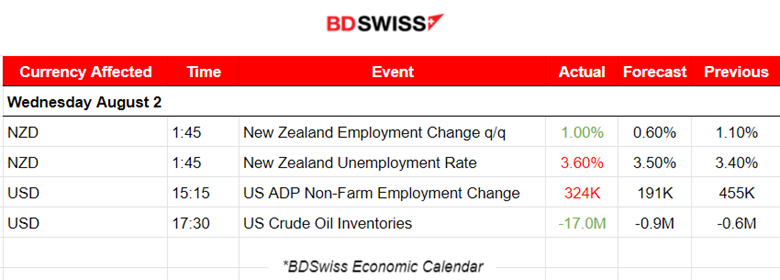

PREVIOUS TRADING DAY EVENTS – 02 August 2023

The Reserve Bank has signalled that it has raised rates sufficiently to tame inflation and that the economy has stalled, expecting further increase in the unemployment rate.

“We envisage that a turning point looks to be close and that greater labour market slack will emerge over the remainder of 2023 and into 2024,” said Mark Smith, senior economist at ASB Bank in Auckland. Still, there’s a risk that “labour market tightness and elevated wage and core inflation could stick around for longer than would be comfortable for the RBNZ,” he said.

Inflation lies at 6% in the second quarter, down from 6.7% in the first quarter. The Official Cash Rate at 5.5% is high enough to close the cycle with aggressive rate hikes. However, economists expect one more increase to take place.

“While capacity pressures have improved compared to the first quarter, the RBNZ will need to see more progress very soon to allow them comfort that the OCR is sufficiently restrictive,” said Henry Russell, an economist at ANZ in Auckland. “We think the next labour market report will raise enough questions about the future path of inflation to draw the RBNZ back to the hiking table.”

“This is the latest in ‘soft-landing’ economic statistics where Fed officials are seeing inflation slowing down without creating the massive unemployment seen in a recession,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “As long as inflation remains on the low side in upcoming reports, the Fed is likely to skip the September meeting when it comes to hiking rates again.”

U.S. stocks were trading lower yesterday causing U.S. indices intraday crash as investors fretted over rating agency Fitch’s surprise move late on Tuesday to downgrade the U.S. government’s credit rating. The dollar rose against a basket of currencies again.

“Last month, the June data from ADP overshot the related June data from the BLS significantly, and over time the ADP report has not been a reliable predictor of the BLS data,” said Daniel Silver, an economist at JPMorgan in New York.

Source: https://www.reuters.com/markets/us/us-private-payrolls-beat-expectations-july-adp-says-2023-08-02/

______________________________________________________________________

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The quarterly employment data and unemployment rate of New Zealand came out early during the Asian session. Employment change was reported at 1%, lower than the previous 1.10% figure and the unemployment rate was recorded at 3.6% higher than the June quarter’s 3.4%. Total employment increased 4% in the past year and has hit an all-time high of 69.8%. NZD pairs were affected by depreciation at the time of the release. NZDUSD dropped more than 20 pips at that time and continues the downward movement even more until the European session approaches.

- Morning – Day Session (European)

At 15:15 the U.S. ADP report for NF Payrolls affected the USD pairs with USD appreciation. The data suggest that the private sector companies added far more jobs than expected in July. The figure was expected to be reported at a much lower level, at 195K versus the previous 497K. However, it was actually reported higher than expected, at 324K. The DXY moved rapidly upwards after the release before retracing.

U.S. Crude Oil inventories report showed a large negative change, -17M which is a massive (record) crude inventory drawdown. Crude’s price dropped at the time of the release as the market actually reacted to the news with high activity. The OPEC+ Joint Ministerial Monitoring Committee will meet online on Friday, providing Saudi Arabia with the open door for a voluntary 1M bpd production cut announced on June 3 for July production for another month to September. It would be the second time the Saudis have extended the voluntary 1M bpd production cut.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

NZDUSD (02.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

With the release of the labour market data for New Zealand at 1:45 the market reacted causing NZD depreciation, thus the pair moved downwards rapidly at that time. It crossed the 30-period MA and moved further to the downside since the unemployment rate was reported quite high. In combination with the USD strengthening, these factors pushed the pair even more to the downside creating a steady intraday downward trend.

EURUSD (02.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility more to the downside early during the European session. Later during the U.S. ADP National Employment Report report figure release, at 15:15, the pair started to move downwards rapidly. It found support at 1.09170 before retracing back to the 30-period MA.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The breakout of the triangle for NAS100 has broken to the downside as the U.S. stock market starts to show more volatility. The index was close to the resistance of 15815 USD but eventually reversed. The RSI showed signs of bearish divergence with its lower highs and that signal was eventually completed after the drop took place. The index continues to drop massively and this is actually happening to all U.S. benchmark indices. Will this be a signal that a downtrend just started? Maybe it is too early to speculate. 15384 USD was a significant support for NAS100 and it has also broken since yesterday. 15265 is quite significant support and its break with the index moving rapidly downwards would probably confirm the start of a downward trend for this index.

______________________________________________________________________

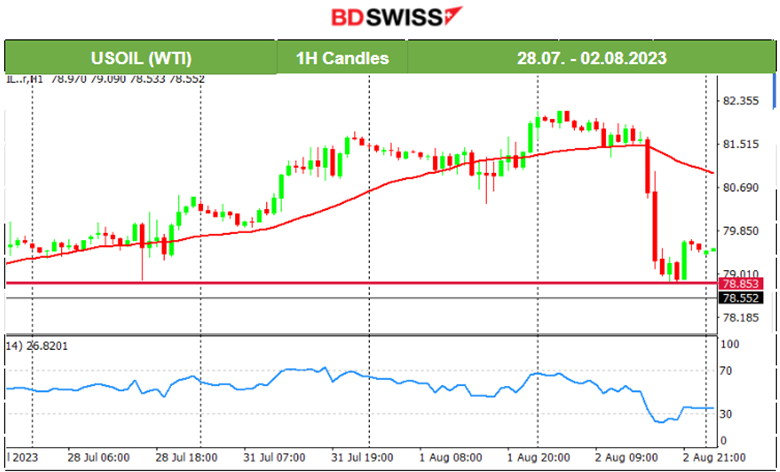

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was moving steadily upwards with moderate volatility remaining above the 30-period MA. Yesterday, on the 2nd of August, the release of the U.S. Crude Oil inventory figures caused a shock for Crude and its price dropped heavily and rapidly reached the support of 78.85 USD/b. A negative figure, -17M showed that during the previous week, way less amount had remained in inventories. Could this signal that more barrels will be demanded for supply, and purchased eventually, thus the reaction and price drop? This is what is currently happening as Saudi Arabia is talking about future supply cuts.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 28th of July, the price settled around the mean near 1955 USD/oz/. It later continued with an upward path but with no strong signal that an uptrend had started. Gold’s price had actually reversed starting from the 31st of July until the 1st of August crossing the MA on its way down and finding support at nearly 1941 USD/oz. The next day, the 1st of August, it actually broke that support as USD appreciates more reaching the next support at 1933 USD/oz. The RSI provides a signal for future upward movement since it shows higher lows (price shows lower lows), thus a bullish divergence.

______________________________________________________________

News Reports Monitor – Today Trading Day (03 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European)

The Swiss Consumer Price Index (CPI) monthly calculation was reported negative. The CPI decreased by 0.1% in July 2023 compared with the previous month, as expected. Not much impact on the market from this release.

The Services PMIs are coming out today and would probably cause more volatility than usual.

At 14:00 we have the Bank of England (BOE) decision on the OBR and a hike of 25 basis points is looming. It would be no surprise to increase beyond that level since inflation in the U.K. is the highest compared with all rich countries and since we saw how difficult it is to lower it down during the past few months it would probably be the right choice. Not to mention the fact that the increasing oil price could have an effect on a more stickier inflation.

U.S. Unemployment claims are released at 15:30, expected to have an impact on USD pairs. These claims were supposed to be reported higher after all these rate hikes, instead, they are reported lower signalling more labour market strength. If we consider that the Fed managed to lower inflation significantly by keeping the labour market strong, then that is positive augury. However, the future expectations for lower inflation might be wrong since we see higher oil prices and more supply cuts on the way.

The ISM Services PMI is released at 17:00 and would probably have an impact on USD pairs but not expecting a great intraday shock.

General Verdict:

______________________________________________________________