Rates as of 06:00 GMT

Market Recap

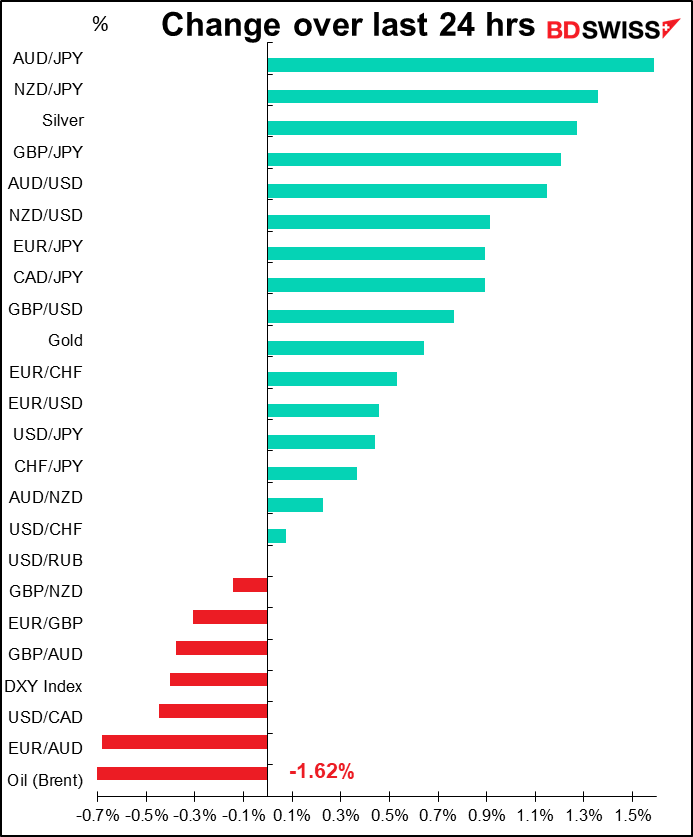

Interesting market! The dollar is down despite a more hawkish-than-expected result from the rate-setting Federal Open Market Committee (FOMC).

The FOMC raised the target rate for the fed funds rate by 25 bps, as expected, with one member voting for a 50 bps hike. It said it anticipates “ongoing increases” in rate will be appropriate. In addition, the Committee expects to begin reducing its balance sheet “at a coming meeting,” which Fed Chair Powell indicated could be as early as May. The statement also noted the conflict in Ukraine and “related events are likely to create additional upward pressure on inflation and weigh on economic activity.”

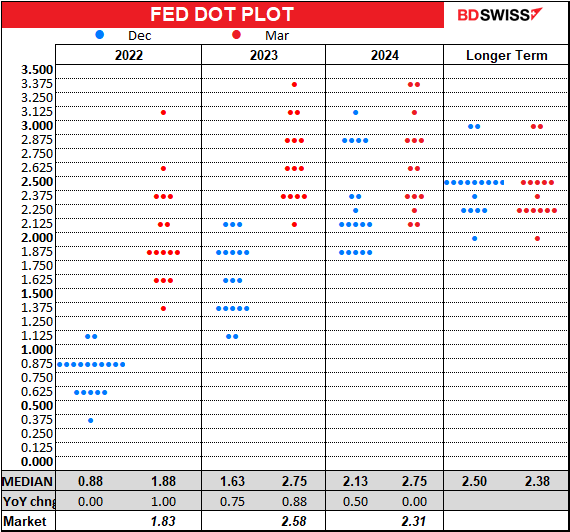

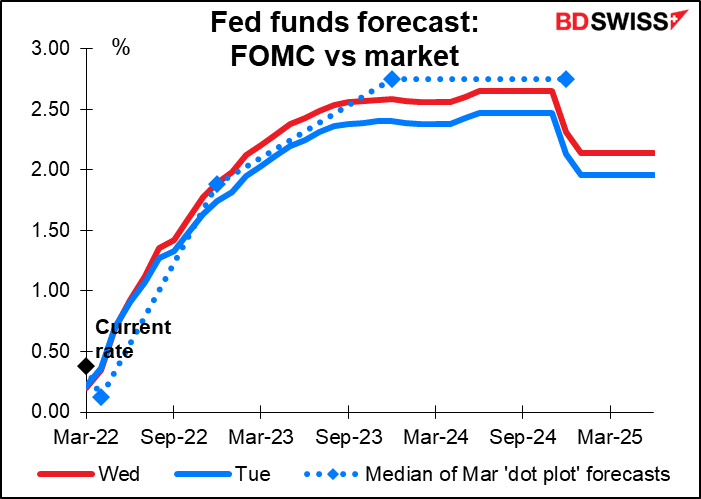

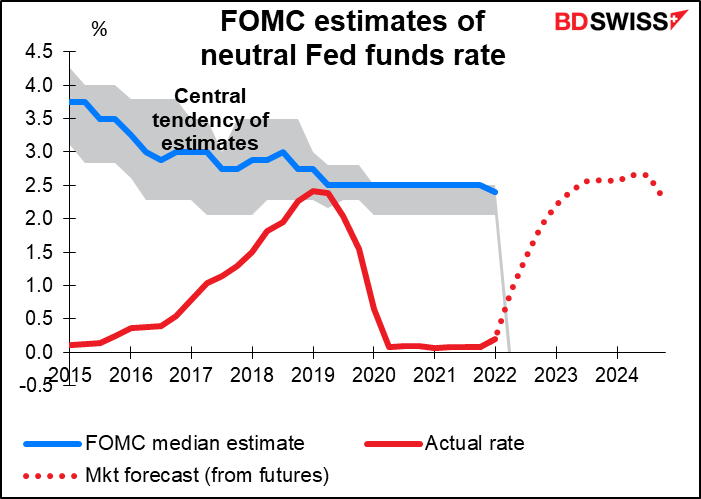

The Committee’s new forecasts for the fed funds rate are much more aggressive than they were just three months ago. They confirmed the market’s estimate of seven rate hikes this year but they are more aggressive than the market for 2023 and 2024 and certainly much more aggressive than the market had anticipated. On Tuesday, before the meeting, the market expected the end-2023 rate to be 2.40%, for it to peak in June at 2.47%, and to end the following year at 2.13%.

Notice also how much more disbursed the forecasts are, especially for this year (125 bps from highest to lowest estimate vs 75 bps before).

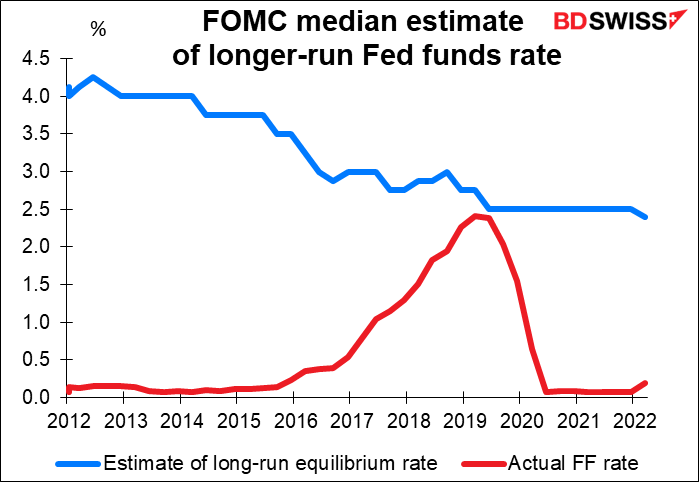

It’s significant that a) the median estimate of the long-run level for the fed funds rate, i.e. the neutral level, fell by 10 bps to 2.4%, and b) the Committee’s median estimate of where rates would be at the end of 2023 and 2024 is above that. In other words, they now expect not just to return policy to neutral but to make it slightly restrictive.

This would be a major change for the US economy. We only have estimates of the “neutral rate” going back to 2012, but the FF rate hasn’t been anywhere near that during the following decade, except for a brief moment in 2019 when it approached that level (it got up to 2.45% in April 2019).

In his press conference, Fed Chair Powell said that every meeting was “live,” meaning that they didn’t have a preset plan for raising hikes at each meeting but rather would go into each meeting and decide what to do based on the data. He noted that the Fed would move more quickly if appropriate, meaning that they could hike by 50 bps at a time if necessary. But he also said that the move to trim the Fed’s balance sheet – quantitative tightening — will equate to approximately one more hike.

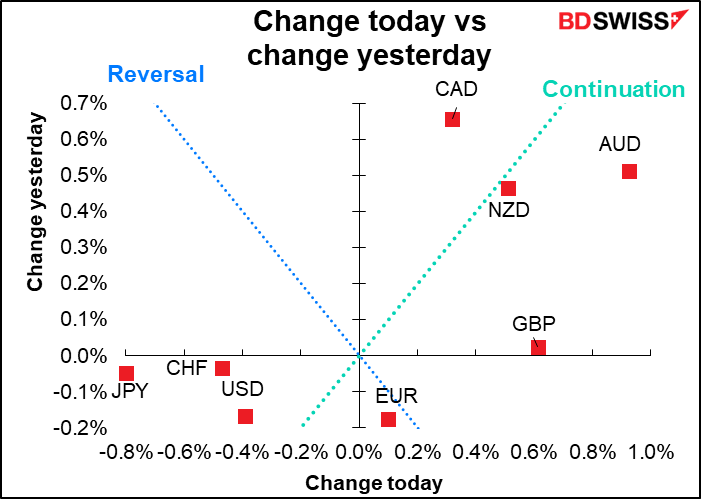

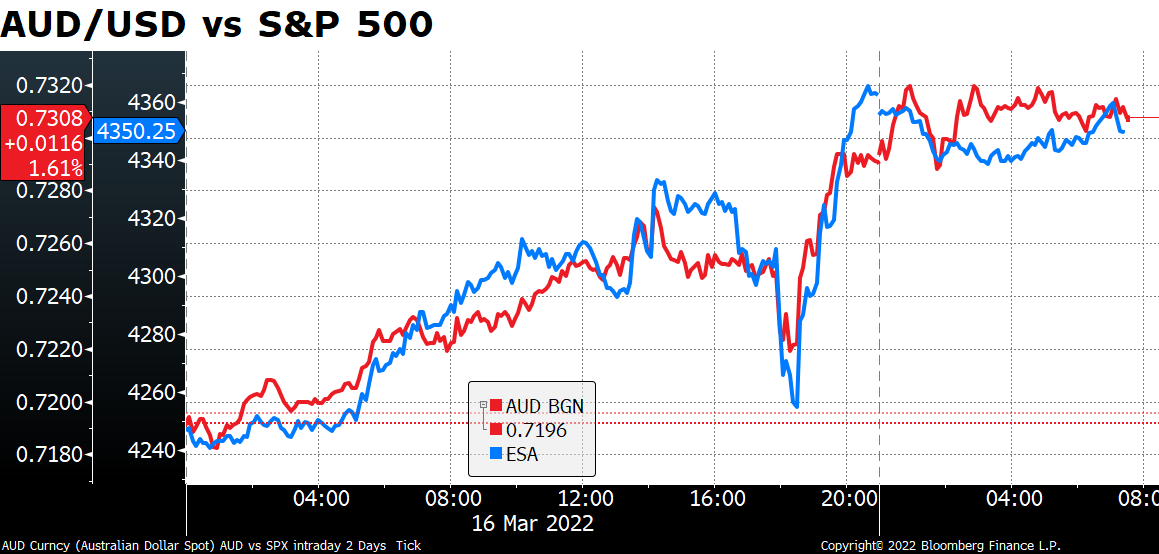

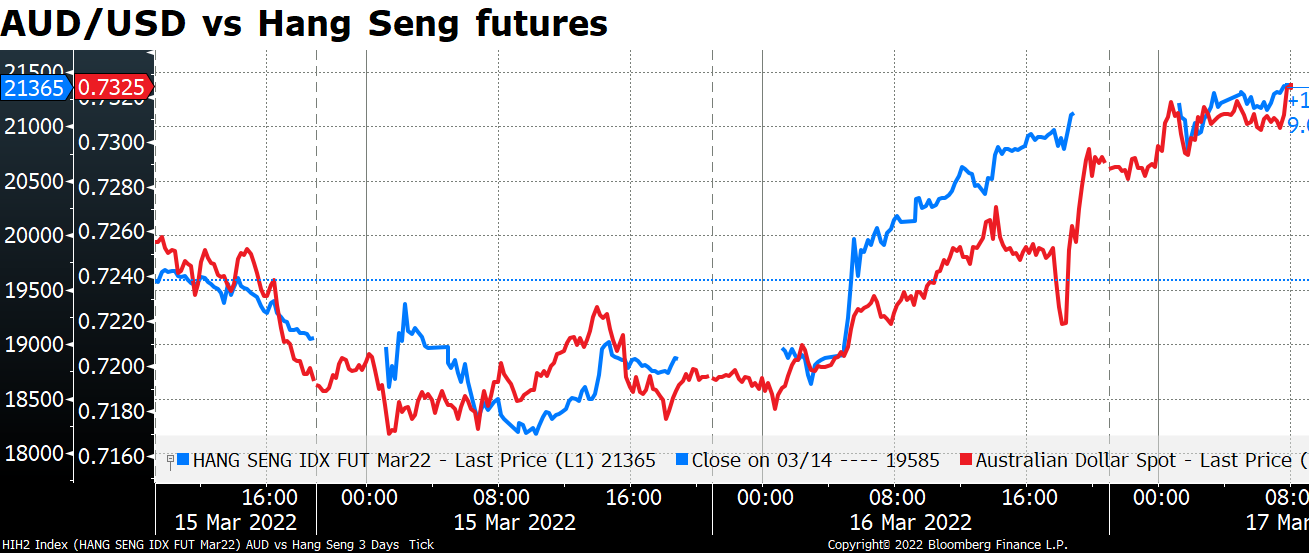

So why didn’t the dollar gain? Because of risk sentiment. The commodity currencies gained as risk sentiment improved. You can see how AUD/USD tracked the S&P 500 index pretty closely during the day.

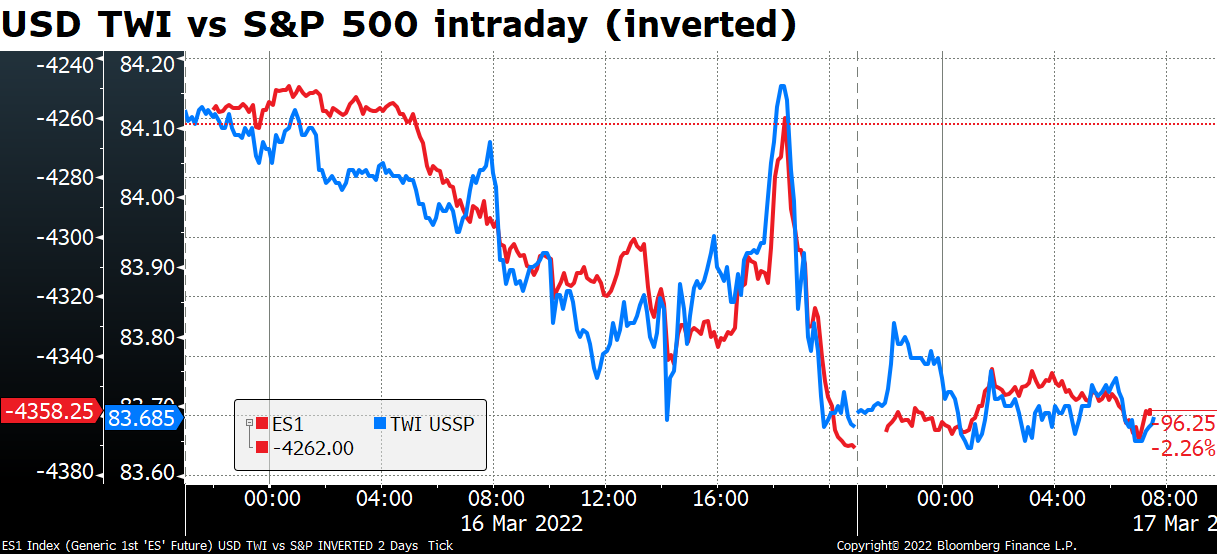

The USD trade-weighted index did too – except in reverse. It appears that the moving force for USD at the moment is risk sentiment, not monetary policy.

That then raises another question: why were stock markets so enthusiastic about the prospects of the Fed tightening into restrictive territory?

First off, Chinese stocks have reversed course dramatically on China’s moves to restore confidence in their economy and capital markets. China’s State Council pledged a more proactive monetary policy and an increase in credit growth, and urged financial institutions to increase their support to the real economy. The authorities also disclosed plans on auditing of companies with American Depository Receipts (ADRs) so that Chinese stocks can continue to trade in the US. China also announced a new Covid treatment strategy that is aimed at balancing Covid containment with economic activity. This raises hopes that the increase in cases there won’t cause the economy to shut down, which would send ripples (more like tsunamis) through supply chains around the world.

As you can see, AUD/USD has been trading along with the Hang Seng index for the last several days, too.

There were also increased hopes for a settlement of the Ukraine war, either through fighting or negotiations. Ukrainian President Zelenskyy addressed the US Congress via a video conference. He asked for a “no-fly zone” to help Ukraine defend their cities or more military supplies if the no-fly zone was not possible. US President Biden later announced that the US would provide more military aid to Ukraine.

Meanwhile there were some optimistic signs about the negotiations between Ukraine and Russia. According to the FT, Ukraine and Russia have made significant progress on a tentative peace plan including a ceasefire and Russian withdrawal if Kyiv declares neutrality and accepts limits on its armed forces, according to five people briefed on the talks. The 15-point draft considered that day would involve Kyiv renouncing its ambitions to join NATO and promising not to host foreign military bases or weaponry in exchange for protection from allies such as the US, UK and Turkey, the people said.

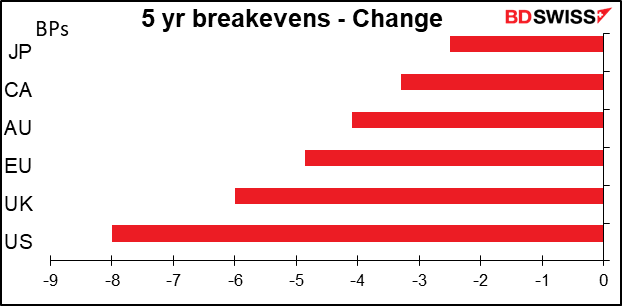

With hopes for a settlement increasing, inflation expectations came down. The price of some commodities affected by the fighting fell sharply – wheat was -7.7%, corn -2.8% (although energy prices generally rose). Lower inflation expectations probably mean less tightening will be required – good for stock markets.

Also, Fed Chair Powell was quite optimistic about the outlook for the US economy and its ability to withstand the tightening. That may also have bolstered confidence in the stock market.

Can this “risk-on” mood continue? It all depends on what happens with the fighting in Ukraine. I’m not a military expert so I don’t claim any unusual insights into this. Nonetheless I do have an opinion even if my opinion isn’t worth very much. It seems to me that Putin was planning for a quick & easy invasion. That hasn’t worked out at all and every day is an embarrassment to his fighting forces. If he can get out quickly with some face-saving exit, I think he’s likely to take the opportunity to cut his losses. Meanwhile the Ukrainians probably don’t want a long-running war of attrition. Both sides therefore have an incentive to come to an agreement sooner rather than later. I’m relatively optimistic. But this is not my field so it’s only my opinion.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The big events on the schedule are the Bank of England Monetary Policy Committee (MPC) meeting today and the Bank of Japan Policy Board meeting overnight. I covered them both in some detail in my Weekly Outlook: The Next Three (the three in this case being the three central bank meetings this week). So I’ll just summarize what I said there.

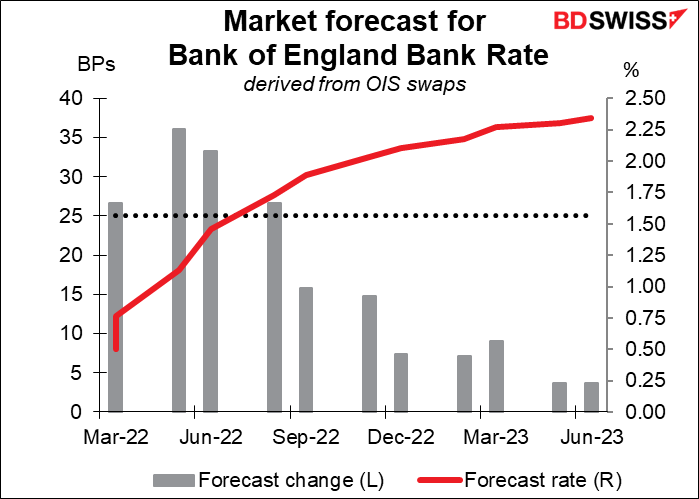

Bank of England: There doesn’t seem to be any doubt in anyone’s mind that the Bank of England will raise its Bank Rate by 25 bps at its meeting next week. The question is, how quickly are they likely to raise rates after that?

Note that while the market has priced in a 25 bps hike at this meeting, it’s pricing in a 37 bps hike at the May meeting and a 33 bps hike at the June meeting. In other words, a good chance of a 50 bps hike at one of those meetings.

This assumption comes from the fact that at the last meeting, in February, four of the nine members of the Monetary Policy Committee (MPC) voted for a 50 bps hike. But it’s by no means certain that they would still vote that way, given the impact of the war in Ukraine and its impact on the UK and global economy.

Do they want to risk adding an interest rate shock to all the other shocks the country is suffering from? On the other hand, do they want to risk inflation expectations becoming “embedded” and therefore risk a wage/price spiral or simply companies taking advantage of the environment to boost profits?

This is the tough balancing act that they will have to confront. Given the risks from the fighting in Ukraine, I expect that they will come out on the dovish side. Last time, four of the nine MPC members voted for a 50 bps hike. I’d expect fewer than before. That might lower the odds of a 50 bps hike at the next two meetings, which would be negative for the pound.

Bank of Japan: I don’t expect anything particularly interesting from this meeting. They won’t release an updated Outlook Report this month so we won’t know what the authorities are thinking about inflation. Gov. Kuroda is likely to discuss the issue in his press conference following the meeting. He’s likely to allude to the possibility of a downturn in growth due to the war, as other central bankers have, vs the likelihood of higher inflation.

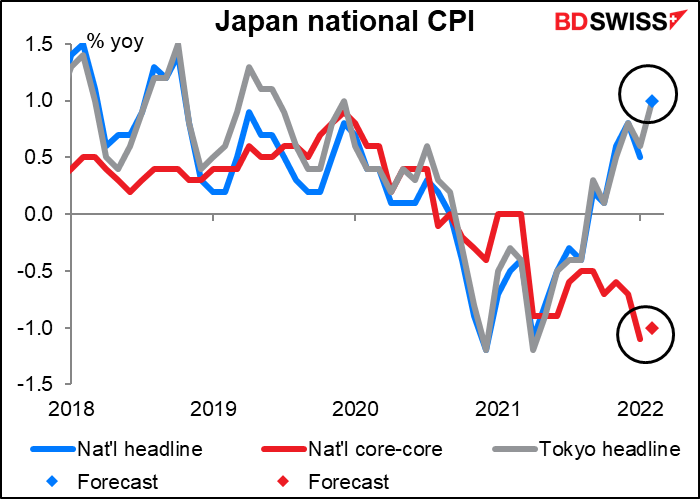

The main question for me is whether Gov. Kuroda will stick to his view that inflation won’t hit 2%. He dismissed the possibility in his press conference in January, but that was before the invasion and the surge in commodity prices. It also ignored the basic arithmetic of Japan’s cut in mobile phone charges. Once that drops out of the equation, inflation “may momentarily rise to a level close to 2%,” as Policy Board member Junko Nakagawa said recently.

Japan’s national consumer price index (CPI) will come out a few hours before the meeting concludes. The headline number is expected to rise sharply to 1.0% yoy from +0.5%. That would be the same as the Tokyo CPI for the month and so would be no big surprise. The “core-core” CPI however – excluding fresh foods and energy, the same as most other countries’ core inflation measure – is expected to remain in deflation. Gov. Kuroda can cite that as evidence that the impact of higher energy prices won’t be enough to push Japan over the line and reason to justify no change in policy.

Today’s indicators

The European day kicks off with the annual ECB and Its Watchers conference in Frankfurt, #22 this year. I like this conference a lot because when I was a kid I used to read Marvel Comics. Every year I hope that a number of the Marvel extraterrestrials, The Watchers, will appear from their home in Watcherworld and give the ECB the benefit of their billions of years of experience. Alas in this case The Watchers are “various monitoring groups, independent academics and market participants.” How disappointing.

Human participants include several ECB bigwigs including President Lagarde, Chief Economist Lane, Executive Board Member Schnabel, as well as a bunch of academics you’ve never heard of, plus the ECB’s first Chief Economist, Otmar Issing, who at age 86 is an example to us all. They will be discussing “Monetary Policy: From the Pandemic Crisis to New Challenges,” “Monetary Policy and Climate Change,” and “Monetary and Fiscal Interactions.”

Much of the conference will be live-streamed this year so you may be able to catch it if you want. The full agenda is available here.

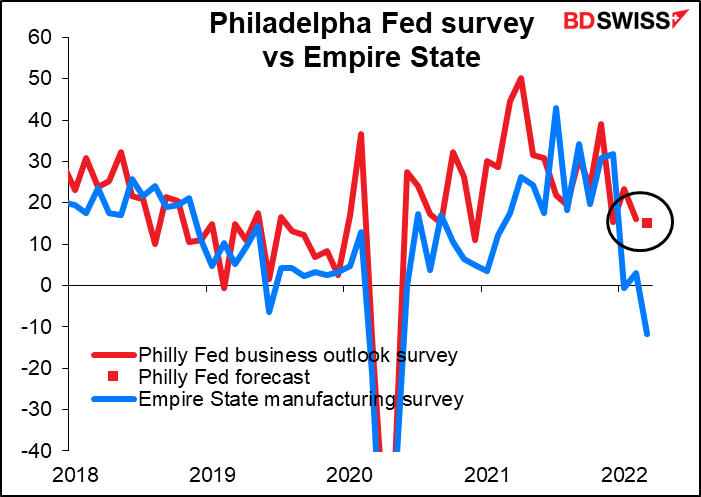

The Philadelphia Fed business sentiment index is expected to be down slightly. This is in contrast to the Empire State manufacturing index, which was out on Tuesday and was expected to be up slightly. You see, economists generally assume that these two will converge so every month they pretty much predict that the higher one will be lower and the lower one will be higher.

However, the Empire State index plummeted into negative territory – the lowest since May 2020, shortly after the pandemic began — as orders fell and delivery times lengthened. Oops! We’ll have to see whether the forecasts for this one fare any better. If they’re both down sharply, that may cause people to reassess their view of the US economy and how fast the Fed can tighten rates.

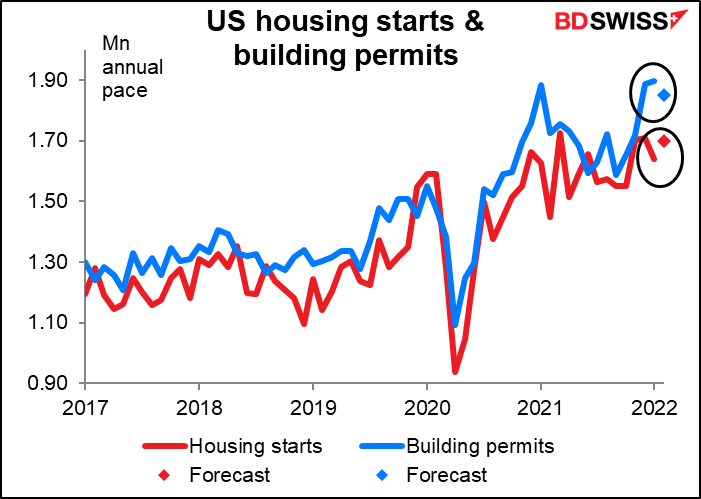

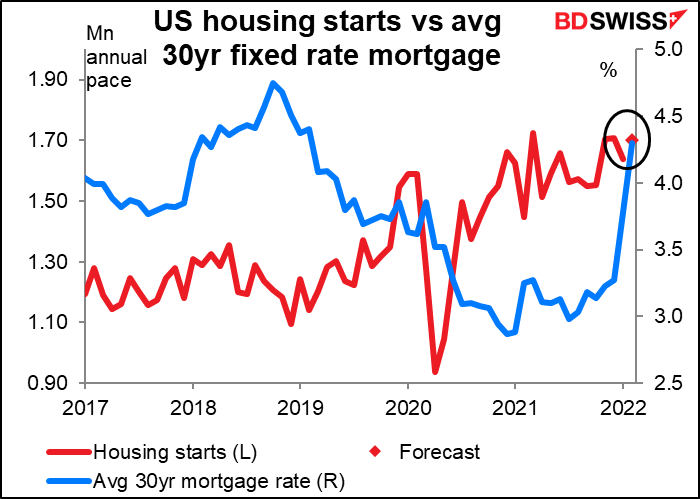

US housing starts are expected to be up a bit, more or less continuing the uptrend that they’ve been in for the last year or two. Building permits are expected to fall a bit but given that last month was the highest since the heady days of the pre-Global Financial Crisis housing boom, that’s understandable.

Mortgage rates have gone up by 113 bps to 4.43% from 3.30% just this year, but it hasn’t derailed the housing market yet. Rates are sure to rise further though as the Fed has stopped buying mortgage-backed securities and is hiking rates. Whether the housing market can remain strong is a major question for the US economy.

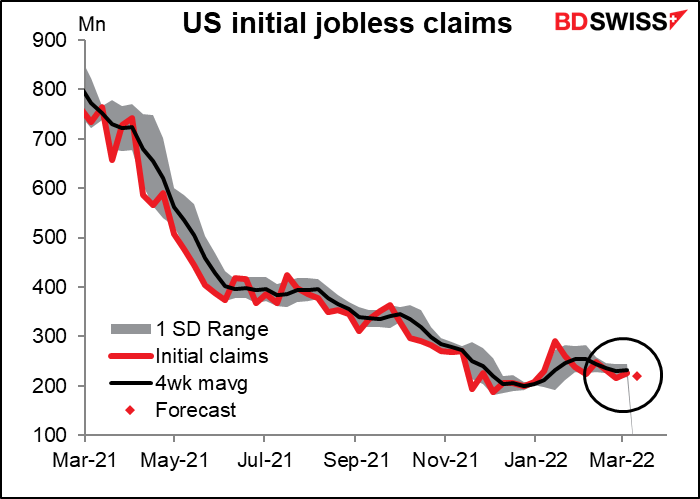

Initial US jobless claims are expected to be down by 7k after being up 11k the previous week. I can’t see many people getting particularly excited about that. It’s basically just sideways from here, I expect. I think this indicator’s 15 minutes of fame is over.

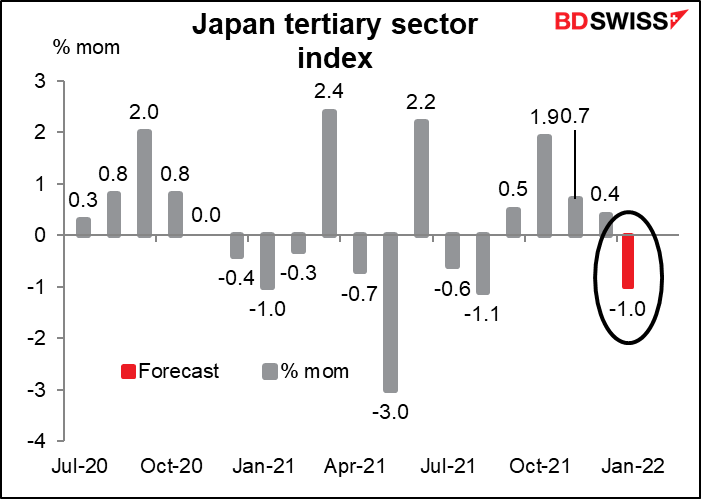

I discussed Japan’s consumer price index above. We also have Japan’s tertiary sector index out today. I’m amazed it has such a high Bloomberg relevance score, since the service-sector purchasing managers’ index and the Eco Watchers’ survey cover the same territory and come out earlier, but this is the way it is. The index is expected to be down sharply, as one might expect in a month when the service sector PMI fell a whopping 4.5 points into contractionary territory (to 47.6 from 52.1).

There’s a good but not excellent correlation between the two indicators.