PREVIOUS TRADING DAY EVENTS – 03 August 2023

The U.S. Federal Reserve and the European Central Bank increased rates by 25 basis points last week, but unlike the Bank of England (BoE), markets think they are at or near the end of their rate-tightening cycle.

The BoE warned that borrowing costs were likely to stay high for some time as it continues to battle high inflation.

“The MPC will ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target,” the BoE said in fresh guidance.

Governor Andrew Bailey: “I don’t think it is time to declare it’s all over,” he told a press conference, adding it was “far too soon” to speculate about the timing of any rate cuts. Bailey also said, “We might need to raise interest rates again but that’s not certain”.

“The Bank of England today acknowledged for the first time in the current tightening cycle that its monetary policy is tight,” as Kallum Pickering, senior economist at Berenberg said. “Although policymakers kept open the prospect of further hikes … this supports our call that the BoE is close to peak rates.”

“If we stick to the plan, the Bank forecasts inflation will be below 3% in a year’s time without the economy falling into a recession,” finance minister Jeremy Hunt said after the BoE’s announcement.

Most economists believe the U.S. central bank will probably not raise rates again this cycle since they see a huge desired drop in inflation. The pause of hikes will keep the economy in the current favourable condition avoiding any recession-related implications

“Recession risk is receding,” said Bill Adams, chief economist at Comerica Bank in Dallas.

According to the JOLTS report, the Labor Department showed that there were 1.6 job openings for every unemployed person in June and little changed since May. Non-Farm Payrolls likely increased by 200,000 jobs in July after rising by 209,000 in June. The unemployment rate is forecast to be unchanged at 3.6% in July. Strong job growth in July was supported by the ADP’s national employment report on Wednesday, which pointed to solid private hiring last month.

“The improving trend in productivity along with slowing nominal wage growth points to inflationary pressures from the labour market starting to subside,” said Sarah House, a senior economist at Wells Fargo in Charlotte, North Carolina.

______________________________________________________________________

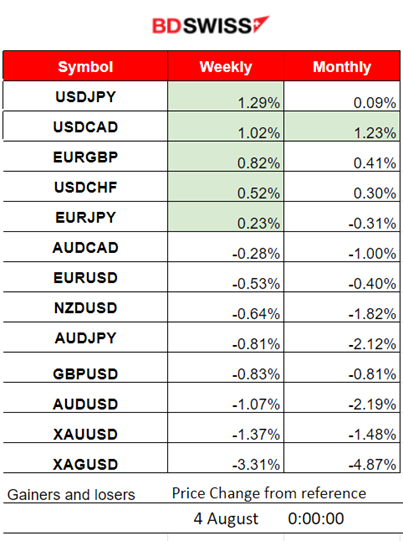

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (03 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European)

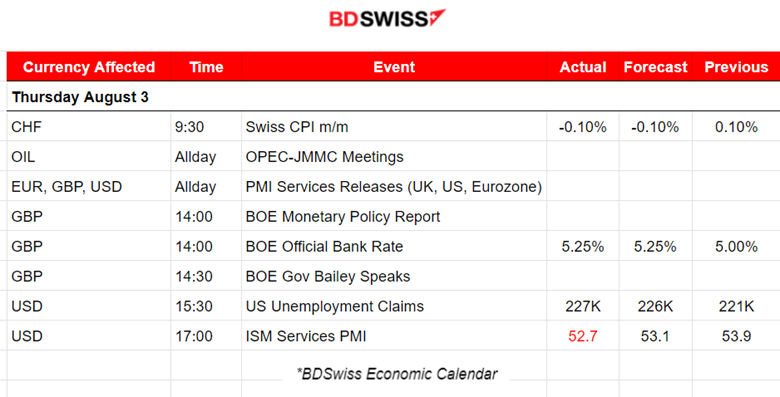

The Swiss Consumer Price Index (CPI) monthly calculation was reported negative. The CPI decreased by 0.1% in July 2023 compared with the previous month, as expected. Not much impact on the market from this release.

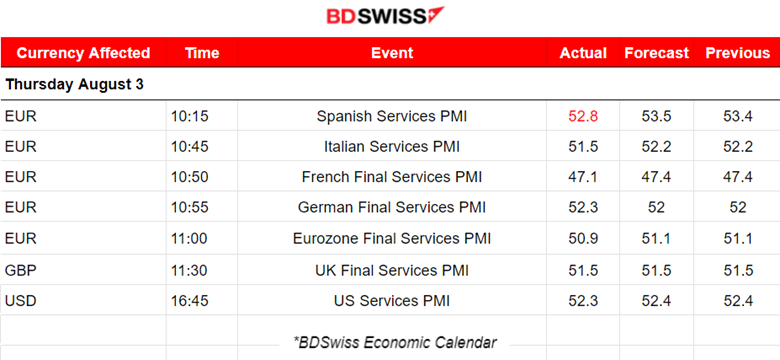

The Services PMIs came out as per below:

Germany: Due to stubbornly high prices the German service sector shows a substantial loss of momentum at the start of the third quarter. The index shows 52.3, indicating no actual improvement remaining just a couple of points above the 50 level that separates contraction from expansion.

France: A disheartening report for this economy as the PMI index shows 47.1, lower than the previous. This economy deteriorates at a faster pace in July amid worsening demand and persistent inflation.

Eurozone: PMI figure for services is actually lower at 50.9. The manufacturing downturn worsens and the service sector seems to not be making progress. The rate hikes are apparently having a negative impact on the economic activity of both sectors.

U.K.: The United Kingdom experienced another period of low business activity in the services sector during July. The index figure remains at 51.5, just 1.5 points above the threshold of 50, in the expansion area. However, this data show very weak performance in services for a long time now in the U.K.

U.S.: Lower U.S. business activity growth in July since demand for services eases. The PMI shows 53.3, just a bit lower than the previous figure but in the expansion area still. Thus further expansion across the sector was reported at the start of the third quarter, highlighting that business activity and new orders increased again, at slower rates though, and more exports with more sales. Better business conditions than any other region I would say according to these data.

In general, the EUR seems that it has not significantly affected the PMI data during the period of their release. The GBP however was depreciating against other currencies at that time. The USD seemed to climb in value moderately and steadily during that period of PMI reports until the start of other scheduled important releases.

At 14:00 the Bank of England (BOE) announced that it decided to increase the OBR by 25 bp as expected by the market. At the time of the release an intraday shock occurred but it was of a very low level causing GBP depreciation at first followed by a quick retracement of the affected pairs. At the time of the press conference after 30 min of the release, the BOE governor statements caused more volatility and GBP appreciation. The USD was barely affected.

U.S. Unemployment claims were released at 15:30, just 1K above expectations, up by 6K to 227K in the week ending July 29, according to Labor Department data. They remain near the lowest levels of the year confirming labour market resilience still. The market did not react significantly to these claims, only with a small intraday shock that weakened the USD momentarily.

At 17:00 the ISM Services PMI was reported lower, 52.7 points indicating that economic activity in the U.S. services sector expanded in July for the seventh consecutive month. The figure suggests a slow down in July though since it is worse than the previous. The USD was affected by depreciation at that time which did not last long.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

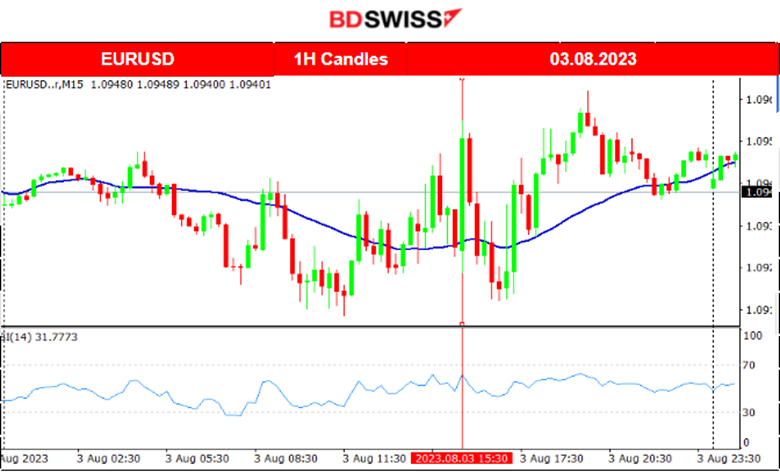

EURUSD (03.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

More of a sideways movement for the pair since the EUR and the USD had not been too much affected by the news. Volatility kicked in only after 15:30 when the U.S. unemployment claims figures were released and later the ISM services PMI caused the USD to depreciate, though not significantly.

GBPUSD (03.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The GBP had depreciated early before even the start of the European session bringing the pair more to the downside. When the BOE eventually released their decision to hike, the GBPUSD experienced an intraday low-level shock causing GBP depreciation at first followed by retracement soon after. With GBP appreciation and USD depreciation at the same time the GBPUSD climbed higher after 15:30.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The level of 15384 USD was a significant support for NAS100 and it has broken. 15265 is also quite important support that has not broken. Instead, it served as the point of reversal for the index. The U.S. stocks have found their way up but it is probably only temporary. A sideways movement is possible currently as we have no data to support one-sided directional movement. Indeed, a retracement took place, honouring the apparent bullish divergence, however, the market is waiting for the NFP to react.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

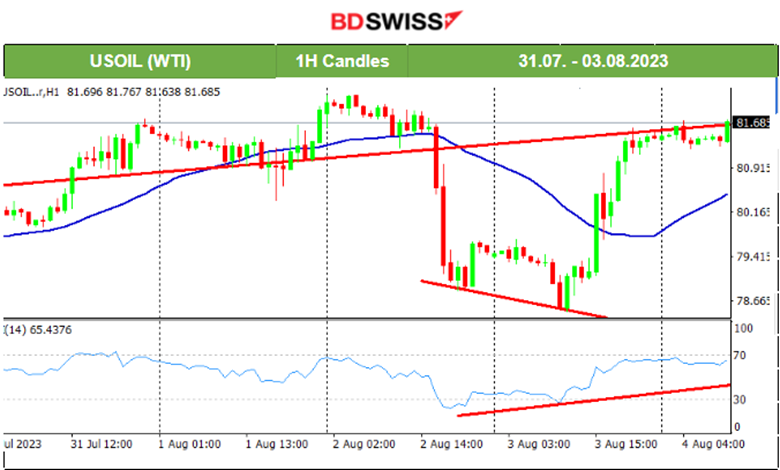

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 2nd of August, the release of the U.S. Crude Oil inventory figures caused a shock for Crude and its price dropped heavily and rapidly reached the support of 78.85 USD/b. A negative figure, -17M showed that during the previous week, way less amount had remained in inventories. Yesterday, the price was showing early signs of bullish divergence, with lower lows, while the RSI was showing higher lows. At the start of the European session, the price eventually jumped, reversing, crossing the MA and moving significantly to the upside. The move was attributed to fundamental factors, the voluntary production cut announcement from Saudi Arabia.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold started from the 31st of July until the 1st of August crossing the MA on its way down and finding support at nearly 1941 USD/oz. The next day, the 1st of August, it actually broke that support as USD appreciates more reaching the next support at 1933 USD/oz. Eventually, The price moved even lower breaking some further support but remaining above 1930 USD/oz. It is currently in a consolidation phase, in range, since the market is not significantly affecting the USD at the moment in anticipation of the scheduled releases i.e. NFP.

______________________________________________________________

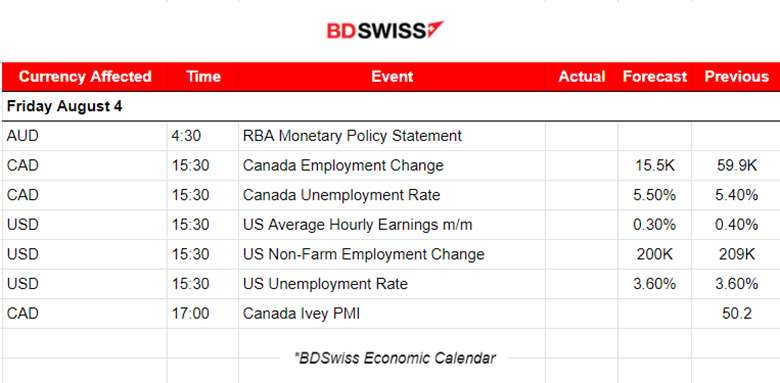

News Reports Monitor – Today Trading Day (03 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The release of the RBA Monetary Policy statement took place at 4:30 indicating that the Board considered raising rates during the August meeting, stating that inflation risks have been balanced but much depends on inflation expectations. The full impact of the tightening policy has not yet been felt. Inflation is moving in the desirable direction, consistent with reaching the target by late 2025. The AUD appreciated during the release for a while but that soon faded.

- Morning – Day Session (European)

At 15:30 Canadian and U.S. Labour data will be released giving a better picture of the employment in those regions. It is expected that the NFP will be reported lower and the unemployment rate to remain at the same level. Canada’s employment change is expected to drop significantly while the unemployment rate figure is expected to increase by 0.10%.

General Verdict:

______________________________________________________________