PREVIOUS TRADING DAY EVENTS – 04 August 2023

Since inflation is still well above the 2% target, June and July rate hikes took place. BOC is due to make its next announcement in September.

Doug Porter, chief economist at BMO Capital Markets said over the phone: “I think their (the Bank’s) conclusion from this would be that it’s probably not a bad idea to pause on the rate hike front.”

Royce Mendes, director and head of macro strategy at Desjardins, said that “today’s data reinforce our view that the central bank is done raising rates for this cycle.”

Stephen Brown, deputy chief North American economist at Capital Economics said: “The softer labor market data support our view that the Bank is unlikely to follow through with current market pricing by raising rates further”.

According to the recent CPI change reports, annual increases in prices slowed sharply in June. These mixed data only support the fact that the labour market is still showing resilience.

“There are many signs that we’re on the path to a ‘soft landing,’ but that path can also lead us to a sustained downturn if we miss the exit to a sustainable and strong labour market,” said Nick Bunker, head of economic research at the Indeed Hiring Lab. “We haven’t approached that fork in the road yet, but there is still a strong possibility that the labour market can rebalance without a recession.”

“The combination of tight labour supply and waning labour demand has slowed job growth to a more typical rate consistent with moderate economic expansion as seen in the years before the pandemic,” said Chris Low, chief economist at FHN Financial in New York.

______________________________________________________________________

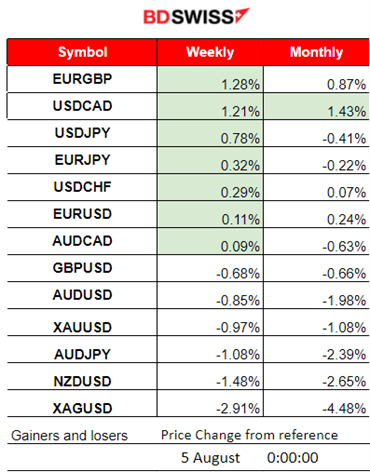

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (04 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The release of the RBA Monetary Policy statement took place at 4:30, indicating that the Board considered raising rates during the August meeting, stating that inflation risks have been balanced but much depends on inflation expectations. The full impact of the tightening policy has not yet been felt. Inflation is moving in the desirable direction, consistent with reaching the target by late 2025. The AUD appreciated during the release for a while but that soon faded.

- Morning – Day Session (European)

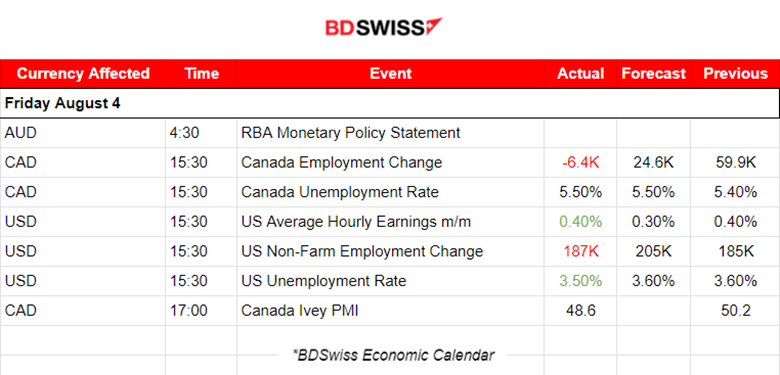

At 15:30, Canadian and U.S. Labour data (including NFP) were released causing intraday shocks for both the CAD pairs and the USD pairs.

The data show that Canada’s unemployment rate rose to 5.5% in July as expected and the unexpected negative figure for the employment change, -6.4K jobs. That was way different than expected since analysts were expecting to see a rise to 24.6K jobs in July, not a drop. Of course, the CAD was depreciating significantly from this shock at the time of the release.

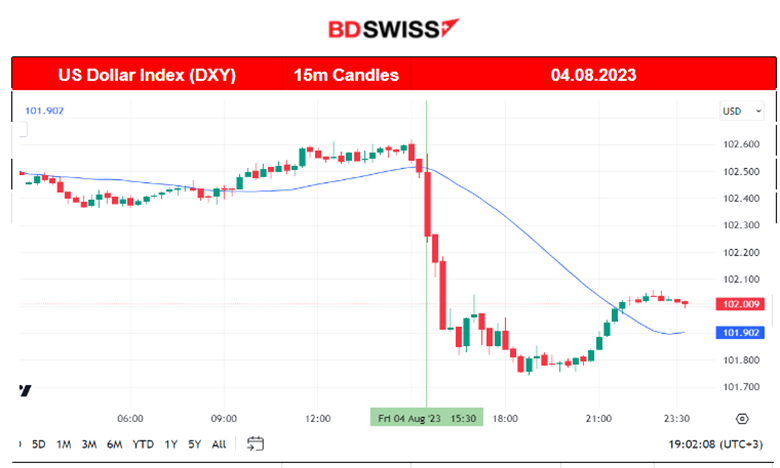

The NonFarm Payrols were reported lower than expected, at 187K, with the unemployment rate falling to 3.5% versus the previous 3.6% figure. Average hourly earnings, a key inflation-related figure, rose 0.4%, more than expected. We actually have mixed U.S. jobs data here but they are obviously signalling a September hike pause since rate increases have a lagging effect. We would expect a significantly lower inflation rate during the next CPI change report. The USD suffered strong depreciation at the time of the release of these figures at 15:30, clearly shown on the DXY chart.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

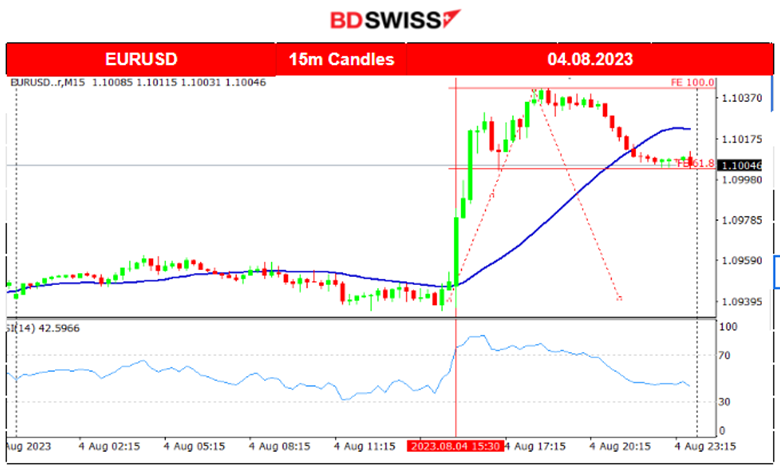

EURUSD (04.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Less volatility before the important scheduled releases and a sideways path for the EURUSD. After 15:30, it is quite clear that there was an intraday shock to the upside since the NFP were reported lower than expected causing high USD depreciation against the EUR. We see that the pair ended its rapid price movement upwards at the resistance near 1.10420 and a retracement followed back to the 30-period MA and to the 61.8 retracement level. We use the Fibonacci expansion tool to show this here. The same “mirror” path can be observed on the DXY chart above indicating that the USD was the main driver of the path.

USDCAD (04.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD was also experiencing low volatility before the major releases, of course, the market participants were waiting for the news to act. After 15:30, we saw an intraday shock with no clear direction at first because both the USD and the CAD were experiencing weakness. This balanced the price and remained on the 30-period MA for some time. After a while, the USD started to show significant depreciation that lasted longer and heavier pushing the USDCAD to drop further to the support near 1.33180 before retracing and experiencing full reversal starting at 19:30 when the USD finally started to strengthen again.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. stock market experienced high volatility recently but did not show any significant signal that the crash that it experienced after the Fitch Ratings actually ended. After the NFP release yesterday, the benchmark indices actually had not been affected significantly. Only after the market opened at 16:30, they eventually resulted in a drop. Now they are testing important support levels, just like the NAS100 as depicted at near 15260 level, and if they eventually brake, they might trigger a downtrend signal. The RSI signals a bullish divergence and that’s why the support is actually significant.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A negative figure, -17M showed that during the previous week, way less amount had remained in inventories. Yesterday, the price was showing early signs of bullish divergence, with lower lows, while the RSI was showing higher lows. At the start of the European session, the price eventually jumped, reversing, crossing the MA and moving significantly to the upside. The major reversal on the 3rd of August and the further climb to higher levels of the Crude price is explained by the recent production cuts announcements. “The Joint Ministerial Monitoring Committee (JMMC) expressed its recognition and support for the efforts of the Kingdom of Saudi Arabia aimed at supporting the stability of the oil market and reiterated its appreciation for the Kingdom’s additional voluntary cut of 1 million barrels per day and for extending it for the month of September. The committee also acknowledged the Russian Federation for its additional voluntary reduction of exports by 300 kbd for the month of September.”

Source: https://www.opec.org/opec_web/en/press_room/7199.html

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price moved lower last week breaking some further support but remaining above 1930 USD/oz. It was in a consolidation phase, in range as depicted by the horizontal red lines, since the market was waiting for the U.S. labour data to act. On the 4th of August, it eventually broke the resistance upwards and reached even 1947 USD/b as the USD suffered strong depreciation with the NFP release.

______________________________________________________________

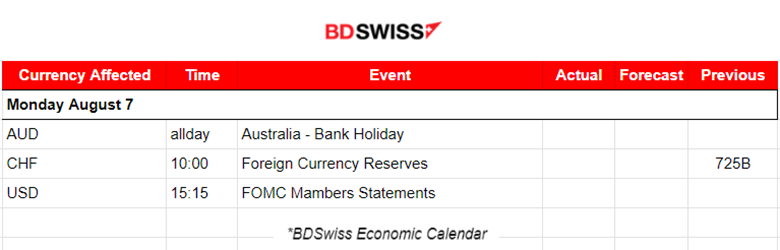

News Reports Monitor – Today Trading Day (07 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no major scheduled releases.

- Morning – Day Session (European)

Generally, there are no major scheduled releases so no shocks are expected. After 15:15, some volatility might be observed for USD pairs due to the speech of the Federal Reserve Bank of Philadelphia President Patrick Harker, due to speak about the economic outlook at an event hosted by Philadelphia Business Journal.

General Verdict:

______________________________________________________________