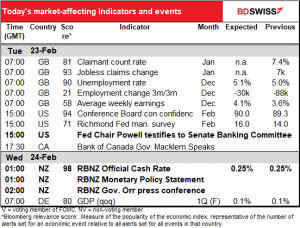

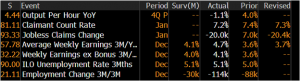

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

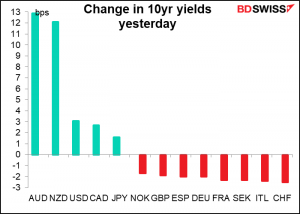

The focus of the markets is on bonds, not stocks. Bond yields climbed further yesterday in many markets around the world.

The rise in yields this year has been accelerating recently.

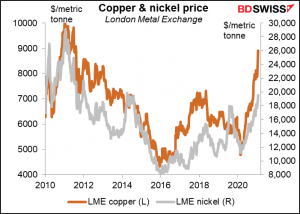

That’s in part because prices of industrial metals keep rising. Copper has climbed to the highest level since 2011 while nickel, which is used in making steel, is at the highest since 2014. This is a sign that commodity market participants are looking for a stronger economy and greater demand in the future.

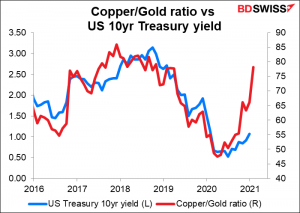

Looking at the copper/gold ratio, which I mentioned yesterday, it would appear that this run higher in bond yields may have further to go. Copper represents the market’s view on reflation and demand; gold represents the demand for safe-haven assets and security.

With bond yields rising, most of the major stock market indices in Europe and the US were lower, with the S&P 500 falling for the fifth consecutive day. Coincidentally, the last time that happened was exactly a year ago, during the last week of Feb. 2020, when the pandemic first started to hit global equity markets.

The “risk-off” sentiment has dissipated somewhat this morning though as most Asian stock markets are higher, except for China and South Korea. The S&P 500 is estimated to open +0.4% higher.

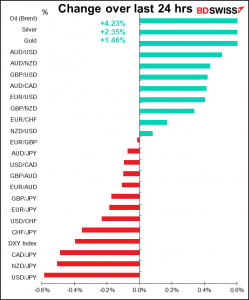

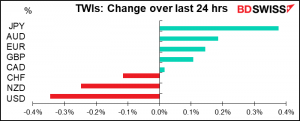

Despite the rise in US yields yesterday, the dollar fell anyway on expectations – hopes? – that Fed Chair Powell would be his usual dovish self this afternoon. That might cause yields to retreat. I wonder though – why did the dollar move on this thought but the bond market didn’t’? Seems fishy to me. See below for more details on Powell’s speech.

The sharp rise in AUD yields explains why AUD jumped, but why then is NZD so weak since its yields jumped almost as much as AUD yields did? A ninth case of Covid-19 was reported in Auckland, raising fears of another lockdown. In most countries, having so few cases would be cause for celebration, but the difference between zero and even one is infinite. I think the drop in NZD may offer a good entry opportunity ahead of tonight’s Reserve Bank of New Zealand (RBNZ) meeting, although I should point out that not every analyst agrees with my expectations for that meeting (see below).

Today’s market

The UK employment data is already out. The unemployment rate was exactly as estimated, but the number of job losses was much worse than the market had expected.

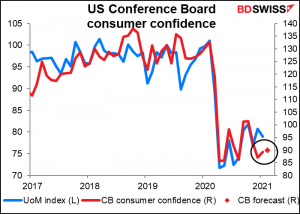

The Conference Board consumer confidence index for February is expected to turn up a little bit, unlike the U of M index, which turned down. But they’re both basically just going sideways so I don’t think it matters.

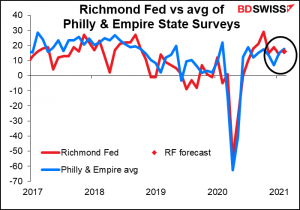

The Richmond Fed manufacturing survey is expected to be up 2 points. That would be in line with the average of the Philadelphia Fed & Empire State surveys, which was up 2.6 points. While the market puts more weight on the latter two, probably because they come out earlier, the Richmond Fed survey is the one that best predicts the Institute of Supply Management (ISM) purchasing managers’ index (PMI), one of the most important monthly indicators. A rise in this indicator would therefore be a positive indicator for the dollar.

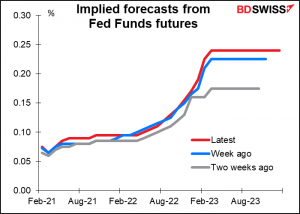

Now we get to the feature of the day: Fed Chair Powell’s semi-annual testimony to Congress. He testifies to the Senate Banking Committee today and the House Financial Services Committee tomorrow. I don’t expect anything new from him or any change in emphasis. Given the lack of support among Republicans for spending money to help people with incomes under $250k a year, I would expect no let-up in his emphasis on the need for continued fiscal support for the economy. He’s likely to reiterate the importance of a “patiently accommodative” monetary policy and stress that “despite the surprising speed of recovery early on, we are still very far from a strong labor market,” as he did in his speech on Feb. 10th, Getting Back to a Strong Labor Market. The message from Fed officials recently has been that they will need to see clear evidence in the data before they start discussing whether there has been “substantial further progress” toward their mandated goals of maximum employment and price stability. I don’t see any change in that view emerging.

The question though is whether this repeat of his usual themes will have any impact on markets, which have been discounting higher inflation and higher interest rates. The risk is that he will take this opportunity to push back on the market’s repricing of Fed rate expectations and try to dampen the rise in Treasury yields. That could push the dollar even lower.

For those who follow Canada, Bank of Canada Gov. Macklem will be speaking by videoconference on Labour market impacts of COVID and sectoral implications. You can watch it here if you want.

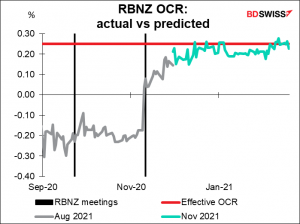

Then overnight the Reserve Bank of New Zealand (RBNZ) meets after a three-month hiatus. I went into my expectations in some detail in my Weekly Outlook piece, which you can read by clicking here. To sum up, I don’t expect that they will change any of their policy settings, or even hint at changing any of them. Nonetheless, with the economy improving and the global virus situation starting to turn, they make take a more neutral stance, perhaps by tinkering with the forward guidance in the last paragraph. Last time it read,

The Committee agreed that monetary policy will need to remain stimulatory for a long time to meet the consumer price inflation and employment remit, and that it must remain prepared to provide additional support if necessary.

We might see more specific wording than just “for a long time” that would give the market some idea of how long the RBNZ intends to keep rates at the current level. In March last year they committed to keeping the Official Cash Rate (OCR) at the current level for 12 months at least – they could qualify that commitment and give some details on what would get them to move. If it’s feeling more optimistic, it could change the phrase “to provide additional support if necessary” to something more symmetrical, such as “to adjust policy if necessary,” thereby opening up the possibility that it could reduce its bond purchases or other extraordinary measures as well as increasing them. Such changes would probably lift rate expectations and be positive for NZD.

Recently the market has been assuming that the OCR would be at the current level at least until November, which is as far out as the overnight index swaps go.