Guess what? Simeon Brown, New Zealand Transport Minister, is shaking things up! He’s scribbling some friendly notes to fuel distributors, asking them nicely to spread the savings from axing regional fuel tax in Auckland. Meanwhile, over at the Reserve Bank of New Zealand, they decided to keep interest rates on hold, just like the markets expected on Wednesday.

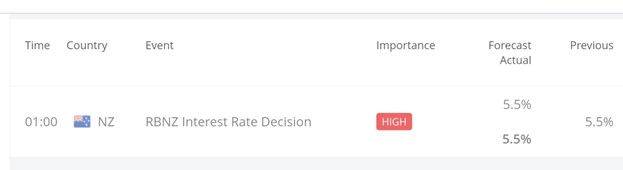

The Reserve Bank of New Zealand (RBNZ) announced its decision to maintain the official cash rate during its latest release at 1:00 GMT. Despite this, notable movements were observed in NZD currency pairs.

Previously, the RBNZ had increased its official cash rate by a total of 525 basis points between August 2021 and May 2023, making it one of the earliest major central banks to respond to the post-COVID surge in inflation.

However, a series of significant cyclones in early 2023 disrupted its efforts to combat inflation, as rebuilding efforts following the disasters drove up price pressures .

In its latest meeting, the RBNZ opted to maintain the official cash rate at 5.5%, marking the fifth consecutive meeting of unchanged interest rates. Although the bank had hinted at the possibility of rate hikes in the near future, the February meeting was widely anticipated to yield no changes.

While acknowledging more positive risks to inflation outlook in recent months, the RBNZ expressed skepticism about inflation reaching its 1% to 3% annual target range in the short term.

This stance suggests a likelihood of prolonged higher interest rates in New Zealand. The RBNZ anticipates annual consumer price index inflation to align with its target range by the third quarter of 2024.

In a statement, the central bank emphasized the necessity of maintaining restrictive monetary policy settings to prevent an escalation in inflation expectations while avoiding instability in key economic indicators such as output, employment, interest rates, and the exchange rate.

From a technical analysis perspective using the 1-hour chart, NZDUSD has been consolidating within a range bounded by 0.60481 as support and 0.62175 as resistance since February 13, 2024. Presently, the price hovers around 0.61021 and exhibits a bearish bias. Following the release of the RBNZ’s cash rate figure, the price swiftly declined from 0.61738 to 0.61218 within the initial hour.

Considering the current price level and the impact of the news release, there is a high probability of further downward movement towards the support level at 0.60481. If the support is breached, it could signal further downside potential. Conversely, if the support holds firm, there is a greater likelihood of price rebounding towards the resistance level at 0.62175.

Sources:

https://global.bdswiss.com/economic-calendar/

https://m.investing.com/news/economy/rbnz-keeps-interest-rates-steady-at-55-as-expected-3317570