Rates as of 05:00 GMT

Market Recap

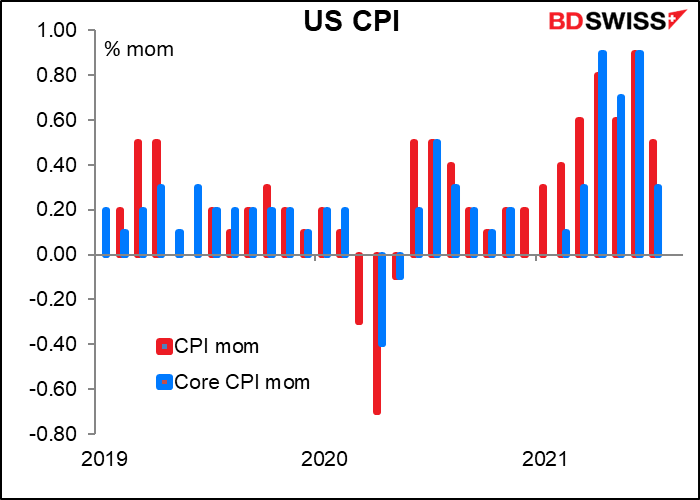

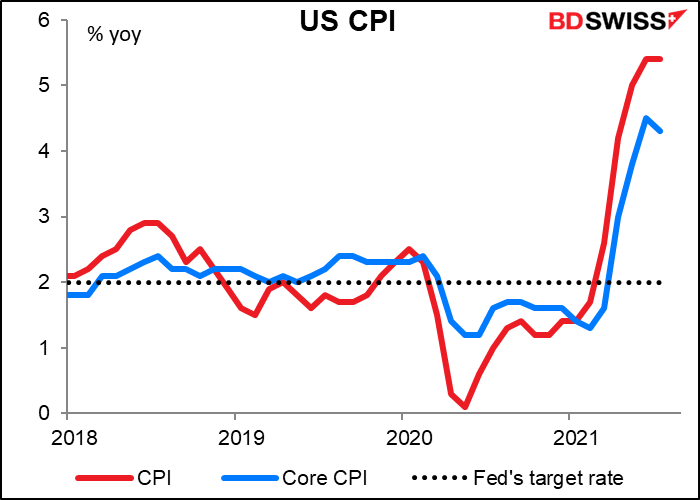

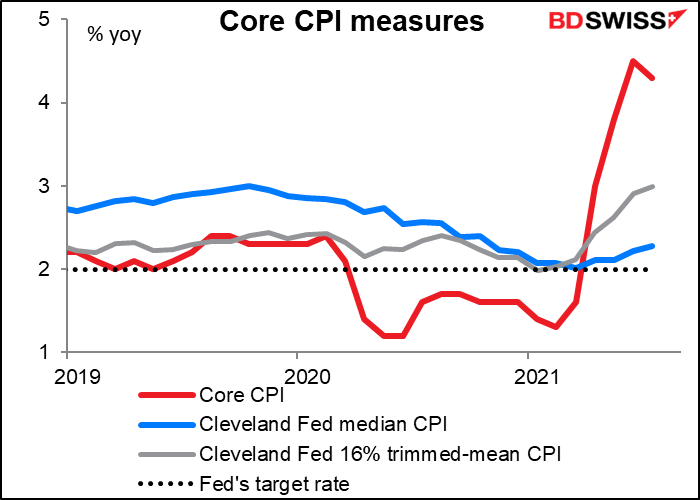

The eagerly awaited US consumer price index (CPI) yesterday had a mixed result: the headline figure was exactly as expected on a mom basis (+0.5% mom vs +0.9% mom previous) but the core measure was a shade lower than expected on a mom basis (+0.33% mom vs +0.4% mom expected, also +0.9% mom previous).

On a yoy basis this translated into the headline rate being a little faster than expected (+5.4% yoy, unchanged from previous, vs +5.3% yoy expected) whereas the core rate slowed as expected, to +4.3% yoy from +4.5%yoy (although it slowed a bit more than expected if you go to the second decimal place). The market clearly places more emphasis on the core measure, because that’s what investors focused on.

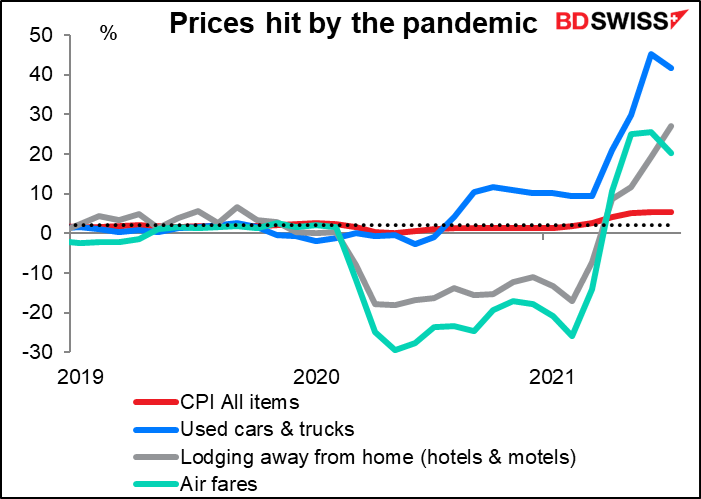

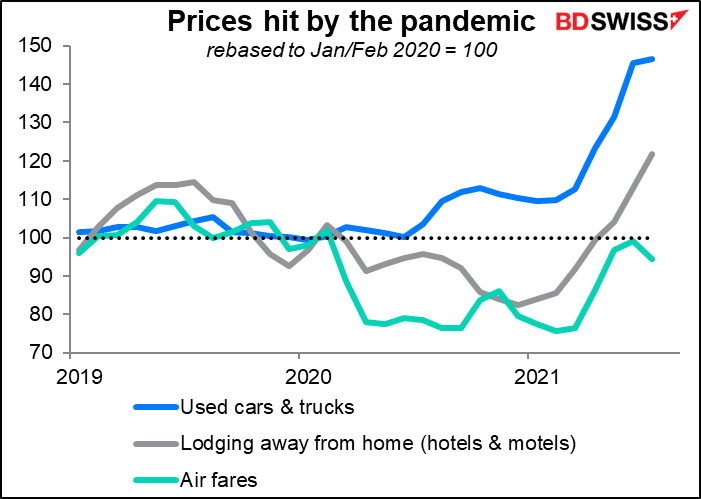

Some of the components that have been responsible for the higher inflation rate showed signs of slowing, especially used cars & trucks and airfares.

Used car prices, the main villain in the higher inflation readings, have now fallen for two months in a row, according to Manheim, the world’s biggest auto auction house.

Meanwhile, airfares are back to where they were before the pandemic while hotel prices are even higher. That suggests these extraordinary upward price pressures may be coming to an end.

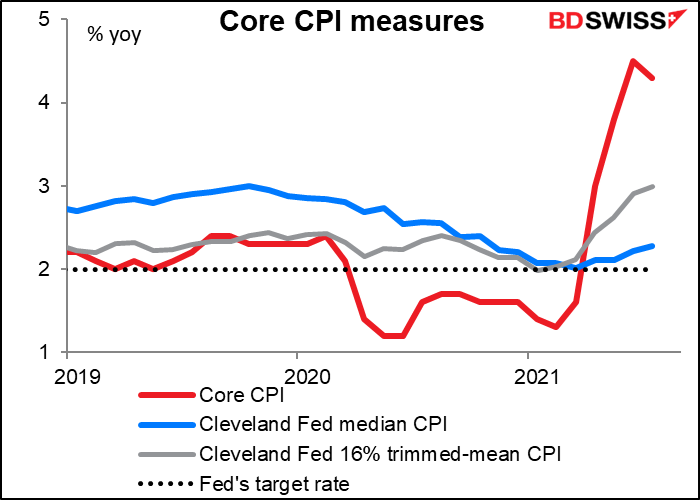

Nonetheless, the data showed that inflation remains entrenched. The Cleveland Fed’s trimmed-mean measure rose to 2.99% yoy from 2.90% – a new high since 2008 – as did the median measure, which rose to 2.28% yoy from 2.21%. These core measures’ mom gains (not shown) were also relatively strong.

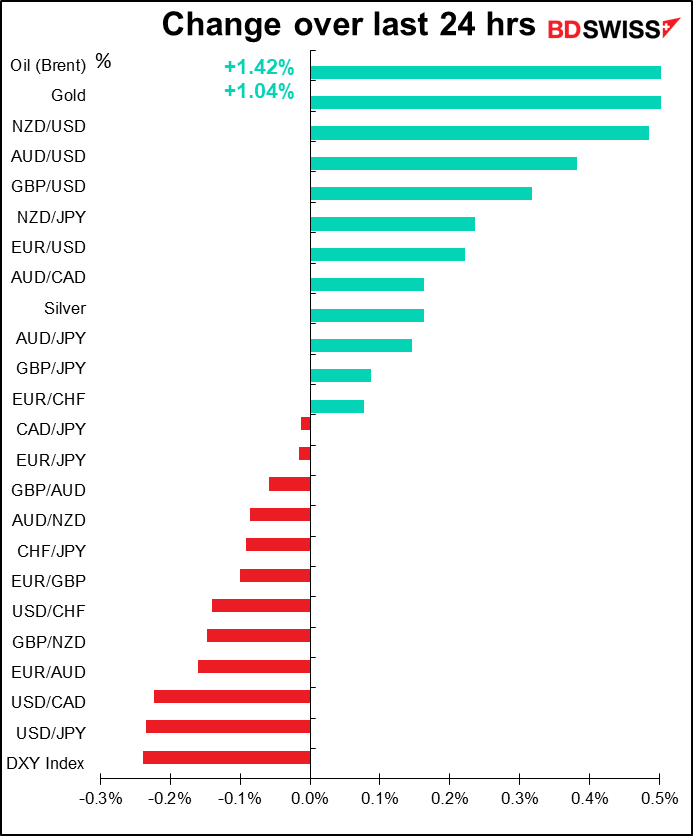

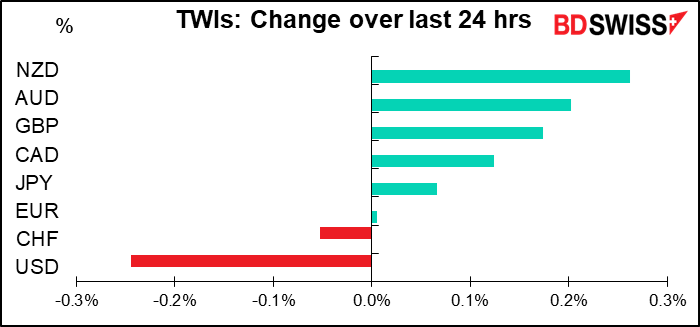

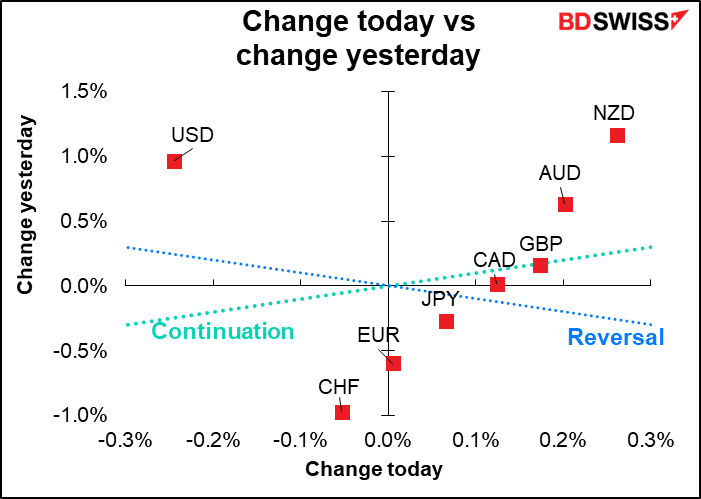

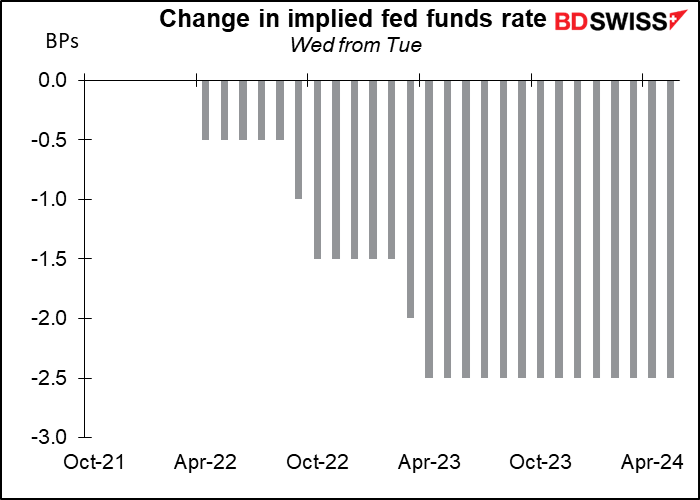

The downside surprise eased fears of more rapid Fed action and pushed rate expectations and US bond yields lower. Shortly after the CPI figures were released, a strong 10yr bond auction saw yields fall intraday to 1.30% from 1.35% the previous day, with indirect-bidder demand at the auction — a proxy for foreign demand — at 77.2%, the highest on record. USD fell along with bond yields. Stocks on the other hand were bolstered and the S&P 500 moved further into record territory.

With thoughts of Fed tightening being pushed back a bit, the activity-sensitive commodity currencies caught a bid. AUD and NZD were higher, with CAD lagging despite higher oil prices as USD/CAD encountered support at the key 1.25 psychological level (0.80 in CAD/USD terms) and the Canadian curve mildly bull steepened in line with Treasuries.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

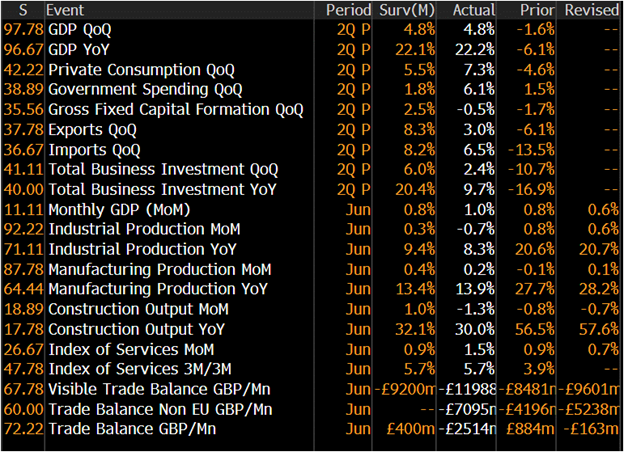

UK short-term indicator day is already over. The quarterly GDP figures were spot on, but the industrial & manufacturing production and the trade data suggest that the recovery is already running out of steam. IP significantly underperformed (falling instead of rising as expected) and the trade balance turned into a substantial deficit instead of a surplus as expected. Hmmm, bummer, bummer. GBP-

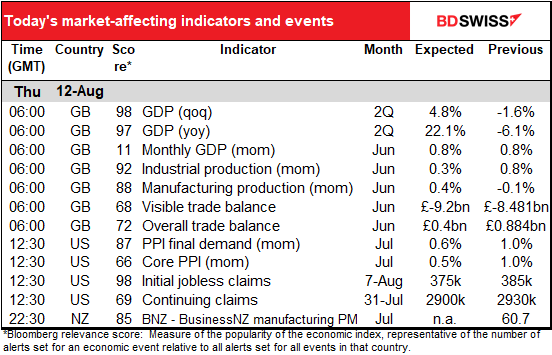

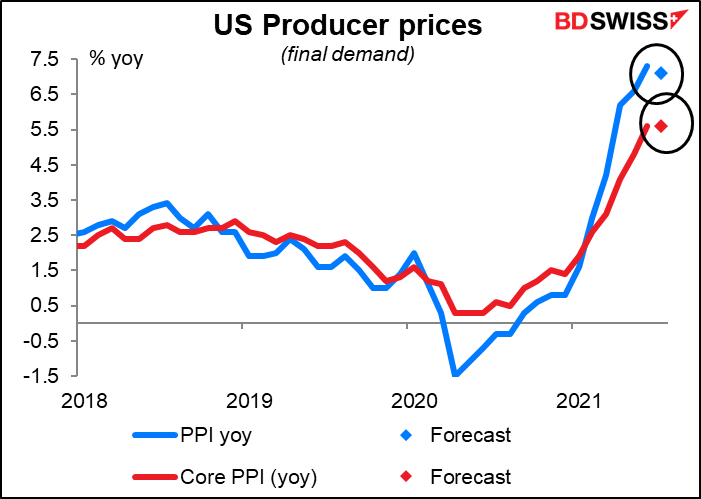

The US producer price index (PPI) is expected to slow somewhat. This would confirm that the rate of inflation probably has peaked, although the relationship between the PPI and CPI is complex and variable – see my special piece on this subject, The PPI and the CPI: what’s the connection?

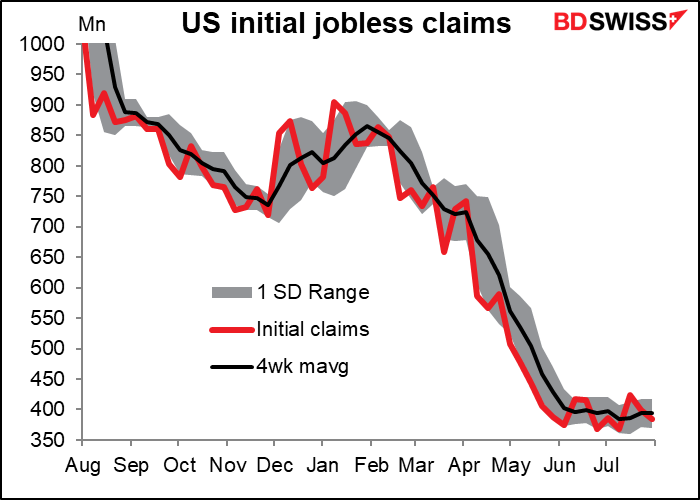

Next up are the dreaded weekly jobless claims, the diabolical indicator that has so befuddled economists recently.

The four-week moving average of the initial jobless claims which is what people used to pay attention to before the pandemic, hasn’t budged in a while. It was 394k last week. It was also 394k on June 25th. So despite the week-to-week fluctuations, claims seem to have hit a plateau, or a valley, or whatever you would call it.

Initial claims are forecast to decline a meager 12k, which seems achievable if indeed they do decline – the last two weeks were -14k and -25k. However the week before that was +56k. So it seems the claims are two steps forward, two steps back, no progress.

I don’t think a 10k change would be enough to move the needle on anyone’s expectations for Fed policy so I don’t think a result in line with the consensus would have much impact on the dollar.

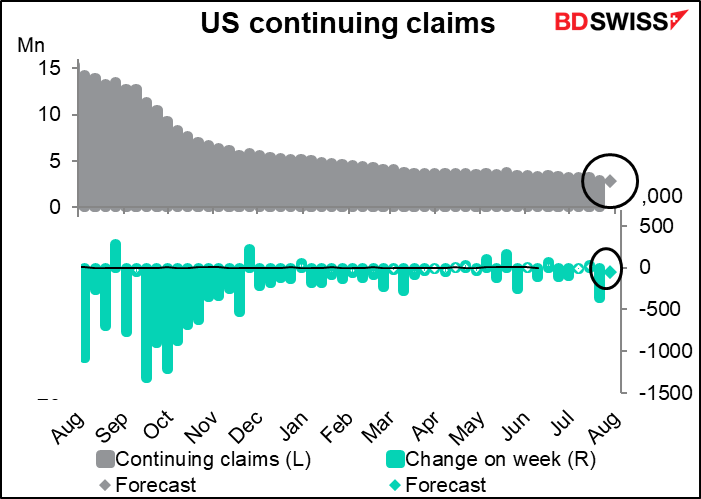

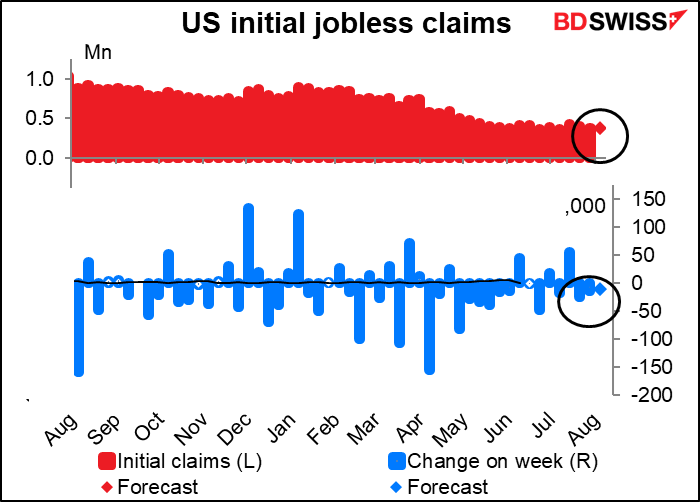

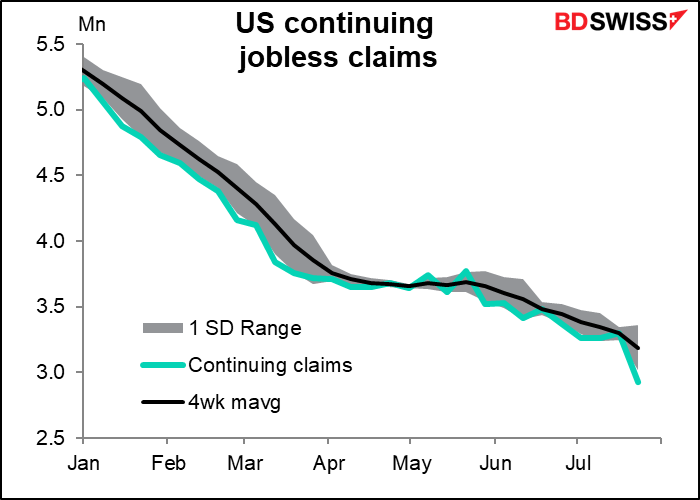

Continuing claims on the other hand are indeed declining steadily. In fact they seem to be declining at an accelerating pace as states cruelly withdraw their federal unemployment benefits even before the money runs out in an effort to force people to go to work.

They’re expected to decline by 30k this week, a far cry from last week’s -366k decline.

Last week the dollar rallied after the figures came out, with the move attributed to the larger-than-expected decline in continuing claims The median forecast was for 3255k, with a range of 3180k to 3280k, while the actual was a much lower 2930k. Continuing claims may once again be the one to watch as the heartless Republican governors ct off support to their struggling constituents.