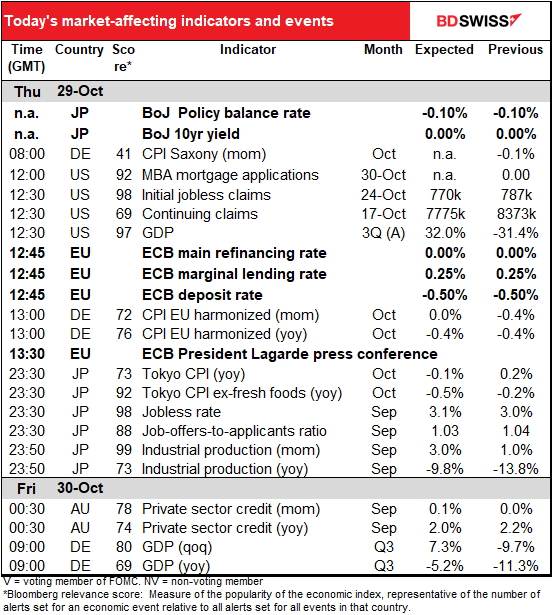

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 04:00 GMT

Market Recap

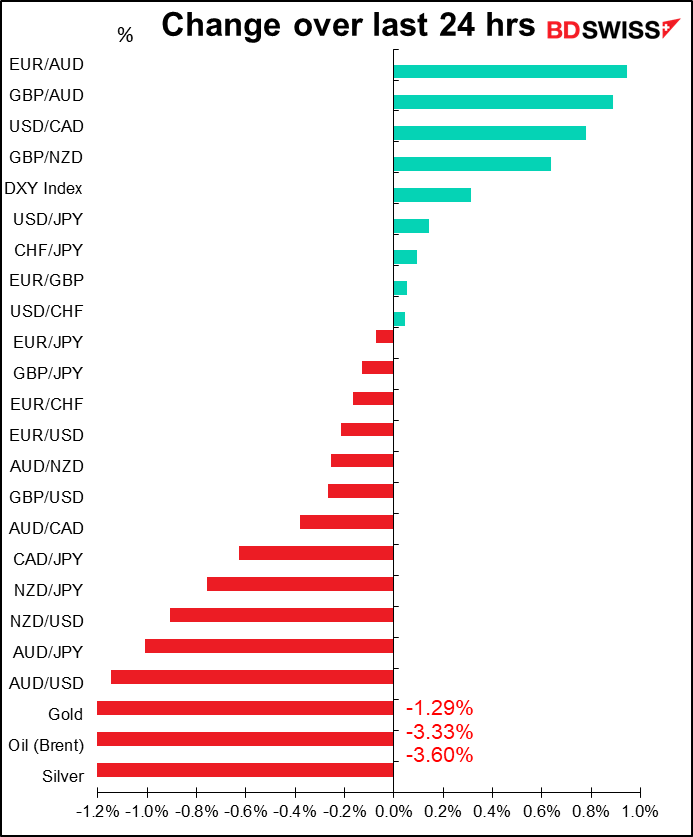

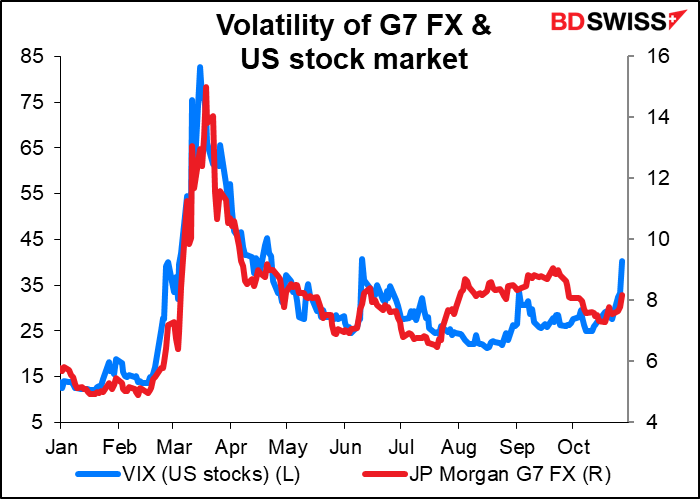

A big risk-off day as virus cases soar and Germany and France announce more restrictions. Stocks around the world fell, including a 3.5% drop in the S&P 500, its largest one-day fall since 11 June. The decline was broad-based, with 97% of the S&P 500 stocks falling.

Although the VIX index of expected volatility in the stock market jumped back above 40 for thie first time since 11 June too, FX market volatility rose less.

However, this morning there’s somewhat of a rebound — the S&P 500 is indicated to open +0.7% and we’re seeing some recovery in the commodity currencies.

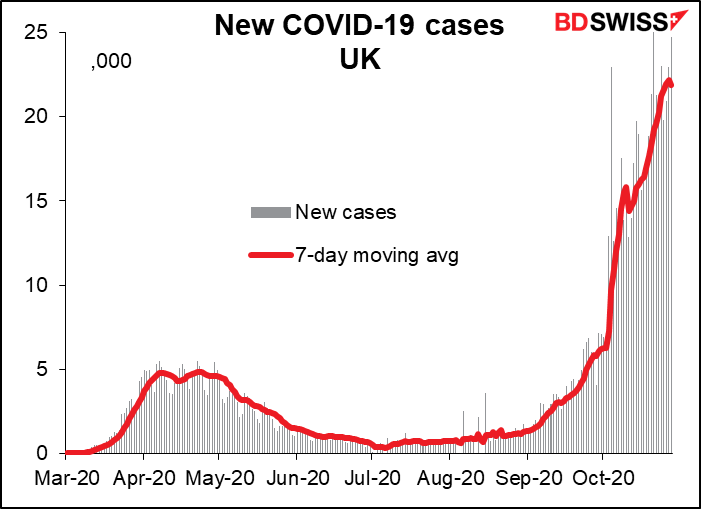

As for the restrictions, there’s a good chance that other countries may announce more restrictions again, too. A new study indicated that R – the number of people that each infectious person infects – is rising in England and the number of new infections is doubling every nine days. I don’t see why it should be different anywhere else in Europe.

Meanwhile, Taiwan has achieved 200 consecutive days without a single case of locally transmitted disease. Small islands like New Zealand (well, two islands there) and Taiwan have an advantage, but there must be other factors at work as well.

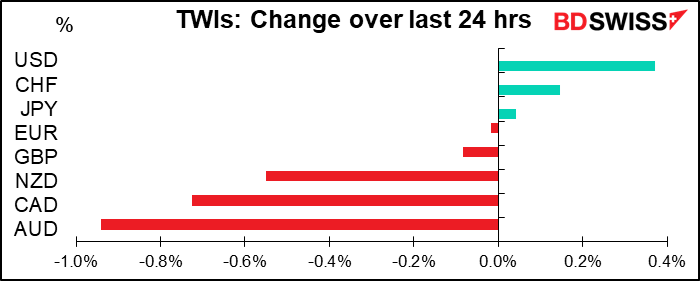

The FX market’s response to the mood was pretty much boilerplate “risk-off,” including a stronger dollar and weaker commodity currencies. There was one notable exception though: the failure of JPY to respond. Not just USD/JPY, which was largely unchanged thanks to a stronger dollar, but also EUR/JPY and GBP/JPY, which both barely moved. It’s not clear why, at least not to me. USD/JPY bottomed out just above 104.10 at 11:12 GMT and hit a high of 104.50 this morning in Tokyo trading before falling back a bit after the Bank of Japan meeting.

I doubt though whether the Bank of Japan meeting had any significant impact on trading. It kept its policies all unchanged overnight, as was almost universally expected. To my surprise though it cut its growth forecast for the current fiscal year (to -5.5% from -4.7%) rather than raising it as I expected. It attributed the change to concerns about the impact of rising virus cases on overseas economies. And it did raise its forecast for next fiscal year. Not that it really matters for policy though. It reiterated that it was ready to take further action if necessary, but concretely, what more can they do? It does have room to buy a lot more bonds and exchange-traded funds (ETFs), but it might be questioning the marginal return on such purchases at this point.

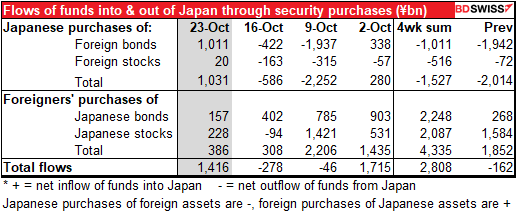

By the way, figures released today suggest that the recent strength of the yen may be connected to sales of foreign bonds by Japanese investors. This is also one way in which the “risk-off” mood translates into yen strength. (In this table, a positive number = an inflow of funds into Japan.)

Another declaration of boredom for pundits! The Bank of Canada yesterday pledged to hold its policy rate unchanged until “the 2 percent inflation target is sustainably achieved.” “In our current projection, this does not happen until into 2023,” they said. That’s quite long-term forward guidance. They also said that the rate is at “the effective lower bound.” In other words, no more cuts and no hikes for at least two years or so. That’s 17 more Bank of Canada meetings I have to write about when nothing’s likely to happen.

The bank also tweaked its quantitative easing (QE) program. It cut the amount it would buying to least CAD 4bn a week from the current CAD 5bn and said it would “shift purchases towards longer-term bonds, which have more direct influence on the borrowing rates that are most important for households and businesses.” In other words, it’s reducing the amount but retargeting the purchases to make them more effective. Do more with less so that the overall effect is the same. This will address criticism that it’s dominating the government bond market (it now owns over a third of all the government bonds.)

The emphasis on longer-dated bonds is a loose form of yield curve control (YCC), holding down long-term rates, which Japan and Australia have already formally launched. It used to be called “financial repression” but that doesn’t sound very nice.

Today’s market

Busy busy day today!

We’ve already had the Bank of Japan Policy Board meeting, as mentioned above. Now we’re all waiting for the European Central Bank meeting. As I explained in my Weekly Outlook: The Storm before the Storm, I think they’ll remain on hold this month even though there’s a good case for loosening. I think they’ll reaffirm their willingness to loosen policy further and probably make some very dovish comments that could be EUR-negative, but they’ll hold off pulling the trigger until December, when the new forecasts can be the catalyst for a change (probably an increase in the Pandemic Emergency Purchasing Program, or PEPP). Please see the weekly if you’re interested in the details of “why.”

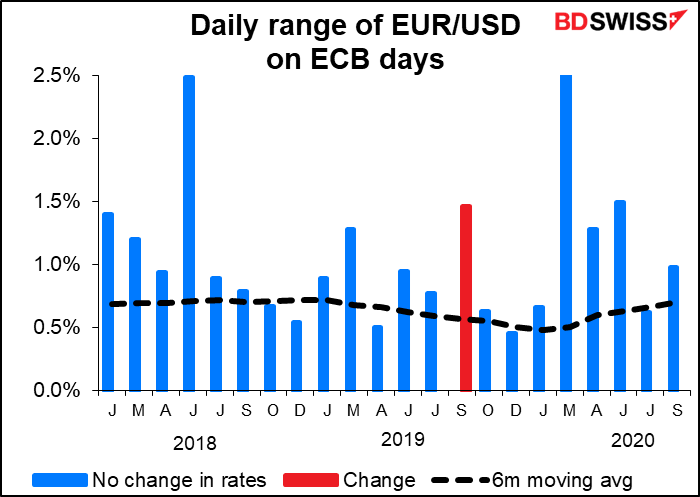

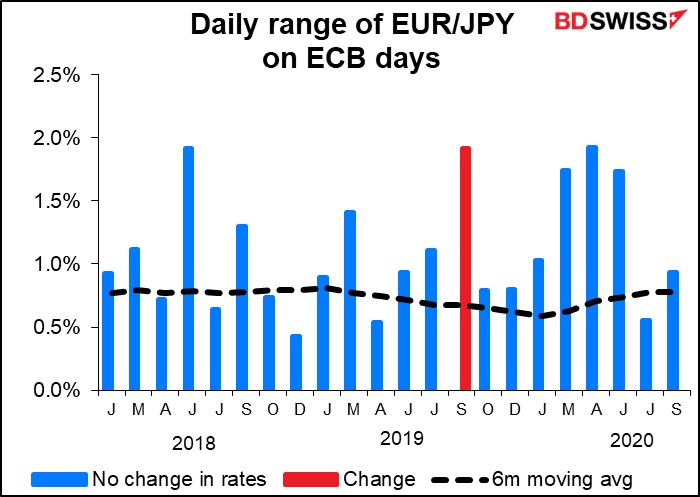

If you’re looking to put on a position ahead of the meeting, it looks as if EUR/JPY would be the better vehicle. It seems to be a bit more volatile on ECB days recently.

The indicators:

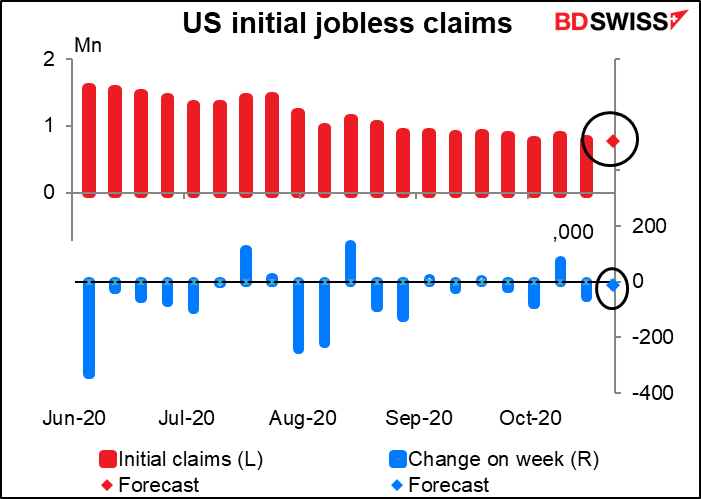

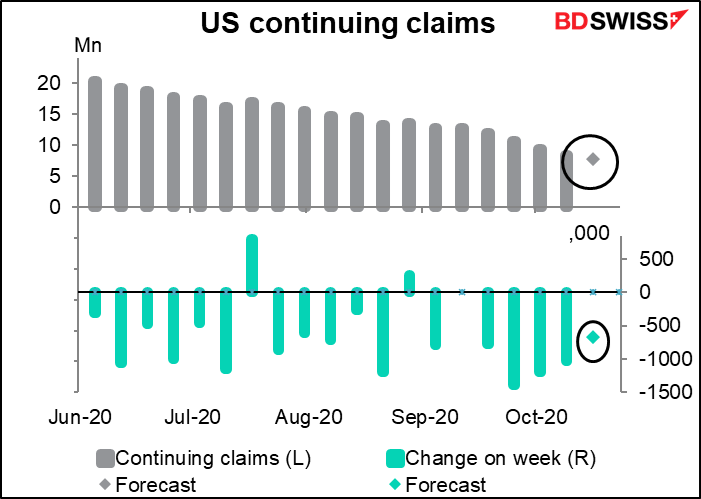

We start the day with the dreaded weekly US jobless claims. They’re expected to be down a bit – 12k for the initial claims and -673k for the continuing claims. That’s not very good.

Initial claims have fallen by an average of 22k a week over the last month, so this would be a slowdown in the pace of decline. Meanwhile, the people who lost their jobs before April 24th (26 weeks ago) should be rolling off the continuing claims. That’s the bulk of the newly unemployed – some 30mn people lost their jobs in April and so should soon be coming to the end of their state unemployment benefits. The continuing claims should be falling by a lot more than they are, I would think.

I would think that a result like this would show slowing progress on jobs and would therefore be considered a “risk-off” indicator.

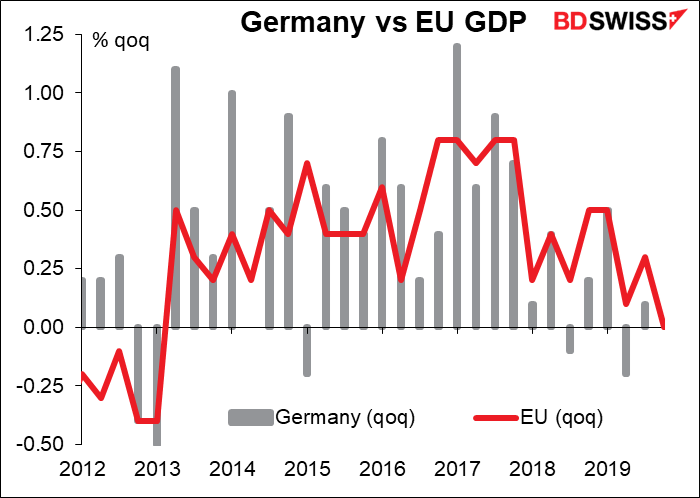

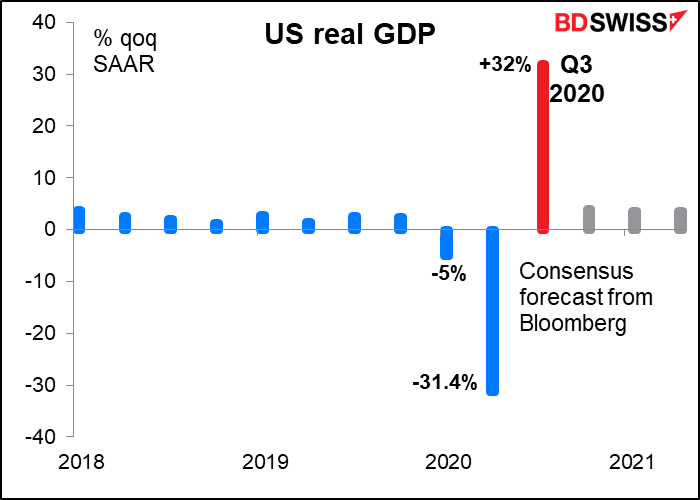

Then comes the first estimate of US Q3 GDP. It’s expected to be up a massive 32% qoq SAAR, following the 31.4% qoq SAAR decline in Q2. Believe it or not, the rebound is actually much less than the decline on a qoq basis (+7.2% qoq vs -9.0% qoq) but just looks bigger because it’s annualized. That’s less than the 9.4% qoq rebound expected for Eurozone GDP tomorrow, but because Eurozone GDP fell so much more in Q2 than the US did (-11.8% qoq vs -9.0 qoq for the US), US growth is expected to be closer to recovery than the EU’s. This report may be positive for USD as a result.

Then chill out and have a glass of wine or a cigar or whatever your pleasure is until Tokyo wakes up and we get the usual end-month slew of Japanese indicators. Which makes me think: for years I’ve been describing this monthly phenomenon as “a slew of indicators,” but what exactly is a slew? It’s from the Irish Gaelic sluagh, meaning “multitude.”

Now that we have that point straightened out, let’s deal with the indicators in order of their importance.

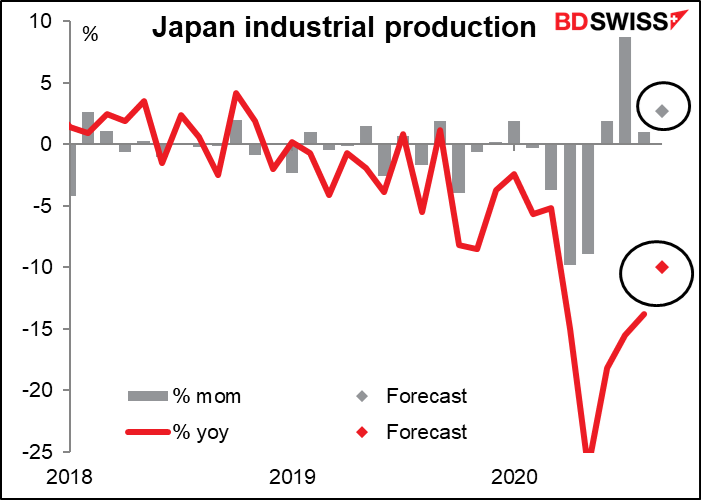

Only industrial production is expected to show any major change. This month (September) it’s expected to rise for the fourth consecutive months, and by more than it did in the previous month, which is a good sign of an accelerating recovery. That might be negative for the yen, oddly enough, in that the stock market might rally and the yen therefore decline in the “risk-on” sentiment. (Although a quick look shows a relatively low correlation between the Tokyo stock market and USD/JPY.)

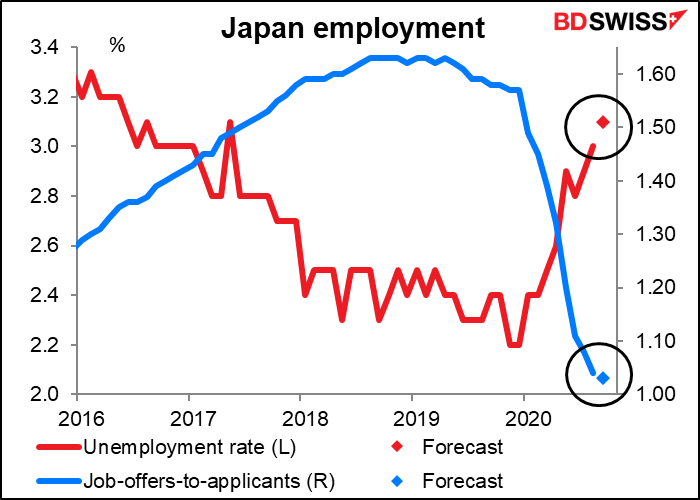

Japan’s unemployment rate is expected to continue climbing gradually. Still, the expected figure of 3.1% is amazingly low – the lowest it got in the US before the pandemic was 3.5%.

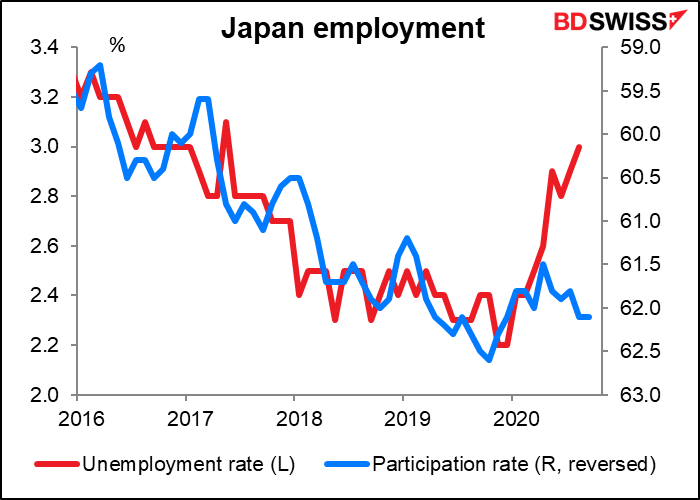

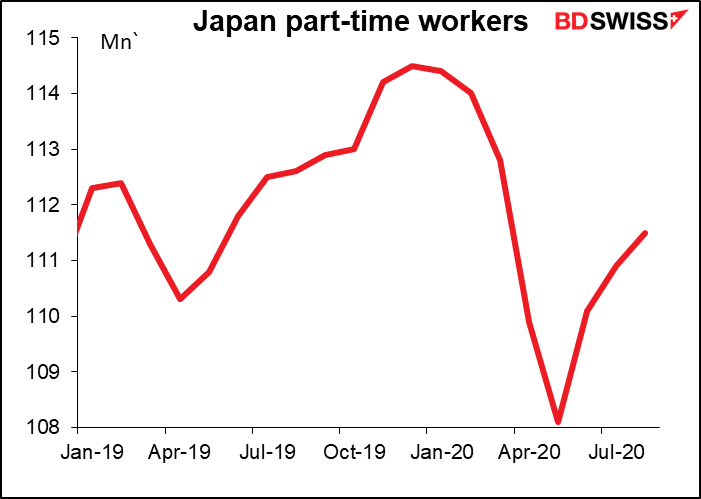

It’s particularly surprising that they can maintain this low unemployment rate with a relatively high participation rate. I had expected that many of the people losing their jobs would be part-time workers, who account for an astonishing 30% of the labor force, and so these people would stop looking for a job and drop out of the labor force entirely, thereby lowering the participation rate. The participation rate did fall a bit, but it’s since recovered about half the losses. It looks like companies are preserving employment by taking advantage of government employment adjustment subsidies and reducing working hours rather than cutting people.

Some 6mn part-time workers did lose their jobs during the downturn, but a lot of those jobs have since returned. In theory this should boost spending and help Japan recover, but in fact the country is the slowest of all the majors – the purchasing managers’ indices still show the economy contracting.

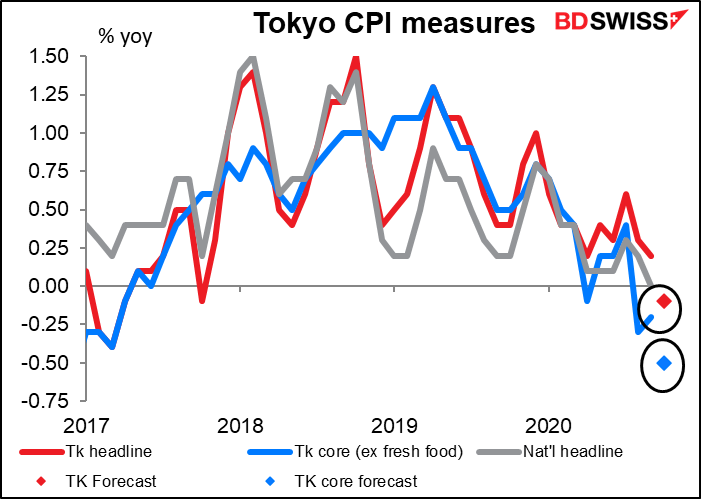

The Tokyo consumer price index (CPI) is expected to fall further into deflation. This is due largely to the government’s own actions, such as the “Go To Travel” subsidies that lowered hotel rates, plus pressure for lower mobile phone charges. Ordinarily the move further into deflation might elicit some hand-wringing at the Bank of Japan, but since these changes are due to government policy, the BoJ can argue that the fall in inflation doesn’t signify any change in the underlying inflation trend and they can ignore it.

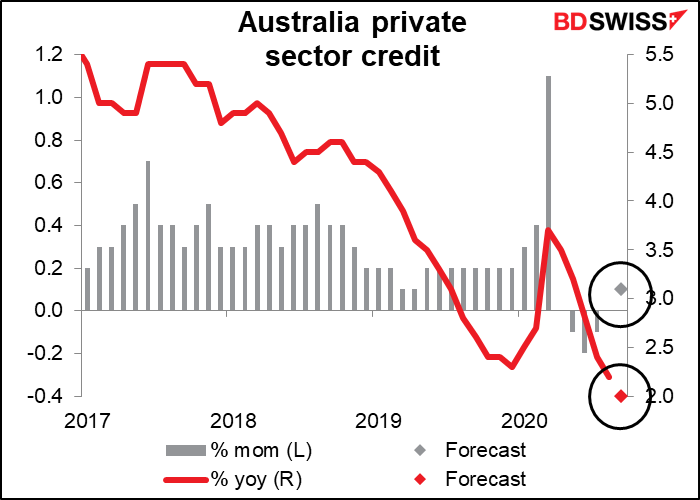

Australia private sector credit is expected to expand slightly on a mom basis, but this comes only after four consecutive months of decline. Businesses are simply trying to survive, not expand, and so they’re not looking to expand capacity but rather trying to reduce borrowing if anything. Personal credit is falling too, while housing credit is rising only slowly. I think any rise would be taken as an encouraging sign of activity bouncing back and so would be AUD-positive..

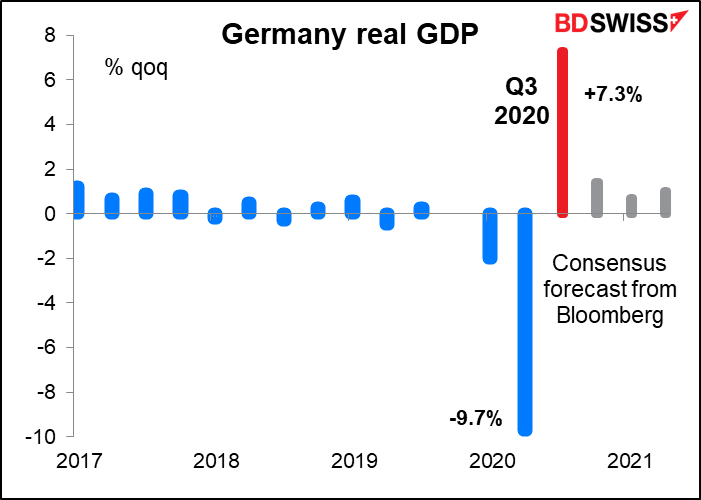

Finally, as dawn breaks over Europe, Germany announces its first estimate of Q3 GDP. Since German GDP accounts for roughly a quarter of Eurozone GDP, it goes a long way to explaining Eurozone-wide GDP (which will be announced later in the day).