Rates as of 04:00 GMT

Market Recap

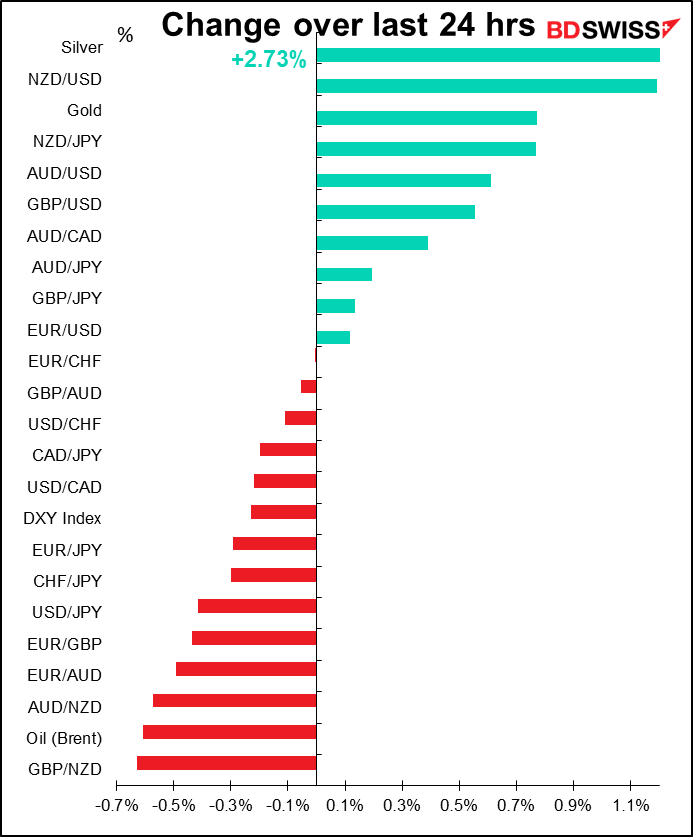

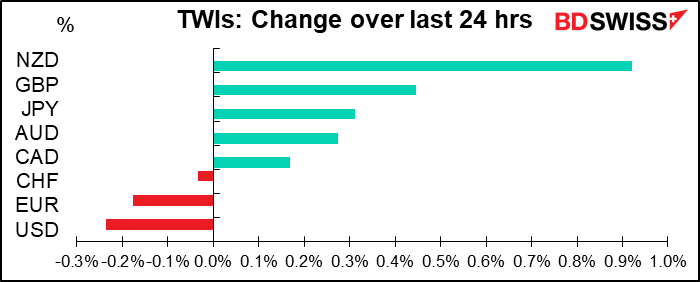

In a continuing “risk-on” environment, with the S&P 500 up 1% and the NASDAQ up an astonishing 1.7%, the dollar continued to weaken. It’s a good example of the difference between the “domestic dollar” and the “international dollar.” The headline US durable goods came out much better than expected (+11.2% mom vs +4.8% expected), which initially caused USD to rise on expectations of faster US growth (domestic dollar), but then as stock markets gained, the currency fell back on better risk sentiment (international dollar).

This time though USD weakness didn’t translate into EUR strength; EUR/USD was little changed on the day (as was EUR/CHF).

The biggest gainer was NZD, which rose in conjunction with foreign buying of government bonds. The country sold NZD 4bn of bonds on Tuesday that will settle on 1 September. That may account for the particularly sharp rise in NZD/JPY.

Several press comments said kiwi was rising because of the “risk-on” environment. In that case I have to ask, why NZD? Why not AUD?

AUD/USD is indeed the one that usually moves more in response to a “risk-on” environment. Its correlation with daily moves in the S&P 500 over the last two years has been 0.44%, vs 0.34% for NZD/USD. Naturally, AUD/NZD is positively correlated with stocks as well (0.20).

Nonetheless today’s move, although at the high end of what’s normal, is no outlier. NZD/USD usually moves only 0.82% as much as AUD/NZD does, as the graph below shows. But today’s move is well within the usual range.

The rise in GBP is yet another sign that the market is ignoring Brexit. The German government, which holds the rotating presidency of the EU council, had intended to discuss Brexit during a meeting of EU ambassadors next Wednesday but yesterday took the subject off the agenda as there’s been no progress in the negotiations. The news is important because it’s been expected that German Chancellor Merkel could play a crucial role in breaking any deadlock, but it appears she’s giving up hope. GBP fell briefly on the news but it didn’t last long. Formal negotiations will resume on 7 September.

Yesterday I mentioned that Hurricane Laura had been upgraded to Category 3. Now it’s Catgeory 4, which is when “Catastrophic damage will occur” and “most of the area will be uninhabitable for weeks or months.” The National Hurricane Center (NHC) said some areas will suffer an “unsurvivable storm surge.”

The economic significance is global: the area accounts for about a quarter of US oil refining capacity and refiners have already halted facilities that process at least 2.4mn b/d of oil, 12.6% of the total, according to Reuters. Furthermore, the area produces half of North America’s production of ethylene, a key plastic raw material, and there are several liquefied natural gas export terminals.

Despite this impending doom (plus a larger-than-expected drawdown in gasoline inventories in the latest week), oil prices fell and CAD was little changed. Oil market participants read the weather forecasts and were well aware of this storm coming ahead of time.

Japan PM Abe will hold a press conference tomorrow . He’s expected to provide an update on his health after two recent hospital visits and to talk about the government’s handling of the pandemic. There are fears that he may resign if he’s unwell. I doubt if that would have any major impact on the country’s economic policies, as his much-lauded “Three Arrows” campaign petered out a long time ago. However JPY could strengthen temporarily just on “risk-off” among domestic investors.

Focus on Jackson Hole Symposium, “Navigating the Decade Ahead: Implications for Monetary Policy”

The focus today and tomorrow will be on the Kansas City Fed’s annual Jackson Hole Symposium, which this year will be held virtually and live-streamed to the public. You can watch the entire proceedings yourself live on the Kansas City Fed’s YouTube channel (with luck they may also have a few videos of dancing cockatoos or Fiona the Hippo during intermissions.)

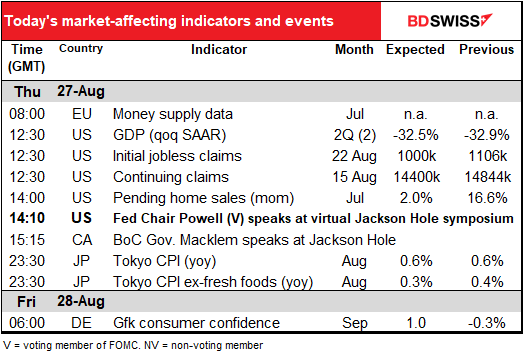

The agenda for the symposium is published here. No big surprises; the major speakers were already known: Bank of Canada Gov. Macklem and ECB Chief Economist Lane today and Bank of England Gov. Bailey tomorrow. The head of the Monetary Authority of Singapore and the OECD’s chief economist will also be speaking, but otherwise it’s all academics.

The big event, the one everyone is waiting for, is the very first speaker: Fed Chair Jerome Powell. Is it significant that on the Board of Governor’s website, his topic is listed as “Monetary Policy Framework Review,” but on the agenda for the symposium it’s just “Opening Remarks”? We’ll see.

I wrote about the speech in great depth and detail in my weekly outlook, which you can review (hah! Just kidding) here. To save you time, I’ll repeat the main points.

Since 2018, the rate-setting Federal Open Market Committee (FOMC). has been engaged in a “broad review of the strategy, tools, and communication practices” of its monetary policy. Powell is expected to give an overview of the changes that the Committee has decided on and explain the reasoning behind them. He might include some excerpts from a revised version of the FOMC’s guidelines, the Statement on Longer-Run Goals and Monetary Policy Strategy, which then would be adopted and released in full at the 16 September FOMC meeting.

The thought in the marketplace is that they’ve finished that review and are going to switch to average inflation targeting. He would also explain why the Committee won’t implement the other possibilities that were discussed, such as negative interest rates or yield curve control (although they might not formally reject them, either).

What is Average Inflation Targeting?

Currently, the Fed’s inflation framework is to keep monetary policy accommodative (i.e., keep interest rates lower than they would otherwise be) until they can predict that inflation will hit their 2% target in the foreseeable future. (They have to raise rates pre-emptively because it takes two to three quarters for the effects of monetary policy to permeate the economy.) At that point they start to raise rates back to a more normal level – depending on the employment situation of course, in line with their “dual mandate” of “maximum employment” and “stable prices.”

If on the other hand they change to an inflation averaging policy, they wouldn’t be so quick to start raising rates.

Their target would be for inflation to average 2% over the longer term. Two percent would be an average, not a ceiling. That means if for example inflation had been 1% for a year, they might let it run to 3% for a year before they started raising rates.

If inflation is higher but interest rates are the same, it means real yields (= nominal yields minus inflation) are lower. And that would be negative for the dollar and positive for risk assets and gold.

Why I don’t think they will go all the way for Average Inflation Targeting

However, I don’t think they will go all the way and change to average inflation targeting. I think the market is likely to be surprised and the dollar rebound as a result.

The first reason is that there doesn’t seem to be any agreement on it among FOMC members. Looking at the minutes of the July FOMC meeting, it said that “a number of participants” discussed the idea. Compare that with how “a majority of participants commented on yield caps and targets” and “many participants” discussed the way they present their asset purchases. I don’t get the feeling that they’ve reached a consensus on doing this.

I suspect that the reason they haven’t agreed to switch to this policy is the difficulty, if not impossibility, of reaching the target.

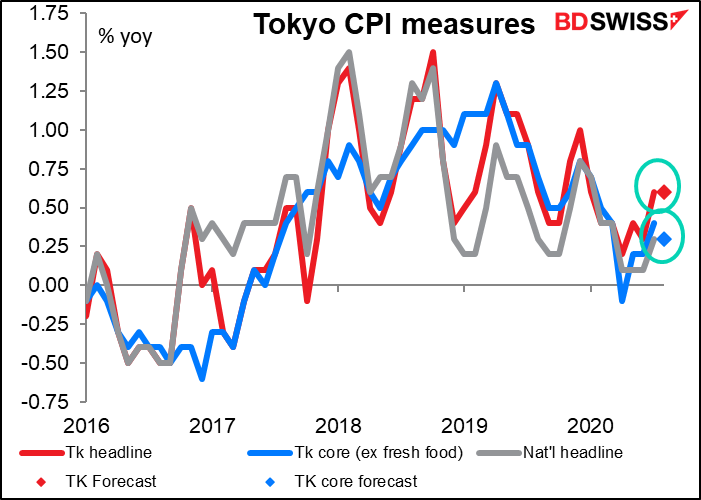

US inflation has been below their 2% target for 75% of the time since 1995, including since January 2019. If they need inflation to go over that 2% line to make up for the undershoot, then they’re going to have to take more and more extraordinary actions and continue them for longer and longer than anyone can currently imagine in order to meet their target. Just look at how long Japan has struggled unsuccessfully to meet its 2% inflation target! (Answer: almost continually since 1996.)

Average inflation targeting would essentially mean QE∞. (QE infinity). That’s too big a price to pay. I don’t see them tying themselves to a target that they’re unlikely to hit ever, which is the problem the Bank of Japan has been struggling with for several decades (see the bit on the Tokyo consumer price index below).

The market however seems convinced that they will go for it. I think the surprise is likely to send the dollar higher today.

What they could go for instead

So if Powell isn’t going to commit to achieving an average inflation level over the long run, what changes might be in store? I think they could simply talk of allowing inflation to run over their 2% target when the economy is below full employment, but not explicitly promising to make up for past downside misses.

Back in the pre-COVID-19 (hard as it is to remember such a time nowadays), one of the big debates in economics was, why wasn’t inflation rising as unemployment got down to record low levels? Not just in the US but all over the world. Something has changed since the economic textbooks were written, but central banks’ reaction function – how they adjust monetary policy in reaction to changes in the economy – hadn’t. I expect that they’ll acknowledge these changes, maybe even emphasize that deflation is now as big a threat as inflation used to be, and implement changes to make policy more symmetrical. For example, they could say that from now they have to hit both their targets – 2% inflation and maximum employment – before they’ll begin normalizing rates, i.e. they’ll let the economy run “hot” and overshoot the 2% inflation target if unemployment is still higher than they’d like. That was under discussion before. Or that they’ll “take account” of periods of below-target inflation or something soft like that.empha

Separately, they’ve justified their asset purchase program as a response to the poor functioning of the bond market. Now that the bond market is functioning normally again, they’ll eventually have to come up with a new justification for the program. They may also want to find some way to give the market forward guidance about the program, such as including forecasts for the program in the Summary of Economic Projections. But I don’t expect Powell to discuss that in the hour he’s got today. That may be something for September or even November.

Today’s data

We get the second estimate of US Q2 GDP today. I can provide you with a nicely colored graph showing how US GDP has been revised over the last several years, even highlighting how it’s gone in Q2 so you can see if there’s any pattern, but boy if there were ever a period in history when the phrase “past performance is no guarantee of future performance” holds, this is it. So I’m not sure how knowing what “usually” happens will help you this time. Much of the preliminary GDP estimate is comprised of just that, estimates, and as the actual numbers come in we could get some pretty big revisions.

The range of forecasts on Bloomberg is from -33.5% to -28.5%.

In any case this is old hat by now, people are wondering about what’s going to happen in Q3.

Jobless claims, both initial and continuing, are expected to resume the downward trend that they unexpectedly broke last week and be down modestly. Initial claims are forecast to be 1.0mn though, which is depressing – below 1mn would be better.

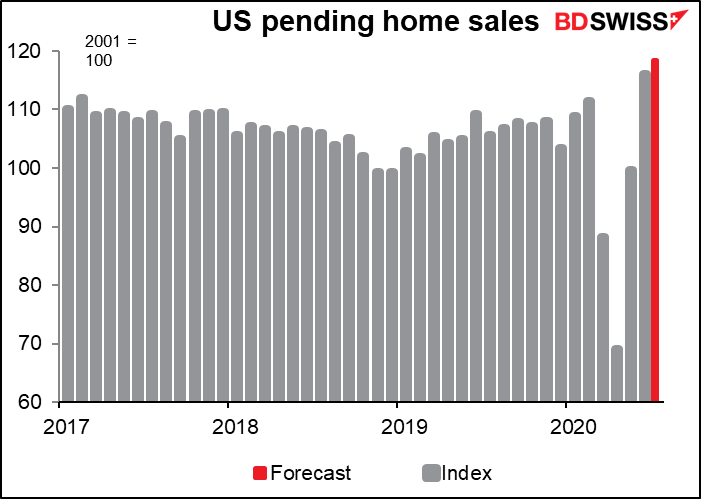

US pending home sales are already exceeding pre-pandemic levels and are expected to rise further. The modest rise that’s forecast would bring the level of sales back to where it was in 2005, when the US housing boom was going full blast. Pretty incredible.

Nothing good is expected from the Tokyo consumer price index (CPI). The headline figure is expected to be unchanged while the Japanese core inflation number (excluding fresh foods) is forecast to drop 0.1 ppt. This is after some 24 years of zero interest rates. This may give you an idea of what the Fed is up against if they change to average inflation targeting.