve Bank of Australia declined to defend its 0.10% target for the benchmark three-year bond, sending bond yields rocketing.

This might be called “the return of the reaction function.” (Maybe that should’ve been this week’s title.) The “reaction function” is the term economists use to describe how a central bank reacts to inflation, in particular, what level of inflation prods them to raise interest rates and by how much. Monetary policy takes a long time to work its magic on the economy, nine months at least and by some estimates as long as two years. It had been assumed that central banks wouldn’t react to the higher inflation on the grounds that by the time they did, the factors that caused it would’ve ended and inflation would come back to normal of its own accord. As that idea loses ground, the market has aggressively raised its forecasts for policy rates (well, rates in some countries, not all).

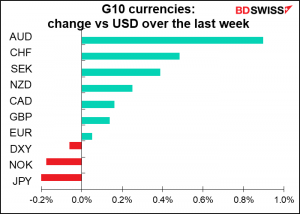

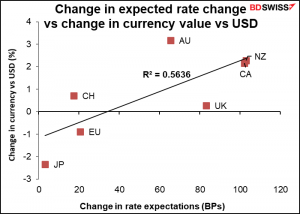

This change (the change in the expected change) has accounted for about 56% of the change in major currencies’ value vs the dollar over the last month. Meaning if you can get central bank policy right, you’re more than halfway to getting your currency call right.

Next week: RBA, Fed, Bank of England, Norges Bank…plus US payrolls

We’ll learn more about central banks’ reaction functions next week, when four of them hold their policy meetings.

The Reserve Bank of Australia (RBA) is almost bound to change its tune. Thursday’s move to let the three-year bond yield rise so far above its target (see graph above) was a declaration that the RBA’s yield curve control (YCC) program is over in fact. Now all that has to happen is for the Bank to make the formal announcement.

As for its first move to hike rates, the RBA is among the most dovish of the central banks. Its forward guidance says:

(The Board) will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The central scenario for the economy is that this condition will not be met before 2024.

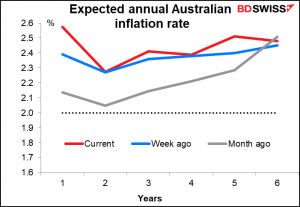

The market however disagrees. Looking at the Australian inflation swaps, investors already believe inflation is sustainably above the 2% level for the next several years.

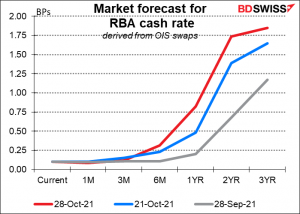

And while the RBA says it expects to keep rates steady until 2024, the market expects the first rate hike around six months from now and for rates to be at 1.75% by 2024. That’s an unbridgeable difference.

I expect the RBA to officially terminate its YCC program and to adjust its forward guidance. However, I can’t see it jumping all the way from 2024 to 2Q 2022 in one leap. Therefore I expect it will remain behind the market and be perceived as dovish, which is likely to be negative for AUD.

Fed: taper time

The colloquial English idiom I’d like to use on this occasion is not really appropriate for macroeconomic analysis, but it goes something like this: it’s time for the Fed to do what it’s been promising us that it would do, namely, to start reducing its bond purchases (aka “taper”). (Maybe “put up or shut up” would be a Compliance-compliant version.)

I expect them to announce that the economy has indeed made “substantial further progress” toward the Fed’s goals of stable prices and maximum employment and as a result, they’ll start tapering down their monthly bond purchases. They’re likely to cut their $120bn-a-month purchases by $15bn a month, which would end the program around June of next year, in line with Chair Powell’s comments that “a gradual tapering process that concludes around the middle of next year is likely to be appropriate.” They’ll probably lay out the taper schedule while stressing that it’s flexible (“the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course…” is what they said when they last started tapering back in Dec 2013.)

The big question for me is, what do they do with the line in the first paragraph of the statement that reads, “Inflation is elevated, largely reflecting transitory factors.” Do they stick with the “we expect these factors to ease” view, like the ECB did? Or do they switch to “more persistent than expected,” like the Bank of Canada? Generally speaking, central banks don’t like to make sudden changes in their stance, so I’d expect them to lean more toward the ECB’s way of speaking, perhaps leaving in the word “transitory” but noting that supply constraints and shortages may keep inflation elevated into next year. There’s likely to be talk about “monitoring inflation carefully” and “prepared to adjust the stance of monetary policy as appropriate,” etc. Note that “carefully” is not just tossed into the statement to fill up space – it really does mean that the Committee is on high alert about something.

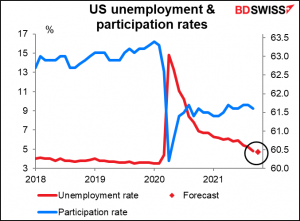

Regardless, I would expect Powell & Co. to stress that “lift-off” – the first rate hike – will not necessarily follow on the heels of the end of the bond purchases. Powell pointed out in his September press conference that the Fed has a “different and substantially more stringent test” for raising rates than the “substantial further progress” benchmark, namely “maximum employment” and inflation sustainably at 2%. The inflation part is probably met, so it comes down to what the Fed thinks “maximum employment” is. I don’t know, but I’d guess that an unemployment rate of 4.7% (as forecast for Friday’s US employment data) and in particular a participation rate of 61.6% (as in September) is nowhere near it.

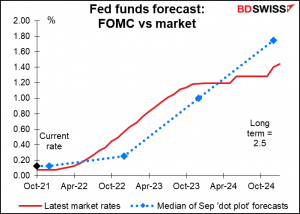

Currently the market has a more aggressive view on rates than the Fed does for next year and 2023, but not for 2024. Unlike ECB President Lagarde, Powell will probably not push back that aggressively on this pricing, due to the inherent uncertainty about the inflation outlook. If Powell retreats from his “transitory” mantra and admits the possibility that the market is correct, we could see rate expectations for 2023 and especially 2024 rising. That could push the dollar higher.

Bank of England: a “live” meeting

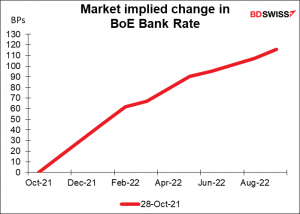

The Bank of England (BoE) has been clear about its hawkish bias. At its August meeting it said that “some modest tightening of monetary policy over the forecast period was likely to be necessary…” At its September meeting, it raised the ante by saying that “Some developments during the intervening period appear to have strengthened that case…” Since then, a couple of senior members of the Monetary Policy Committee (MPC) have been dropping not-so-subtle hints that the time might be now. Gov. Bailey recently stated flatly that the Bank “will have to act and must do so if we see a risk, particularly to medium-term inflation and to medium-term inflation expectations.” “And that’s why we at the Bank of England have signalled, and this is another such signal, that we will have to act,” he said.

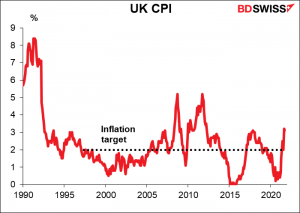

It’s true that inflation in the UK is high and probably rising. Although the rate came down a bit in September, the Bank’s new Chief Economist, Huw Pill, recently said that it was likely to rise to “close to or even slightly above 5%” early next year. That’s far above their 1%-3% “zone of tolerance.” It hasn’t been that high in 10 years (since Sep 2011). More to the point, it’s only been 5% or above for three months since Britain’s historically high inflation came down in the early 1990s.

However, I think Gov. Baily may have promised more than he can deliver at this meeting.

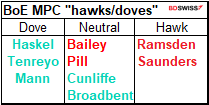

The way the MPC works is that the Governor “invites” the Committee to vote on a proposition that he believes will be supported by the majority of MPC members. The MPC’s decision reflects the votes of each individual member rather than a consensus of the committee. If there is a tie, the Governor casts the deciding vote.

Since the pandemic began, the votes have been unanimous to keep rates unchanged. It would be unusual – although not unprecedented – for them to suddenly turn around and tighten policy.

The MPC has voted to raise rates 21 times since the Bank of England became independent in 1997, and only six of those times followed meetings when officials had voted unanimously to keep rates unchanged. Most of the time the change is preceded by dissent. Taking for example the last hiking cycle, Kristin Forbes voted to raise rates in March 2017 in an 8-1 vote and by the June meeting Michael Saunders and Ian McCafferty joined her. She subsequently left the MPC and in August and September the vote was 7-2, but by November it was 7-2 in favor of hiking (Jon Cunliffe and Dave Ramsden being the “nays.”) Similarly in June 2018 the vote was 7-2 to keep rates stable, while the next month it was 7-2 in favor of hiking.

This time around, no one has voted to hike rates since the pandemic began, although two – Ramsden and Saunders – did vote at the last meeting to stop the BoE’s quantitative easing program “as soon as practical…rather than continuing it until around the end of the year, as currently planned.” These two might well vote to hike rates this time, as perhaps would Chief Economist Pill.

But with three definitely in the “dove” camp, the decision would require both of the centrists – Jon Cunliffe and Ben Broadbent – to move over into the hawk camp. Unfortunately neither gentleman is especially voluble and so we don’t know exactly what they’re thinking nowadays, but it seems unlikely to me that they’ve been converted. If one voted to tighten then Gov. Bailey could break the tie, but with so many uncertainties in the world – the virus plus all the Brexit issues – is now really the time for such a close vote on a major change?

I think Gov. Bailey has painted himself into a corner and is likely to find that he doesn’t have the votes to tighten at this meeting. I would expect then for him to propose to keep rates unchanged and for there to be several dissents, paving the way for a rate hike at the December meeting. This would probably disappoint the market, which is pricing in a 62% chance of a 25 bps rate hike at next week’s meeting – or maybe 100% chance of a 10 bps hike. Failure to hike rates at this meeting would probably be negative for GBP.

Norges Bank: no idea

I don’t follow Norges Bank, the NOK, or the Norwegian economy. Life is short, my time is limited, and we do little business in the currency. In any case, they raised rates at their last meeting on Sep. 23rd and the market doesn’t expect them to raise rates again this time. Nonetheless, it may be worth looking at what they say, given that they were the first G10 central bank to hike rates in this cycle.

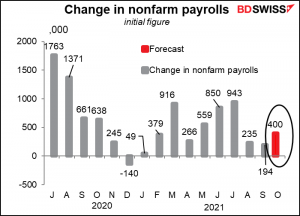

Nonfarm payrolls: an anticlimactic figure

Friday’s US nonfarm payrolls (NFP) figure, usually the highlight of the month, is likely to be anticlimactic this time. We’ve been watching this series like a hawk for several months to see if the increase in jobs is enough to meet the Fed’s “substantial further progress” benchmark for tapering. But assuming that we get the tapering announcement on Wednesday and that “lift-off” won’t come until after they’re through tapering next June at the earliest, what importance does the NFP figure hold anymore?

As mentioned above, the Fed has a “more stringent test” for lift-off. “Maximum” employment has been defined to be not just the headline unemployment rate, but “broad and inclusive” employment. The participation rate is probably as important as the unemployment rate nowadays, I should think. Digging even deeper, minority employment and the employment ratio — the percentage of the population that is currently working – are important too. I went through this topic in great depth and detail a few months ago in my weekly comment A Picture of Maximum Employment. Please take a butcher’s at that if you’re interested.

In any case, further progress on jobs will be necessary to see lift-off, so although we’re not at a tipping point right now, the data will still be closely watched.

The headline figure is expected to be good but not great, in line with what we’ve been seeing in recent months. Not as good as June or July but better than August or September.

As mentioned above, the unemployment rate is expected to fall to 4.7% from 4.8%, but we have to see whether that’s because of more people working or because of people dropping out of the labor force.

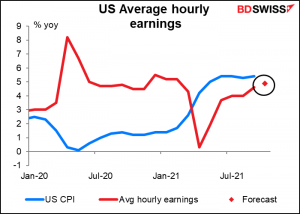

Average hourly earnings are expected to accelerate but to remain below the rate of increase in prices. This means the Fed doesn’t have to worry about a wage/price spiral causing inflation to become entrenched, which would require a stronger response.

Nor for that matter do workers have to worry about seeing their standard of living rise. I wonder though what the impact of compositional changes has on this index – that was a big factor earlier in the pandemic, when poorer-paid workers were dropping out and higher-paid workers were a bigger share of the index, which boosted the rate of growth. I would hope that that phenomenon is being reversed.

Of course ahead of the NFP, we get the ADP Employment Report on Wednesday. And Canada also releases its employment data on Friday – last month that pushed CAD up significantly (USD/CAD lower). New Zealand also releases its employment data on Wednesday.

Other data next week are relatively scarce. Wednesday we get the manufacturing purchasing managers’ indices (PMIs), the final ones for those countries that have preliminary versions and the one-and-only ones for the rest. The service-sector PMIs come out on Wednesday.