Rates as of 05:00 GMT

Market Recap

It was a “risk-on” day in Europe yesterday as most European stock markets gained. The upward revision to the Eurozone service-sector and composite PMIs propelled the STOXX 600 index up +0.34 to 458.36, almost back to last month’s record high of 459.86. Commodity prices were also generally higher, including several key industrial metals. US markets were closed for the Independence Day holiday.

The big news was that the OPEC+ talks broke down. They were supposed to resume Monday after a weekend of behind-the-scenes discussions, but nothing doing. As a result the output hike that was scheduled for August won’t take place. That sent oil prices up further. Over the longer term though it could mean the breakdown of discipline within the cartel and a free-for-all as countries try to maximize their production.

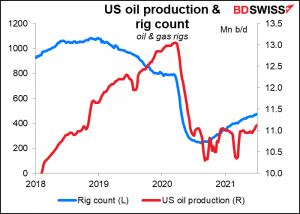

I wonder though if the US can step in to fill the gap. US oil production is down sharply from its peak in March last year, just as the pandemic sent economic activity crashing. Perhaps the higher prices will revive the US oil industry. That would be positive for USD. However it’s likely to take some time and it’s unclear whether oil companies (and their bankers!) will be willing to take the risk, particularly when it’s still difficult to hire people.

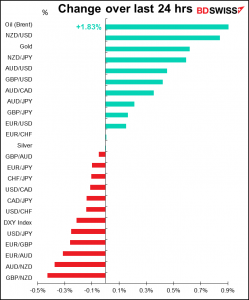

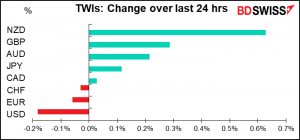

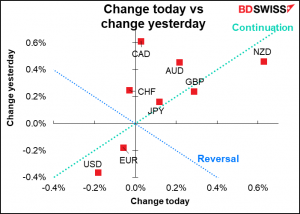

The FX market seems to be split in two: some trending currencies (USD, JPY, GBP, and NZD today) and some that are on the sidelines (CAD, CHF, EUR).

AUD appreciated modestly. The Reserve Bank of Australia (RBA) meeting went pretty much as I (and everyone else) had expected. They retained the April 2024 bond as their yield target while extending their AUD 100bn quantitative easing program by at least two months (until mid-November) while cutting the pace of purchases to AUD 4bn a week from AUD 5bn. The Board will review the program at its Nov. 2nd meeting, “allowing the Board to respond to the state of the economy at that time.”

While the moves were a modest tightening of financial conditions, they didn’t have that much impact on the market because a) they were well discounted ahead of time and b) the RBA still expects to keep rates at current levels until 2024. A bit of doubt did creep into their comment however. They said that their “central scenario” was that the conditions for raising rates “will not be met before 2024.” By contrast, last month they said “This is unlikely to be until 2024 at the earliest.” The idea of a “central scenario” implies other scenarios that have different outcomes, whereas last month such possibilities were “unlikely.”

Nonetheless, 2024 is definitely at the far end of the major central banks that have speculated when they might normalize policy. I went through all of them in my recent Weekly Outlook (FOMC meeting is a game-changer, June 18th). The Bank of Canada said “sometime in the second half of 2022” while the Reserve Bank of New Zealand included a projection of a rate hike in the 3rd quarter this year. The Fed of course has two rate hikes penciled in by end-2023 in its “dot plot.”

Naturally, the market is forecasting no change in rates in Australia this year. In contrast, it’s forecasting one rate hike in New Zealand by the end of the year. I think this reluctance to normalize policy even in the face of a recovery that is “stronger than earlier expected and is forecast to continue” means AUD is likely to be the laggard among the commodity currencies. I prefer CAD, at least as long as oil prices keep at these high levels.

Elsewhere, USD/JPY was unable to remain above ¥111. It’s trading just below that level this morning.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The Official Monetary and Financial Institutions Forum (OMFIF), an independent think tank for central banking, economic policy and public investment, reported that the European Central Bank (ECB) will hold a “special conclave” today and tomorrow (and possibly Thursday) to discuss issues from the ECB’s long-running strategy review. The event is not on the official ECB schedule. According to OMFIF, there are two major topics under discussion:

- 1)Asset purchases: The representatives of the “frugal” countries (Germany, Netherlands, Belgium and Austria) want a clear decision on ending the EUR 1.85t Pandemic Emergency Purchase Program (PEPP) on schedule at the end of March 2022. On the other hand, the representatives of the southern European countries, plus Chief Economist Lane, want to maintain flexibility on the end of PEPP, maybe cutting purchases this fall but extending them beyond March.

- 2)The ECB’s long-mooted ‘symmetrical’ definition of price stability aimed at 2% inflationBy adjusting the current wording (in place since 2003) of ‘close to but below 2%,’ the ECB is recognizing that it may overshoot inflation in coming years after persistently undershooting it. A key issue dividing the hawkish and dovish groups is whether the ECB should agree merely to ‘tolerate’ compensatory overshooting or should adopt overshooting as a policy goal, as the Fed has done.

The two topics are linked because the implementation of the new strategy will affect how the PEPP is wound down. Agreement on the new strategy would allow the ECB to announce a coordinated policy decision when the next joint assessment of financing conditions and the outlook for inflation takes place at their meeting on Sep. 9th. According to OMFIF, they might make an announcement on the new strategy following this “conclave” if they can agree on all the issues.

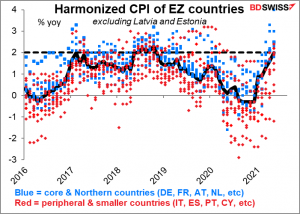

I’m particularly delighted that this debate is occurring because it allows me to use one of the most difficult – well, maybe tedious — graphs I ever made. This shows the inflation rates of all the Eurozone member countries (excluding Latvia and Estonia, which had exceptionally high inflation for a few years) separated into the “core” northern countries, such as Germany, France, Belgium, Austria, etc., (blue) and the southern, peripheral and smaller countries, such as Italy, Spain, Ireland, Greece and of course Cyprus (red). What you can see is that the core countries currently have higher inflation rates than the smaller & peripheral countries. The two groups’ views on ECB monetary policy are therefore likely to be different.

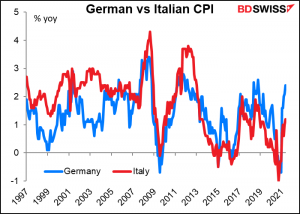

For example, for some years we’ve been in the hitherto unthinkable situation of Italian inflation being lower than Germany’s.

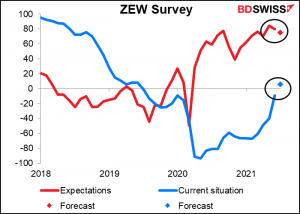

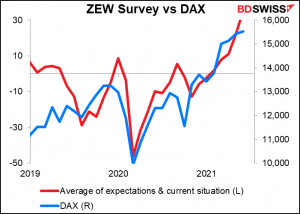

Things are evidently getting a lot better in Germany. The consensus forecast for today’s ZEW Survey is that the “current situation” index will jump 14.6 points to move into positive territory. The “expectations” index is forecast to move down a bit, but that’s not significant. Remember though that the ZEW survey polls analysts and economists, not people who actually see demand trends, so it’s more of a sentiment survey than an indicator of activity.

I don’t see why people care about the ZEW survey – most of the time it seems to be a function of the DAX, anyway.

EU retail sales aren’t that much of a market-mover, but the expected large rise in May does suggest the EU economy is gradually unfreezing.

Still, the EU is lagging behind the US and UK in this respect, although this figure would lift it above Japan’s performance (as far as we know).

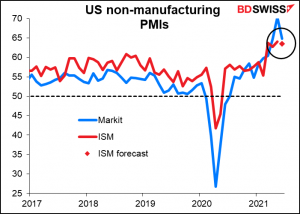

The US Institute of Supply Management (ISM) non-manufacturing purchasing managers’ index (PMI) is expected to be down slightly. This would correspond to the big drop in the Markit version of this index.

Analysts will be scrutinizing the employment sub-index especially after last Thursday’s ISM manufacturing index fell below 50 (49.9) for the first time since November.

Also the prices paid index after the manufacturing version hit the highest level since 1979.

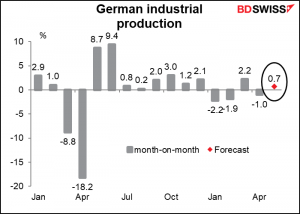

Then that’s about it until tomorrow morning, when we get German industrial production. The expected +0.7% mom increase contrasts with this morning’s -3.7% mom fall in factory orders.

You can see here how factory orders fell much further than production did during the early months of the pandemic and how they’ve bounced back more since then. This is probably due to companies and stores putting in orders to rebuild inventories. At the same time, manufacturers are having trouble meeting demand thanks to supply bottlenecks and difficulties sourcing some products, such as microchips. This gap could be inflationary eventually. On the other hand, I would expect orders to calm down after a while once the restocking is finished.

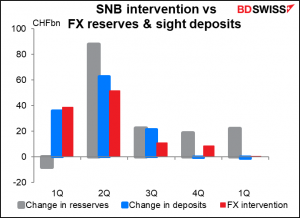

Finally, Swiss foreign exchange reserves are closely watched but misleading. The weekly sight deposit figures give a better indication of FX market intervention because they’re not affected by currency valuation changes.