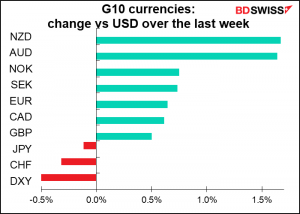

The coming week is relatively light on economic data, as is usual for the second week of the month. That doesn’t mean it’s devoid of excitement though. It features not one, not two, but three major central bank meetings: the Reserve Bank of Australia (RBA) on Tuesday, the Bank of Canada (BoC) on Wednesday, and the European Central Bank (ECB) on Thursday. The key question we’ll be watching for in all these meetings is: what’s their assessment of the virus situation and what impact will it have on their policy?

All three central banks are faced with the question of taping down their extraordinary bond purchases, much like the Fed is contemplating. We want to know whether the surge in virus cases will affect this decision, as it so clearly did last month in New Zealand.

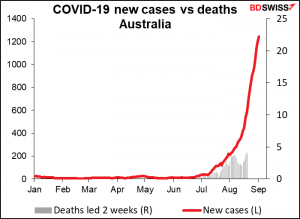

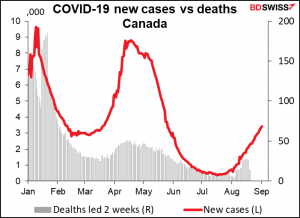

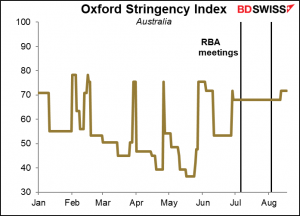

Australia and Canada are seeing rapid increases in virus cases – parabolic in the case of Australia.

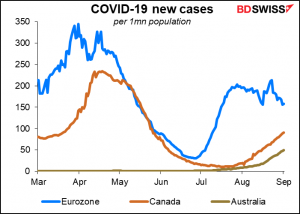

Cases seem to have peaked for now in the Eurozone, but I doubt if anyone is 100% confident that that’s the case. (Note: the surge in deaths is due to a problem with the data from France, which shows an increase of 11,434 deaths from one day to another.)

Having said that, the absolute number of new cases is still relatively small for Canada and Australia. But given the nature of exponential growth, that’s probably small comfort.

The question is whether these concerns will be enough to affect policy – in which case the market will have to start discounting them more – or whether they’re enough. All three face the question of whether to taper their extraordinary aid to the market. I expect that concerns about the virus, among other issues, are likely to keep all three central banks on hold this month.

Bank of Canada to leave asset purchases unchanged at CAD 2bn per week

The BoC has already reduced its weekly asset purchases from CAD 5bn a week to CAD 2bn, bringing their overall balance sheet down to CAD 492bn from CAD 575bn in March.

At the July meeting, when they cut to CAD 2bn from CAD 3bn, they said:

Decisions regarding further adjustments to the pace of net bond purchases will be guided by Governing Council’s ongoing assessment of the strength and durability of the recovery. We will continue to provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation objective.

So how will they assess the “strength and durability of the recovery”?

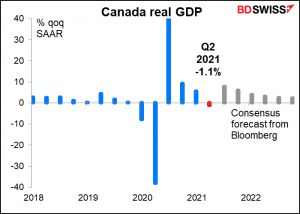

The first thing to note is the surprising fall in GDP in Q2. It was -1.1% qoq SAAR, vs the BoC’s forecast of +2.0% at the July meeting. While the BoC and the market expect a bounce-back in Q3, nothing is certain except death and taxes, eh?

Especially with part of the economy back in lockdown. Also if we look at the Q2 GDP report, the main contributor to the decline by far was weak exports, meaning that the future performance may be dependent on what happens in other countries, not what happens domestically.

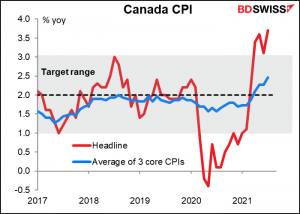

On the other hand…(there always has to be another hand)…headline inflation is running well above their target. But like other central banks, the BoC has stuck by its view that “the factors pushing up inflation are transitory,” as they said in July, and Gov. Macklem has consistently downplayed concerns about above-target inflation (e.g. on July 29th when he wrote an opinion piece for the Financial Post in which he said “we shouldn’t overeat to these temporary price increases” and that inflation “should move back inside our target range next year…”)

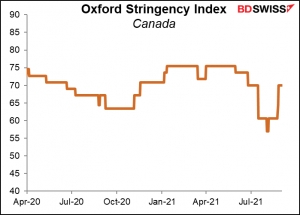

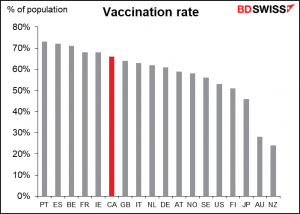

The focus then will be on the tone of the statement following the meeting. If the statement takes a relatively sanguine view of the decline in GDP, saying as the RBA did recently that “once virus outbreaks are contained, the economy bounces back quickly,” and points to the country’s high vaccination rate as a reason to be optimistic about the course of the virus, then it’s likely that the market will start to price in further tapering of the pace of asset purchases, probably at the next meeting (Oct. 27), and CAD would be likely to gain.

We also have to see if there is any change in the Bank’s estimate for when “lift-off” – the time when they can finally start normalizing their policy rate – is. In July they said it’s expected to happen “sometime in the second half of 2022.” Any change there would be significant. Currently the market is pricing in one hike by next July.

ECB: A PEPP rally?

The question facing the ECB is what to do about their Pandemic Emergency Purchase Program (PEPP), the EUR 1.85tn emergency program set up in March 2020 to counter the impact of the virus on the eurozone. The Governing Council pledged to keep it going “until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.” In April it decided to conduct PEPP purchases “at a significantly higher pace than during the first months of the year,” a decision that it reaffirmed in June and July.

Now however the hawks and doves disagree about what to do with it. Dutch Central Bank Gov. Knot has said he thinks the PEPP should be wound up on schedule without a replacement, while Chief Economist Lane has said he thinks asset purchases should continue at a strong pace to support the inflation target, and in any case they don’t need to make a decision six months in advance because their regular Asset Purchase Program (APP) will continue running after March in any case.

Given the concerns about the virus and the long time before they have to make a decision, I expect that they will stand pat and wait for more information. Even Knot said, “I can understand that next week we may want to maintain some optionality, also to see how the delta variant will play out.” Perhaps they will take a page from the Fed and ECB President Lagarde will make some statement at the annual ECB Forum on Central Banking in Sintra, Portugal (well, virtually this year, but) on Sep. 28th and 29th. The title is Beyond the pandemic: the future of monetary policy.

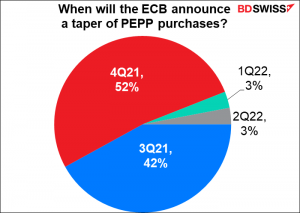

In a recent Reuters poll, analysts were divided fairly evenly between thinking that the announcement would come in Q3 or Q4, with a few saying next year. That suggests September is considered unlikely.

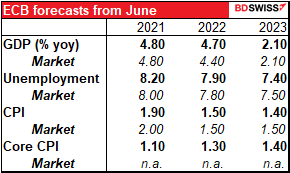

If they decide to hold off on making a decision, as seems likely, then the focus will be on the new staff forecasts. The June forecasts are still preternaturally close to the market forecasts, suggesting that we shouldn’t expect any major changes in the outlook.

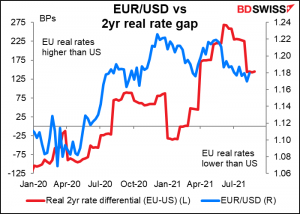

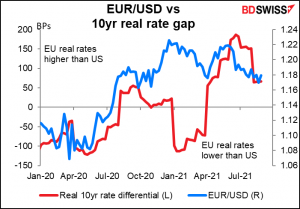

The ECB’s 2023 inflation forecast is a bit below the market’s. Even if they were to increase it to slightly above the market forecast – say, 1.6% — that would still be well below their new target of “2% inflation over the medium term.” The fact that they expect their current policy will fail to meet their goal within the forecast horizon should keep them on a dovish path for now, which suggests no imminent rise in bond yields even as EU-wide inflation rises. Given that the Fed on the other hand seems hell-bent on tapering down its bond purchase by the end of the year, which should push up US bond yields, this “monetary policy divergence” is likely to keep EUR/USD under pressure.

RBA: Will it cave?

At its meeting on July 6th, the RBA decided to retain the April 2024 bond as the bond for the yield target rather than shifting out to the Nov. 20204 bond. This was in effect a small tightening of policy, because that allowed the longer-dated bond – which has more impact on retail rates – to move higher. They also decided to continue purchasing government bonds after the completion of the current bond purchase program in early September, but to reduce the rate of purchases to AUD 4bn a week from AUD 5bn “until at least mid November.”

During July, the pandemic worsened significantly in Australia and lockdowns were instituted. It was widely expected that because of the ensuing hit to economic activity, the RBA might relax some of its tightening measures at its Aug. 3rd meeting. However, they maintained their stance, arguing that “The experience to date has been that once virus outbreaks are contained, the economy bounces back quickly.” “Prior to the current virus outbreaks, the Australian economy had considerable momentum and it is still expected to grow strongly again next year,” they said. The Statement on Monetary Policy explained that they thought fiscal policy was a more appropriate way to aid the economy in response to a short-term shock. Fiscal policy would deliver its aid immediately, whereas rescinding those tightening measures would only come into effect in several months and even then would take a long time to affect the economy, by which time the crisis would probably have passed.

The question is, with the lockdowns having been prolonged and extended, will they still hold that view or will they make some concessions? They’ve made two slightly different pledges on this issue. In the statement following the August meeting, they said, “The Board will maintain its flexible approach to the rate of bond purchases. The program will continue to be reviewed in light of economic conditions and the health situation, and their implications for the expected progress towards full employment and the inflation target.” In contrast, the Statement on Monetary Policy said that “the Board will nonetheless keep the rate of bond purchases under review in light of the evolving health situation and is prepared to act if worsening health outcomes affect the economic outlook.”

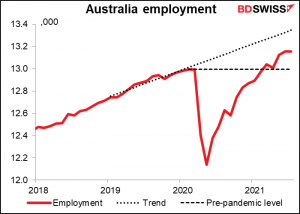

There’s no doubt that the “evolving health situation” has affected the economic outlook, but how about the “progress towards full employment and the inflation target”? Employment has already recovered to the pre-pandemic level, although not to the pre-pandemic trend.

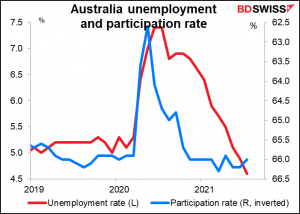

The unemployment rate is below its pre-pandemic level while the participation rate is back to where it was. So while this may or may not have been “full employment,” it is where they were back when the cash rate was 0.75%, not 0.10%.

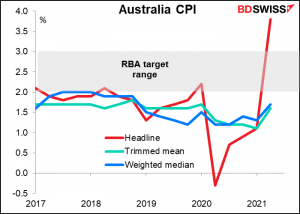

Meanwhile, headline inflation is well above the RBA’s 2%-3% target range, although the trimmed measures aren’t even in the range.

Accordingly, I think the RBA too will stick to their guns and refrain from changing their plans. That would probably be positive for AUD.

There seems to be no market consensus on what they’re likely to do. Several banks think that they will rescind the tapering announcement, while others don’t (although it seems to me that more expect them to rescind it than not – Westpac for example said “it would be quite extraordinary if the Board did not decide to.”) What that means is AUD is likely to react strongly regardless of which way the decision goes. Probably the upside if they don’t rescind it will be greater than the downside if they do.

The indicators: JOLTS report, UK short-term indicator day

Outside of those meetings, there’s not that much on the schedule.

Monday is a holiday in the US and Canada.

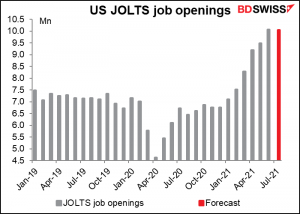

Wednesday we get the Job Openings and Labor Turnover Survey (JOLTS) report, with its figure on how many job openings there are. It hit a record in June; it’s expected to be down a bit in July. But very few economists forecast this indicator and they really have nothing to go on except their hunches, so we can’t place too much faith in the forecast.

Even so, that would still mean a significantly higher number of jobs relative to the shrinking number of unemployed persons in the country. That should encourage the Fed into keeping with their tapering schedule, which would tend to push up bond yields and the dollar.

The Fed will also release the Beige Book on Wednesday.

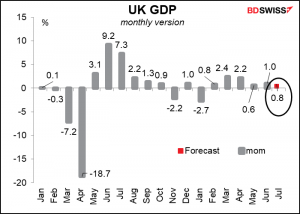

Outside of that, Friday brings UK short-term indicator day, when they announce monthly GDP, industrial & manufacturing production, and the trade data. The GDP is the most important number. I think a continued steady increase in growth there despite the newspaper photos we see of empty supermarket shelves would be reassuring to the market and could help GBP to rally.

Elsewhere, the extraordinary US federal unemployment benefits of $300 a week are set to expiry on the 6th. We’ll have to see how that affects the economy. Will it force more people to go back to work and therefore be a net benefit, or will peoples’ spending power decrease and therefore cause a rise in unemployment? This is one of the big question marks hanging over the US economy.

Finally, Japan PM Suga Friday announced that he would not run for re-election in the upcoming Japanese general election. This leaves the ruling Liberal Democratic Party scrambling to find a new leader shortly before the election (which must be held by the end of November). He lasted a little over a year in office (Sep 16 last year). There’s bound to be a lot of discussion next week about who the next PM will be and what effect if any his (yes, his for sure) policies might have on the economy. Usually this is just a contest between Tweedledum and Tweedledummer, with no implications for the economy at all as the bureaucrats continue to run things. Tokyo stocks did climb Friday on hopes that former Foreign Minister Fumio Kishida might get the job. He supports expanding fiscal stimulus to support the economy during the pandemic.

However the yen moves more on relative interest rate expectations and global risk sentiment rather than domestic economic conditions and so until there’s a new Bank of Japan governor – not likely until April 2023 – I don’t think the contest for PM will have much impact on the yen.