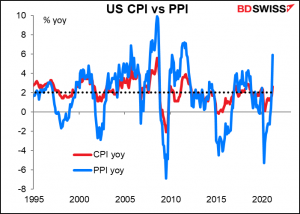

Today the US Bureau of Labor Statistics (BLS) releases the producer price index (PPI). With the market’s attention focused firmly on the outlook for inflation, this is likely to be an important indicator. That’s because many people take the PPI to be a harbinger of future consumer price inflation, which is what matters for the policymakers at the Fed. But is this true?

I’d like to discuss here how the PPI differs from the consumer price index (CPI), what exactly the PPI measures, and most importantly, what it tells us about future consumer inflation and therefore possible changes in official policy.

What’s the relationship between the CPI and the PPI? They both measure the price of a basket of goods and services, but the baskets are different. According to the BLS, which calculates the two, the PPI includes the entire marketed output of US producers. This excludes imports. The CPI on the other hand includes goods and services purchased for personal consumption by urban US households, including imports.

There are several measures of the PPI that take goods at different stages of production. The most commonly used one, the one we look at, is the one for finished goods. Although consumer goods are finished goods, the PPI and CPI two don’t measure a comparable basket. First off, the PPI includes capital equipment, which individuals don’t buy (unless you want an oil rig in your backyard, for example). Meanwhile, the CPI includes services, which aren’t included in the PPI. And of course, even when the same thing appears in both baskets, the weightings are usually different.

Why pay attention to the PPI?

People look at the PPI because they believe changes in the PPI will eventually filter through to changes in the CPI. That is, if companies are having to pay higher prices for their inputs, they’ll eventually have to charge more for their outputs. Either that or their profit margins will be eroded.

There is some evidence that this is true. Researchers have indeed found such a connection (such as here). But it ain’t necessarily so. Other studies have shown that they both drive each other, especially when rising, “signifying the existence of both demand-pull and the cost-push nature of inflation.” And still other studies have shown that at some time and in some places, the CPI drives the PPI and not the other way around.

The BLS summed it up as follows:

Some assume that a price change recorded in a particular component of the PPI will eventually and directly be seen in the same or most similar component of the CPI. In reality, it is difficult to project whether, in what magnitude, or when an increase in the PPI will “pass through” to the CPI. An increase in the price paid to a producer for a good may not be passed on by a retailer if, for example, competitive conditions in the retail market preclude such an action. Alternatively, the retailer may increase the selling price for the good in question, but not by the full extent of the increase in the price paid to the producer. In this case, for example, the retailer may be realizing efficiencies in operations which allow a shrinkage in markup. This particular example also illustrates that, because of the possibility of change in the costs to transport wholesale or retail products, the CPI for a given component may change even though there has been no change in the PPI for the same component.

In any case, the link between the PPI and CPI is getting weaker because of globalization. They used to be quite closely correlated but then started to diverge after 2001, when China joined the World Trade Organization (WTO). According to researchers at Columbia University, this is because of the increasing length and complexity of global value changes. There are now more stages in the production process and more intermediate goods, so the impact of one on the other is muted.

In short, the PPI is one factor that people are going to look at to get an idea of where retail price inflation is headed. But the relationship is neither simple nor clear-cut.