Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:30 GMT

Market Recap

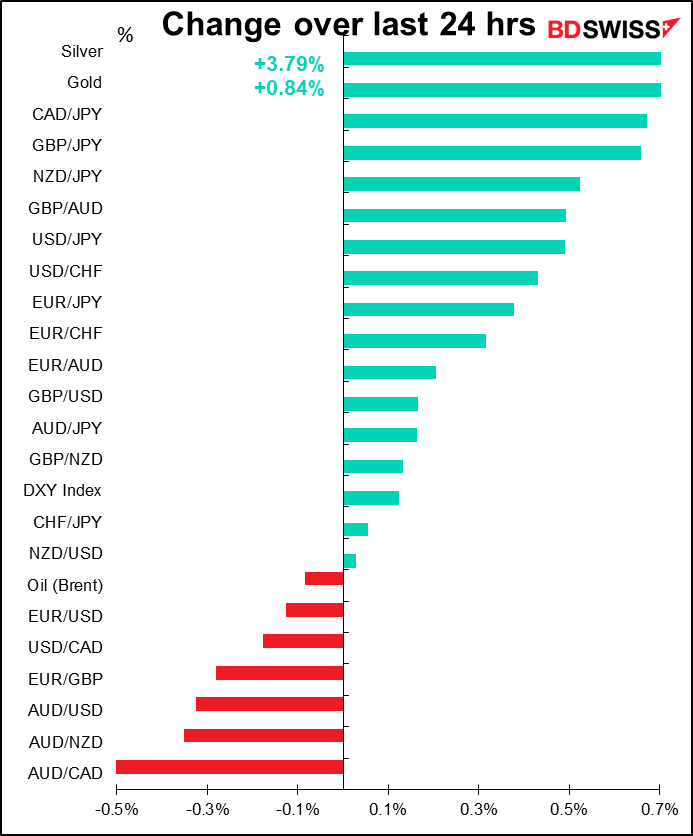

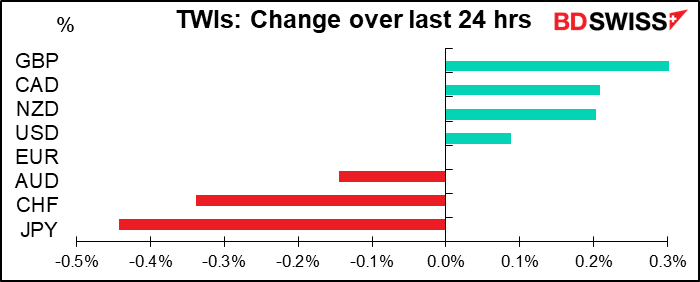

Although I generally confine myself to writing about FX, the stock markets grabbed my attention today as the final results of November were tallied. The 10.8% rise in the S&P 500 index was nice, but that wasn’t the stunner: the European STOXX 600 index of stocks in 17 European countries had its largest monthly gain (+13.7%) since the index began (January 1987), as did the US small-cap Russell 2000 index (+18.3%) (December 1978). The “risk-on” mood that this strong performance represents was naturally negative for safe-haven assets: gold was down 5.4%, its worst monthly performance in four years. In contrast though Bitcoin was up an astonishing 42% during the month – it’s clearly a risk asset, not a safety asset.

Yesterday the members of OPEC met among themselves (virtually, of course). Today they were supposed to meet again together with Russia and a few other non-OPEC producers in the group known as OPEC+. As I explained in great depth & detail yesterday, they’re trying to decide whether to extend their current output cuts of 7.7mn barrels a day (b/d) into next year or to reduce them – that is, increase production – from the start of January by 1.9mn b/d, as was originally planned.

Going into the meeting, observers expected that they would extend the current level of cuts, probably through Q1 of next year. However, the OPEC members couldn’t reach a consensus in yesterday’s talks. They therefore delayed today’s meeting until Thursday to allow ministers more time to discuss & debate.

The problem seems to be not whether to delay increasing output but rather what conditions to attach to the delay. Out of the nine non-OPEC members of OPEC+, only three have kept to their production quotas. The rest, notably Russia, are overproducing. The UAE and some others want these overproducers to compensate by reducing their output in Q1, or at least to keep to their targets

Despite the disarray, oil prices are barely changed from yesterday morning – WTI is up 4 cents and Brent is down 4 cents. Does this signify that people expect the delay to win out – or does it imply that the fall in oil prices at the opening Sunday was sufficient to discount the possibility that they won’t reach an agreement? I think probably the former. I therefore expect oil (and oil-related currencies) to fall further if they can’t reach some sort of agreement that would withhold oil from the market.

AUD was slightly lower, but it wasn’t related to the Reserve Bank of Australia (RBA) decision this morning – the big drop came during US trading hours yesterday. The graph shows how AUD/USD plunged and USD/CAD shot up at about 16:00 GMT yesterday. This was around the time that the Saudi Arabian oil minister said he was considering resigning his role as the co-chair of OPEC+ Joint Market Monitoring Committee (JMMC), news that sent oil prices lower. The JMMC is the group of ministers that oversees the month-to-month deliberations of the wider OPEC+ coalition. Russia is the other co-chair. If the Saudis were to abandon this committee, it would probably mean they were giving up their role in steering OPEC – which would mean giving up their role as OPEC’s swing producer and instead operating in their own interests.

The RBA, as expected, held its policies unchanged. You can expect to see that line repeated frequently from now on. Gov. Lowe said that “Given the outlook, the Board is not expecting to increase the cash rate for at least 3 years.” The RBA meets 11 times a year, vs eight for most other central banks That means at least 33 more meetings I’ll have to write about when nothing will happen. Sigh. Although they could always cut rates or increase their quantitative easing (QE) program – Lowe said they were prepared to do more if needed. Unless something unexpected happens, there probably won’t be anything notable from them until their April meeting, when their AUD 100bn QE program is scheduled to end and they’ll have to decide whether to extend it or not.

So what will drive AUD from now on? Probably commodity prices, global reflation in general, and trade. Watch for more Australia-China tensions, which so far haven’t played that big a role in the currency’s movements.

GBP was the best-performing currency as politicians from both sides said a trade deal could be struck this week – although both sides agreed that they were still very far from an agreement and that the other side would have to compromise in order to reach an agreement. Of course it’s easy to be optimistic if you assume your opponent will capitulate. We still await some news about concrete developments. Stay tuned.

Today’s market

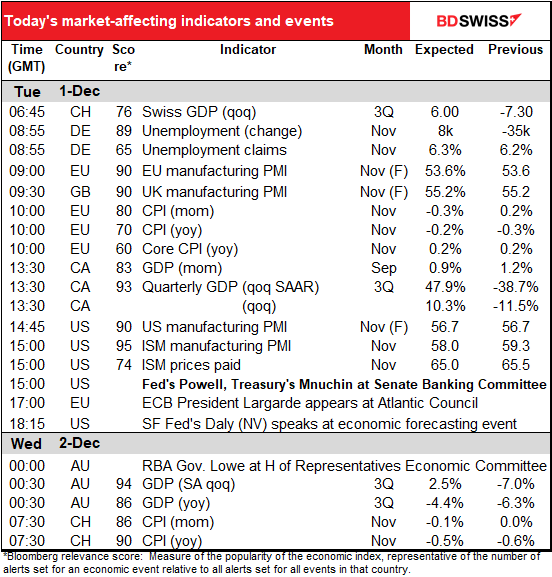

Both the garrulous ECB President Lagarde and the more reclusive Fed Chair Powell speak today. Lagarde talks all the time, and today’s talk isn’t likely to be particularly interesting. She’s appearing at the start of some GeoEconomics Center for the Atlantic Council According to their website, “President Lagarde will offer her insights on leadership through crisis, the path to recovery for both the US and Europe, and how transatlantic cooperation will be key to revitalizing the global economy.”

Powell and his arch-enemy, the malevolent Treasury Secretary Mnuchin, will be appearing at the Senate Banking Committee today and the House Financial Services Committee tomorrow for the quarterly CARES Act report to Congress. You can watch this one yourself if you want – it’ll be broadcast live.

Powell’s testimony was released ahead of the hearing. As expected, he said the rebound in the economy “is due, in part, to federal stimulus payments and expanded unemployment benefits, which provided essential support to many families and individuals.” While he didn’t exactly ask for the support to be extended, senators should get the idea. He also gave a rundown on the five emergency lending programs that the Treasury is discontinuing, no doubt with an eye to demonstrating how useful they are and why they should be continued.

I’m sure that at least the Democrats on the Committee will ask the two gentlemen about the recent disagreement between the Fed and the Treasury about these five programs. We can also look for some hints as to how the two parties are thinking about further fiscal stimulus, especially as Congress is in the middle of negotiating an omnibus spending bill for the rest of FY 2021. The exponential increase of virus cases coinciding with the impending expiration of federal unemployment insurance benefits at the end of the year is a looming disaster for the US economy. Powell is sure to plead for more. But maybe the Republicans want a disaster, to make President-elect Biden’s first term harder? Don’t dismiss the idea.

This is Mnuchin and his wife. Don’t they look like Bond villains? Especially her with her elbow-length gloves.

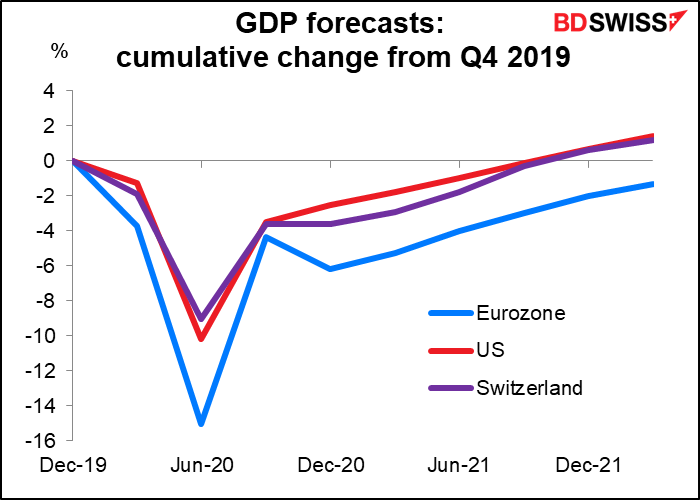

As for the indicators, the day starts out with Swiss GDP. I’m not sure how much Swiss indicators actually affect CHF. My guess is, not much, since the Swiss National Bank has been on hold indefinitely and will probably continue to be on hold for some time.

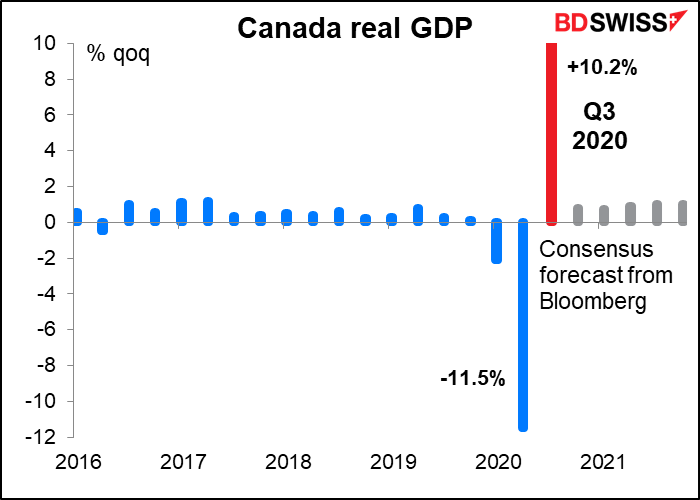

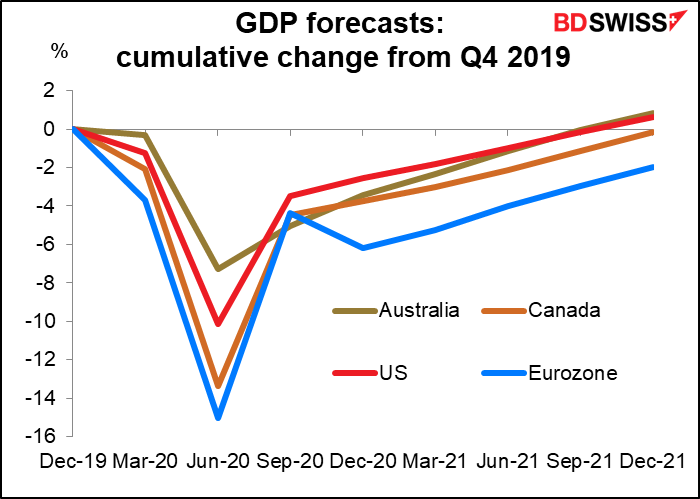

Switzerland’s economy has held up better than the Eurozone’s, even though the virus is really dreadful there. They have so many cases in this small country, they’ve nearly run out of ICU beds, much to my distress. (Fortunately my wife is on extended vacation in Japan now, but I still have a daughter in Switzerland.) Yet based on the forecast for today’s figure, the country’s economy is following the relatively robust US path, rather than the more sluggish Eurozone path. Maybe that’s because Switzerland didn’t have such harsh lockdown measures. Maybe that’s also why the virus is running out of control in the US and Switzerland.

Notice too that the market is forecasting a dip in output for the Eurozone in Q4. It’s not shown here but it’s also forecasting such a dip for the UK. I think it’s only a matter of time before it forecasts something similar for the US, if not in Q4 than in Q1 2021, after the CARES Act unemployment benefits run out.

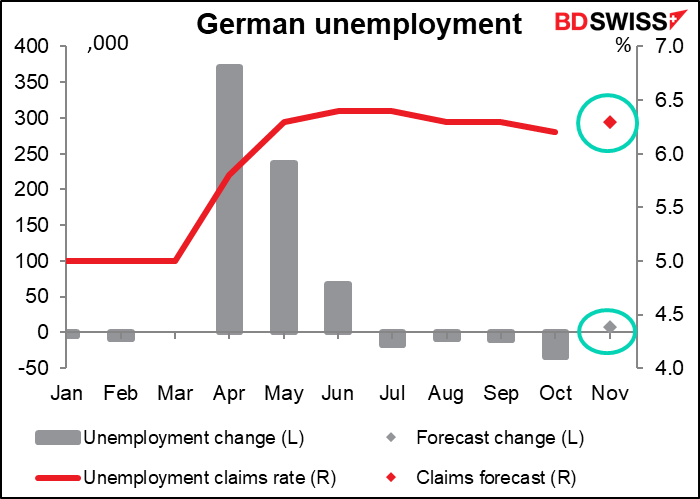

German unemployment almost looks normal. The number of unemployed persons is expected to rise by a tiny 8k, which is nothing in the recent context, while the unemployment rate is forecast to back up one notch to 6.3%, where it was in August and September before it dipped down in October. The small worsening in labor conditions is relatively minor against the background of the “lockdown lite” measures that were reinstated in November. I don’t think a number in line with estimates would have much of an impact on the euro.

The final manufacturing purchasing managers’ indices (PMIs) from the Eurozone and the UK are rarely revised much, although when they are, they can impact the currencies.

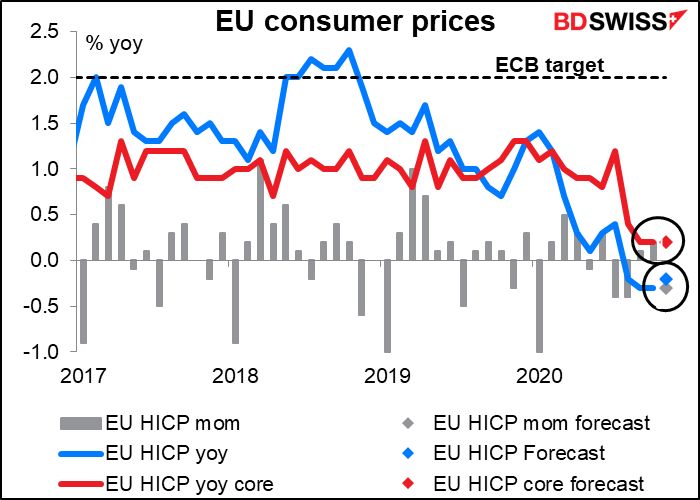

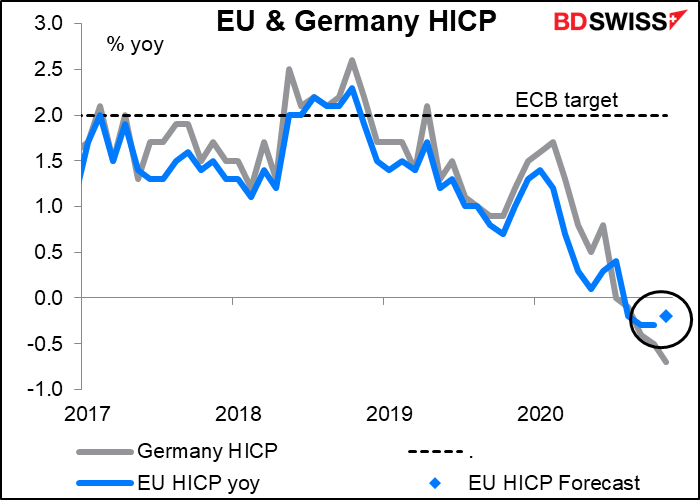

Yesterday’s German consumer price index (CPI) was worse than expected — prices fell by 0.7% yoy vs -0.4% expected That suggests today’s EU-wide CPI might be even worse than expected, too. The European Central Bank is already getting its bazooka ready for next week’s meeting though so I don’t think this will make any difference unless there are a few lingering hawks on the Executive Council.

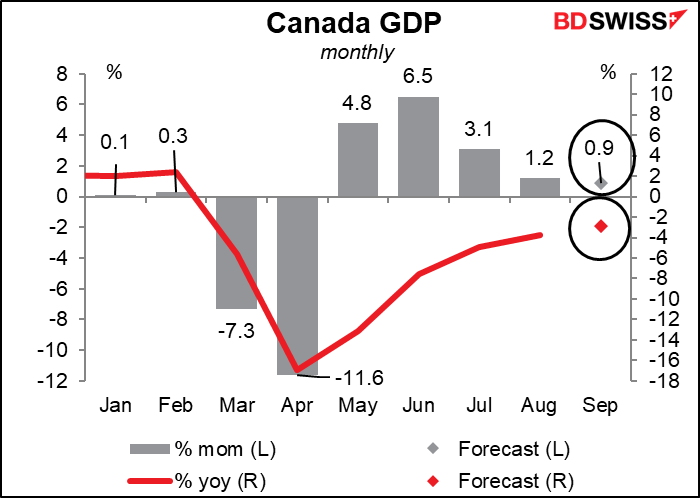

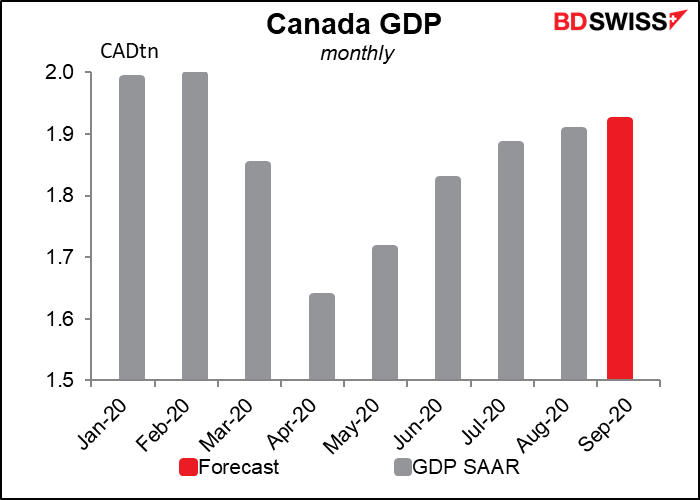

When the North American day starts up, Canada announces both its monthly GDP for September and its Q3 GDP. Monthly, the pace of growth is forecast to continue its downward trend.

The level of output would still be some 3.6% below the average in January and February.

Canada, like the US, uses the qoq seasonally adjusted annualized rate, which makes some sense during normal times but is ridiculous right now, because there is no way on earth growth is going to continue at the same pace for the next four quarters. I’ve therefore translated it back into the more common qoq rate of change. The forecast is for much but certainly not all of the decline in Q2 to be recovered in Q3. The market consensus forecast of +10.2% qoq growth is exactly in line with the Bank of Canada’s forecast in its October Monetary Policy Report (pg 15). I therefore doubt if it would have much impact on the FX rate.

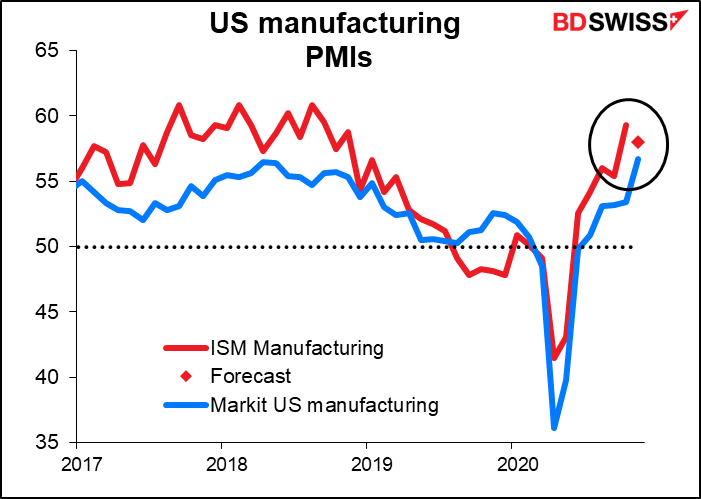

Then shortly after Markit announces the final manufacturing PMI for the US, the Institute of Supply Management (ISM) pipes up with its version. It’s expected to fall substantially, but remain above the Markit version. Both show US manufacturing expanding nicely and so should be positive for stocks, hence perhaps negative for USD.

Overnight, Australia announces its Q3 GDP. It’s expected to be pretty bad, comparatively. The average for the Eurozone, US, Japan and UK has been +9.9% qoq, whereas the market’s only going for a pitiful 2.4% for Australia. Part of that is no doubt because Australia’s Q2 decline was less than the others’. The country’s -7.0% qoq fall compares with an average for those other four of 12.1%. It also reflects the stringent lockdown imposed in the state of Victoria for two-thirds of the quarter (Victoria accounts for about 25% of Australia’s GDP).

Furthermore, as I’ve stressed during this unique period in human history, the phrase “past performance is no guarantee of future performance” has never been more true. While economists are busy downgrading their estimates for Q4 here and there – the market consensus is for a 1.9% qoq fall in the Eurozone and -1.6% in the UK – that’s not likely to be the case in Australia, as the country has effectively eliminated the virus and will be able to enjoy a healthy rebound in Q4. The current forecast is for +1.7% qoq in Q4. Thus Australia is expected to return to pre-pandemic output about the same time as the US and earlier than Canada, another of the commodity currencies.

Then tomorrow morning, bright and early, we get the Swiss consumer price index. I don’t believe I’ve ever before mentioned two Swiss economic indicators in one day’s report. I could even have discussed three, as the Swiss manufacturing PMI comes out on Tuesday too and much to my surprise there’s a forecast for it – 51.6, down from 52.3. Once again though I doubt if the CHF moves on these indicators. It seems to be much more affected just by general “risk-on” and “risk-off” than by any news.