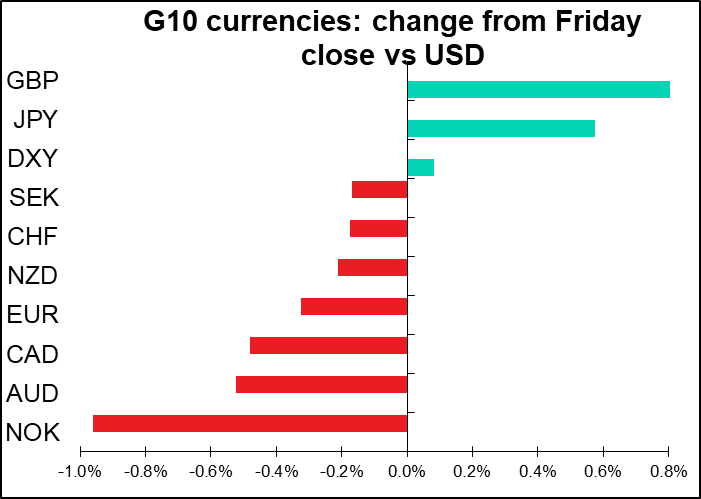

This week there’s a lot to talk about: a (not particularly eventful) FOMC meeting, a surprising dovish/hawkish Bank of England meeting, and the worsening coronavirus crisis, not to mention the locust plague in East Africa. These are just short-term events (I hope! in particular, I hope we get over the coronavirus soon). Instead I’d like to focus on the event of the week whose afteraffects we’ll be dealing with for years: Brexit.

There are a few special days in my career that stand out because of the historical events I was privileged to live through and comment on – memorialize, perhaps – to my colleagues. The two that stand out most: I remember the morning meeting I gave on 10 November 1989, the day after the Berlin Wall fell. Luckily in those pre-internet days I had a copy of Trotsky’s The Russian Revolution and so could get the quote right: You are bankrupt, your role in history is played out. Go out where you belong – onto the dustheap of history. I remember the day Barack Obama was elected; choking back emotion, I quoted to my colleagues the words of Martin Luther King: “I have a dream that my four little children will one day live in a nation where they will not be judged by the color of their skin but by the content of their character.” I thought Obama’s election signaled that that day had arrived in the US. How wrong I was.

But what am I to say to my colleagues today, Brexit Day? A day nearly as heavy with historical import, but for me, totally bereft of the hope and vision of a new, better future that these other landmark dates were imbued with. On the contrary, this seems to me to be a country rejecting the future and turning to a mythical past, and in the process committing economic and political suicide: the impoverishment of the people leading, most likely, to the dissolution of the centuries-old alliance among the several nations of the United Kingdom. This time the map is being redrawn out of fear, not out of hope.

What can I say this time except to quote the Welsh poet Dylan Thomas: “Rage, rage against the dying of the light”?

Even the British government admits it’s going to be bad, bad, bad. You can see a PowerPoint presentation giving their estimates for the impact of Brexit. Or you can read a more detailed analysis here.

Here are some of their estimates.

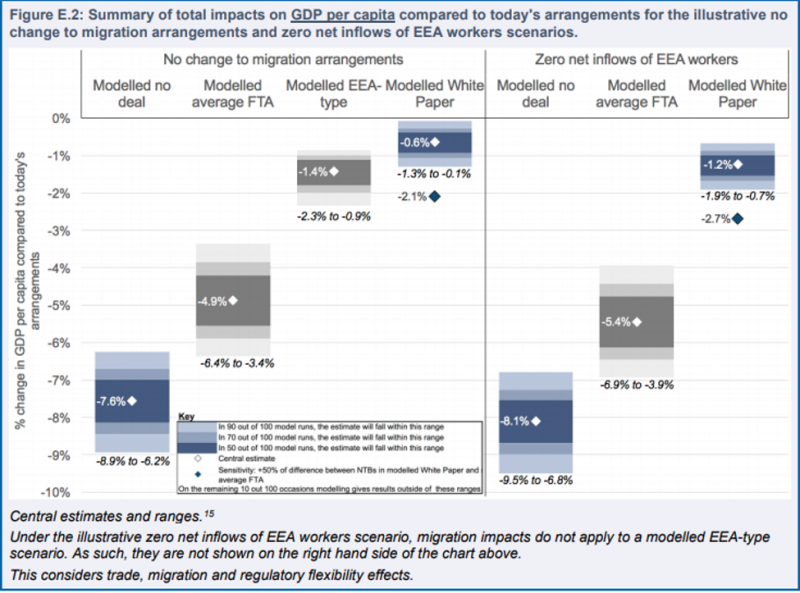

The best-case scenario they have is that UK per capita GDP will be more or less unchanged to down 1.3%-1.9%. That’s the best case.

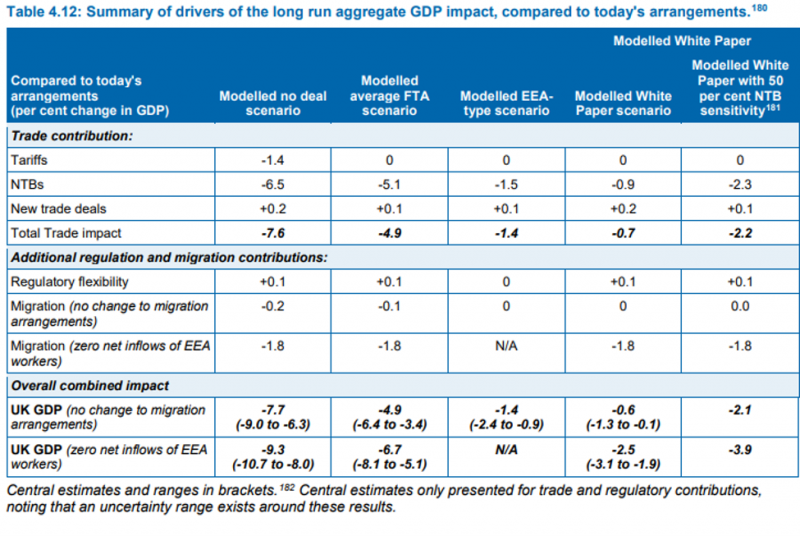

Or how about this encouraging table, where the best-case scenario is -0.6% on GDP and the worst case is -9.3%?

I must admit, I didn’t read all 83 pages of this report. Nonetheless, in my brief examination I did not find one single instance where the Government predicted that the UK economy would be better off by leaving the EU.

The Brexiteers sold the country a lie that freed from the shackles of EU membership, Britain could forge new and better trading arrangements with its trading partners. Hah! If you believe that, then I have a bridge to sell you…

On the contrary, a recent article observed that Trump is threatening a damaging new trade war with the United Kingdom after Brexit. “As (UK PM) Johnson prepares to seek new trade deals outside the EU, the Trump administration is poised to take advantage of the UK’s vulnerable new position on the world stage,” the article says. “In recent weeks, the president and his allies have issued a series of threats to the UK on everything from telecoms to vehicle tariffs to security cooperation…” To me, this report calls into question the whole economic logic of Brexit, if indeed there were any to begin with.

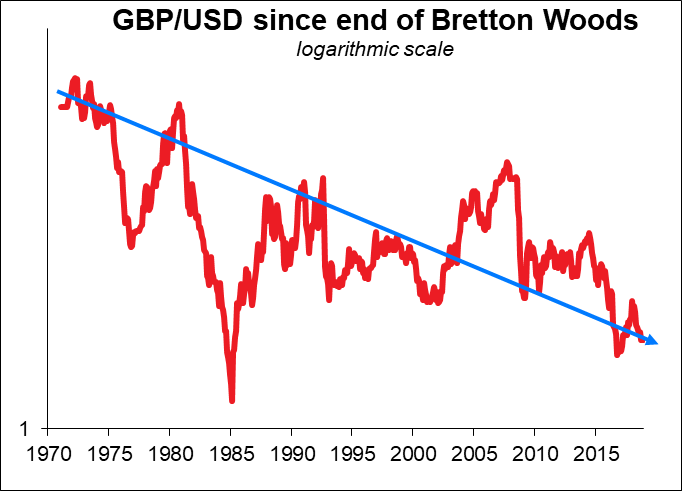

The problems that Britain will face working out new trade arrangements with most of the countries in the world is just one of the reasons why I am structurally bearish on GBP until further notice.

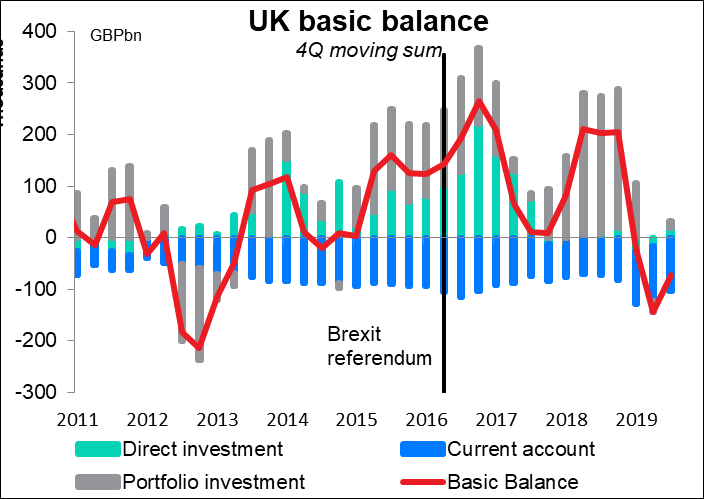

The country already has one of the largest current account deficits in the world relative to its economy. What do you think will happen once Britain gets on worse trading terms with virtually every country on earth? Will nostalgia for the Commonwealth make up for reduced access to the Continent?

Britain’s been able to finance this deficit for years thanks to net inflows of direct investment and portfolio investment. But the basic balance has turned negative as first direct investment, then portfolio investment dried up in the face of Brexit uncertainties. Next comes disinvestment.

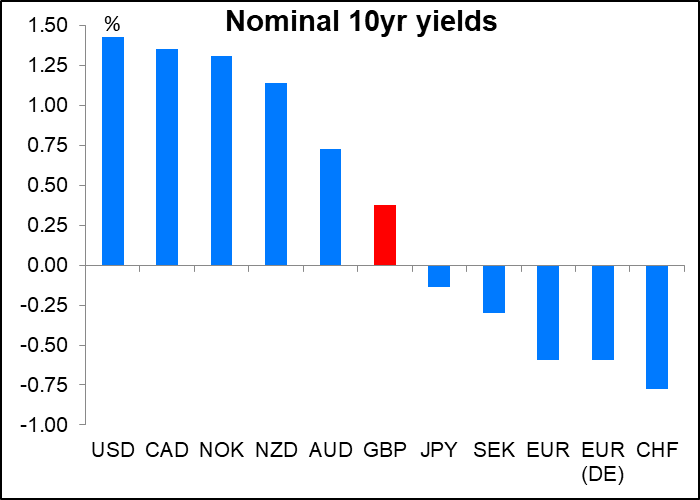

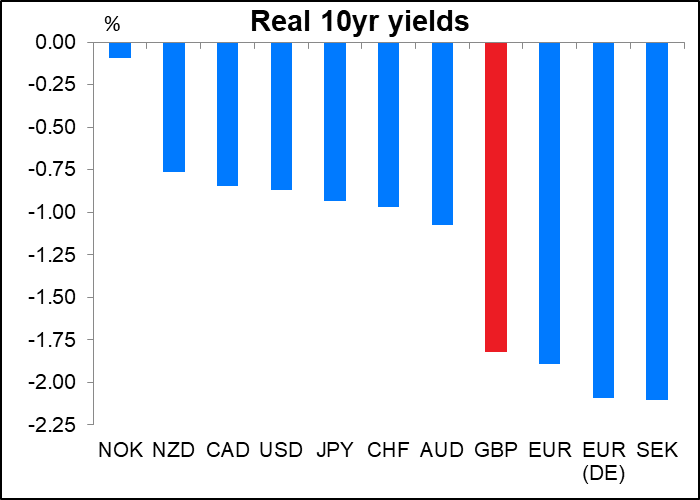

Meanwhile although nominal yields on gilts are still (just barely) positive…

…the real yield on gilts is among the worst in the G10. And set to get worse if the currency falls, pushing up inflation, while the Bank of England has to cut rates in order to support the economy.

There will of course be occasionally uptrends within the overall downtrend. It’s a truism in markets that nothing moves in a straight line. But as growth weakens, the Bank of England is likely to have to cut interest rates to support the economy even as the country’s primary balance moves more into deficit (larger current account deficit, less money coming in on the financial account). I suspect that by the time the UK and EU settle on their long-term arrangements at the end of this year, we may finally be able to hold that “Parity Party” that traders briefly prepared for in 1984.

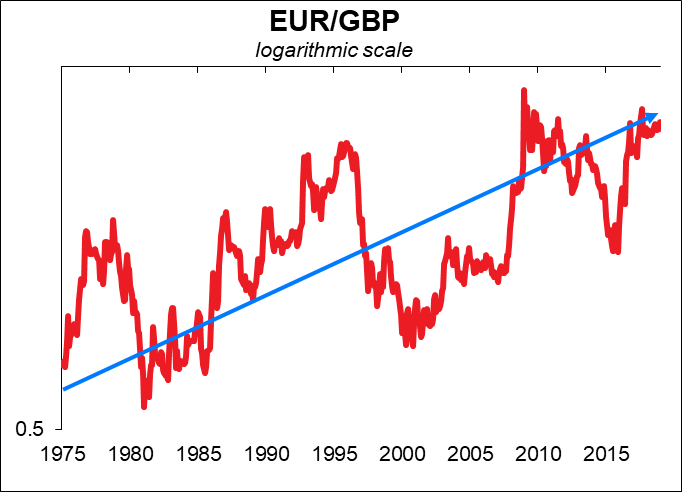

If not GBP/USD parity, then perhaps EUR/GBP parity.

Even granting that economics isn’t everything, especially in politics – national pride and independence are important too – but will Britain really be prouder to be poorer and smaller? The local assemblies of Scotland, Wales and Northern Ireland all refused to ratify the Withdrawal Agreement. The Scottish National Party is already angling for another independence referendum, while the December General Election changed the tone in Northern Ireland, resulting in more nationalists (those who want to unify Northern Ireland and the Irish Republic) than republicans (those who want to remain part of the UK) elect for the first time. On the other side of the border, in the Irish Republic, the opposition Sinn Fein party has pledged to press London for a vote on unification if it gets into power. “It is game on for unification and I think the thoughtful thing, the wise thing to do, is to plan from now,” said party leader Mary Lou McDonald.

God Save the Queen, because Her Majesty’s Government can’t or won’t.

Next week: NFP, final PMIs, RBA meeting, US politics

Next week it’s back to the usual monthly drama over the US nonfarm payrolls. The final purchasing managers’ indices (PMIs), including the US version from the Institute of Supply Management (ISM), plus PMIs from those countries that haven’t been heard from yet will be the global focus, although they may be seen as “old news” at this point with the coronavirus affecting global demand. The only G10 central bank meeting on the schedule is the Reserve Bank of Australia (RBA), which meets 11 times a year (most others meet only eight times).

Nonfarm payrolls:

The nonfarm payrolls (NFP) is indisputably the most closely watched indicator every month, although personally I think the inflation data – particularly the core personal consumption expenditure (PCE) deflator, the Fed’s preferred inflation gauge – is more important. But the NFP is more volatile and harder to predict than the core PCE deflator and so the NFP announcement tends to move markets more. Besides, it’s assumed that inflation follows employment as a tighter labor market is supposed to lead to higher wages and therefore higher prices – although it hasn’t worked out like that for some time now.

Having said that…

This month’s forecast for the NFP is hardly surprising. The market consensus for this initial figure is for an increase of 160k jobs. The six-month moving average of the initial figure is…162k. Surprise, surprise. Maybe I can get a job forecasting these indicators, too? No need for Kalman filters or Box-Jenkins smoothing; my secret weapon would be Excel’s “moving average” function. The unemployment rate meanwhile is expected to stay at the 50-year low of 3.5%.

Although the NFP number is what everyone talks about, in fact I’d argue that the average hourly earnings are more important. That’s because the Fed wants to see a tighter labor market feeding through to higher wages and thereby pushing inflation back up towards its 2% target. Indeed, some committee members have argued that that’s the very definition of a tight labor market – that the economy is not at full employment until wages are rising. Hence if it were up to me, I’d refer to this monthly announcement as the hourly earnings figure, not the nonfarm payrolls. But if it were up to me, everyone would be a vegetarian, and that’s not going to happen any day soon, either.

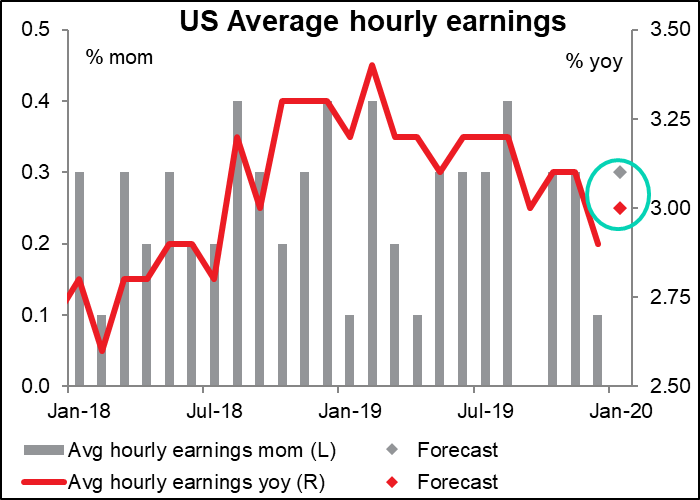

The forecast for January is a +0.3% mom rise, which would mean modest acceleration in the yoy rate to +3.0% from 2.9%. That would probably be bullish for the dollar.

Assuming the figures hit the forecasts, the data are likely to be modestly bullish USD, I in my view. Continuing at trend would at least indicate that there hasn’t been a slowdown in the job market yet, which is what everyone is worried about. Furthermore, the slight acceleration in earnings that’s expected would suggest that the slowdown in the annual pace of growth may have bottomed.

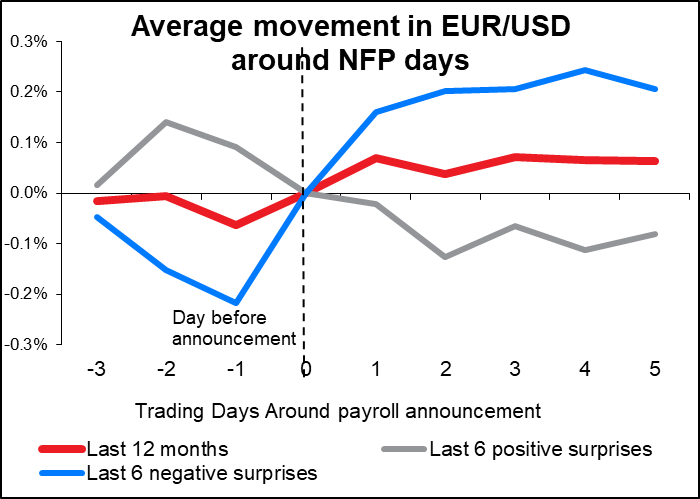

The result of the NFP seems to set the trend for EUR/USD for the next few days. As one might expect, the pair tends to move higher (USD weakens) following a weaker-than-expected figure, while it moves lower (USD strengthens) following a better-than-expected number.

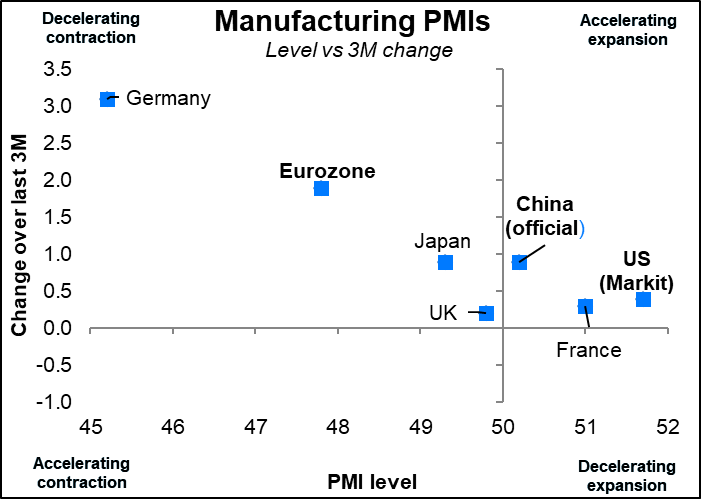

The final PMIs for the major economies will be released on Monday (manufacturing) and Wednesday (services), together with the PMIs for many countries that don’t announce preliminary figures. The preliminary versions were fairly positive. All of the majors were either in the “decelerating contraction” or “accelerating expansion” quadrants. Nonetheless although the trend may be favorable, the absolute value is still worrisome; Japan, the UK, German and the Eurozone as a whole remain in contractionary territory. Furthermore, the surveys were generally done “pre-coronavirus.” Things could be very different a month from now. As a result, while the data could be good for “risk on” trades, I suspect any favorable impact will be swamped by any news, good or bad, about the virus.

As mentioned above, the only major central bank meeting this week is the Reserve Bank of Australia (RBA) on Tuesday. That’s followed by Gov. Lowe addressing the National Press Club on Wednesday and the quarterly Statement on Monetary Policy (SMP) on Friday, with its updated forecasts. So get ready for a week focused on Australia, mate!

The market is getting increasingly convinced that there will be two rate cuts this year.

The fundamentals already supported some loosening this year: Inflation remains below target and the unemployment rate, perhaps an even more important metric for the RBA, is stubbornly above their estimate of full employment. Add to that the disastrous bush fires around the country and there’s good cause for the central bank to take out some “insurance.”

Now on top of that comes the coronavirus, which is liable to hit Australia hard. China is far and away Australia’s biggest trade partner, with 31% of total exports of goods and services going there. The top five exports and China’s share in Australia’s trade are as follows:

The impact of the virus on Australia depends to a great degree how much Chinese industry is affected. If factories aren’t running, then demand for iron ore will obviously suffer. Coal and natural gas too, although less in that households will still use electricity. Tourism is obviously quite vulnerable, but its impact on the economy is not that great. I think the coronavirus adds to the already strong argument for one easing and at the margin may push the scale over to two easings, depending on how long the epidemic lasts and what its effect on output is – something we don’t know yet.

I would expect the RBA to take a noticeably more cautious stance, which is likely to result in some downward pressure on AUD (if it’s not already discounted). At their last meeting in December, the RBA was starting to get optimistic; they said, “The outlook for the global economy remains reasonable” as some of risks “have lessened recently.” Specifically on China, they noted that “the authorities have taken steps to support the economy while continuing to address risks in the financial system.” Obviously their view on China will have to change and with that, the whole tenor of the statement is likely to become more cautious.

Other events: BoJ speeches, Iowa caucuses, impeachment proceedings

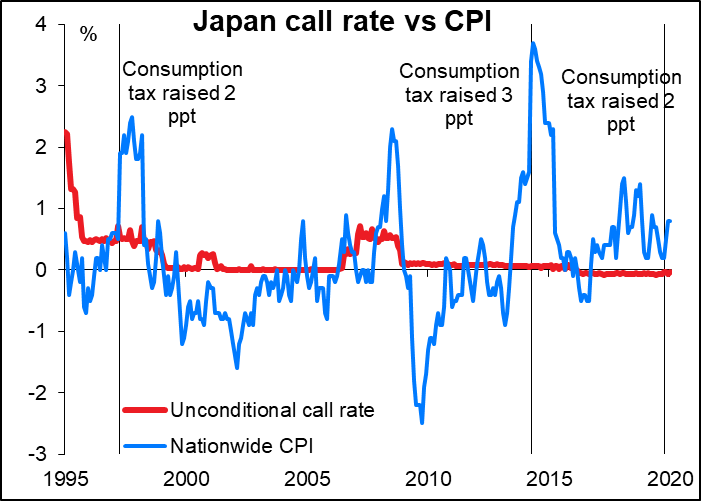

There are two speeches by members of the Bank of Japan’s Policy Board. Normally these are of absolutely no interest to anyone in the markets, because it’s assumed that the Board is in BoJ Gov. Kuroda’s pocket, so we only have to listen to what he says. And even that isn’t so important, because the BoJ is stuck: it has virtually no room to loosen policy further, but with inflation still far below its target it can’t possibly tighten, either.

However, this week’s “Summary of Opinions,” a sort of digest of the main points made by participants in the Monetary Policy Board meetings, showed a wider range of discussions than usual. For example, one member for example noted that the ECB and the Fed are reviewing their frameworks for monetary policy and suggested that policy in Japan may also warrant review. (Speakers are not identified.) There seemed to be less focus on the risks to the Japanese economy from overseas and more on the possible side effects of negative rates. Also, the government nominated Seiji Adachi to replace Yutaka Harada on the board. While Adachi is also in favor of a reflationist policy, like Harada, he has commented in the past that he isn’t in favor of lowering negative rates further if more easing is necessary.

Given that Japan has had near-zero rates for some 25 years and yet inflation has barely ever even hit their target, much less surpassed it, it would seem to me that some review would be appropriate.

The US Democratic primary season begins with the Iowa caucuses. If Sen. Bernie Sanders or Sen. Elizabeth Warren wins, there could be some negative impact on the US stock market and perhaps even the dollar out of fear that they might disrupt the gravy train Washington neo-Keynesian economic consensus. On the other hand, a good showing by former Vice President Joe Biden might reassure the markets that continuity was likely.

And as for the US impeachment proceedings and the trial of Trump in the Senate…I would like to introduce you to the Japanese phrase gongo-doodan 言語道断. Originally it’s a Buddhist term that means “the ultimate truth of Buddha’s teaching cannot be expressed by (mere) words,” but now it’s used pejoratively to mean “words cannot express,” or, according to my textbook, “unspeakable, unutterable, unmentionable, outrageous, unpardonable, inexcusable, preposterous, absurd, abominable, shocking, scandalous, beyond description.” I think that pretty well sums it up.