Rates as of 04:00 GMT

Trump update

Trump is either the Jim Jones of US politics or a closet Democrat. Either he’s trying to kill off all his followers, or maybe he’s a Democrat playing the long game – see how many Republican politicians and supporters he can kill, thereby ensuring that the party eventually disappears. I’d like to post the latter idea on some QAnon website – I’m sure I could get some conspiracy theory enthusiasts to believe it. (You can read here how he went to several fund-raisers and talked with doners, many of whom are elderly, even though he knew he was infected & contagious. That’s in addition to the estimated 40+ people associated with the White House who are now infected.)

Or maybe he’s a kamikaze agent for the Russians. All the top military leaders of the US – the members of the Joint Chiefs of Staff, a body that consists of the top commanders from each of the armed services — went into quarantine Monday night after attending meetings at the Pentagon with a Coast Guard admiral who tested positive for the virus.

In any case, I firmly believe his behavior is being affected by the drugs he’s taking. Danielle DiMartino Booth, a former Fed official, said that “The one time I’ve been administered steroids for a serious lung ailment, I found myself up in middle of the night scrubbing my baseboards clean with an old toothbrush.” Trump often tweets a lot, but yesterday he sent our around 40 tweets in two hours. This followed his ALL-CAPS TWEETSTORM the day before – is this normal behavior?

In any event, his decision to cut off talks between the Treasury Secretary and House Speaker Pelosi on the stimulus package until after the election has killed the frail bird of hope on whose wings the stock market was flying higher. The New York market closed lower, but stocks are generally higher this morning in Asia.

Market Recap

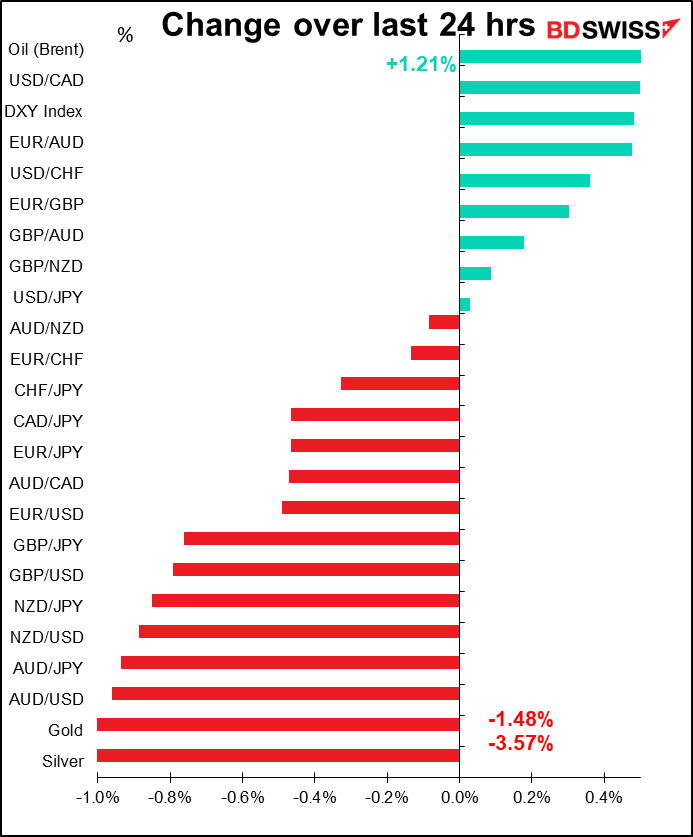

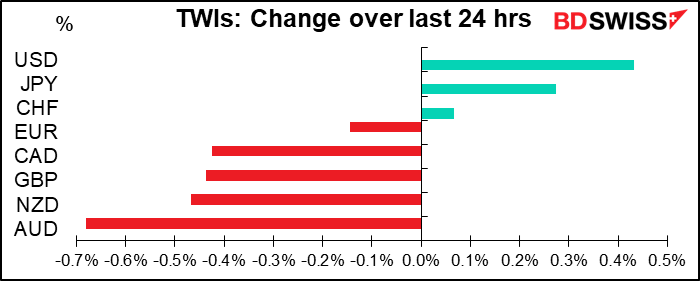

The shock of Trump stopping the CARES Act 2.0 negotiations sent a “risk-off” reaction across asset classes, including credit markets, gold, and equities both domestic and foreign. FX went along too, with USD, JPY and CHF rising and the commodity currencies falling.

the dollar rallied in the New York afternoon. The market had started to become more optimistic about the chance of a deal before the election, although the consensus remained that it was more likely afterward. Thus when Trump killed the talks and the dollar rallied on a knee-jerk reaction, some hedge funds that had never expected a deal before the election anyway sold dollars and bought the dip in gold and silver, limiting their fall.

In any case, I think this is really serious. With many people losing all their unemployment insurance, no additional funds for the Paycheck Protection Program (PPP), the small business loan program that delivered more than 5 million loans totaling $525bn, and no funds for state and local governments, the US economy is going to run out of fuel soon, as Fed Chair Powell warned in a speech yesterday.

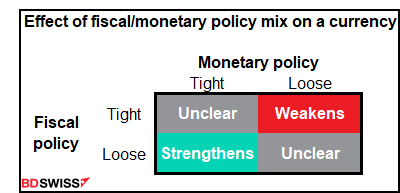

The question as always is, will the “international dollar,” which rallies in reaction to “risk-off,” dominate or will the “domestic dollar,” which responds like other currencies to developments in their domestic currencies, dominate? For now the “international dollar” is dominant, but if fiscal policy ends and Powell et. al. decide to take up the burden themselves with more monetary stimulus, then a weaker dollar seems likely. At least, that’s the usual reaction, although things could be different because of the dollar’s unique place in the global monetary system.

GBP was buffeted by dueling stories. A Reuters story quoted some unnamed diplomat as saying “We seem to be getting closer and closer to a deal, even though the no-deal rhetoric in public might suggest the opposite.” But on the other hand, a Bloomberg report said that “The European Union has no plans to offer concessions to Boris Johnson before next week’s Brexit deadline” and that it would rather see talks drag on past the deadline than compromise on its fundamental principles.

Both stories agreed that Brussels is prepared to negotiate until as late as mid-November (Bloomberg said even into December). This would be a relatively long extension, as we’ve been assuming that everything has to be wrapped up in time for next week’s EU summit (which is impossible to achieve at this point). Longer negotiations of course leave more time for compromise and reduce the chances of a “no-deal” Brexit, but if the reason for allowing more time is because one side is waiting for the other to move – rather than both sides working out what’s possible – then it means less of a chance of finding a solution. GBP remains vulnerable to rumors and leaks. I’m starting to become more optimistic that Boris “The Big Umbrella” will once again fold when push comes to shove.

Is the ECB no longer worried about the exchange rate? Yesterday, ECB Chief Economist Lane addressed the National Association of Business Economics (NABE) along with Fed Chair Powell) and uttered that sentence that I said yesterday I was looking for – minus the part about the exchange rate! He said, “In terms of policy making, the ECB Governing Council will carefully assess the incoming information with regard to its implications for the medium-term inflation outlook.” As I mentioned yesterday, the formulation recently has been “the Governing Council will continue to assess carefully the incoming information, including developments in the exchange rate, with regard to the implications for the medium-term inflation outlook.” (emphasis added)

I think it’s significant that they dropped the phrase. Maybe it’s because EUR/USD is no longer moving higher – it’s lost its upward momentum (for now). Or maybe they decided that the exchange rate wasn’t a big factor in the lower inflation after all. Perhaps they decided they didn’t need this excuse to ease rates further, that they can talk about the weak recovery and use that as their rationale while hoping the impact spills over into the exchange rate without them having to say so specifically. Whichever, this takes some of the downward pressure off of the euro. We may trend sideways in this 1.17-1.19 channel for a while as a result.

Let’s hear what if anything ECB President Lagarde has to say on the subject today.

Today’s events

The big event of the day will be this evening in the US: the Vice Presidential Debate: VP Mike Pence vs Senator Kamala Harris. Have you ever seen the cartoon short, Bambi meets Godzilla? It’s a classic. You should watch it. It’s only 1:38 and it’ll give you a good idea of what to expect this evening.

Before he went into politics, Pence was a daily talk-radio host, so he’s no slouch at this format. He and Tim Kane, Hillary Clinton’s VP candidate, had some animated discussions back in 2016, including talking over each other occasionally, but nothing that anyone would seize on. Just not that honest – you can listen to him praising Trump’s business acumen and castigating the Democrats for huge budget deficits. It sounds quaint, knowing what we know now.

Harris though…she started out as a public prosecutor and is used to going after people aggressively in court. I suspect the roles we saw played out at Trump/Biden debate will be reversed, as the Pence meets with the aggressive Harris. Here’s a medley of her greatest hits from the Democratic debates. You can see her go after VP Biden himself about his record on busing and imagine how she’s going to react if Pence tries to talk after her.

The implications for the election are hard to pin down. On the one hand, Pence is bound to be more polite than Trump, which could reassure some people who are leaning Republican but have their doubts about Trump. At the same time, Harris is bound to be more passionate than Biden, which may reassure people on the left who think Biden is too middle-of-the-road, too willing to compromise with the Republicans. I think people will come away thinking what they thought when they first sat down to watch.

There are also a couple of unusual presentations.

There’s something I’ve never seen before at the Fed: a virtual event series on “Racism and the Economy.” It’s aimed at understanding “the implications of structural racism in America’s economy and advancing actions to improve economic outcomes for all.” Atlanta Fed’s Bostic (NV), Minneapolis Fed’s Kashkari (V) and Boston Fed’s Rosengren (NV) will be participating, along with a host of business luminaries. I tie this seminar in with the Fed’s new heightened concern about employment and the impact of the downturn on minorities and the lower-waged. It’s my impression that the “Fed Listens” series, when Fed officials went around the country listening to people talk about how monetary policy affects them, really changed their way of thinking – from trying to prevent above-target inflation to trying to encourage full employment.

Also, NY Fed President Williams pulls off a neat trick of two meetings back-to-back that under normal circumstances would be on opposite sides of the continent. I have no idea why he’s talking with Henry Kissinger – I’m surprised to learn that Kissinger is still alive, for that matter (he’s 97 years old). The Economic Club of New York is holding the discussion. Like Powell yesterday, Williams will probably plead with the politicians to cobble together some further aid for the unemployed, but after Trump’s tweet yesterday, that plea is pretty much DOA.

Today’s indicators

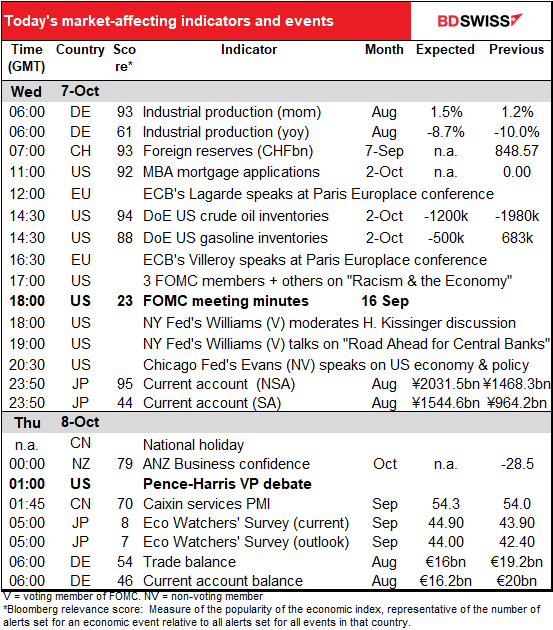

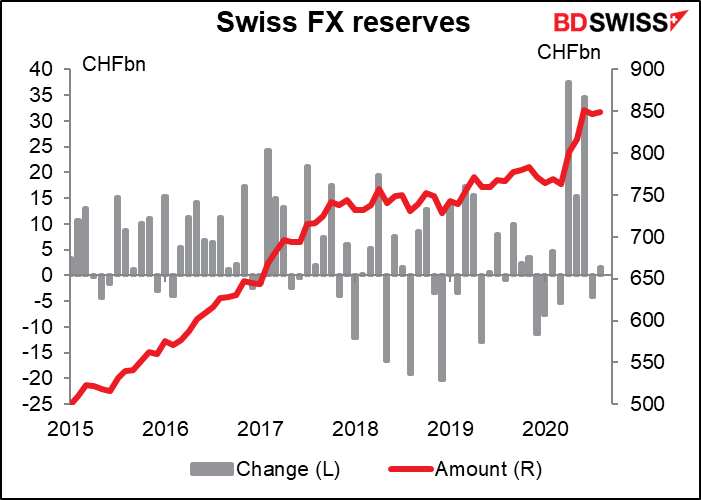

There’s no forecast for the Swiss foreign currency reserves data. The figures show little intervention in August, and the weekly sight deposit figures suggest even less intervention in September.

The Paris Europlace international financial forum will have several esteemed speakers, including ECB President Lagarde again and Bank of France Gov. Villeroy de Galhau. I’m sure they’ll tell you how very, very worried they are about inflation and that they stand ready to adjust policy using all their tools, etc etc.

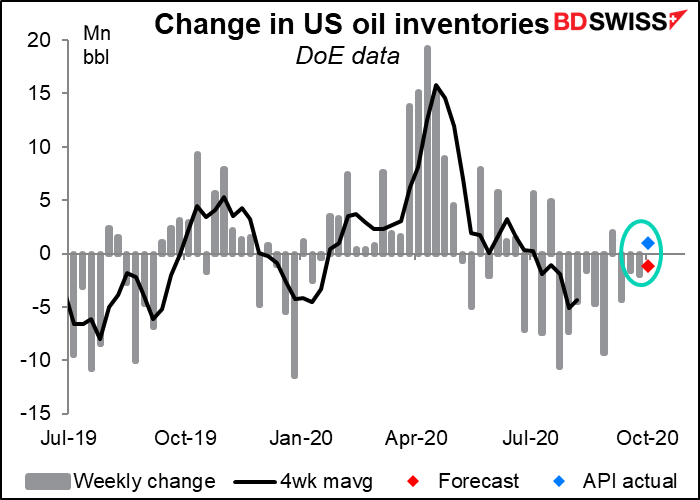

Last week the market was encouraged by a fall in US crude oil inventories. This week, the American Petroleum Institute (API) figures out yesterday showed a small increase in inventories of 941k bbl, vs an expected decline of 1.2mn.

People will be looking for three main topics in the minutes of the September meeting of the Federal Open Market Committee (FOMC). A) What could get them to ease policy further? In particular, what could get them to change the size and composition of their bond purchases in the quantitative easing program. The market was disappointed after the statement came out because they didn’t make any changes there. B) What were the differences in the views on the change in the forward guidance? There were two dissents to the new language, for opposite reasons. Any specific conditions that the Committee members think could trigger an increase in rates? And C) how much additional fiscal stimulus were they assuming when they upgraded their economic forecasts? Because it’s not happening, so they may have to revise those forecasts.

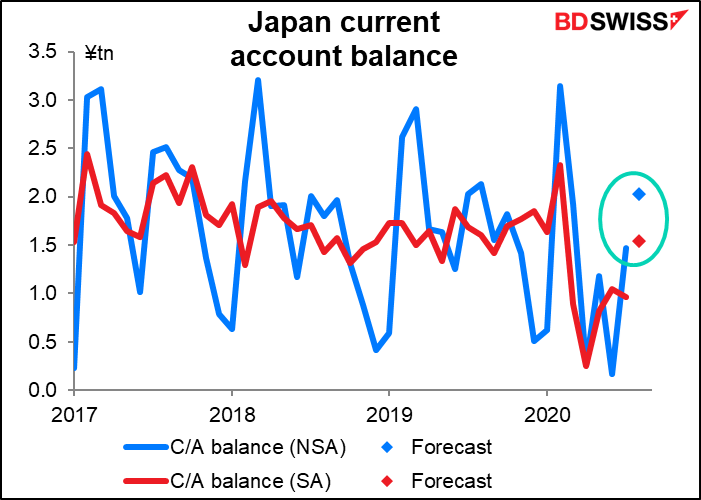

Overnight, Japan announces its current account balance. It’s expected to be noticeably higher, as the country’s exports pick up faster than its imports. However, most people in Japan look at the not-seasonally-adjusted figure and compare it to a year earlier, in which case it’s expected to be slightly lower (¥2.032tn vs ¥2.135tn).

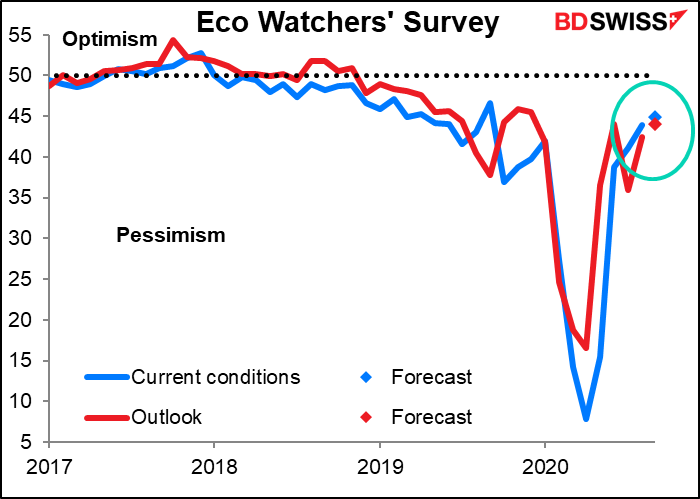

That’s the 4th most closely watched Japanese indicator. Now we come to the bottom of the barrel, the indicator with absolutely the lowest ranking for Japan on the Bloomberg system, the Eco Watcher’s Survey. Why do I bother including it? Some reprehensible miscreants will no doubt allege it’s because I get paid by the word, but this is just baseless calumny. It’s because I like the survey. I think the service sector is important nowadays and this indicator is probably a better gauge than the more closely watched service-sector purchasing managers’ index (PMI), or even more closely watched tertiary sector index. Anyway it’s supposed to rise a bit, but still not to the level of optimism. That corresponds with the picture we have of the Japanese economy recovering more slowly than Western economies, probably due to its dependence on foreign trade.

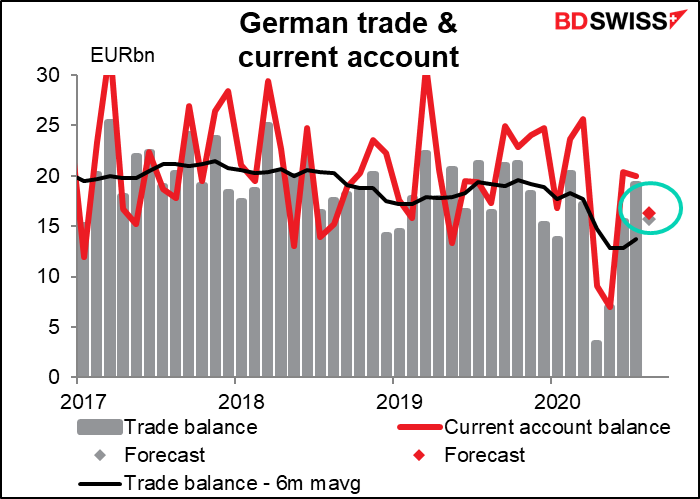

Finally, as the Bavarian hausfraus are warming up yesterday’s leftover Weisswurst and Sauerkraut, Germany announces its trade balance and current account. They haven’t yet returned to pre-pandemic levels, and in fact they’re both expected to be lower than the previous month, which is not encouraging. It might reinforce the ECB’s fears about the exchange rate’s impact on inflation, which I think are just a fig-leaf for their concern about a strong EUR/USD dampening European exports. EUR-negative