Rates as of 04:00 GMT

Market Recap

The New York stock market started off on a firmer note, but news that the much-heralded Gilead antiviral drug remdesivir failed to work on COVID-19 in first trial dampened spirits and New York closed lower. Most Asian stock markets are lower today too.

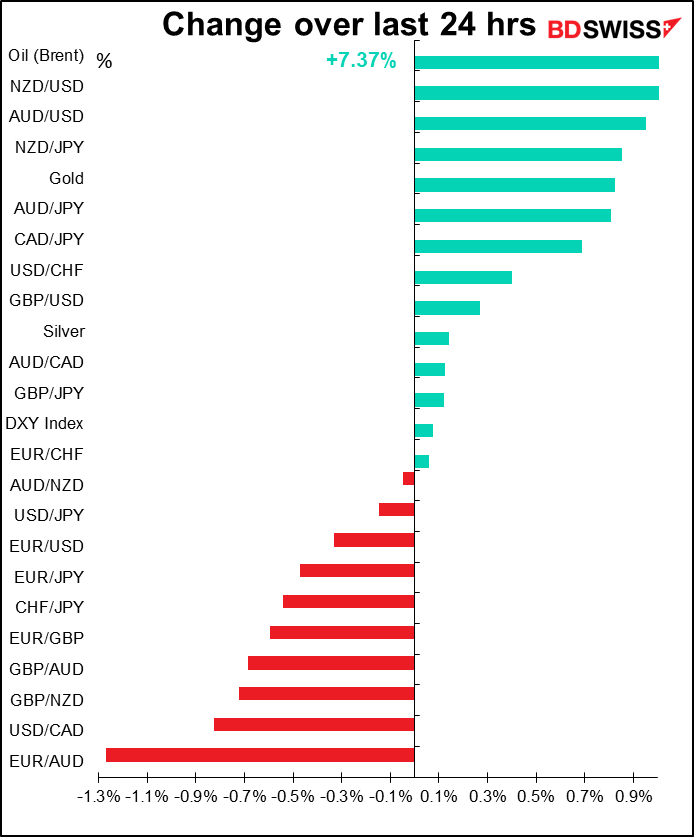

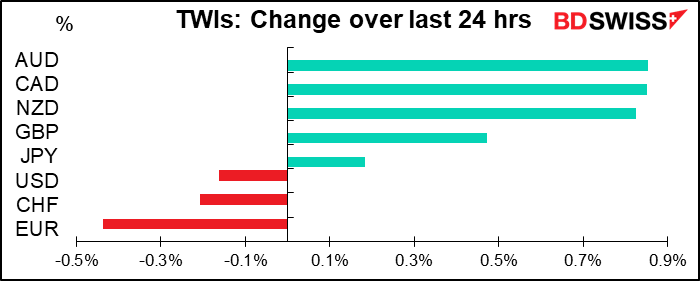

Interesting then that the FX market is showing a typical risk-on pattern, with the three commodity currencies higher – the most risk-sensitive one, AUD, leading the way – and CHF lower (JPY up a bit). It could be because of oil’s further recovery, but that’s a tenuous reason – AUD/USD, AUD/JPY, NZD/USD and USD/CAD are all much more closely correlated with stocks than with oil.

Looking at the charts, it appears that these currencies strengthened during the US day but started to turn around late in the US afternoon after the news of the Chinese drug trial appeared. They’ve been coming off during Asian times, gradually catching up with stocks. We could see further “risk off” movement today in FX as the week draws to a close and FX follows stocks.

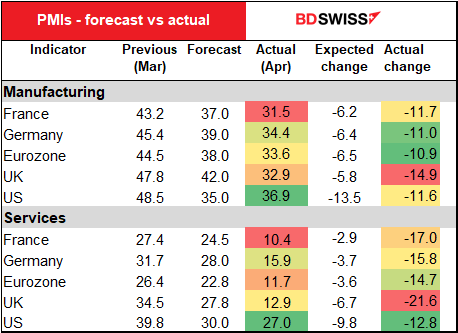

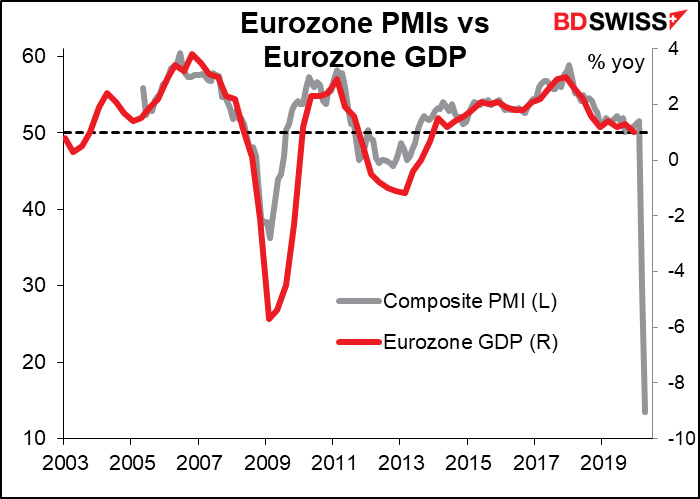

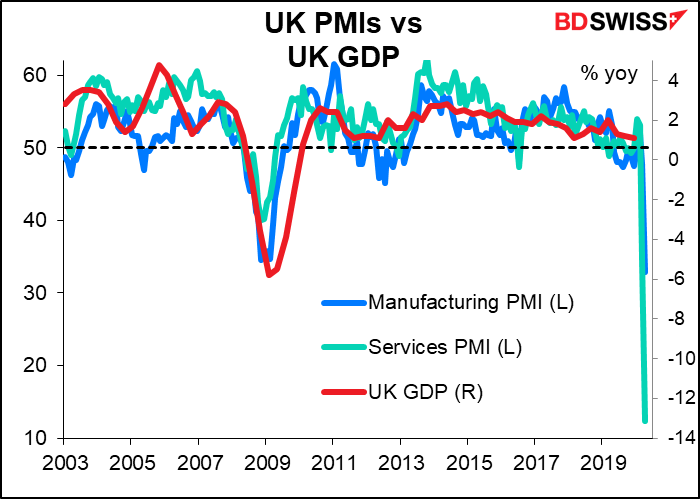

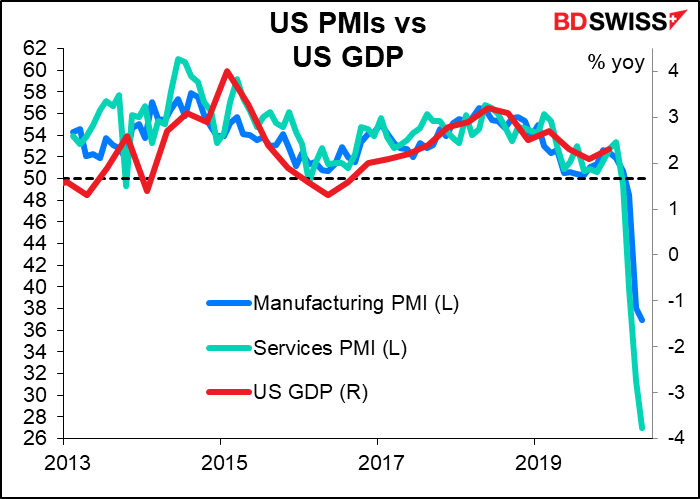

The purchasing managers’ indices were dreadful. They were expected to be bad, but with only one exception – US manufacturing – they were weaker than expected. Services were especially weak, which is significant since services constitute the bulk of the economy. The Eurozone services (and composite) indices hit record lows.

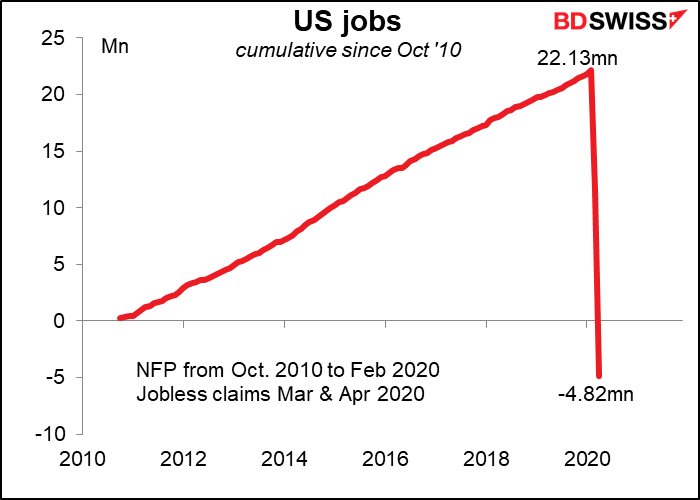

Speaking of dreadful, the US jobless claims were almost exactly as predicted — +4.43mn vs +4.50mn expected. Admittedly that’s the third consecutive decline in the rate, but that just means it’s gone from horrendous to horrible.

Using the jobless claims for March and April (so far), the US has lost all the jobs that were created during the longest-ever period of peacetime expansion in jobs – 113 months of consecutive job gains in the monthly nonfarm payrolls.

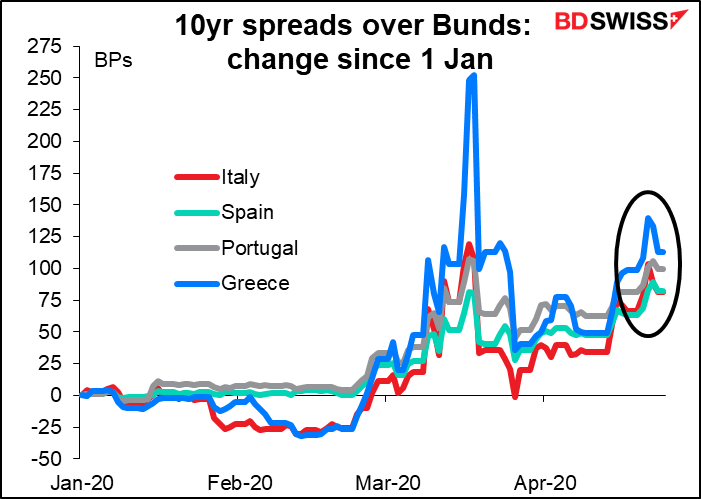

EUR weakened after EU leaders as expected kicked the funding decision down the road. They agreed in principle on what we basically knew already: that the EU urgently needs a large fund to aid in the economic recovery after the pandemic is over and that the fund should be targeted towards those member states that have been hit hardest by the virus. However, there were no specifics: no idea how big the fund might be, how it would be financed, how it should be linked to the EU budget, nor how much would be grants vs than loans, which appears to be one of the main sticking points.

While the group failed to agree on specifics, at least they didn’t break up in acrimony, like the finance ministers did after their 9 April meeting. It was particularly significant that Italian PM Conte, whose country is the source of much of the disagreement, tweeted afterward “great progress, unthinkable a few weeks ago.” Italian finance minister Gualtieri called the conclusions a “success for Italy.” If the Italians are happy and no one is overtly upset, that’s progress by EU standards. But it wasn’t enough to satisfy the markets.

Nonetheless, spreads on peripheral debt came in a couple of basis points, which suggests to me that perhaps the market is a little less disappointed with the meeting now than the initial reaction. In that case we could see EUR regain a bit of lost ground today.

Today’s market

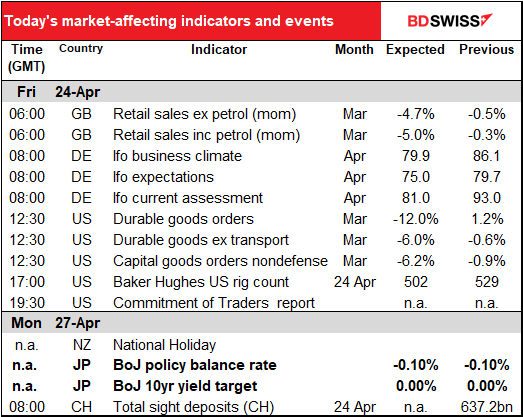

The big point of interest is Monday morning’s Bank of Japan (BoJ) Policy Board meeting, which will be over well before I get out Monday morning’s comment. I discuss that in great depth and detail in today’s Weekly Outlook, which will be winging its weary way to you in a few hours. In brief, I expect them to take more measures to support bank lending to companies, such as increasing its purchases of commercial paper and corporate bonds or introducing negative interest rates on its fund-supplying operations, which would help to channel money to companies. There is even some talk that it might buy loans from banks and other financial institutions. The Nikkei carried a story saying that they might scrap their JPY 80trn target on buying government bonds and turn it into an unlimited pledge, but since they’re not buying anything near JPY 80tn a year now, that would just be smoke and mirrors. Read the Weekly for more details.

We discussed this morning’s UK retail sales yesterday. They’re expected to be the worst ever in data going back to 1988. No surprise here as no one can go shopping.

The Ifo business climate and Ifo current assessment for April are expected to be lower but still not as bad as during the 2008/09 GFC. However, the Ifo expectations index is forecast to hit a record low (data only goes back to 2005). This shouldn’t surprise anyone.

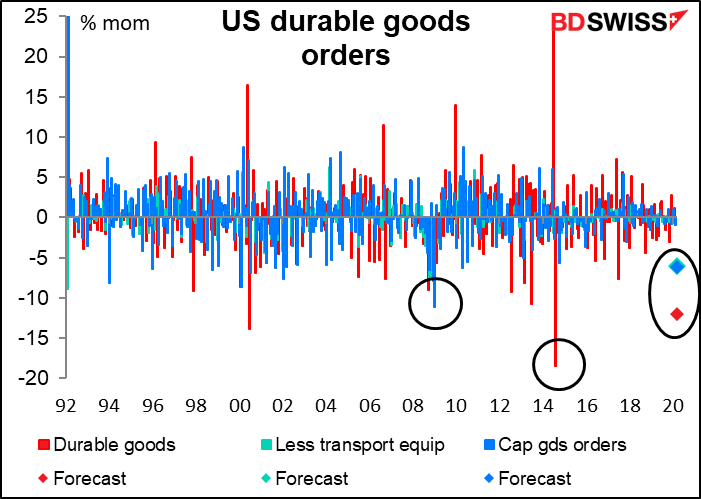

US durable goods orders are expected to be bad, but not to set a new record by any means. The headline figure is expected to be down 12%, which is pretty bad but not as bad as -18.4% mom in August 2014. Excluding transportation equipment, it’s expected to be down 6.0%, which compares with a record decline of 10.2% in January 2009, during the GFC. And nondefense capital goods orders excluding aircraft, a good leading index of capital investment, is forecast to be down 6.2%, nowhere near as bad as -11.1% in again January 2009.