Rates as of 05:00 GMT

Market Recap

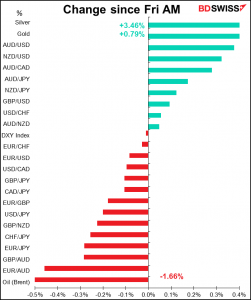

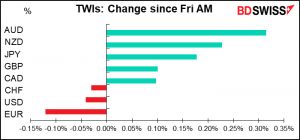

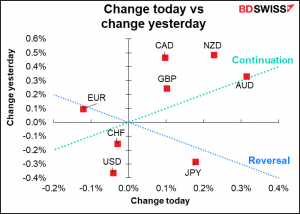

Friday’s US nonfarm payrolls were a huge shock. The 235k figure was far below even the lowest estimate among the 70 economists Bloomberg polled (400k-1.0mn). The market had expected the Fed to announce tapering at the November FOMC meeting at the latest, but they’ll only have one more month’s unemployment figures then – will that be enough to meet the “substantial further progress” metric? There’s now a chance that the announcement comes at the December meeting and the tapering begins next year…or later.

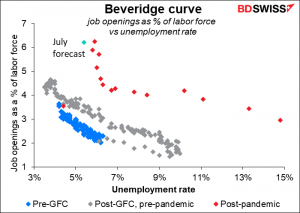

It’s clear that something fundamental has changed in the US labor market. This graph sums it up nicely. It’s the Beveridge curve – the relationship between the unemployment rate (X-axis) and the number of job openings expressed as a percent of the total labor force (Y-axis). As you can see, there was a shift to the right after the 2008 Global Financial Crisis, but that was nothing like the shift to the right that’s occurred since the pandemic began. It’s amazing how little the unemployment rate has shifted while job openings have risen. If the post-pandemic relationship were still holding, the unemployment rate with this many vacancies would be -1.0%!

The Washington Post had a big article, “Why America has 8.4 million unemployed when there are 10 million job openings.” They explain:

At heart, there is a massive reallocation underway in the economy that’s triggering a “Great Reassessment” of work in America from both the employer and employee perspectives. Workers are shifting where they want to work — and how…Resignations are the highest on record — up 13 percent over pre-pandemic levels. There are 4.9 million more people who aren’t working or looking for work than there were before the pandemic. There’s a surge in retirements with 3.6 million people retiring during the pandemic, or more than 2 million more than expected. And there’s been a boost in entrepreneurship that has caused the biggest jump in years in new business applications.

What that would imply is that payrolls aren’t rising fast enough simply because people don’t want to work. Is that so bad? If people can afford more leisure, then why not?

There’s also a large measure of mismatch. Some of that may be because people are fed up with poor working conditions (eg retail & hotels).

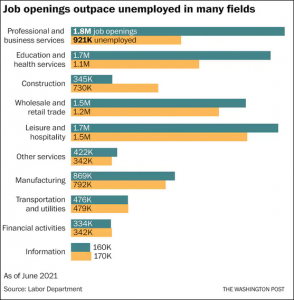

It doesn’t help that the abundance of job openings right now are not in the same occupations — or same locations — where people worked pre-pandemic…There is a fundamental mismatch between what industries have the most job openings now and how many unemployed people used to work in that industry pre-pandemic. For example, there are 1.8 million job openings in professional and business services and fewer than 925,000 people whose most recent job was in that sector. Leisure and hospitality, as well as retail and wholesale trade, also have more openings than prior workers, and many workers who lost jobs in those industries have indicated they don’t want to return. There’s a similar mismatch in education and health services, where there are 1.7 million job openings and only 1.1 million people whose last job was in that sector.

I wonder though…the Fed’s goal is “maximum employment.” If more people are happy not working, then the Fed should shift its definition of “maximum employment.” Maybe a monthly increase in payrolls of 235k is OK under these new circumstances.

In any case, one data point isn’t a trend. We’ll have to see the September figures to really know hat’s happening. In any case, tapering is likely to be delayed, and that’s negative for the dollar.

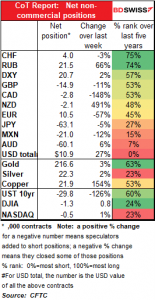

Commitments of Traders (CoT) report

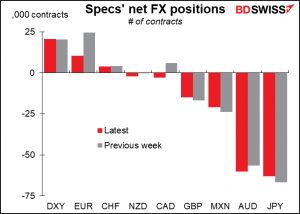

Specs continued to increase their long dollar positions. The biggest move was in EUR, where they cut their long EUR positions further. Their biggest net long is now in the DXY index. They also flipped from long CAD to short CAD and increased their short AUD positions.

On the other hand, they trimmed their short JPY position (their largest position overall) and short MXN & GBP.

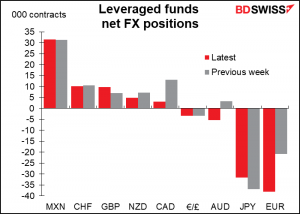

Hedge funds increased their short EUR position by 83%. They also flipped to short AUD from long and trimmed their long CAD position significantly and long NZD a bit as well.

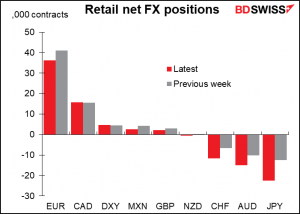

Retail also turned more bullish USD, cutting its EUR longs and adding to JPY, AUD, and CHF shorts.

Meanwhile, specs added to their long gold position and kept their long silver position stable.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Today is going to be relatively quiet as both the US and Canada are on holiday.

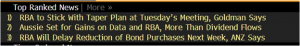

The main focus then will be the Reserve Bank of Australia (RBA) meeting overnight. As regular readers probably guessed, I wrote more about this than even my mother would read in my coruscatingly brilliant Weekly Outlook, which you can access simply by clicking on that link.

To sum up what I said there, the question for the RBA is whether they should rescind the decision they made in July to continue purchasing government bonds after the completion of the current bond purchase program in early September, but to reduce the rate of purchases to AUD 4bn a week from AUD 5bn “until at least mid November.” They argued then that “The experience to date has been that once virus outbreaks are contained, the economy bounces back quickly.” They also said though that “The program will continue to be reviewed in light of economic conditions and the health situation, and their implications for the expected progress towards full employment and the inflation target.”

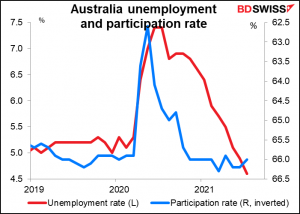

The question is, with the lockdowns having been prolonged and extended, will they still hold that view or will they make some concessions? There’s no doubt that the “evolving health situation” has affected the economic outlook, but I don’t think it’s been enough to derail progress toward their targets. The unemployment rate and participation rate are both back to where they were when the cash rate was 0.75%, not 0.10%.

Meanwhile, headline inflation is well above the RBA’s 2%-3% target range, although the trimmed measures aren’t even in the range.

Accordingly, I think the RBA will stick to their guns and refrain from changing their plans. That would probably be positive for AUD.

There seems to be no market consensus on what they’re likely to do. Several banks think that they will rescind the tapering announcement, while others don’t (although it seems to me that more expect them to rescind it than not – Westpac for example said “it would be quite extraordinary if the Board did not decide to.”) What that means is AUD is likely to react strongly regardless of which way the decision goes. Probably the upside if they don’t rescind it will be greater than the downside if they do.

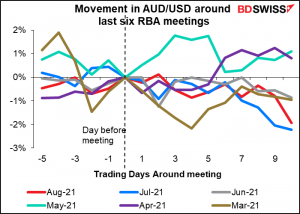

On average, AUD/USD has tended to weaken after the last several RBA meetings, but of course much depends on the decision made

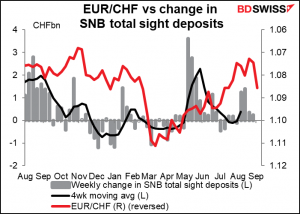

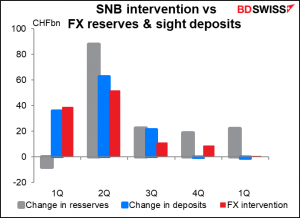

Since German factory orders are out already (see below), the only other significant European indicator is the weekly Swiss sight deposits, a proxy for Swiss National Bank (SNB) intervention. It looks like the SNB has been withdrawing from the market as EUR/CHF climbed. Recently there have been some unusual movements in EUR/CHF however. It will be interesting to see if they were caused by “supernatural forces” in the FX market.

Tomorrow morning there’ll be some attention paid to Swiss FX reserves as another (albeit delayed) indication of SNB activity.

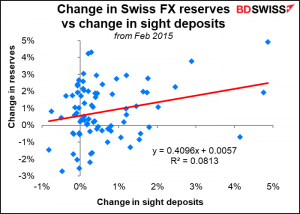

However, the sight deposit figures are actually a better indicator of FX intervention than the reserve data, surprisingly enough. That’s because the reserve data is distorted by valuation changes.

There’s no good relationship between the two, unfortunately.

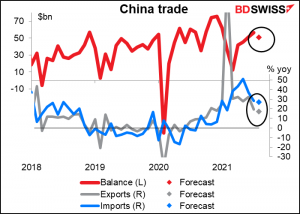

Overnight, China announces its trade data. The trade surplus is expected to fall slightly as the yoy rate of increase of both exports and imports slows. Of course,

Don’t get too worried about the decline. The level of both imports and exports are well above their pre-pandemic levels, a gain that’s probably unsustainable in any case. Nonetheless a decline might be taken as negative for the commodity currencies.

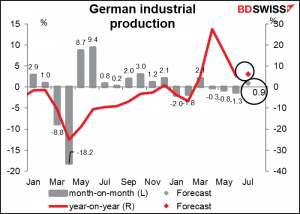

Then, in the morning European time, Germany will be doing it with the industrial production data.

After three months of fairly weak data, some improvement seems likely. Still, despite high confidence and order books, the growth in industrial production will probably continue to operate under a speed limit due to supply chain disruptions.

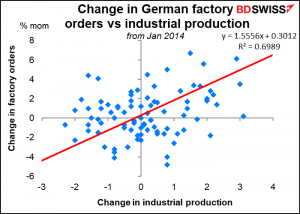

Monday’s factory orders were much stronger than expected, +3.4% mom vs -0.7% expected. That bodes well for a strong IP figure tomorrow – possible upside surprise.

The German manufacturing purchasing managers’ index (PMI) has come down, but remains in significantly expansionary territory. The sluggish growth may be beyond manufacturers’ control however if it’s due to supply constraints.