Guess what? February 25th, 2024, ECOWAS did a little happy dance and lifted the sanctions on Guinea and Mali! And just the other day, they did the same for Niger. Now, let’s cross our fingers and hope Nigeria’s interest rate decision today, February 27th, 2024, hops on the “lifting” train and gives the naira a little boost too!

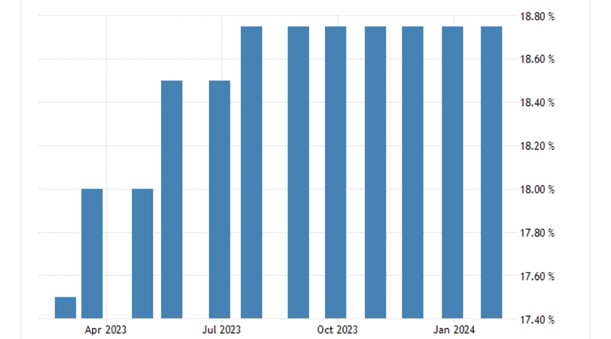

Let’s take a quick trip down memory lane: March 21, 2023, saw an interest rate of 18%, followed by 18.5% May 24, 2023, and 18.75% July 25, 2023. Now, considering this uptrend, a higher interest rate on today , February 27, 2024, could spell good news for the naira, which has been on a downward spiral lately.

Friday, February 23rd, the USDNGN exchange rate wrapped up at 1,488.4000, while historically in February 2024, the Nigerian Naira reached a high of 1607.08. This rollercoaster ride in exchange rates has hit Nigerian folks hard, squeezing the purchasing power of the Naira. As the Naira takes a dip, the prices of imported goods shoot up, putting a strain on consumers and possibly lowering their living standards. Not to mention, businesses dealing with imports or international trade are feeling the pinch too, facing inflated costs and tougher competition on the global stage.

But fear not! There’s a glimmer of hope on the horizon. By tweaking interest rates upward, can give the currency a boost, drawing in more foreign investors, pumping up capital flows, taming inflation, and restoring faith in the investment arena. So, let’s stay vigilant and keep our trading game strong for the big day.

According to the daily chart of USDNGN, the price has been on an uptrend since February 7th, 2024, reaching an all-time high of 1607.08 February 23rd, 2024, before retracing back to around 1505.85.

The current market pattern indicates a ranging market scenario. A break below the support level at 1405.76 suggests a potential further downward movement in price. Conversely, a break above the resistance level at 1607.08 indicates a likelihood of continued upward momentum in price.

Sources: