There’s a discrepancy like I’ve never seen before in the markets nowadays.

On the one hand, this is clearly the worst downturn in the economy most people alive today have ever experienced. Depending on how long it goes on for, it could be the worst ever. Yesterday’s purchasing managers’ indices (PMIs) were astonishingly bad.

The Bank for International Settlements (BIS) recently did a survey of forecasts on the subject and found that compared to what they were estimating before, firms now thought output would be 5% to 9% lower for the US and 4%-4.5% for the global economy. A “worst case” scenario would be 11% for the US and 8% for the global economy.

The IMF’s World Economic Outlook (WEO), released on 14 April, estimated that global output in 2020 would be 3% below the level of 2019, “much worse than during the 2008–09 financial crisis.” The BIS added that “There are also possible long-term damages from a prolonged economic shutdown, harder to quantify but potentially significant.”

The St. Louis Federal Reserve has estimated that the US unemployment rate could hit 32% in Q2, worse even than the depths of the 1930s recession (24.9%).

And yet, the stock market has (so far, at least) bottomed earlier and recovered faster than during similar cataclysmic events in the past. Of course, things aren’t over yet – we don’t know what will be the situation a year from now.

Meanwhile, the largest investment-grade bond fund, the iShares iBoxx $ Investment Grade corporate bond ETF, is almost back to its record high, while its high-yield counterpart has recovered half its losses.

Why is this? I can think of two main reasons. The first is that unlike previous crashes, this one was not caused by any structural problems in the economy. Rather, it’s simply a natural disaster, and one that – in theory at least – can be overcome, if scientists can find a vaccine or a treatment. So while the downturn may be the severest we’ve ever seen, the length should be limited. At least, that’s what we thought at the beginning, when everyone (including me) was comparing this event to the SARS epidemic in 2003.

That reason though is looking increasingly untenable as we begin to realize how intractable the disease is and how a “second wave” may well arrive once countries begin to lift the lockdown. Yet even as I write, the S&P 500 is up 1.2% today.

The other reason then is more likely: the incredible flood of money that central banks and governments have unleashed. Simply put, the amount of money that they’ve thrown at the problem is astonishing.

Just looking at the G10, central banks have expanded their balance sheet by some $3.4trn so far this year, with the Fed accounting for 64% of the total.

The significance of that figure? Looking at the IMF’s World Economic Outlook Database, which contains the data on which their WEO is based, the 3% fall in global GDP amounts to $3.7tn. Global central banks have already pumped in almost enough money to make up for the expected loss of output this year.

And that doesn’t count the countless fiscal programs that countries all over the world have embarked on. Just in the US alone, the government has authorized spending of $3.3tn – and counting. The EU is another $1.6tn at least, while Britain is kicking in around $480bn.Japan, China, and the IMF are also contributing, as are a host of smaller countries. Fiscal programs will no doubt surpass $5tn.

The combination of the two amounts to some 6.1% of global GDP. In theory at least that’s more than some forecasters were expecting the economy to grow this year anyway.

My former colleague at Deutsche Bank, Jim Reid, put together the following graphs showing the value of the fiscal and monetary packages combined and how they compare to other rescue packages previously (translated into 2020 dollars). He’s included only the US and the largest European economies. Nonetheless, it already dwarfs anything we’ve ever seen before.

In fact, this program is so much bigger than anything that’s come before that he had to publish the graph in log scale just so we could see the earlier programs.

The question is, can this flood of liquidity and aid support markets long enough to get the global economy over this period? It remains to be seen, but certainly it’s a formidable amount of money.

One of the oldest adages in finance is, “Don’t fight the Fed.” This adage has worked on a global scale for the last 25 years at least.

Of course there’s another adage as well: that “this time is different” is always wrong. However, I would argue that this time really is different. All other crashes that we’ve seen have been financial: caused either by “irrational exuberance” or by the monetary authorities being too loose or too tight. This is the first crash in the modern era caused by a global natural disaster. (There of course have been local recessions caused by such events, such as the Great Hanshin earthquake in 1995 or the 2011 Tohoku earthquake in Japan.) We don’t know how the event will end and we therefore don’t know how the financial markets will turn out.

The coming week: BoJ, FOMC, ECB

There are a variety of interesting statistics out in the coming week, such as the first estimate of GDP from the US and the EU, plus inflation data from Australia, Germany, EU, the US and Japan. But as I explained a few weeks ago (Looking for New Market Drivers, 14 April), the statistics are taking a back seat nowadays to what the authorities have to say. With the Bank of Japan (BoJ) Policy Committee meeting Monday, the US Fed’s Federal Open Market Committee (FOMC) meeting Wednesday, and the European Central Bank’s (ECB) Governing Council meeting on Thursday, the statistics are likely to be in the trunk (= boot in Britain) this week. As the graph above shows, these three central banks have been responsible for most (90%+) of the increase in G10 central bank balance sheets so far this year, so they are the key to what’s happening.

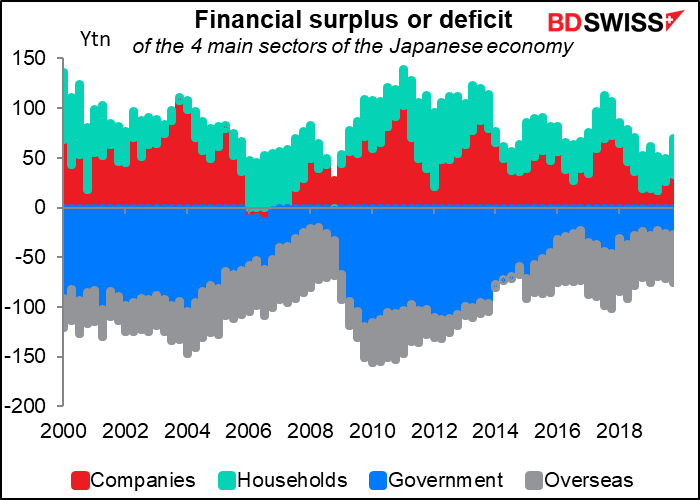

The BoJ meeting has been shortened to one day from its usual two. Nonetheless, it’s widely expected to introduce some new tools to support bank lending for business, as is being done widely throughout the world. Many Japanese firms are well capitalized and the sector as a whole runs a financial surplus (i.e. is a net saver), unlike in most other countries, that surplus has fallen notably in the last few years and there are no doubt many companies, particularly small- and medium-sized enterprises, that will be in financial difficulties as the lockdown begins to bite.

Among the possible measures are to increase its purchases of commercial paper and corporate bonds. It could introduce negative interest rates on its fund-supplying operations, which would help to channel money to companies. There is even some talk that it might buy loans from banks and other financial institutions.

On the other hand, since its current measures have mostly been ineffective, doubling down on them probably wouldn’t be much good. I therefore don’t think they would increase their purchases of equity ETFs or reduce further its negative interest rates. The Nikkei newspaper said the BoJ might discuss abandoning its JPY 80tn target for its annual purchases of Japanese Government bonds and replacing it with an unlimited target. That would be a totally symbolic move, because in fact the BoJ hasn’t hit that JPY 80tn target in a long time.

Further action, or even the promise of further action, to boost inflation is unlikely. Despite its many easing measures over the years, the market seems to have given up hopes of ever seeing any inflation in Japan whatsoever. The BoJ, too.

Its mantra had been that “the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost.” However, it seems to be quietly abandoning this “momentum” idea – never really spelled out in the first place. That sentence was in the January statement but not the 16 March one, and Gov. Kuroda failed to mention inflation at all in a speech earlier this month. Not only has the BoJ been singularly incapable of hitting its inflation target for the last 25 years or so, but its own survey shows that some 80% of households say they don’t want inflation.

The other main point of interest in the meeting – as with most central bank meetings nowadays – will be the revised forecasts. The BoJ provides forecasts in its quarterly Outlook for Economic Activity and Prices report, which is due to be released with this meeting. A serious downgrade in its forecast for growth and, yes, inflation are likely. God only knows how deep. The BoJ’s current forecasts are for 0.9% yoy growth this year with 1.0% inflation. The market however has a different idea: the consensus according to Bloomberg is for GDP to bottom at -4.5% yoy (-10.1% qoq SAAR) in Q2 and then start to recover slowly, with output for the whole year being down 3.2% yoy. Inflation is expected to be zero this year and +0.4% next year.

The Fed

The Fed has already done a whole lot, but it can still do more.

The Fed’s asset purchases so far have been aimed at managing the Treasury market: keeping the market functioning, liquid and stable. It announced a QE program on 15 March aimed explicitly at improving the functioning of the Treasury and agency MBS markets. The sharp decline in Treasury market volatility back to normal levels indicates that it’s been fairly successful so far.

Now the authorities are likely to turn their attention towards easing financial conditions, which have tightened recently, and increasing the degree of policy accommodation.

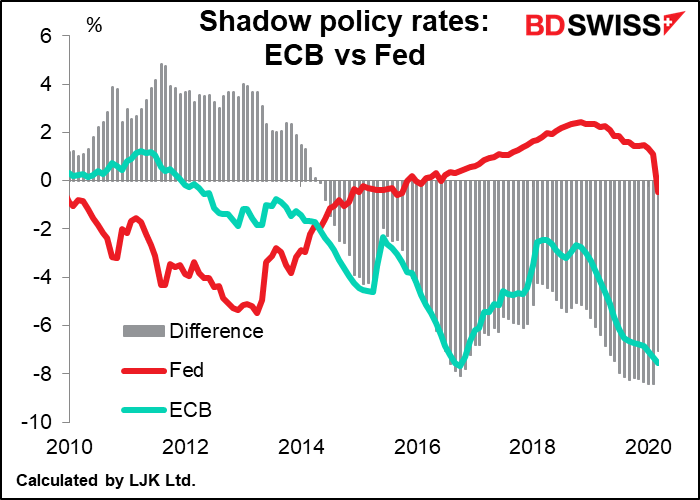

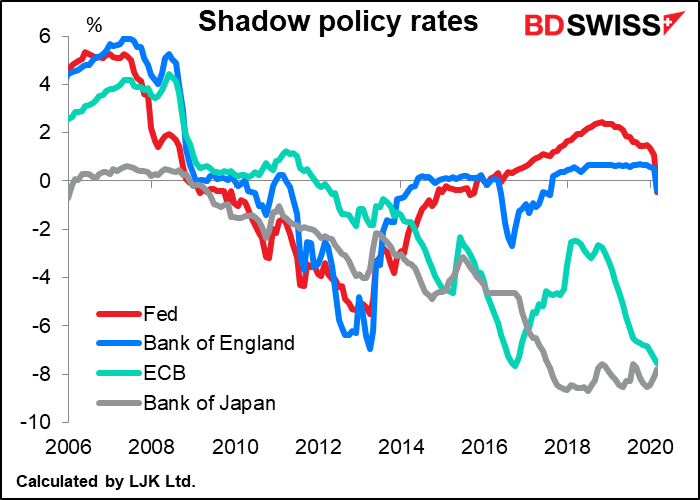

While the Fed’s nominal policy rate is about as low as anyone else’s right now, its shadow policy rate – the rate taking into account the various policy measures that it’s undertaken – is significantly higher than the BoJ’s or the ECB’s (at least it was at end-March – the figures haven’t been updated for April yet.)

As a result, I would expect them to continue to increase the size of their balance sheet, currently some $6.6tn (of which $2.4tn has been added just since the beginning of March). Estimates are that it will have to add another $4tn to that during the year. One idea is for it to replace its weekly purchasing target of $75bn/week with a monthly program of perhaps $150bn a month, perhaps targeting longer-duration bonds. While this would be a reduction in the pace of its purchases, it could emphasize that it was changing the aim from the technical goal of helping the market to function smoothly to the policy goal of improving the transmission of its stance and easing financial conditions.

The Fed’s latest forward guidance is relatively vague, as befits a situation where no one knows what’s likely to happen. They just said that the Committee “expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” With the situation still so uncertain, I suspect that they’ll keep their language vague. The earliest they might change would be the June meeting, which is the next time that they’re scheduled to issue a Summary of Economic Projections together with their notorious “dot plot.” We could then see more concrete language about unemployment and inflation targets.

FX market implications: The tsunami of liquidity that the Fed has flooded the market with, both with its domestic operations and currency swaps with foreign central banks, has been aimed in part at satisfying the very real need for dollars among borrowers both at home and abroad. The fact that the currency swap basis in several currencies has turned positive recently indicates that they have succeeded in satisfying this sudden rush for dollars overseas. If the market perceives that the Fed is going to continue to stuff it with dollars even after borrowers have apparently covered their positions for now, then the dollar could turn into the WTI of the FX market: the price might fall as supply continues to overwhelm demand. That depends on how much the Fed promises to supply and just how serious it sounds about wanting to ease financial conditions further. For the latter we have to wait for Chair Powell’s press conference to see how strongly he emphasizes the Fed’s willingness to act quickly and aggressively if necessary. I expect he will radiate confidence and that the dollar will weaken afterward.

The ECB

The ECB may be the least interesting of the three meetings. It’s already taken a number of significant actions (as have all the other central banks, too). At this meeting I would expect it to stand pat but to reaffirm its willingness to “do whatever it takes” to keep the Eurozone together.

The most important action the ECB has taken was the establishment on 18 March of its EUR 750 Pandemic Emergency Purchase Programme (PEPP). As it currently stands, the PEPP will run at least until the end of this year, perhaps longer if necessary. It also expanded the range of assets that it could buy in the corporate sector purchase program (CSPP) to include non-financial commercial paper. Finally, it eased the collateral requirements for its Targeted Long-Term Refinancing Operations (TLTROs). Together with the governments’ loan guarantee programs, estimated at around EUR 2tn or 15% of Eurozone GDP, these measures should support lending. The ECB also eased some capital requirements for the banks while simultaneously asking them to suspend dividends and share buybacks. And just on Tuesday it agreed to buy “fallen angels,” bonds of companies (and countries!) that were rated investment grade before the crisis hit but were downgraded afterward to levels that normally would’ve made them ineligible for purchase by the ECB.

Nevertheless, it’s clear that the ECB’s job is by no means over. Indications are that financial conditions in the Eurozone remain extremely stressed.

What more could the Governing Council do at this meeting? The most basic thing I would expect would be to reinforce their message of 18 March that “the ECB stands ready to adjust all of its measures, as appropriate, should this be needed to safeguard liquidity conditions in the banking system and to ensure the smooth transmission of its monetary policy in all jurisdictions.”

The “all jurisdictions” part of that is important, because one of the problems they face is widening spreads in the Eurozone periphery. With Eurozone governments unable to decide how to fund the recovery once countries emerge from lockdown, the pressure will be on the ECB to act further, probably by increasing the size of the PEPP or continuing it after the end of the year. Eurozone governments have running bigger deficits and issuing more bonds this year, which may exhaust the PPEP’s target ceiling earlier than expected. They could announce as early as this meeting their intention to expand the PPEP, although I don’t expect that.

I would not expect any further rate cuts, which were rejected at the 12 March and 18 March meetings. The Governing Council said that they would prefer further quantitative easing (QE) if there’s a need to support the economy further. And after that comes the less-than-likely prospects of buying bank bonds or equity ETFs, a la the BoJ.

FX market implications: As mentioned above, one of the Fed’s aims is to lower its shadow policy rate – the policy rate taking into account the impact of quantitative easing measures. Changes in the difference between the Fed and the ECB’s shadow rates explain a lot of the movement of EUR/USD over the past decade. If the Fed succeeds in lowering its shadow rate by increasing its market operations while the ECB stands pat for now, we could see EUR/USD move lower.