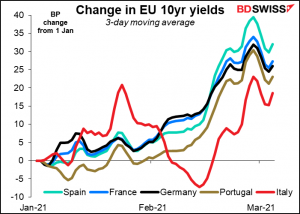

There’s been a marked change in sentiment in financial markets recently. The change has emanated from the bond market, specifically the US Treasury market, where yields have risen substantially. But the surge in yields has been global.

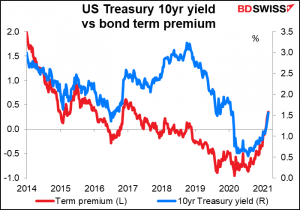

The rise stems from a dramatic change in the behaviour of the bond market, namely after 2 ½ years, the bond term premium has turned positive again.

What is the “bond term premium” and why is it important?

Bond yields can be decomposed into two parts. One is the expected path of short-term interest rates. For example, a two-year bond can considered to be an overnight loan that’s rolled over 730 times. If short-term rates are likely to be unchanged during that period, then lenders should be indifferent to lending overnight or for two years and the two interest rates should be the same.

The other part of the yield of a bond is what’s called the term premium – the extra fee that lenders demand for lending long, to compensate them for the inherent uncertainty in this vale of tears: the uncertainty of central bank policy, of inflation, of growth, of market volatility, etc.

Neither figure can be observed directly, they both have to be estimated through fancy math that I couldn’t begin to deal with. Fortunately, someone else has done this and the Fed publishes an estimate of the term premium weekly.

As you can see from the graph above, it was briefly negative in 1962 and again for a few weeks in 1969. It then stayed positive until 2016, when it started turning negative occasionally. In November 2018 it turned decisively negative and then stayed there – until February.

In short, for the last 2 ½ years investors seemed worried about the risk of not being in the bond market. They were willing to pay a premium for the privilege of holding bonds. But now that’s turned around. Now investors are once again worried about the risks of holding bonds – which is the normal state of affairs – and are demanding to be compensated for taking on that risk. This is a big change in sentiment.

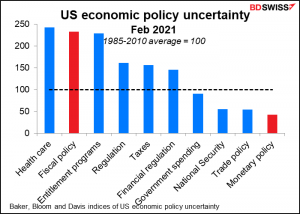

I must say, it’s hard to see what specifically is causing the increase in uncertainty. It doesn’t seem to be government policy. The Baker, Bloom and Davis indices of US economic policy uncertainty don’t show any particularly high level of uncertainty. Monetary policy uncertainty, the one most important for the bond market, is specifically far below average.

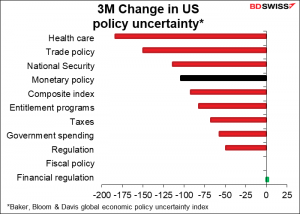

Compared with three months earlier, uncertainty has fallen almost across the board.

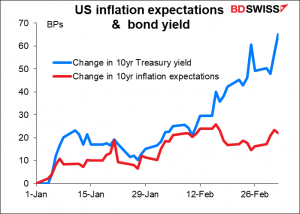

My guess is that it’s uncertainty about growth and inflation. Although the noticeable thing is that real yields have risen considerably – that nominal yields have risen more than would be necessary just to keep pace with the increase in inflation expectations.

We can see that something happened around Feb. 17. Before then, US yields were rising as US inflation expectations were rising. In other words, real yields were staying the same.

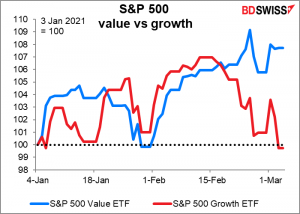

On the same day something dramatic happened in the stock market. Before then, value stocks and growth stocks were going up at about the same pace. On Feb. 17th they started to diverge noticeably and have continued to.

Is the stock market being driven by the bond market? Or are both being driven by something else, e.g. doubts about the recovery, or perhaps something even more striking: certainty about the recovery. Perhaps the market is switching from hope to expectation and with that a rotation out of assets that make money through loose liquidity and abnormal situations, such as the tech stocks that’ve been soaring recently, and into assets that make money in normal times, such as banks. (Note that about a third of the “value” ETF is financials, while about the same percent of the growth ETF is infotech.)

In that case, the story of the markets nowadays would be the conflict between the recovery/liquidity narrative and the inflation/higher rates narrative. The strong recovery boosted by continued loose liquidity from central banks is good for risk assets, but higher inflation that results in higher yields is bad. The tug-of-war as one day one narrative dominates and the next day the other is likely to keep markets volatile.

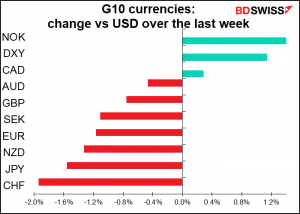

Although central bankers have been relatively sanguine recently about the higher yields, I would expect them to step in with at least verbal intervention if the rise in yields risks choking off the recovery prematurely. That’s why I expect the recovery/liquidity narrative to win and the commodity currencies to benefit. That would mean the dollar falls back after its recent surge, together with the safe-haven CHF and JPY, (which were the worst-performing currencies this week – see chart below).

Is this macro story the whole story? There are several technical issues going on behind the scenes that are pushing up bond yields too. These are too complicated to get into in any detail, but just in brief they are related to regulations concerning bank capital requirements and share buybacks, which affect how much money banks have left at the end of the day to buy bonds with and to lend to those who want to buy bonds. Uncertainty about these regulations, some of which are currently scheduled to expire at the end of March, is also causing a lot of chaos in the bond market.

Next week: Bank of Canada, European Central Bank

As usual, the second week of the month is a slow time for indicators. It’s also a slow week for Fed and European Central Bank (ECB) speakers this month, because they’re not allowed to talk in the two weeks before a meeting. So, the week will be relatively quiet until Wednesday, when the Bank of Canada meets and the US releases the one big indicator of the week, the consumer price index. Then on Thursday the ECB meets, and that’s about it, folks. In the early early morning Friday we get UK short-term statistics day, with the monthly GDP, industrial & manufacturing production, and trade figures, plus Canada’s employment data, which doesn’t come out along with the US nonfarm payrolls this month.

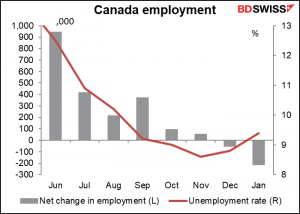

I don’t expect either central bank to make any change in policy, and neither does anyone else, I expect. There were some thoughts that the Bank of Canada might make a “mini-cut” of 5 or 10 bps at the Jan. 20th meeting, following the surge in virus cases, the strengthening of the currency, and the disappointing December employment figures. Since then, the economy hasn’t shown that much improvement: unemployment is up further, retail sales are down, and growth slowed notably in December.

There has been a major success in one area in Canada however: cases of the virus have fallen substantially as the vaccine roll-out proceeded.

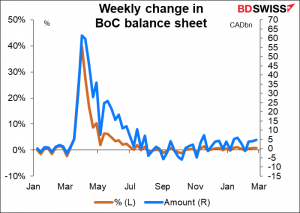

The Governing Council has pledged to keep rates at “the effective lower bound” until its 2% inflation target is “sustainably achieved,” so we don’t have to think about a rise in rates any time soon (it forecast that that wouldn’t happen until “into 2023.”) It did add one phrase to its forward guidance that hinted at a possible reduction in its massive CAD 4bn-a-week (at least) bond purchases: it said, “As the Governing Council gains confidence in the strength of the recovery, the pace of net purchases of Government of Canada bonds will be adjusted as required.” The question then is whether enough data will have been released in the intervening 40 days to allow them to gain such confidence. I suspect that they would want to see at least the January GDP figures, due out on March 31st, before deciding that question.

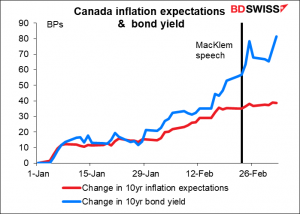

On Feb. 23rd, Bank of Canada Gov. Macklem made a speech, “Canada’s labour market: rebound, recuperation and restructuring”. In the Q&A after the speech he was asked about the Bank’s bond purchases. He said that while there would be adjustments made to the quantitative easing program, it would continue until the recovery was well underway. This remained “some ways off,” he said. I can’t imagine that things have changed so dramatically in the two weeks since. Accordingly, I expect them to stand pat at this meeting.

As for the ECB, I won’t even bother you with a lot of reasons why they probably won’t make any changes. If they didn’t cut rates back in March last year, they’re not going to do it now. Furthermore, they just “recalibrated” all their tools in December. It’s too early to think about doing it again.

The big question that people will be looking to answer is of course what these two central banks think about the recent rise in bond yields.

The Bank of Canada seems OK with it. Again, in the Q&A after his Feb. 23rd speech, Gov. Macklem was asked specifically about the rise in long-term interest rates. He said it bore witness to the success of fiscal supports and vaccine development and, in turn, to rising inflation expectations. He considered this a good thing. By this time, the process had gone on substantially, and his comments gave rates a further fillip upward.

It will be interesting to see if Gov. Macklem and his homies still think that way after seeing how the trend has continued. If they continue to accept higher yields, I would expect CAD appreciate further.

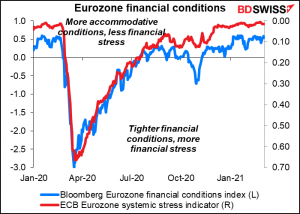

I’m sorry to say that the ECB seems not to be so sanguine on the same subject, sadly. The Governing Council is worried – very worried – very, very worried – about financial conditions. ECB Chief Economist Lane, whom some people suspect is the shadow ECB President, recently made a speech on the subject in which he mentioned the term “financial conditions” 53 times.

Financial conditions seem pretty loose right now, while systemic stress is almost zero. So in theory the ECB shouldn’t have too much to worry about.

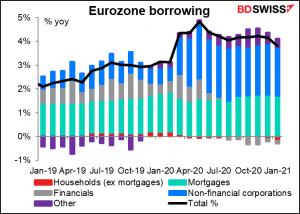

However, the loose market conditions aren’t necessarily getting transmitted to the end-user. The ECB’s Bank Lending Survey shows that banks have been tightening their lending standards – not as much as during the Global Financial Crisis nor the Eurozone debt crisis in 2011, but still, it’s not what the ECB wants to see.

And bank lending growth, already sluggish, is slowing further.

ECB Governing Council members have made their view clear: they’re worried. The account of the ECB’s January meeting said that “it was important to monitor the recent increase in nominal risk-free rates.” Since then the verbal intervention has only intensified, with half of the Executive Board – Lagarde, Lane and Schnabel – specifically commenting on the subject of rising yields. Lagarde said the ECB is “closely monitoring the evolution of longer-term nominal bond yields.” Lane reiterated that point and added that they will buy bonds flexibly to prevent undue tightening. Schnabel said “a too abrupt increase in real interest rates on the back of improving global growth prospects could jeopardize the economic recovery. Therefore, we are monitoring financial market developments closely.” However, these comments have failed to arrest the rise in European yields.

The main debate at this meeting will be how to respond to these higher rates. Policymakers have signalled that they’re willing to use the Pandemic Emergency Purchase Program (PEPP) to fight the trend if necessary, by stepping up purchases. The question facing them though is whether higher yields accompanied by higher inflation expectations are mostly a sign of increased confidence in the recovery, which should be welcomed. Plus, yields are only one aspect of the ECB’s assessment of overall financing conditions, which as mentioned above remain quite loose.

I would expect some saber-rattling at this point but no concrete action yet. They are likely to stress their willingness to take further action if necessary, though. Some possible things they could do: step up the pace of purchases from the PEPP, extend the program beyond its current end-date, concentrate purchases in a specific country if spreads begin to widen out, or maybe even “twist” their purchases by buying longer-dated bonds.

If they do take any of these actions though, I think the market reaction would be swift and large. The contrast between the Fed’s laissez-faire attitude and the ECB’s active stance would probably push EUR/USD lower.

Other indicators: US CPI, JOLTS report, UK short-term indicators

There are a few indicators of note coming out during the week.

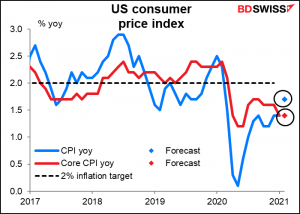

The US consumer price index (CPI) on Wednesday is always of interest. Core CPI is expected to rise at the same yoy pace of increase, but the headline rate of inflation is forecast to accelerate notably. This could further the “inflation is back” narrative, cause bond yields to rise further, and push up the dollar.

I don’t know if Thursday’s Job Openings and Labor Turnover Survey (JOLTS) report is going to come back in fashion, now that a) its main booster, former Fed Chair Yellen, is back on the financial scene, and b) the Fed is focusing far, far more on the job market than inflation. In any case, it’s not expected to be good the forecast is for a small (46k or 0.7%) decline in the number of job openings. It’s hard to see how the US will squeeze 18.3mn people into an expected 6.6mn job openings. In that case, unemployment is going to last a long time, the Fed will have to keep policy loose, and stocks will rise but the dollar probably fall – if people pay attention to the indicator, which is a big if.

The University of Michigan will also announce its consumer sentiment index on Friday. It’s expected to be up slightly but nothing major – still within the post-pandemic trading range.

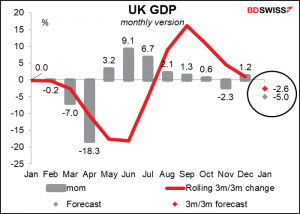

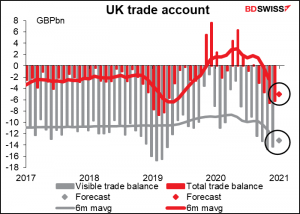

Friday is also UK short-term indicator day, when they announce monthly GDP, industrial & manufacturing production, and the trade account.

GDP is expected to have contracted during the month, but you knew that already thanks to the lockdown. It shouldn’t hurt the pound much unless it’s much weaker than expected.

The trade data will probably be closely watched as it’s the first month’s data after Brexit. That’s why I’m surprised the market expects the trade deficit to narrow despite the well-publicized cascade of unexpected consequences from the pages and pages of new rules that no one really understood. If the deficit did narrow, my guess is that’s only because either lorries were stuck on the Continent and couldn’t make it to Britain, or everyone was stuck and home due to the lockdown and couldn’t go out and buy anything in the first place. Often though traders just look at the headlines and not the reasons, so a narrowing deficit could be good for the pound.

Also Friday we’ll get the Canadian employment report. Usually this comes out at the same time as the US version, but not this month. There’s no forecast, but labor market data is becoming increasingly important for all central banks, the Bank of Canada not least. In Gov. Macklem’s speech on the labor market, mentioned above, he said:

For the Bank, a healthy labour market is central to achieving our mandated goal of low, stable and predictable inflation. Indeed, at its heart, inflation targeting is about achieving low inflation together with full employment because to sustainably achieve either, we need both.

The Bank is reviewing its monetary policy, much as the Fed did recently and the ECB is. I don’t know if this is a hint that it could move to a “dual mandate” like the Fed and the Reserve Bank of New Zealand have, but certainly in today’s world, when too-low inflation is the problem, not too high inflation, central banks are going to focus on what they can do to get the economy back on their feet. So far, the news from Canada has not been encouraging. The number of people with jobs has been falling and the unemployment rate has been rising.