The world of dew

is a world of dew.

And yet, and yet—

Haiku by Kobayashi Issa, 1763-1827

One of the main themes of Japanese aesthetics is the transitory nature of life. Influenced by Buddhist thought, the Japanese of old were acutely aware of nature’s impermanence. They perceived beauty, even if mournful, in the transient nature of existence. The poet Issa for example saw the world as a dewdrop perched precariously on a blade of grass, gone in an instant, as in the above poem composed after his infant daughter died of smallpox. Sei Shonagon, a court lady writing around the year 1000, wrote “how precious to me are all things that die and fade away.” Mono no aware: the ‘pathos in things’, a special feeling for the ephemeral and impermanent, was the essence of beauty.

What then would they have made of the argument now about whether the recent relatively high level of inflation is “transitory?” In their minds, everything was transitory.

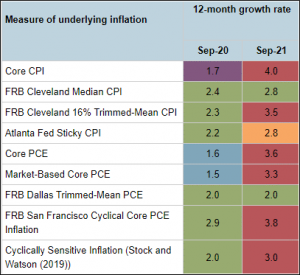

The Atlanta Fed’s underlying inflation dashboard shows that while a year ago most measures of inflation were within the target range (±0.25% of the 2% target), now most are well above target.

This above-target inflation could be just what the Fed ordered. From last year they have been operating under what’s called the “flexible average inflation targeting (FAIT)” regime. They explained this new regime in their Statement on Longer-Run Goals and Monetary Policy Strategy:

In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

The Fed purposely left undefined how high “moderately” is and how long “some time” is. That was easy to say when inflation was below target, but now that it’s above, they have to decide when enough is enough.

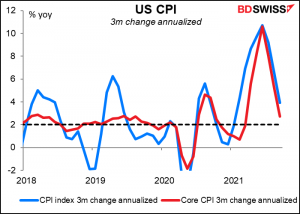

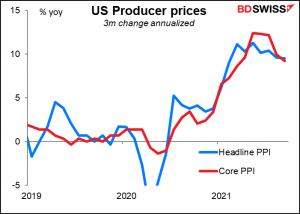

There’s no doubt that inflation is slowing. If instead of looking at the 12-month change in prices, we just look at the three-month change and annualize it, we can see that inflation is slowing at both the consumer and producer level.

But is it slowing quickly enough? How long will it take for it to get back to the 2% target? Will it get back there of its own accord, or will it need some “help” from the central bank?

The question then is not over whether the current higher level of inflation is “transitory.” It’s how long can something exist and still be called transitory?”

Originally people had thought that it might take a few months for the world to come out of hibernation and readjust to the new level of demand. Car rental companies that had sold off their fleets would have to buy new cars. Airlines that had mothballed airplanes would have to get them out of storage. Companies that furloughed employees would have to call them back. This would take some time, but pretty soon we’d be back to normal.

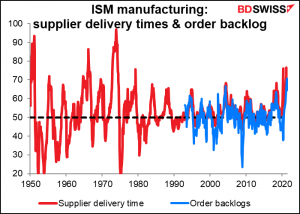

Now it looks like it might take longer than that as supply chain woes hit every industry. Looking at the Institute of Supply Management’s manufacturing purchasing managers’ indices (PMIs), the “supplier delivery PMI” was recently the highest since 1974 (the aftermath of the 1973 oil shock) while the “order backlogs” PMI was at a record high (data back to 1993).

Executives at S&P 500 companies have mentioned the phrase “supply chain” about 3,000 times on investor calls, according to Bloomberg. That’s far more than in any other year.

Just one example: Lead times in the semiconductor industry — the gap between putting in an order for semiconductors and taking delivery – has hit an average of 21.7 weeks or five months, according to Susquehanna Financial Group. In 2018/19 the highest was 14.3 weeks, so this is 50% longer.

I wonder if “persistent” will replace “transitory” as the new central bank “mantra,” as in these lines from the minutes of the September meeting of the Federal Open Market Committee (FOMC):

Most participants saw inflation risks as weighted to the upside because of concerns that supply disruptions and labor shortages might last longer and might have larger or more persistent effects on prices and wages than they currently assumed.

With regard to inflation, upside risks cited included the possibility that elevated levels of inflation would continue for longer than expected, especially if labor and other supply shortages proved more persistent than currently anticipated…

The Bank of England also made mention of “persistent” after their September meeting, as in:

Against a backdrop of robust goods demand and continuing supply constraints, global inflationary pressures have remained strong and there are some signs that cost pressures may prove more persistent.

Indeed, some Fed officials are already pushing back against the idea that higher inflation is only “transitory.” “Transitory is a dirty word,” said Atlanta Fed President Bostic (V) in a virtual speech to the Peterson Institute for International Economics earlier this week. He spoke with a glass jar labeled “transitory” at his side, depositing $1 each time he used the “swear word,” as it’s become known to him and his staff. “It is becoming increasingly clear that the feature of this episode that has animated price pressures — mainly the intense and widespread supply-chain disruptions — will not be brief,” Bostic said. “By this definition, then, the forces are not transitory.”

Issa and Sei Shonagon might disagree with Bostic – in their view, the world and everything in it was transitory – but to our modern-day way of thinking, “transitory” is beginning to segue into “persistent.” That’s likely to induce a whole different set of responses from central banks, starting with the Fed and the Bank of England.

Next week’s schedule: Inflation indicators, preliminary PMIs

In a week without any central bank meetings, the focus will be on CPI data from New Zealand (Monday), UK and Canada (Wednesday), and Japan (Friday). Transitory or persistent?

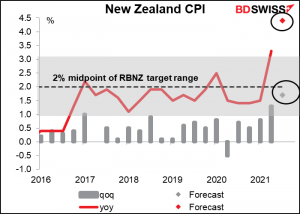

New Zealand only announces its CPI quarterly, which means there’s more riding on each announcement than usual in most countries. The NZ CPI was already above the Reserve Bank of New Zealand’s target range and this time is expected to leap higher. Nor can it be attributed to base effects, as the qoq increase is expected to be a stunning 1.7% qoq – not the highest on record (that was 8.9% qoq in Q4 1986) but the highest since +2.3% qoq in Q4 2010.

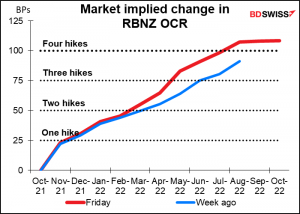

The market has been revising up its estimates of how quickly the RBNZ might normalize policy. A further rise in inflation could push these expectations up even further. That could be beneficial for NZD.

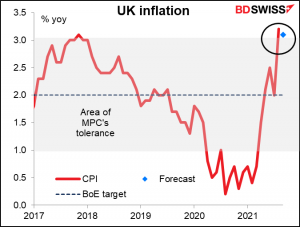

UK inflation is expected to slow slightly (to 3.1% yoy from 3.2%) but I don’t think that will calm anyone’s concerns about inflation in the UK. As mentioned above, the Bank of England is worried that “there are some signs that cost pressures may prove more persistent.”

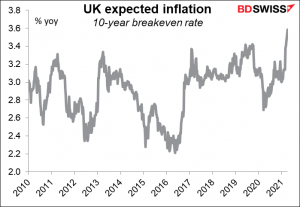

UK breakeven inflation rates have recently risen to a record high, so clearly the market shares the Bank’s concern. They won’t have missed this clue. (UK breakevens are much higher than other countries’ because they are based on Britain’s retail price index, which is constructed differently from the standard consumer price index and is therefore higher – currently 4.8% yoy vs 3.2% for Britain’s CPI.)

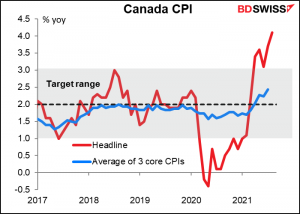

No forecast available at the time of writing for the Canadian CPIs. At 4.1% yoy the headline figure is already far above the 1%-3% target range. The three core CPI measures, which are what the Bank of Canada says it looks at to evaluate inflation, are still within the band but are creeping up slowly.

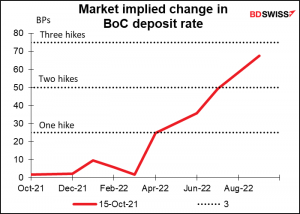

The market currently doesn’t see the Bank of Canada moving until April of next year. This inflation figure could move that date forward – or backward, perhaps.

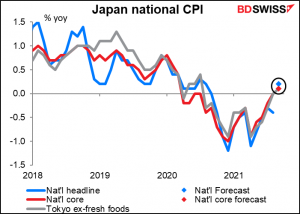

Japan is expected to exit deflation (just barely). This would be no surprise as the Tokyo CPI rose from -0.4% yoy in August to +0.3% yoy in September, although “core-core” CPI – excluding fresh food and energy – was still down 0.1% yoy. (“Core” inflation in Japan only excludes fresh food, not energy as it does most everywhere else.)

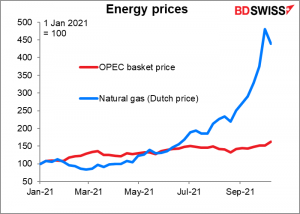

Going forward, higher prices for liquified natural gas (LNG) could have a significant impact on Japan, which is the world’s largest importer of LNG. Nonetheless, around 80% of the country’s LNG imports are on long-term contracts linked to crude oil import prices, and crude oil prices have gone up much less than LNG prices. Oil import prices tend to lead LNG import prices by about six months. This means the headline CPI is likely to be under upward pressure from higher energy prices for some time.

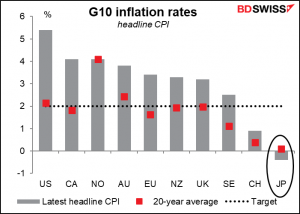

Nonetheless, the higher energy prices might not fully offset the negative impact of lower mobile phone prices on core inflation. Furthermore, the Kishida administration is considering reviving the Suga Administration’s disastrous “GoTo Travel” campaign, a nationwide program to subsidize travel and eating out, which could reduce core CPI inflation by 0.2-0.3 percentage points (never mind that it acted as a giant “super spreader event” – my wife was able to quarantine in a great hotel real cheaply thanks to it). It’s therefore likely that Japan will remain the global outlier with regards to inflation and the Bank of Japan will remain on hold until the Sun Goddess Amaterasu-no-Omikami returns.

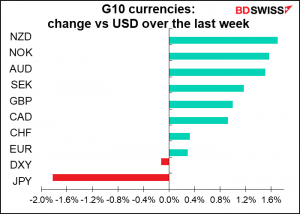

That “monetary policy divergence” is likely to keep JPY on a weakening trend as other central banks begin normalizing policy, in my view. (But please remember I have a daughter in university in Japan and so am structurally short JPY, meaning I’m biased toward believing JPY will weaken.)

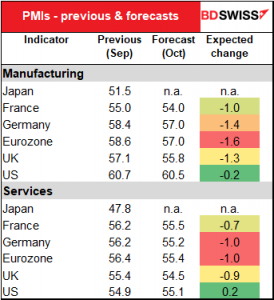

The preliminary purchasing managers’ indices (PMIs) for the major industrial economies will be released on Friday. All the manufacturing PMIs are expected to be lower, while all the service-sector PMIs are expected to be lower except for the US (which is expected to be only slightly higher).

The data would be largely in line with the IMF’s World Economic Outlook, released this week, which trimmed the organization’s global growth forecast against a background of persistent supply chain disruptions and inflation pressures. In that respect it would confirm the existing narrative rather than change people’s views. Nonetheless, the larger expected declines in Eurozone PMIs than in the US could lead to some weakness in EUR.

As for the US, we’ll be looking forward to the “Summary of Commentary on Current Economic Conditions,” aka The Beige Book on Wednesday, as always two weeks before the next FOMC meeting. It’s significant for the market because the first paragraph of the statement following each FOMC meeting tends to mirror the tone of the Beige Book’s characterization of the economy. The book doesn’t have any number attached to it that quantifies its contents, but many research firms do calculate a “Beige Book index” by counting how many times various words appear, such as “uncertain,” or nowadays probably “supply chain,” “transitory,” and “labor shortage.” In any case, the book is largely anecdotal so you’ll just have to watch the headlines as they come out.

Other major US indicators out during the week include industrial production (Monday), housing starts (Tuesday), and the Philadelphia Fed business survey (Thursday).

Britain releases its retail sales on Friday, as does Canada.

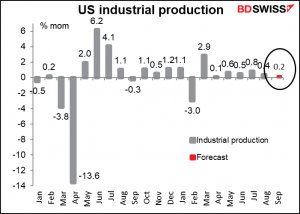

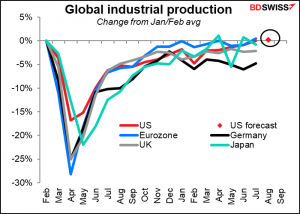

The only major US indicator during the week is industrial production on Monday, but even that isn’t so big for the FX market. It’s expected to be up slightly.

This would put the US ahead of the other major industrial economies, although they haven’t yet announced their September figures so perhaps the comparison is a bit unfair.

In addition, we get US housing starts on Tuesday and the Philly Fed index on Thursday. Plus the earnings season gets further underway.

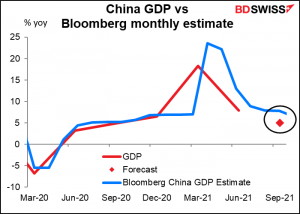

Early Monday, China comes out with its three major monthly economic indicators (industrial production, retail sales, and fixed asset investment) plus this month the all-important GDP figure.

The annual rate of growth in GDP is expected to slow to +5.0% yoy, Bloomberg’s monthly GDP estimate for August was +5.3% yoy, so the forecast is reasonable.