Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

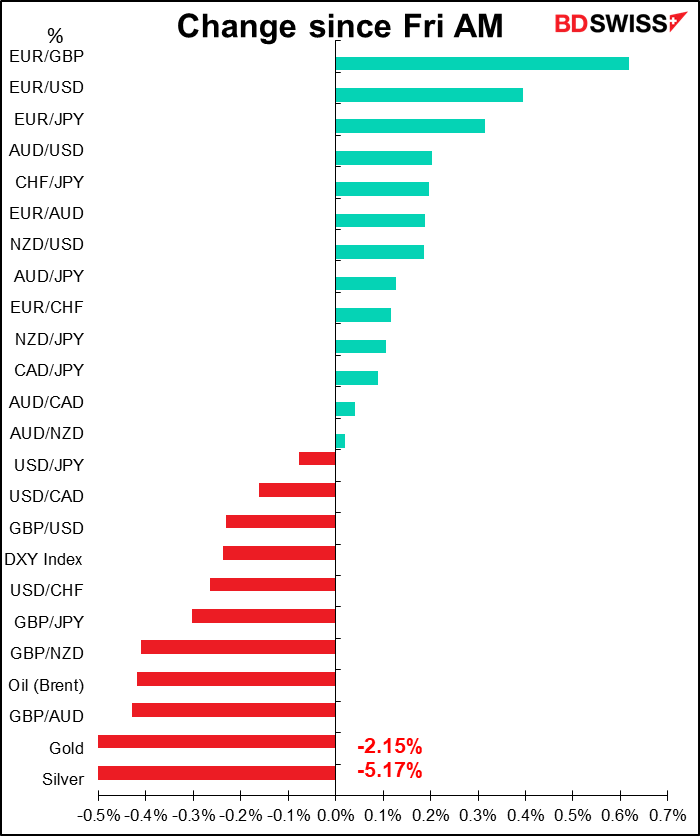

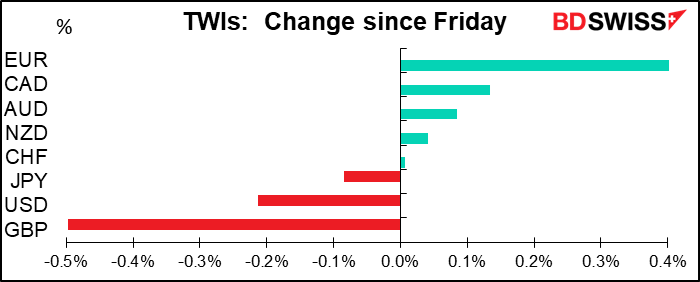

The table above is a bit misleading. The pound has indeed fallen the most since Friday, but it’s recovering this morning on an article in The Telegraph newspaper alleging that “A Brexit breakthrough on fishing could be close with the EU set to formally recognise British sovereignty over UK waters.” The report said, “Senior Government figures believe that tentative compromise is a prelude for the EU to cave to other British demands on fishing in the coming week of intensified negotiations in London.” However, most of the rest of the article – which doesn’t appear on The Telegraph’s website as far as I could tell – just rehashes comments made by both sides over the weekend stressing the problems that they’re having reaching an agreement. I’m therefore a bit dubious about this article, particularly as I think it’s much more likely that Britain caves than the EU caves.

The action today shows that there is indeed some upside left to the pound if and when they do reach an agreement, and there’s also some downside left if they don’t and Britain crashes out with a “no-deal Brexit.” Last week, the Office for Budget Responsibility (OBR) estimated that a “no-deal” Brexit would cut 2% off of Britain’s GDP every year on top of the 4% reduction that they estimate leaving with an agreement would cause. (Note that this means output would be 2% lower than it would be otherwise, not that growth will be 2 percentage points slower.) This is much worse than their estimate for the long-run impact of the virus on the UK economy, which the OBR estimates will be negligible.

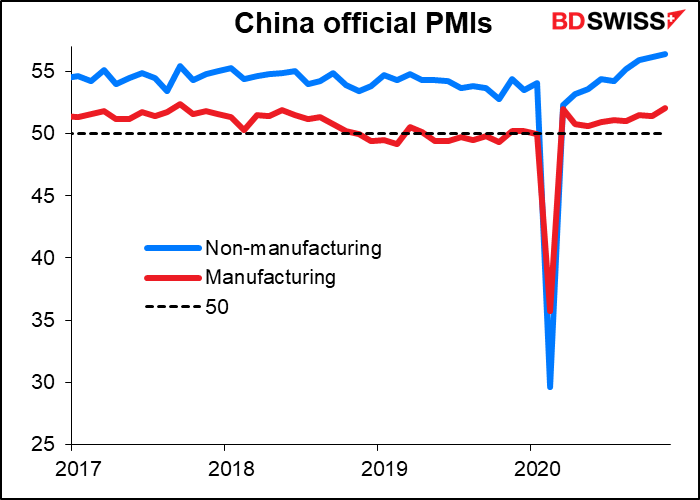

Elsewhere, there seems to be a general “risk-on” mood in the FX market, with USD and JPY down and EUR up. (As usual, I’m judging “up” and “down” by the currencies’ trade-weighted indices.) The good mood was bolstered by a number of encouraging indicators out overnight. Japan’s industrial production was higher than expected at +3.8% mom vs +2.4% expected (3.9% previous). At the same time, China’s official purchasing managers’ indices (PMIs) both beat expectations – the manufacturing PMI rose to 52.1 from 41.5 (51.5 expected), while the non-manufacturing PMI rose to 56.4 from 56.2 (56.0 expected).

CHF was higher despite the risk-on mood after Swiss voters rejected two proposals: one that would’ve held multinational companies responsible for human rights and environmental problems abroad, and another that would’ve banned the Swiss National Bank and pension funds from investing in companies in the defense business. Under the Swiss system of direct democracy, any proposal that you can get enough signatures on goes to a national vote, and any proposal that passes becomes law. It’s pretty amazing.

The mood is quite different in stocks, as most Asian markets are lower, except for China. The S&P 500 index is indicated down 0.9%. I can’t find out why though because Bloomberg mostly has robots writing stock market reports. They give us a lot of numbers and tell us which stocks were up and which were down but fail to explain the reason behind the moves. There was one article that attributed the change to a Reuters report that the US is set to include China’s top chip-maker, SMIC, and national offshore oil and gas company CNOOC to a blacklist of alleged Chinese military companies. That has supposedly raised geopolitical tensions. Odd though that Chinese stocks would be almost the only ones in positive territory in such a case.

Today’s market: focus on OPEC

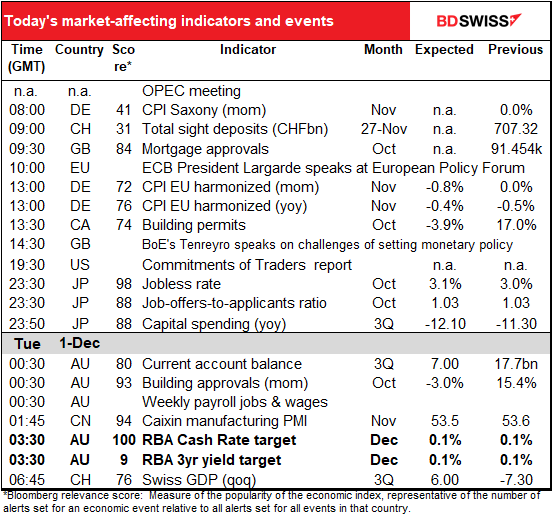

After two days of an almost-empty calendar, we’re back to a more normal schedule today.

The big event of the day is the (virtual) meeting of the oil ministers from the Organization of the Petroleum Exporting Countries (OPEC). They meet among themselves today and tomorrow will meet with other major exporters such as Russia and Kazakhstan in the group known as OPEC+. They are due to decide whether to extend their current output cuts of 7.7mn barrels a day (b/d) into next year or to reduce them – that is, increase production – from the start of January by 1.9mn b/d, as was originally planned.

(I’m sorry I don’t know what time the meeting starts – it’s not on the OPEC website and I couldn’t find the information elsewhere. I’ve begged Bloomberg dozens of times to carry information about OPEC in their economic calendar, but why should they listen to me? Today’s meeting of the Cato Institute on “Trade Policy Priorities through the Eyes of Congressional Democrats” is significant enough for them to include in their daily calendar, but not an OPEC meeting.)

Sunday there was an informal meeting of OPEC+ ministers – a meeting to arrange what will happen at the meeting. According to press reports, most ministers agreed to extend the current level of cuts through Q1 of next year. But not everyone – the United Arab Emirates and Kazakhstan were reportedly opposed. Iraq and Nigeria have previously grumbled at the restraints as well.

Some members point to the recent surge in prices above $40 a barrel (bbl) and argue that prices are high enough to allow them to pump more oil. West Texas Intermediate (WTI), the US benchmark crude, averaged around $44.84/bbl last week. Prices need to get up to $45-$55/bbl to allow North American shale producers to start pumping oil again. If that happened, the OPEC+ production restraints would simply allow room for other producers to benefit at the group’s expense.

On the other hand, OPEC’s own analysts calculate that there’s something like 1.3bn barrels more oil in storage above ground than there was at the beginning of the year, enough to meet any surge in demand. (OPEC’s current output is estimated at between 23.2mn and 24.7mn b/d.) That would argue in favor of keeping production down, because any surge in prices will quickly be met by drawing down inventories.

OPEC’s problems are compounded by the fact that oil isn’t just oil and demand isn’t just demand. There are different markets and different products that require different kinds of crude. As each market recovers at its own pace, each producer faces a different supply/demand curve, which erodes the unity of the group. Demand in Asia has recovered significantly, while it’s still depressed in Europe. Gasoline and diesel consumption has recovered to about 90% of their normal levels, but with far fewer people flying, consumption of jet fuel is still only about 50% of usual. And the market for heavy-sour crudes is relatively buoyant, thanks to output cuts by Saudi Arabia and Russia, but the market for light-sweet crudes is oversupplied, thanks in part to increased supply from Libya, where a cease-fire recently went into effect.

However, OPEC+ targets only crude, not products, and can only implement an overall production ceiling with cuts uniformly distributed. It therefore has a delicate balancing act to keep prices high enough to satisfy countries that are strapped for cash but at the same time allowing some space for those countries that need to pump more.

Keeping output at the current level for Q1 is already discounted in the market. If that’s what they decide, it probably won’t boost prices that much. On the other hand, increasing production (i.e., reducing the output cuts) would probably come as a surprise and depress oil prices and oil-linked currencies, such as CAD. Deutsche Bank estimates that failure to reach agreement would send prices down by about 10%. A third possibility — keeping output unchanged not just through Q1 but through Q2 as well — would be a positive surprise that would probably send oil higher.

Today’s indicators

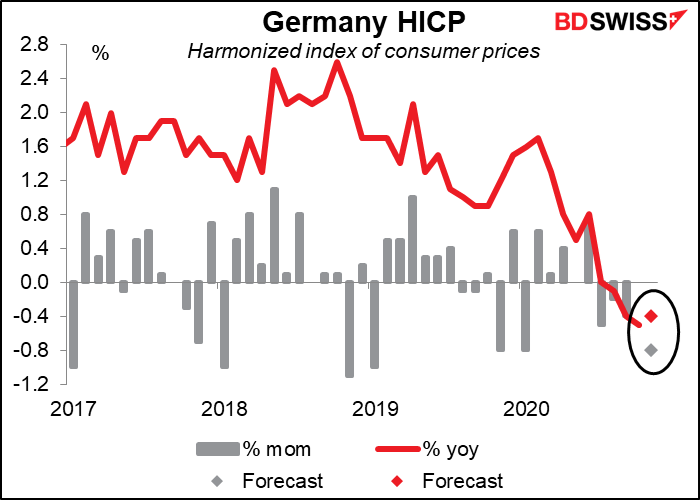

This morning starts with the consumer price index (CPI) for the German state of Saxony, which is always the first of the German states to announce its CPI. There’s never a forecast, but it’s worth watching as a reasonably good estimate for the German national CPI, which comes out later in the day. Prices are expected to fall rather steeply on a mom basis. That seems to be an annual event every November though, and so the yoy rate of change is expected to rise a little bit – although remaining well in deflation. In any event, everyone already expects the European Central Bank to come out with a massive package of easing next week (Thursday) so I don’t think this will change anyone’s outlook. EUR neutral

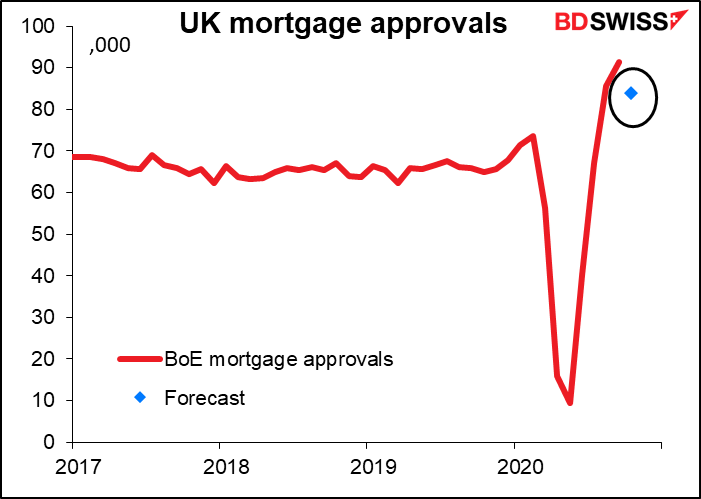

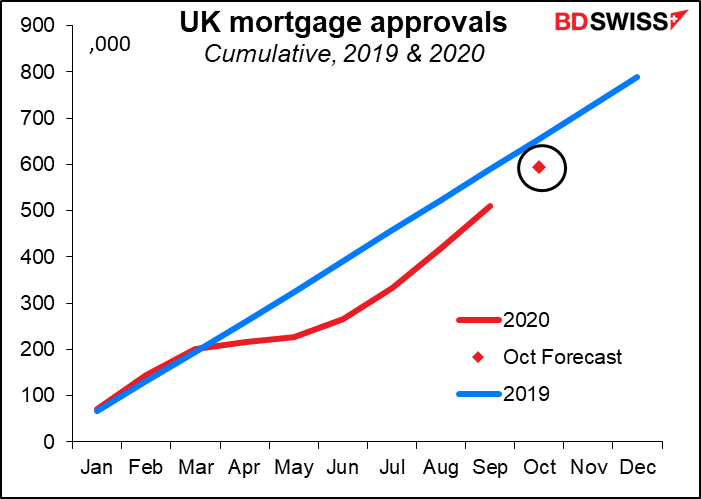

Before the nationwide German CPI comes out though we get the UK mortgage approvals from the Bank of England, part of their monthly money supply data. They’re expected to show a drop from the previous month, as would be expected during a lockdown.

If we look at how this year is going compared to last year, it’s not that bad. People have generally made up for lost time when they could. If the October forecast is correct, the total number of approvals year-to-date in October will be only 61k or 9.3% below that of the like year-earlier month – not bad when you consider that there were long periods when people were barely allowed to leave their homes.

Then that’s about it for the day. Canadian building approvals don’t really seem to affect the FX market that much, although they have a decent Bloomberg relevance score so I include them in the calendar.

Overnight though there are some important indicators for people who follow JPY and AUD.

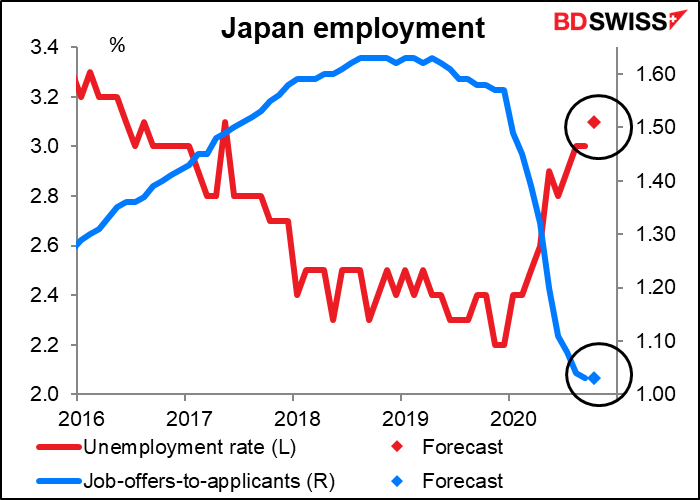

Japan’s unemployment rate is expected to tick up a bit, but the job-offers-to-applicants ratio is forecast to remain the same at slightly more than one offer for every applicant – not bad! One reason for the extraordinarily low unemployment rate is that Japanese companies have adjusted their wage bill by cutting working hours rather than jobs. Meanwhile, new job offers – a leading labor market indicator – have been rising since June. However, the labor market could deteriorate more rapidly in coming months as the number of virus cases increases nationwide.

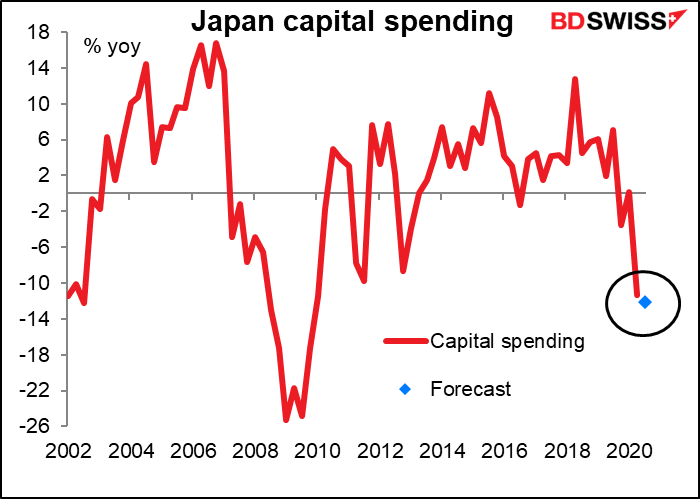

Japan’s capital spending is expected to fall at about same pace as in Q2, which would reaffirm the weak recovery in capital spending (as does the GDP data). Manufacturers seem to be increasing their investment but non-manufacturers are still cautious, as one might imagine looking at the purchasing managers’ indices, which remain in contractionary territory.

We then get two Australian indicators, a mere two hours before the Reserve Bank of Australia (RBA) meets. But as the RBA isn’t expected to do anything at this meeting, the data could still affect the currency.

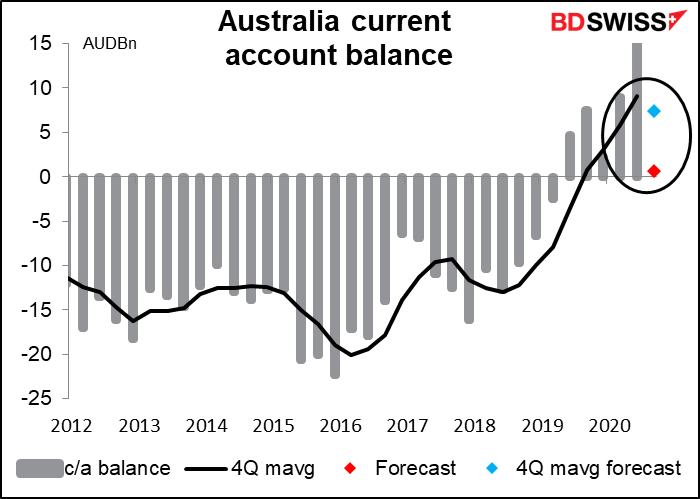

The current account surplus is expected to fall sharply from the record high of Q2, but to remain in surplus for the sixth consecutive quarter. Imports flooded in thanks to the relative strength of the Australian economy (relative, not absolute – the country nonetheless suffered its first recession in three decades), while exports dropped off sharply as economic activity elsewhere slowed even more. I think although the surplus is lower, the fact that it is still in surplus is likely to be beneficial for AUD. AUD-positive

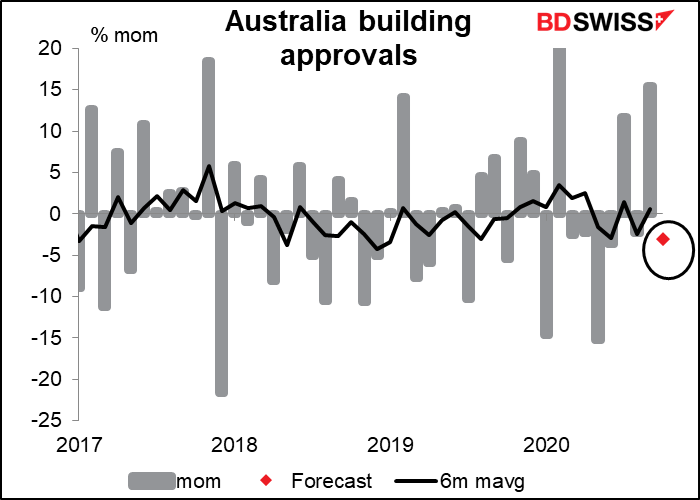

Australia’s building approvals rose sharply in September with no discernible impact from the second lockdown in Victoria. With other states well into re-opening rebounds, housing markets lifting and the HomeBuilder scheme still helping support the market, approvals are likely to remain relatively strong. There may be some decline from September’s level, but the forecast decline would leave the six-month moving average almost unchanged, showing modest growth of +0.5% mom.

Then we get to the overnight feature, the RBA meeting. As I pointed out in my Weekly Outlook, last month the RBA decided on an extensive package of measures, including a cut in the cash rate target to 0.1% from 0.25% and a similar reduction in the target for the yield on the 3-year Australian Government bond. That’s probably enough for now. I don’t expect any more changes at this meeting, just an update on how those newly enacted measures are working. The market will also wait to hear how the Board views the new vaccines and the near-elimination of the virus in the country (down to an average of 12 new cases a day from a peak of 541 in August – this in a country of 25mn people).