Rates as of 05:00 GMT

Market Recap

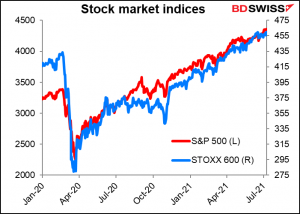

The same story as yesterday: both stocks and bonds rallying (although unlike yesterday, commodities were mixed). The S&P 500 eked out another record close yesterday as stocks in Europe nearly did too (STOXX 600 cloxed at 459.53, just a fraction away from the June 16th record close of 459.86).

Meanwhile, 10-year US Treasuries yields fell a further -3.2bps to 1.32%, their lowest closing level since late February.

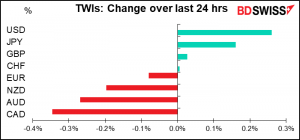

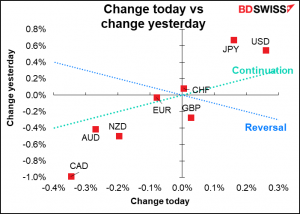

The market reaction to this surprises me, I have to admit. FX continued to move in a “risk-off” pattern, with USD and JPY rising while the commodity currencies fell. CAD was particularly hard hit, much to my embarrassment, as oil fell further.

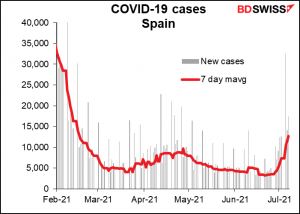

My suspicion is that this latest move is being driven by the virus. The new delta variant is getting really worrisome. We had this headline on Tuesday:

Then today we have:

Market concern about the virus can be seen in the relative performance of sectors that benefit from reopening the economy, such as airlines and hotels. Those sank yesterday even while the overall markets rose.

I can only deduce then that bond markets are rallying in anticipation that the reopening will be slowed and central bank support to the markets continued for longer than people may be expecting. Stock markets would then be rallying in anticipation that rates will remain lower for longer.

Lower bond yields & expectations of slower tightening might also help to explain why gold has risen for six consecutive days despite the stronger dollar.

As I’ve said before, I’m a market strategist by training and have no medical background beyond what I read in the papers, so your guess is as good as mine as to whether this trend continues. It does seem likely that at least concern about this trend will continue for some time as more news comes out. This makes me more bullish on USD, less negative on JPY and less bullish on the commodity currencies until we know what we’re dealing with here.

The minutes of the recent Federal Open Market Committee (FOMC) meeting confirmed what we already knew. Officials are spit between the “various participants” who think that conditions for tapering down the Fed’s $120bn-a-month bond purchases might be met “somewhat earlier than they had anticipated” and “some participants” who see a “less clear signal” in the data and want to see more information “in coming months to maker a better assessment.” Similarly, “several participants” wanted to start tapering the mortgage-backed securities purchases first in light of the hot US housing market, while “several other participants” preferred to taper them both at the same pace. “because this approach would be well aligned with the Committee’s previous communications or because purchases of Treasury securities and MBS both provide accommodation through their influence on broader financial conditions.”

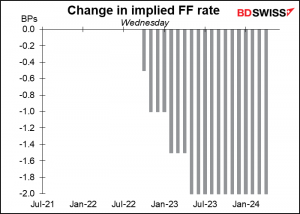

I have to admit I got no sense from the minutes as to which side was winning the argument. I certainly didn’t get the sense that the “sooner rather than later” crowd was winning. That probably means no change in policy in September, unless we see some dramatic improvement in the labor market or further surge in inflation during the summer. I would consider that negative for the dollar, but apparently the market disagrees. The fed funds futures did show a small decline in rate expectations starting a year from now, but not enough to overcome the flight to safe havens.

You can read the minutes for yourself here if you want. The relevant part is the 13th and 14th paragraphs in the section Participants’ Views on Current Economic Conditions and the Economic Outlook (Just search for the phrase “Participants discussed,” which is the beginning of the two paragraphs.)

One other key point to emerge: staff projections for inflation in 2022 remain below 2% with the risks balanced. That’s lower than the 2.1% median forecast of FOMC members.

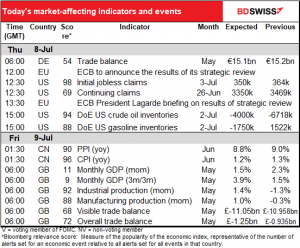

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Today’s big surprise is the scheduled announcement of the European Central Bank (ECB)’s new monetary policy strategy. It’s the first change since 2003. The results of the 19-month-long review were not due to be announced until September, but after policymakers reached agreement yesterday they decided to make the announcement.

The “core decisions” will be announced at 13:00 CET (12.00 GMT), after which President Lagarde and VP de Guindos will present the outcome at an online press conference. You can read the announcement and watch the press conference here.

According to the FT, the new policy is likely to amend the inflation target while also addressing climate change and housing costs. Currently they aim to keep inflation “close to, but below, 2%,” with core Eurozone inflation as their gauge. That sets an upside limit to inflation. The new target is likely to be a more straightforward 2%, with policymakers emphasizing that it is symmetric, meaning they’ll be just as concerned about exceeding it as being below it. The target will be a medium-term objective with flexibility to fluctuate in either direction in the short term, the FT said. However they’re unlikely to go as far as the Fed has and deliberately aim for a period of over 2% inflation to make up for periods of below-2% inflation.

This has been de facto ECB policy for some time. Making it explicit would probably be negative for the euro nonetheless by allowing for a slower increase in rates.

The ECB will also address public concern that monetary policy does not take enough account of rising housing costs. They will encourage the EU’s statistical body, Eurostat, to add housing to its inflation calculation. That would add an estimated 20 bps to the current rate of inflation, according to recent ECB research. That could tend to be positive for the euro if it resulted in less need to loosen policy, but that’s a long-term concern.

The new plan is also expected to include a “green shift” in the ECB’s bond-buying operations to deal with climate change. Instead of buying bonds in strict proportion to the composition of the market – a policy known as “market neutrality” – they will tilt their asset purchase portfolio and collateral rules away from companies with high carbon emissions that do not have a plan to meet the EU target to be net zero by 2050.

I think the immediate impact will be small if any because they haven’t been able to hit their 2% target anyway. The longer-term impact may be greater though if and when they do manage to get inflation back to 2%. The impact on the corporate bond market could be substantial, although that will take place only gradually.

Today’s data

The German trade & current account balance isn’t that important for the markets, and even that is out already, so we don’t have much to worry about during the European day.

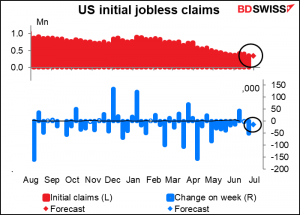

Failing that, we just have to sit and wait until the weekly US jobless claims come out. After last week’s surprisingly large drop of 51k, the market is looking for a more modest decline of 14k. The average for the last six weeks is -13k, so this is not beyond the realm of the possible.

People are also paying attention to the continuing claims to see if the heartless and vindictive moves by 26 Republican governors to deny their state’s residents access to federal pandemic unemployment payments is having the desired effect of forcing people to take dangerous jobs that don’t pay enough to buy the calories necessary to carry out the work involved.

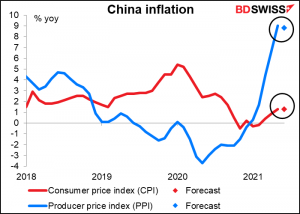

Overnight, China announces its inflation data. The skyrocketing producer price index (PPI) is expected to slow a bit but not significantly. The consumer price index (CPI) though is expected to keep rising at the same modest annual pace.

The CPI in China is usually more of a function of food prices than it is of goods & services, but not now – the recent rise has not been due to food prices. This bodes ill for global inflation because China tends to set the minimum price for so many things.

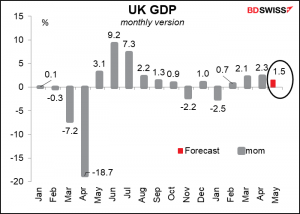

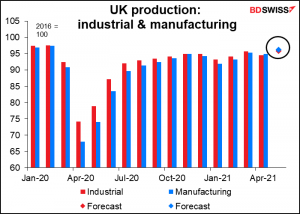

Then, as dawn breaks over Buckingham Palace (actually, over the Thames Estuary first), Britain has “short-term indicator day.” The Office of National Statistics releases the monthly GDP figures, industrial & manufacturing production data, and the trade data, all at the same time (as well as construction output, which the FX market doesn’t watch).

GDP growth is expected to slow as the economy gradually returns to normal and we start to get more normal figures. (EG, in the five years before 2020, the average of the absolute value of mom changes was 0.2%, so ±0.2% would be a typical mom change in GDP, not +1.5%.) The continued reopening of the service sector will no doubt be providing the main boost to growth. The question is, will people see this as a slowdown from the previous two months – thus falling prey to the anchoring fallacy – or will they look at it as continued abnormally high growth? Alas I don’t have much faith in the wisdom of the markets when interpreting indicators. I think people will just say “oh, growth is slowing” and it will be considered negative for GBP.

Industrial production and manufacturing production are both expected to rise +1.4% mom, hence only one dot on the graph.

This would put them -1.7% and -0.8% below pre-pandemic levels, respectively.

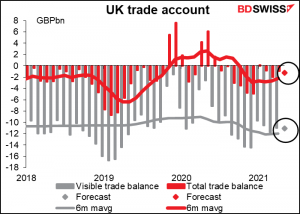

The visible trade deficit is forecast to be little changed, but the overall trade deficit is forecast to widen somewhat but still be narrower than the six-month moving average. In short, the trade picture does not seem to be worsening for Britain despite the post-Brexit travails.

This is not however because of any great success in finding new export markets for all the goods suddenly shut out of the EU. Rather, it’s because imports haven’t recovered yet either.

All told, I think the data coming out today is likely to be positive for the pound. While the slowdown in GBP growth may disappoint some investors, that would have to be balanced against the recovery in industrial & manufacturing output. And the steady trade balance should also be a plus for the currency.