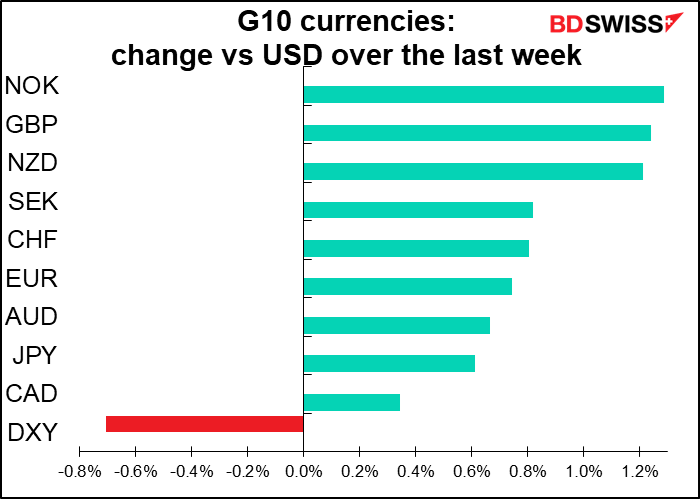

We’ve got a really busy week coming up, just before one of the busiest weeks I can remember.

There are three major central bank meetings – Bank of Canada on Wednesday and Bank of Japan the European Central Bank on Thursday. Plus the end-month Japanese data, first estimates of Q3 GDP for the US and EU, and some important US data, such as personal income & spending. Plus the 5th Plenum of the Chinese Communist Party will be held from 26 to 29 October. And of course the US elections and Brexit negotiations are fast approaching their denouement. Busy busy busy!

At least the Fed and ECB are in their “purdah” periods, when officials aren’t allowed to speak to the public, so there aren’t as many comments to keep track of.

Don’t forget my webinar Tuesday on the US election! You can register here.

Let’s discuss the central bank meetings first. None of them is likely to make any change in policy, but we’ll have to read the statements and look for any change in nuance, if any.

Bank of Canada: Happy campers

The Bank of Canada meeting will be accompanied by an updated version of the Bank’s quarterly Monetary Policy Report (MPR). With no change in rates likely, the focus of interest will probably be on any change in forecasts in the MPR. At the September meeting, the Board said that economic activity in the first half was “largely in line with the Bank’s July MPR central scenario.” “As the economy reopens, the bounce-back in activity in the third quarter looks to be faster than anticipated in July,” they noted.

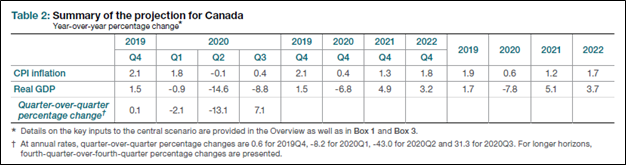

These were their forecasts in July. They were looking for GDP to bounce back 7.1% in Q3 after falling 13.1% in Q2.

In fact, GDP fell “only” 11.5% qoq in Q2, less than the Bank expected in July, and the market looks for it to bounce back by 9.7% qoq in Q3, more than the Bank expected. In other words, things are going pretty good in Canada.

Although headline consumer prices are approaching deflationary territory, the three “core” CPIs – which the Bank says it uses “as an operational guide to monetary policy” — are all right near the center of the target range. Besides, they said in September that headline inflation “is expected to remain well below target in the near term,” so this should come as no surprise.

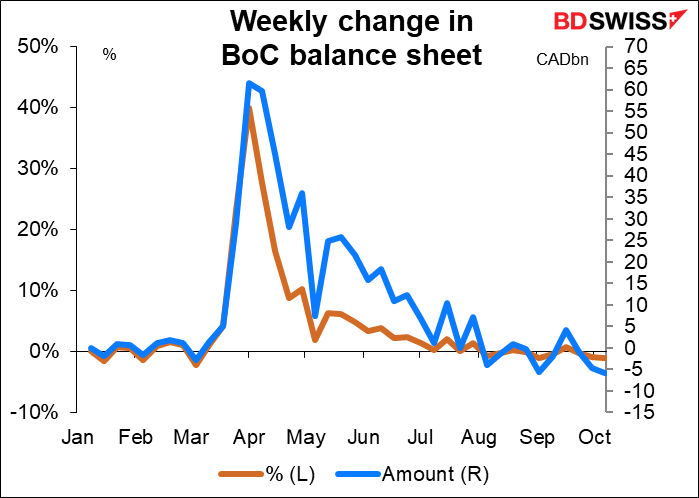

In any event, the fact that they’ve already begun to reduce the size of their balance sheet shows that they are pretty well satisfied with where they currently are. I should add that in September they reiterated that rates were at “the effective lower bound,” meaning that they have no intention of lowering rates any further, either.

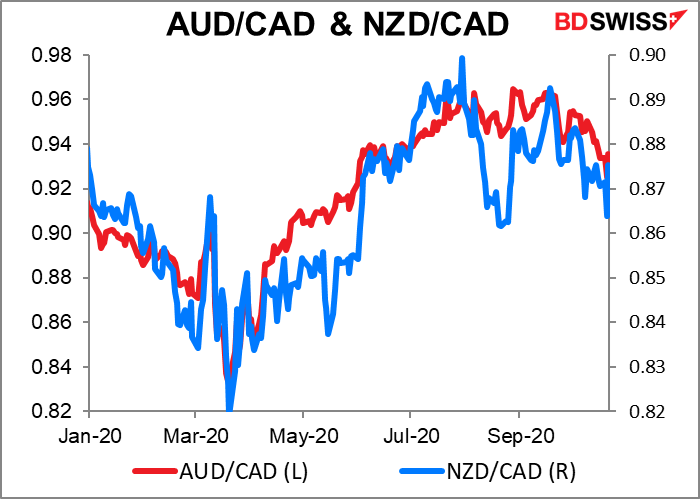

I don’t expect much change if any in the statement and look for some upgrade in the forecasts. This steady policy would be in contrast to that of the other two commodity currencies, AUD and NZD, where the central banks are both preparing further loosening efforts. This is probably why AUD/CAD and NZD/CAD have both started to turn lower recently. I think this monetary policy divergence can continue to push these two pairs lower while eliminating the whole “risk-on” and “risk-off” phenomenon from the trade.

Bank of Japan: Can’t loosen, can’t tighten – on hold indefinitely

The Bank of Japan (BoJ) has for some time been one of the more boring central banks. It hasn’t made any major changes that I can remember since September 2016, when it instituted the diabolical “Quantitative and Qualitative Monetary Easing with Yield Curve Control.” Rates are still at -0.1% and the 10-year Japanese government bond yield is pegged at around 0% as was established then. (They’ve tinkered with the wording of their forward guidance, adjusted the pace of their bond buying, and made other minor adjustments.) (Please correct me if I’m wrong.) I doubt if anyone expects any change at this week’s meeting.

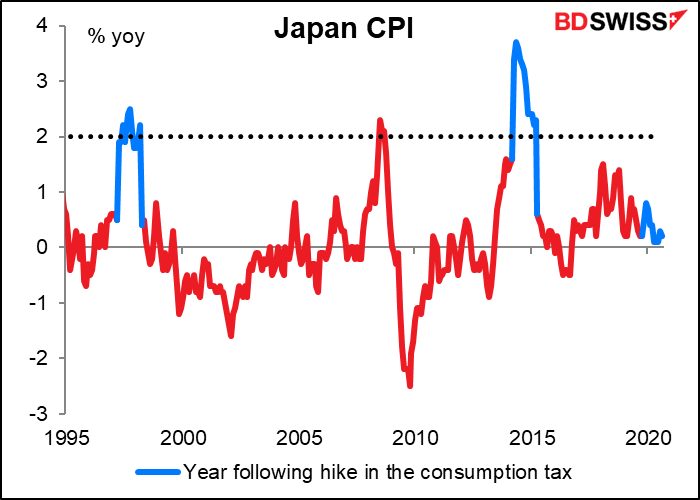

Since the last meeting on 17 September, the BoJ’s quarterly tankan survey on 1 October confirmed that the economy has stabilized, while the Bank’s 8 October Regional Economic Report (commonly referred to as the “Sakura Report”) upgraded its assessment of eight of Japan’s nine regions, the most wide-ranging upgrade in seven years. Unemployment has risen much less than in other countries, corporate bankruptcies have been minimal, and USD/JPY has held pretty steady between ¥104.50–¥106.00 (average ¥105.25). While inflation is far below target and falling, it’s been below target for decades, so that’s nothing new. The BoJ has quietly given up fighting inflation.

In the absence of any policy moves, people will be looking at the quarterly Outlook for Economic Activity and Prices to see what changes if any they make in their forecasts. I’d expect them to raise their growth forecast thanks to the faster-than-expected recovery overseas, but to lower their inflation forecast thanks in part to various government moves, such as the “Go To Travel” subsidies that lowered hotel rates and pressure for lower mobile phone charges. But since these changes are due to government policy, the BoJ can argue that the fall in inflation doesn’t signify any change in the underlying inflation trend and they can ignore it.

I think it’s probably too early for the BoJ to be discussing whether to extend its pandemic-related operations beyond their end-March expiration date. (The bank has instituted ¥45tn of special pandemic lending operations). The US election, the Brexit talks, the virus and a possible vaccine…so much could happen between now and then. The 18-19 March meeting is probably too late to decide, so I’d expect them to tackle this at the 20-21 January meeting, when it will also be publishing a new Outlook Report.

The BoJ meetings haven’t had much impact on the yen recently, and I wouldn’t expect this one to be any different.

European Central Bank (ECB): Wait until December

Now we come to the European Central Bank (ECB). This is one place where there’s can be some disagreement and some surprises. Although there’s a good case for further easing at this meeting, I think they’ll just hint this time and prefer to wait until December to make any changes.

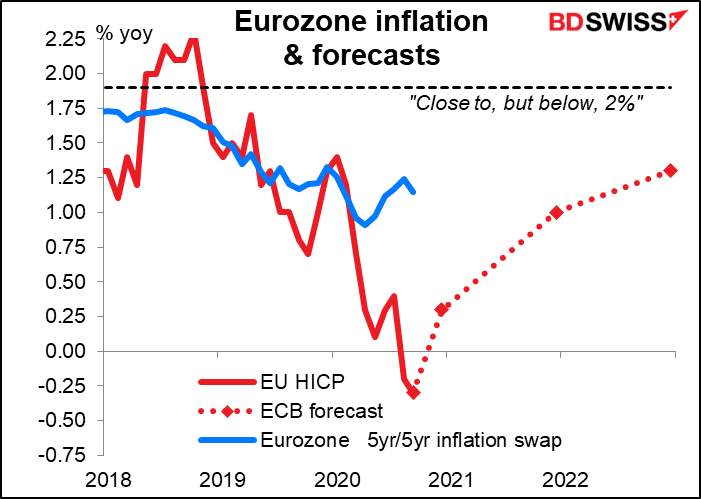

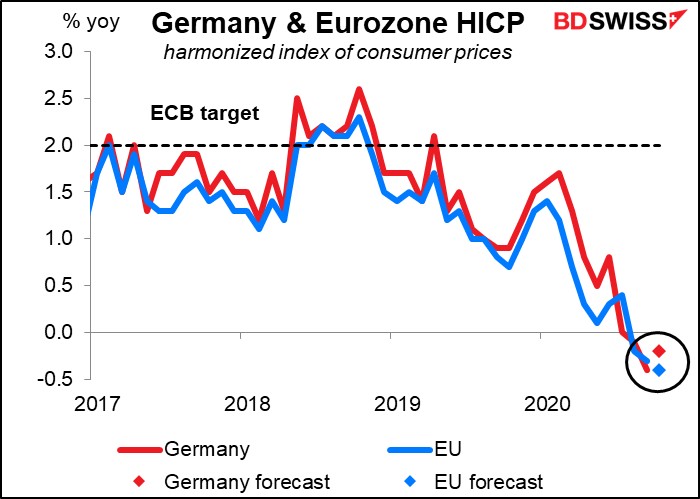

Why might they ease further? Unlike many other central banks, the ECB has a single mandate: inflation. At their last meeting on 10 September, the ECB noted that inflation had slowed since the pandemic began, and indeed the September inflation numbers, which came out after the meeting, surprised to the downside. And the October figure, which comes out the day after the meeting; is expected to show headline inflation moving further into deflation (see below). Inflation expectations are close to a record low and the ECB doesn’t necessarily disagree; it forecasts inflation to be only 1.3% yoy in 2022, still below their target of “close to, but below 2%”. So there are quite enough reasons for a central bank focused on inflation to ease further.

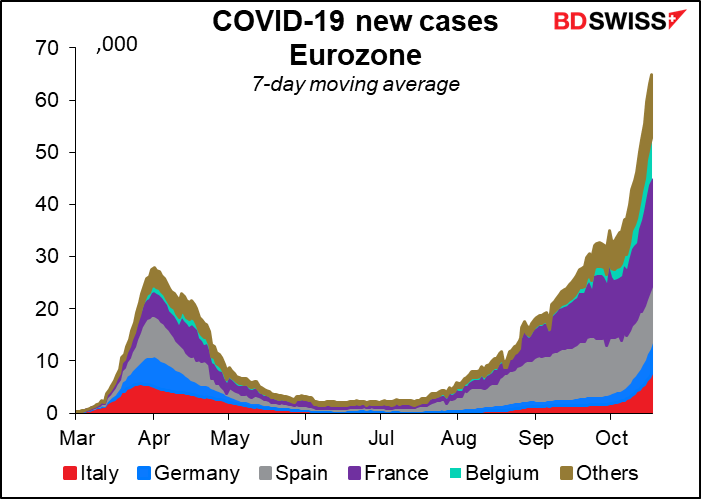

And to make matters worse, several countries have tightened their social controls as the second wave of the virus turns out to be much much worse than the first wave. That’s going to slow activity again and put further downward pressure on inflation.

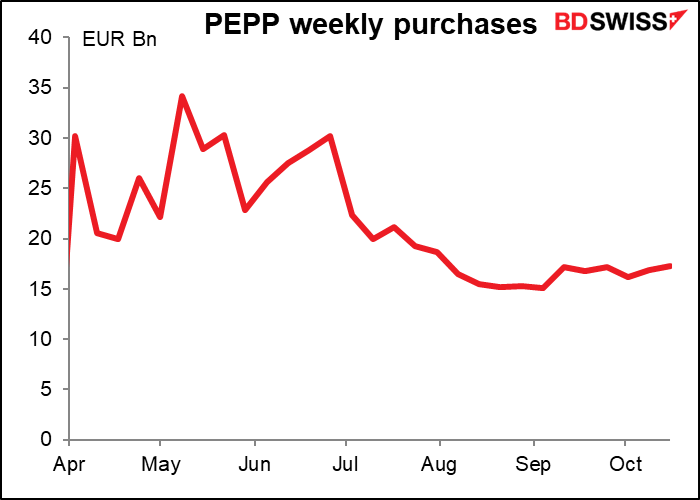

So why might they not ease further at this meeting? First off, this isn’t a meeting where the ECB staff updates its forecasts, and unless there’s an emergency, they prefer to take action based on a fresh set of projections. Secondly, the Pandemic Emergency Purchase Program (PEPP) still has some EUR 750bn of resources, which is up to a year’s worth of purchases at the current pace. That means there’s no pressing need to take action. Finally, at the 10 December meeting they’ll not only have new set of forecast but also they’ll know what happened with the US election, the Brexit negotiations, the 2021 budgets, and the second virus wave, so they’ll be able to judge better what’s needed.

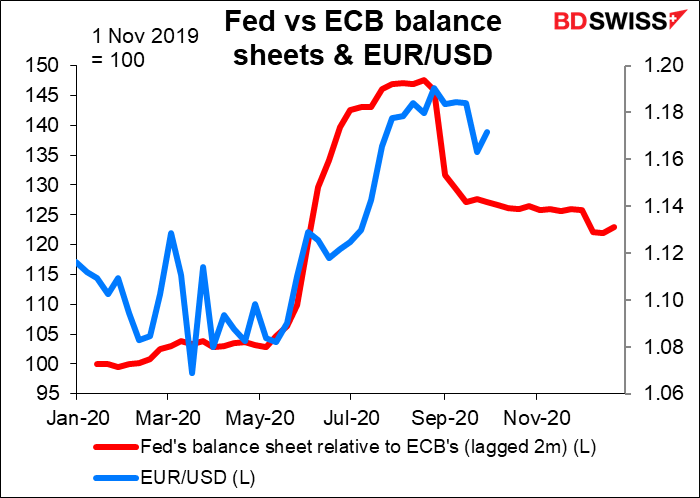

When they do move, what are they likely to do? Before we address that question, I’d like to bring to your attention an ECB research paper published just Tuesday (Does a big bazooka matter? Quantitative easing policies and exchange rates). It concluded that “quantitative easing (QE) measures have large and persistent effects on the USD/EUR exchange rate.” It estimated that 6% of the 10% EUR/USD rally this year was due to the Fed expanding its balance sheet more than the ECB expanding its.

It then concluded by saying

These developments show how significant the exchange rate is as a transmission channel of monetary policy. As mentioned earlier, the ECB’s monetary policy does not target the exchange rate itself. At the same time, in the current environment of heightened uncertainty, the ECB will carefully assess the implications of incoming information – including developments in the exchange rate – for the medium-term inflation outlook.

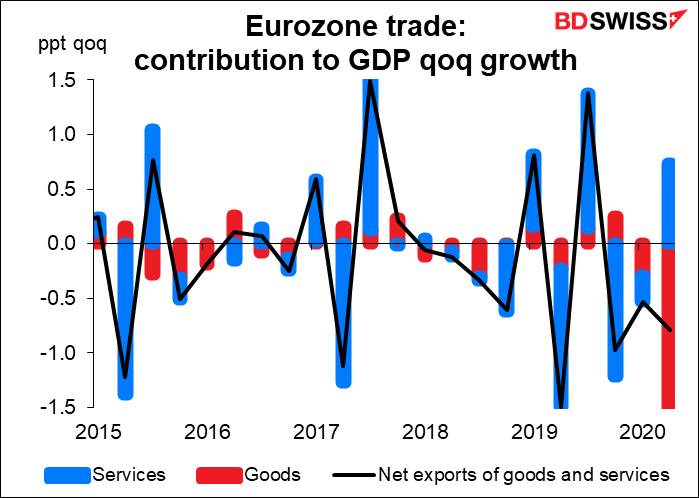

I think the first question we have to ask is, why is the ECB studying this question right now? I think it’s because they’re looking for ways to get the exchange rate down, and just as important, looking for ways to justify getting the exchange rate down with reference to their mandate, inflation. Given the ECB’s other work that shows the exchange rate doesn’t have that big of an impact on the inflation rate, I think this is just a smokescreen for them to weaken the exchange rate to boost exports. Pardon me for being cynical, but I think the following graph, which shows that exports of goods (red bar) subtracted 1.5 percentage points from growth in Q2, is the actual reason why they want to ease further.

That’s why I think if and when they do decide to move, they’re going to choose to increase their QE efforts rather than cut interest rates further. They’re likely to add more funds to the Pandemic Emergency Purchase Program (PEPP) and perhaps extend its life from end-June 2021 to end-year. They could decide to step up the pace of purchases, currently averaging some EUR 16bn a week over the last quarter vs some EUR 27bnn a week in the first full quarter of the fund’s existence. They could also increase and/or extend the other main pandemic response tool, the Targeted Long-term Refinancing Operation (TLTRO), a program that pays banks to increase their lending. The ECB seems to believe that a further cut in rates deeper into negative territory would still be effective, but I think they’ll use QE first, because of the impact on the exchange rate.

US indicators

We also have a number of important indicators out during the week. For the US, we get durable goods orders, Conference Board consumer confidence survey, and the Richmond Fed manufacturing survey on Tuesday. The Richmond Fed survey isn’t the most closely watched of the five regional Fed surveys, probably because it’s usually the third or so to be released, but it has the best correlation with the Institute of Supply Management (ISM) manufacturing purchasing managers’ index, so it’s probably the most informative of them all. It’s expected to be down slightly but remain solidly in expansionary territory (18.0 vs 21.0).

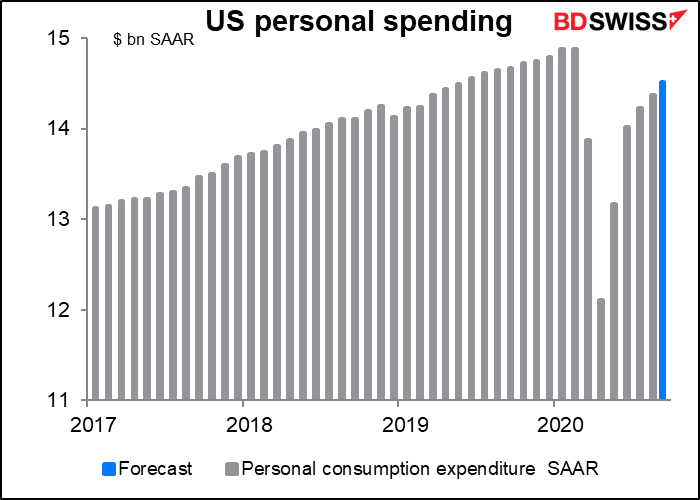

On Thursday we get pending home sales, and on Friday the biggie of the week: personal income & spending, and with it the personal consumption expenditure (PCE) deflators. The PCE deflators used to be the more important ones for the FX market, but now the Fed’s on hold indefinitely while everyone is wondering just how long people the economy can keep going with so many unemployed people.

Personal income is expected to be up a small 0.3% mom after the previous month’s 2.7% fall. Even that small rise would leave incomes 2.7% above their pre-pandemic levels.

Personal spending is forecast to rise by a more solid 1.0% mom. It plunged in April but has risen every month since then. Still, on this month’s forecast it would be 2.5% below pre-pandemic levels, so by no means a full recovery yet. Nonetheless I think the combination of the two – still-strong incomes and recovering spending – would be positive for risk sentiment, which probably means negative for the dollar.

First estimates of Q3 GDP from US and EU

On Wednesday we get the first estimate of US Q3 GDP. It fell 31.4% qoq SAAR in Q2, but it’s expected to bounce back by 32% in Q3. That looks like more than a full recovery, but it’s not, thanks to the quirks of the annualization calculation. It amounts to a 9.0% qoq decline but only a 7.1% qoq recovery. (Yes, I thought it was strange too, but I checked my work and it’s correct as far as I can tell. If it’s wrong please let me know. I freely admit that math isn’t my strong suit. I was a History major in college.)

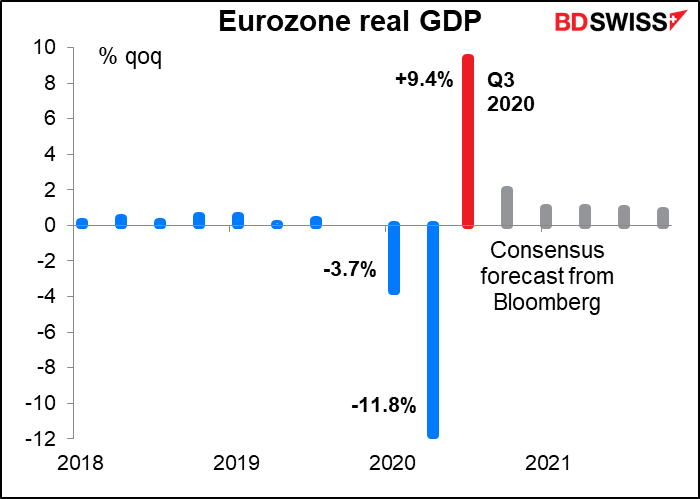

In the Eurozone, output fell 11.8% qoq in Q2 but is expected to rebound by 9.4% qoq in Q3 (Friday). (Remember, EU growth is expressed as qoq, whereas US growth is expressed qoq annualized.) That’s a steeper decline but a sharper recovery than in the US.

It would still leave relative output in the EU lagging behind that of the US. That may be another reason why the ECB wants to ease. This growth differential is negative for the euro.

Other EU data: Ifo, inflation

The Ifo indices for Germany come out on Monday. Then there’s German inflation on Thursday and EU-wide inflation on Friday. Both are expected to remain in deflation at the headline level, with the EU-wide CPI moving one notch further. That’s also negative for the euro.

End-of-month Japan data + Tokyo CPI

Friday is the last working day of the month, and as usual we get Japan’s unemployment rate, job-offers-to-applicants ratio, industrial production, and this month the Tokyo CPI as well. (Also several others, but we won’t bother with them.) These are all high-profile indicators, but three of the four don’t move much from month to month so I won’t bore you with them.

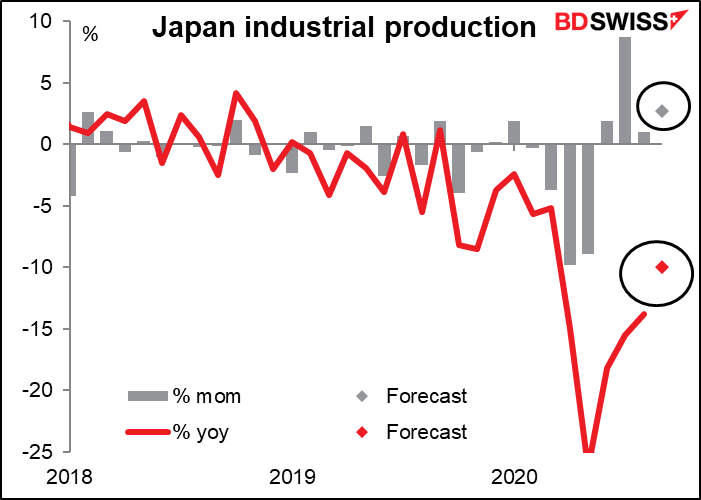

Only industrial production is expected to show any major change. This month (September) it’s expected to rise by more than it did in August, which is a good sign of an accelerating recovery. That might be negative for the yen, oddly enough, in that the stock market might rally and the yen therefore decline in the “risk-on” sentiment. (Although a quick glance shows a relatively low correlation between the Tokyo stock market and USD/JPY.)

Other events: CCP 5th Plenum, US elections, Brexit

In China, in addition to the PMIs coming out on the 31st and Nov. 2nd, we will witness the 5th Plenum of the Chinese Communist Party (CCP) will be held from Monday to Thursday. More than 300 members of the Central Committee will gather to establish the blueprint for the 14th Five-Year Plan (2021-2025), and a new medium-term economic strategy called the “Vision 2035.” The country is trying to refocus its economy to depend on domestic consumption rather than on exports for growth. That will help to limit the impact of “decoupling” from the US, not to mention the virus, which has dampened demand globally. If reorienting the economy toward domestic growth means more infrastructure spending, it could boost commodity prices and AUD. The Plenum will also approve new working rules for the Central Committee. This appears to be a move by President Xi to concentrate power at the top of the Party, and therefore in his own hands.

And of course we have the three major stories we’ve been living with: the virus, the US elections (the last week before the election!) and the Brexit negotiations (two weeks left before what’s probably the last EU summit that can make a deal.) We’re coming down to the wire on both of those!

Note that I said the “US elections,” plural, not singular. That’s because the Senate elections are probably just as if not more important than the Presidential, and they’re really in play – a lot of seats that seemed to be in firm Republican hands (or since they’re seats, maybe…not hands?) are now seen as a close contest or even leaning Democrat. A “blue wave” that brought Democratic control of the Senate as well as the White House would probably be good for risk assets. Its implications for the dollar however are debatable, and in fact I will be debating – or at least discussing – that very point at my webinar Tuesday.

You can register here for the Mastermind Webinar: Market Outlook Q4.

My guess though is that one long-running story may drop out for now: the US fiscal package to replace the expiring CARES Act. I think if we don’t get that solved Friday, then they’ll probably wait until after the election to bring it up again.