Rates as of 04:00 GMT

Market Recap

A mixed day for risk in the stock markets, with the S&P 500 up but NASDAQ down and stocks mixed in Asia this morning. But as far as the FX market was concerned, it was “risk-on” all the way with the commodity currencies up and USD & JPY down (CHF little changed).

After the landmark agreement on the EU recovery fund, EUR/USD rose to an 18-month high. But EUR was up only slightly against CHF and GBP, indicating that the rise in EUR/USD was more a result of USD weakness than EUR strength.

With the European rescue package now settled, the market focus will shift to the US discussions over the next fiscal package. It’s what they call in Britain “a dog’s dinner,” or maybe it’s a dog’s breakfast, I could never tell the difference. (Looking it up, it seems they mean the same thing – I guess dogs eat the same thing for breakfast and dinner.) The Republicans can’t even agree among themselves what they want, so it’s impossible to start negotiations between them and the Democrats. The problem is that at the end of the month the $600-a-week supplementary benefits (Federal Pandemic Unemployment Compensation) that are keeping a lot of Americans afloat are going to expire, and then what happens? According to the NY Times “because of a quirk in the calendar, workers in most states won’t qualify for the payments after this week. Most will be left with regular unemployment benefits, which total only a few hundred dollars a week in many states.” We’re talking about over 20mn people losing more than half their income. This is going to crush US consumption and reverse whatever recovery we’ve started to see. USD-negative

In fact, it looks like the US economy is already starting to turn over. Yesterday the NY Fed updated its Weekly Economic Index (WEI). The WEI is an index of ten daily and weekly indicators of real economic activity, scaled to align with the four-quarter GDP growth rate. It fell to -6.86% from -6.08%. The Fed attributed the decline to “a decrease in retail sales and the fact that series that have recently driven the WEI upward are not yet available for that week. These factors outweighed increases in steel production and consumer confidence.” Once those other data are available it could be revised up. Nonetheless, the contrast with Germany is clear: the US is struggling while Germany is recovering.

AUD continued to climb, hitting the highest levels since April of last year. The minutes of the latest Reserve Bank of Australia (RBA) meeting, released Tuesday morning, showed that the Committee thought the rally in AUD was “consistent with commodity prices and interest differentials” and that members agreed there was “no case for intervention in the foreign exchange market, given its limited effectiveness when the exchange rate is broadly aligned with its fundamental determinants, as at present.”

RBA Gov. Lowe reinforced that message in the Q&A session after his speech yesterday, when he said, “you can’t at the moment make the case the Australian dollar is misaligned.” “As I’ve been saying, for a long time, I would like to see a lower Australian dollar…,” he added. “But the Australian dollar’s value is set in the market, and we’re not going to intervene to force it lower in the current circumstances.”

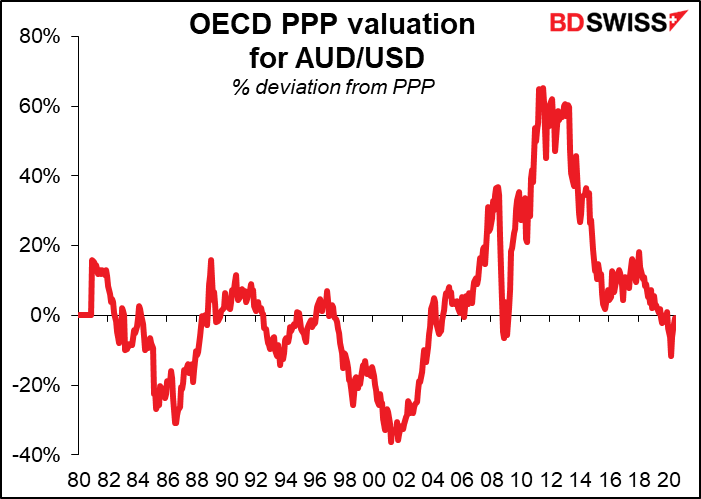

In fact, it would be very difficult indeed to argue that the AUD is “misaligned.” According to the OECD’s estimate of AUD’s purchasing power parity (PPP) value, it’s almost spot on fair value at recent levels (maybe +2.6% overvalued today).

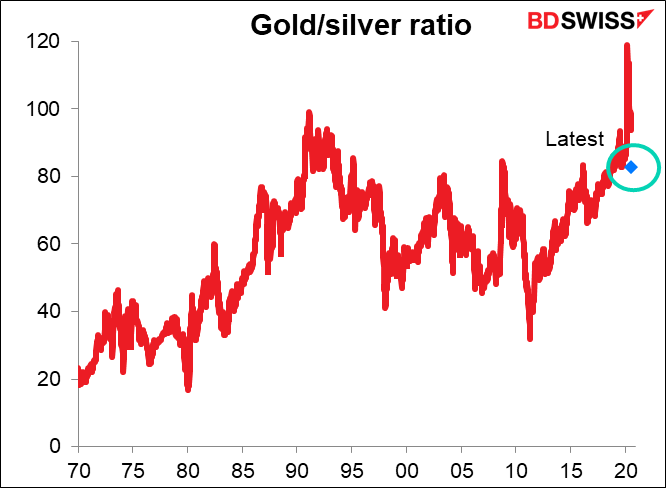

The big action though was once again in silver, which is up 10.1% this morning from where it was yesterday at this time. Looking at the official opening & close, it was up 7.0% yesterday and another 6.1% this morning – pretty amazing stuff, although by no means a record (it was up 14.1% on 17 Sep 2008 – two days after Lehman Bros. went bust). The gold/silver ratio came down from 86.5 yesterday to 82.5 this morning. The ratio has been much lower in the past though so I think there is still room for silver to gain vs gold. Note that gold also gained, so this is not just a silver move – it’s a continued move into precious metals, with silver catching up.

Yes, the Senate Banking Committee did approve Judy Shelton’s candidacy for the Fed Board of Governors (along with St. Louis Fed director of research Christopher Waller). The next question is, when will the Senate vote? Republicans hold a 53-47 majority on the Senate so it would take four brave souls to torpedo her disastrous candidacy. As the Wall Street Journal pointed out, Shelton’s could be a crucial vole if any of the current Fed governors depart during her tenure. Emergency lending programs like those implemented recently require the votes of at least five governors. That would give any one of them veto power if the board is staffed by five or fewer members.

Waller is a more conventional candidate and I don’t think anyone would object to him, except maybe some crackpots who actually want to return to the gold standard and therefore support Shelton. I don’t doubt that there are some such people among the Republican Senators.

Today’s market

Once again, not much on the schedule. In fact it’s a pretty boring week for indicators all around.

The Mortgage Bankers’ Association (MBA) mortgage market weekly index doesn’t have a forecast, but it’s still closely watched (a score of 92.3 on Bloomberg) It’s still showing considerable interest in taking out mortgages, much higher than at any time in the last 10 years.

Canada’s inflation data would normally be big stuff for CAD, but like most central banks, the Bank of Canada’s reaction function is effectively frozen at this point – they can hardly loosen policy further even if inflation slows, and they’re not going to raise rates until the emergency is over. As a result the inflation data is sort of like a tree that falls in the forest – does it make a noise if no central banker hears it?

In any event, the Bank of Canada is already expecting inflation to remain low. AT its meeting last week, the Bank said

“CPI inflation is close to zero…Inflation is expected to remain weak before gradually strengthening toward 2 percent as the drag from low gas prices and other temporary effects dissipates and demand recovers, reducing economic slack.”

Headline inflation is forecast to tick back up (barely) into positive territory, but two of the three core inflation measures that the Bank relies on are forecast to show slowing inflation. Nevertheless, as that’s expected, it won’t elicit any reaction – not that it could.

Existing home sales are expected to rebound significantly. Housing has been one of the few bright spots in the US economy as new home sales never fell that far to begin with. It’s been reported that a lot of people living in cities have recently discovered that they can work from home and subsequently decided to trade their small flat in a crowded city for a larger home in the nice green suburbs. But since the people in the ‘burbs aren’t going anywhere, the only houses they can buy are new ones, which may be why new home sales (out Friday) have held up better than existing home sales.

Record-low mortgage rates may also have something to do with it, although I’ve read that this exodus from the cities is not a uniquely US phenomenon. But then again, neither are record-low interest rates.

Oil inventories have fallen two out of the last three weeks and are expected to fall again in the latest week. However, the American Petroleum Institute (API) yesterday announced an unexpected 7.544mn barrel increase in inventories.

I was wondering whether the decline in inventories is the result of a pick-up in demand or a reduction in supply. It’s a bit of both.

US oil output has fallen 16% from its peak this year, but stablized, according to the Dept of Energy figures.

Demand has also come back from the April lows, although it too seems to have leveled off recently.

Overnight it’s a holiday in Japan: Marine Day. A pretty hokey holiday if you ask me. Friday is Sports Day. Why don’t they just make a two-day holiday, Swimming Day? These two were just invented to give people a couple of days off, because Japanese are still discouraged from taking their allotted vacation days.

Then from the early early mornin’, we get Germany’s Gfk consumer confidence. I’m kind of baffled by this indicator. I never paid much attention to it before, because it never really changed much and besides, it didn’t seem to be market-affecting. From its inception in Jan 2005 to end-2019 it had a range from 1.5 to 10.8, with the biggest monthly move ±3.8. Now it’s jumping all over the place.

In any case, the index is expected to improve but to remain negative. Not surprising.