Rates as of 05:00 GMT

Market Recap

Friday’s US nonfarm payrolls was a “Goldilocks report”, neither too hot nor too cold. The headline figure was better than expected at +850k (vs +720k expected), but the unexpected increase in the unemployment rate to 5.9% from 5.8% (vs an expected fall to 5.6%), coupled with no change in the participation rate, was disappointing. Together the report was strong enough to reassure investors that the labor market is continuing to recover, but not strong enough to trigger concerns that the Fed might start tapering down its support to the economy earlier than expected.

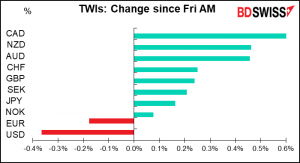

The report spurred a “risk-on” mood in the market that sent the commodity currencies higher and USD lower. EUR also fell for reasons that are unclear to me, alas and alack.

Among the commodity currencies, CAD was the best-performing as oil prices rose in the wake of OPEC+ disarray. The OPEC+ meeting broke up Friday without any decision. Talks have continued over the weekend and will resume this afternoon. All the other members of OPEC+, including both Saudi Arabia and Russia, have agreed to increase production over the next few months while also extending the production restraint agreement, which was supposed to end after March, until the end of 2022. The UAE however is against extending the deal and wants only a short-term increase and better terms for itself for 2022. Saudi Arabia’s Prince Abdulaziz said that if they don’t extend the arrangement, the fall-back deal would be to keep output unchanged for the rest of the year. That would probably send oil prices sharply higher. On the other hand, it could also cause the group to break apart and an oil free-for-all that would send prices lower.

Commitments of Traders (CoT) Report

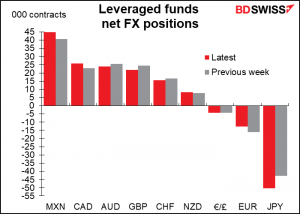

The CoT report showed specs decreasing their short USD positions.

EUR longs were hardly changed. The biggest move was a large increase in short JPY positioning. The second-biggest move was in CHF, where specs cut their longs notably. It looks like the previous week, when they were long 13,552 contracts, may have been the high for the time being.

The other significant change was an increase in CAD longs. These have remained fairly constant for some time since mid-May though.

As for hedge funds, they increased their MXN and CAD longs while trimming their GBP longs. They also trimmed their EUR shorts but extended their JPY shorts significantly.

As for precious metals, spec increased their long silver position slightly but cut their long gold.

Today’s market

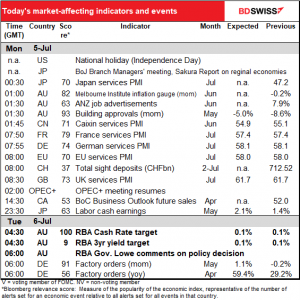

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The main focus today will be the Reserve Bank of Australia meeting overnight. As usual, I dealt with that in some detail in my world-renown Weekly Outlook, so for the pretty graphs etc please look there. But to save you the trouble and sum up what I said, at the May meeting the Board said it would decide in July “whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond.” The Board “will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September.”

Two big decisions. So what will they do?

It looks like the market thinks they will not shift into the November bond. Otherwise the yield on the two would be converging.

By switching their purchases into the November bond, they would be buying a bond with seven months longer to maturity – that would tend to flatten the yield curve more and, significantly, would affect more mortgages and bank loans, which in Australia are usually tied to the three-year rate. But with unemployment recovering far faster than they expected, I doubt whether they’ll feel the need to loosen policy further. Accordingly, I think they’ll continue to target the April bond, which will allow the impact of their intervention to fade gradually. That might be called a “Lao Tsu Tightening” (Lao Tsu being the Taoist master who said “by doing nothing, everything is done.”)

The impact of such a decision could be positive for AUD, except that looking at the price of the two bonds I’d say it’s pretty well in the market already.

As for the bond purchase program, in the latest Reuters survey, 16 of the 20 forecasters polled thought that the RBA would extend its bond purchase program but with a flexible approach. Currently it’s buying AUD 5bn a week. It’s likely to maintain that pace for now but review it periodically in light of the economic data.

RBA Gov. Lowe will also make a speech after the announcement.

Today’s indicators

The main indicators will be the service-sector and composite purchasing managers indices (PMIs), including the final versions for those countries that have preliminary versions.

For the Eurozone, both the flash service-sector and composite indices hit post-Global Financial Crisis highs, so even if they are revised down a bit, it wouldn’t be significant. However in recent months the service-sector PMIs have usually been revised up, so an upward revision is more likely. EUR+

EUR/CHF moved up in the week ended June 25th and so Swiss sight deposits didn’t rise very much. EUR/CHF fell in the latest week however; how did the Swiss National Bank respond?

Then basically that’s it. With the US on holiday, we won’t get an update on the Markit US service-sector PMI nor the Institute of Supply Management (ISM) version of that index. Those come out tomorrow.

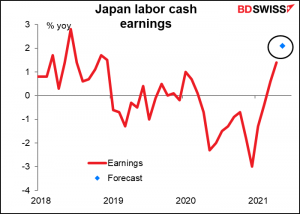

When Japan starts up, they release the labor cash earnings, which doesn’t have much impact on the financial markets but I follow it because my daughter will be entering the workforce there one of these days. Also it should have an impact on the market, just like average hourly earnings used to in the US, but of course now all the labor markets are so distorted that overall earning figures aren’t reliable.

The yoy rate of change looks great, but that’s largely because wages fell sharply in May last year. In fact with overtime working hours falling, total cash earnings are likely to fall on a mom basis too. Summer bonuses are expected to be pretty bad this year too, which is likely to lead to further slowdowns in wages growth. How will my daughter ever support me in my dotage?

Then as day begins in Europe Tuesday, Germany announces its factory orders.

Companies cut their inventories during the pandemic and have since been trying to rebuild them back to normal levels. That move may now be gradually coming to an end, but as we’ll see tomorrow, the gap between orders & industrial production remains quite wide.