Rates as of 05:00 GMT

Market Recap

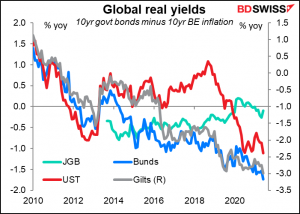

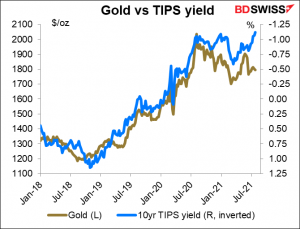

While stock markets continued to plow into record territory (well, the S&P 500 did; the Euro STOXX 600, which hit a record on Friday, didn’t), the market was focused on another record: record low real yields. Not just in the US but in Europe too as both German government bonds (Bunds) and UK government bonds (gilts) hit record lows on this metric (the 10-year nominal yield minus the 10-year breakeven inflation rate, the inflation rate that will give investors the same return from buying a normal bond or an inflation-linked bond). Japan is an exception however, as usual.

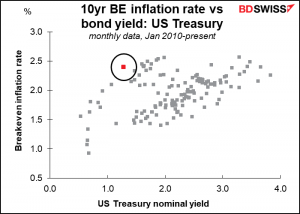

It’s not that people think the recent bout of high inflation is going to be “transitory,” as all the central banks insist. On the contrary, 10-year breakeven inflation rates are at multi-year highs for most of these countries, Japan once again being the exception.

It’s the low yields when inflation expectations are so high that’s pushed real yields down so far.

The current level of nominal yields isn’t the lowest ever and the breakeven inflation rate isn’t the highest ever. It’s just that the combination of the two is at the extreme edge of past performance.

Gold should be a beneficiary of this trend, as it tends to perform better during times when real interest rates are low or negative. That’s because there’s an opportunity cost of holding gold, since it doesn’t pay any interest. But when interest rates are negative, this “opportunity cost” can turn into an “opportunity benefit.”

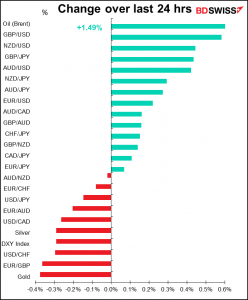

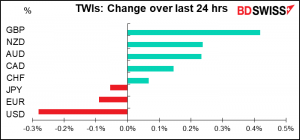

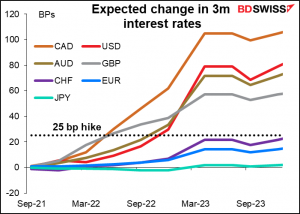

In the FX market, record low yields plus strong risk appetite send USD lower. Low real yields reduce the incentive for investors to put money into US bonds. It’s therefore negative for the dollar. However, I think the “monetary policy divergence” theme – the idea tthat the Fed may raise rates sooner than some other central banks – is likely to come back to the fore tomorrow after the Fed meets. So I wouldn’t bet on this move lasting that long.

The “monetary policy divergence” theme may also work in favor of GBP (see below) and the commodity currencies.

GBP was the best performer – with no particular news to spur the move, I can only attribute it to end-month portfolio rebalancing. Having said that, the fundamentals for the UK are improving. New COVID-19 cases have been falling steadily since the peak on July 17 despite the easing of restrictions two days later. This has increased market expectations for a strong UK recovery leading perhaps to an earlier shift in Bank of England thinking.

AUD, which had a terrible day Friday, reversed some of its losses yesterday. That may have been in anticipation of a strong consumer price index out tomorrow in Australia, which could boost the currency (see below).

Today’s market

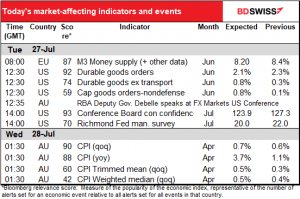

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Lots going on today!

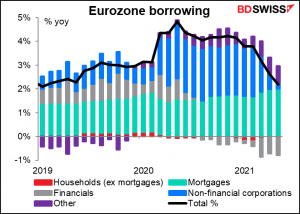

After the new ECB strategy review decided to add “financial conditions” to “monetary conditions” as the second “pillar” of their decision-making process (along with “economic conditions”), the bank lending data included in the EU money supply figures may take on added importance. As the graph shows, the rate of increase in bank lending has been slowing for some time, but especially since February of this year as corporate borrowing (blue bars) dried up. This may be of concern to officials.

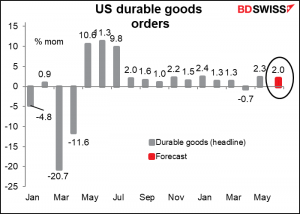

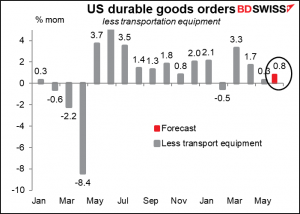

The market is expecting a second month of solid increase in durable goods orders, in large part thanks to a rebound in transportation orders.

The ongoing strength of the US economy should be even more evident in orders excluding transportation equipment, which is expected to show substantially better growth than last month.

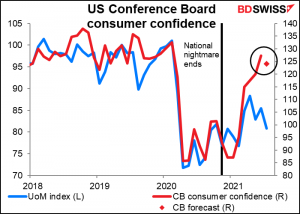

The Conference Board’s consumer confidence index is expected to fall. This should come as no surprise after the U of M version of this index fell from 85.50 to 80.80 during the month.

Note that the Conference Board index was almost back to pre-pandemic levels, while the U of M index languishes far below. The U of M index is comprised of a current conditions and an expectations index. The Conference Board consumer sentiment index has a 95% correlation with the U of M’s current conditions index but only an 82% with the expectations index. That perhaps explains why the Conference Board index is doing better – the U of M index captures more of peoples’ worries about the future, especially inflation. Furthermore, the Conference Board measure is more heavily weighted towards the labor market, which has been improving, while the Michigan methodology places more emphasis on longer-term macroeconomic expectations, such as inflation as I mentioned.

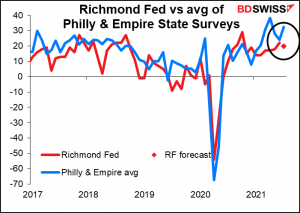

The Richmond Fed survey is expected to be down slightly. The Empire State and Philly Fed indices can’t provide much guidance – the former jumped to 43.0 from 17.40, while the latter dropped to 21.9 from 30.7. So the fact that the average of the two rose doesn’t really tell us much.

The market doesn’t pay as much attention to the Richmond Fed index as it does to the Empire State and the Philly Fed surveys, maybe because it’s usually the third to come out every month and so it’s getting to be a little old news. Nonetheless they should, because it’s the survey that is the most reliable indicator of the Institute of Supply Management (ISM) manufacturing purchasing manufacturer’s index (PMI). I would think though that a small decline as forecast would be no big deal for the market as it would still be indicating a strong US economy. USD neutral

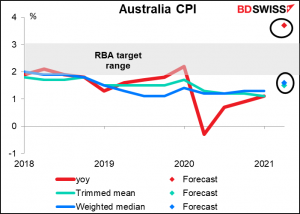

Overnight, Australia’s headline inflation is expected to leapfrog over the Reserve Bank of Australia (RBA)’s 2%-3% target band to +3.7% yoy. This is fully expected; the RBA said after its meeting a few weeks ago that “CPI inflation is expected to rise temporarily to about 3½ per cent over the year to the June quarter because of the reversal of some COVID-19-related price reductions a year ago.” With both of their core inflation measures still below the target band, the rise in headline inflation won’t worry the RBA. The market though is likely to be a different matter, as not everyone believes the central banks’ view that such increases are temporary. AUD+

The market has been pushing back its estimate of when the RBA might start raising rates. This leap in inflation – no matter if the RBA does believe it to be “transitory” – could change some minds.